As filed with the Securities and Exchange Commission on May 31, 2002

Registration No. 333-

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Huntsman International LLC

(Exact Name of Registrant as Specified in its Charter)

| Delaware | 2800 | 87-0630358 | ||

| (State or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

500 Huntsman Way

Salt Lake City, UT 84108

(801) 584-5700

(Address, Including Zip Code and Telephone Number, Including Area Code, of Co-Registrants' Principal Executive Offices)

Robert B. Lence, Esq.

Secretary

Huntsman International LLC

500 Huntsman Way

Salt Lake City, UT 84108

(801) 584-5700

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent For Service)

Copy to:

Phyllis G. Korff, Esq.

Skadden, Arps, Slate, Meagher & Flom LLP

4 Times Square

New York, NY 10036

(212) 735-3000

| Exact Name of Additional Registrants |

Jurisdiction of Incorporation |

Primary Standard Industrial Classification Code Number |

I.R.S. Employer Identification Number |

|||

|---|---|---|---|---|---|---|

| Eurofuels LLC* | Delaware | 2800 | 91-2064641 | |||

| Eurostar Industries LLC* | Delaware | 2800 | 87-0658223 | |||

| Huntsman EA Holdings LLC* | Delaware | 2800 | 87-0667306 | |||

| Huntsman Ethyleneamines Ltd.* | Texas | 2800 | 87-0668124 | |||

| Huntsman International Financial LLC | Delaware | 2800 | 87-0632917 | |||

| Huntsman International Fuels, L.P.* | Texas | 2800 | 91-2073796 | |||

| Huntsman Propylene Oxide Holdings LLC* | Delaware | 2800 | 91-2064642 | |||

| Huntsman Propylene Oxide Ltd.* | Texas | 2800 | 91-2073797 | |||

| Huntsman Texas Holdings LLC* | Delaware | 2800 | 87-0658222 | |||

| Tioxide Americas Inc.* | Cayman Islands | 2800 | 98-0015568 | |||

| Tioxide Group* | U.K. | 2800 | 00-0000000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If the securities being registered on this form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box: o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: o

CALCULATION OF REGISTRATION FEE

| Title of Class of Securities to be Registered |

Amount to be Registered |

Proposed Maximum Offering Price per Note(1) |

Proposed Maximum Aggregate Offering Price(1) |

Amount of Registration Fee |

||||

|---|---|---|---|---|---|---|---|---|

| 97/8% Senior Notes due 2009 | $300,000,000 | 100% | $300,000,000 | $27,600 | ||||

| Guarantees | (2) | (2) | (2) | None | ||||

The Registrants hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrants shall file a further amendment that specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until this registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information contained in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to completion—Dated May 31, 2002.

PRELIMINARY PROSPECTUS

![]()

Huntsman International LLC

Exchange Offer for

$300,000,000 97/8% Senior Notes due 2009

This exchange offer will expire at 5:00 p.m., New York City Time,

on , 2002, unless extended.

Terms of the exchange offer:

See the "Description of New Notes" section on page 99 for more information about the new notes to be issued in this exchange offer.

This investment involves risks. See the section entitled "Risk Factors" that begins on page 17 for a discussion of the risks that you should consider prior to tendering your old notes for exchange.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or the accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is dated , 2002

DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS

All statements other than statements of historical facts included in this prospectus, including, without limitation, statements regarding our future financial position, business strategy, budgets, projected costs and plans and objectives of management for future operations, are forward-looking statements. In addition, forward-looking statements generally can be identified by the use of forward-looking terminology such as "may", "will", "except", "intend", "estimate", "anticipate", "believe" or "continue" or the negative thereof or variations thereon or similar terminology. Although we believe that the expectations reflected in such forward-looking statements are reasonable, there can be no assurances that such expectations will prove to have been correct. Important factors that could cause actual results to differ materially from our expectations are disclosed under "Risk Factors" and elsewhere in this prospectus, including, without limitation, in conjunction with the forward-looking statements included in this prospectus. All subsequent written and oral forward-looking statements attributable to us, or persons acting on our behalf, are expressly qualified in their entirety by the cautionary statements in this prospectus.

Market data used throughout this prospectus was obtained from internal company surveys and industry surveys and publications. These industry surveys and publications generally state that the information contained therein has been obtained from sources believed to be reliable. Results of internal company surveys contained in this prospectus, while believed to be reliable, have not been verified by any independent sources. References in this prospectus to our market position and to industry trends are based on information supplied by Chem Systems, an international consulting and research firm, and International Business Management Associates, an industry research and consulting firm. We have not independently verified such market data.

WHERE YOU CAN FIND MORE INFORMATION

We are subject to the informational requirements of the Securities Exchange Act of 1934, as amended, or the Exchange Act. In accordance with the Exchange Act, we file periodic reports, registration statements and other information with the Securities and Exchange Commission, or the SEC. You may read and copy our reports, registration statements and other information we file with the SEC at the public reference facilities maintained by the SEC at 450 Fifth Street, N.W., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for more information on the public reference rooms. In addition, reports and other filings are available to the public on the SEC's web site at http://www.sec.gov.

If for any reason we are not subject to the reporting requirements of the Exchange Act in the future, we will still be required under the indenture governing the notes to furnish the holders of the notes with certain financial and reporting information. See "Description of New Notes—Certain Covenants—Reports to Holders" for a description of the information we are required to provide.

| |

Page |

|

|---|---|---|

| PROSPECTUS SUMMARY | 1 | |

| RISK FACTORS | 17 | |

| THE EXCHANGE OFFER | 28 | |

| COMPANY BACKGROUND | 37 | |

| USE OF PROCEEDS | 42 | |

| CAPITALIZATION | 43 | |

| UNAUDITED PRO FORMA FINANCIAL DATA | 44 | |

| MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 49 | |

| BUSINESS | 61 | |

| MANAGEMENT | 82 | |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 91 | |

| CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | 91 | |

| OTHER INDEBTEDNESS AND CERTAIN FINANCING ARRANGEMENTS | 96 | |

| DESCRIPTION OF NEW NOTES | 98 | |

| PLAN OF DISTRIBUTION | 142 | |

| CERTAIN U.S. FEDERAL TAX CONSEQUENCES | 143 | |

| LEGAL MATTERS | 143 | |

| EXPERTS | 143 | |

| HUNTSMAN INTERNATIONAL LLC AND SUBSIDIARIES INDEX TO CONSOLIDATED FINANCIAL STATEMENTS | F-1 | |

| INDEPENDENT AUDITORS' REPORT | F-25 |

i

In this prospectus, the words "we", "our", "us" and the "Company" refer to Huntsman International LLC, the issuer of the new notes, and its subsidiaries. The following summary highlights selected information from this prospectus and may not contain all the information that is important to you. This prospectus includes the basic terms of the new notes we are offering, as well as information regarding our business and detailed financial information. You should carefully read this entire document.

General

We are a global manufacturer and marketer of specialty and commodity chemicals through our four principal businesses: Polyurethanes, Pigments, Base Chemicals and Performance Products. We believe that our company is characterized by low-cost operating capabilities; a high degree of technological expertise; a diversity of products, end markets and geographic regions served; significant product integration; and strong growth prospects.

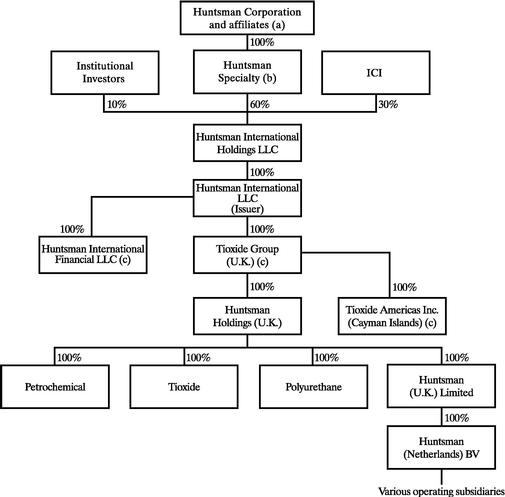

Our company, a Delaware limited liability company, was formed in 1999 in connection with a transaction between our parent, Huntsman International Holdings, Huntsman Specialty Chemicals Corporation ("Huntsman Specialty") and ICI. In connection with the transaction, Huntsman International Holdings acquired, on June 30, 1999, ICI's polyurethane chemicals, selected petrochemicals and TiO2 businesses and Huntsman Specialty's PO business. Huntsman International Holdings also acquired BP Chemicals' 20% ownership interest in the Wilton olefins facility and certain related assets. Huntsman International Holdings transferred the acquired business to us and to our subsidiaries. Huntsman International Holdings owns all of our membership interests. Huntsman International Holdings' membership interests are owned 60% by Huntsman Specialty, 30% by ICI and its affiliates and 10% by institutional investors.

For the year ended December 31, 2001, we had revenues of $4.6 billion, pro forma EBITDA of $385 million and pro forma adjusted EBITDA of $398 million. For the three months ended March 31, 2002, we had revenues of $1 billion, pro forma EBITDA of $84 million and pro forma adjusted

1

EBITDA of $88 million. For the year ended December 31, 2001, our polyurethanes, pigments, base chemicals and performance products businesses represented 48%, 19%, 26% and 7%, respectively, of revenues. For the three months ended March 31, 2002, our Polyurethanes, Pigments, Base Chemicals and Performance Products businesses represented 49%, 20%, 20% and 11%, respectively, of revenues. For the definitions of pro forma EBITDA and pro forma adjusted EBITDA, please see Note 1 to our "Summary Historical and Pro Forma Financial Data".

Polyurethanes

Our Polyurethanes business is composed of the polyurethane chemicals business that we acquired from ICI and its subsidiaries, the PO business that we acquired from Huntsman Specialty, and the TPU business that we acquired from Rohm and Haas in August 2000.

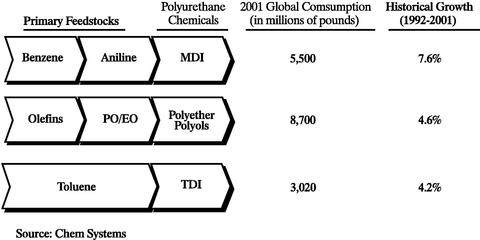

We are one of the leading polyurethane chemicals producers in the world in terms of production capacity. We market a complete line of polyurethane chemicals, including MDI, TDI, TPU, polyols, polyurethane systems and aniline, with an emphasis on MDI-based chemicals. According to Chem Systems, we have the world's second largest production capacity for MDI and MDI-based polyurethane systems, with an estimated 21% global MDI market share; are the fourth largest producer of TPU, with an estimated 11% global TPU market share. Our customers produce polyurethane products through the combination of an isocyanate, such as MDI or TDI, with polyols, which are derived largely from PO and ethylene oxide. Primary polyurethane end-uses include automotive interiors, refrigeration and appliance insulation, construction products, footwear, furniture cushioning, adhesives and other specialized engineering applications. According to Chem Systems, global consumption of MDI was approximately 5.5 billion pounds in 2001, growing from 2.9 billion pounds in 1992, which represents a 7.6% compound annual growth rate. This high growth rate is the result of the broad end-uses for MDI and its superior performance characteristics relative to other polymers.

Our Polyurethanes business is widely recognized as an industry leader in utilizing state-of-the-art application technology to develop new polyurethane chemical products and applications. Approximately 30% of our 2001 polyurethane chemicals sales were generated from products and applications introduced in the previous three years. Our rapid rate of new product and application development has led to a high rate of product substitution, which in turn has led to MDI sales volume growth for our business of approximately 9.0% per year over the past ten years, a rate in excess of the industry growth rate. Largely as a result of our technological expertise and history of product innovation, we have enjoyed long-term relationships with a diverse customer base, including BMW, Weyerhaeuser, Nike, Louisiana Pacific, DaimlerChrysler, Whirlpool, Bosch-Siemens and Electrolux.

According to Chem Systems, we own the world's two largest MDI production facilities in terms of capacity, located in Rozenburg, Netherlands and Geismar, Louisiana. These facilities receive raw materials from aniline facilities located in Wilton, U.K. and Geismar, Louisiana, which in terms of production capacity are the world's two largest aniline facilities. Since 1996, we have invested over $600 million to significantly enhance our production capabilities through the rationalization of our older, less efficient facilities and the modernization of our newer facilities at Rozenburg and Geismar. According to Chem Systems, we are among the lowest cost MDI producers in the world, largely due to the scale of our operations, our modern facilities and our integration with our suppliers of the products' primary raw materials.

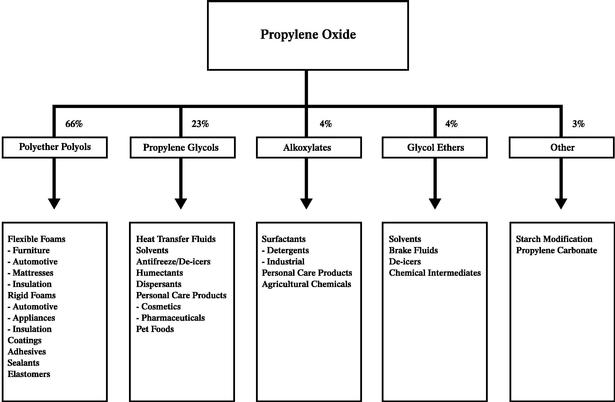

We are one of three North American producers of PO. Our customers process PO into derivative products such as polyols for polyurethane products, propylene glycol, which is commonly referred to in the chemicals industry as "PG", and various other chemical products. End uses for these derivative products include applications in the home furnishings, construction, appliance, packaging, automotive and transportation, food, paints and coatings and cleaning products industries. We are also, according to Chem Systems, the third largest U.S. marketer of PG, which is used primarily to produce

2

unsaturated polyester resins for bath and shower enclosures and boat hulls, and to produce heat transfer fluids and solvents. As a co-product of our PO manufacturing process, we also produce methyl tertiary butyl ether, which is commonly referred to in the chemicals industry as "MTBE". MTBE is an oxygenate that is blended with gasoline to reduce harmful vehicle emissions and to enhance the octane rating of gasoline. See "Business—Polyurethanes—MTBE Developments" for a further discussion of MTBE.

We use our proprietary technology to manufacture PO and MTBE at our state-of-the-art facility in Port Neches, Texas. This facility, which is the most recently built PO manufacturing facility in North America, was designed and built under the supervision of Texaco and began commercial operations in August 1994. According to Chem Systems, we are among the lowest cost PO producers in North America largely due to our proprietary manufacturing process. Since acquiring the facility in 1997, we have increased its PO capacity by approximately 30% through a series of low-cost process improvement projects. The current capacity of our PO facility is approximately 525 million pounds of PO per year. We produce PG under a tolling arrangement with Huntsman Petrochemical Corporation, which has the capacity to produce approximately 130 million pounds of PG per year at a neighboring facility.

Pigments

Our Pigments business, which operates under the tradename "Tioxide", is a leading European TiO2 producer, with an estimated 13% market share, according to International Business Management Associates. TiO2 is a white pigment used to impart whiteness, brightness and opacity to products such as paints, plastics, paper, printing inks, synthetic fibers and ceramics. In addition to its optical properties, TiO2 possesses traits such as stability, durability and non-toxicity, making it superior to other white pigments. According to International Business Management Associates, global consumption of TiO2 was approximately 3.9 million tonnes in 2000, growing from 3.0 million tonnes in 1992, representing a 3.2% compound annual growth rate, which approximates global GDP growth for that period.

We offer an extensive range of products that are sold worldwide to over 3,000 customers in all major TiO2 end markets and geographic regions. The geographic diversity of our manufacturing facilities allows our Pigments business to service local customers, as well as global customers that require delivery to more than one location. Our Pigments business has an aggregate annual nameplate capacity of approximately 576,000 tonnes at our eight production facilities. Five of our TiO2 manufacturing plants are located in Europe, one is in North America, one is in Asia, and one is in South Africa. Our North American operation consists of a 50% interest in a manufacturing joint venture with NL Industries, Inc. and our South African operations consist of a 60%-owned subsidiary.

We recently commenced construction of a new TiO2 manufacturing plant at our Greatham, U.K. facility. This new plant will allow us to close an older plant located at Greatham and will increase our annual production capacity of the facility to 100,000 tonnes of chloride-based TiO2. We expect to commence production at the new plant in mid-2002. In addition, we are in the process of expanding our Huelva, Spain plant by 17,000 tonnes by late 2003.

We are among the world's lowest cost TiO2 producers, according to International Business Management Associates. We have embarked on a comprehensive cost reduction program which has eliminated approximately $120 million of annualized costs since 1996. As part of this program, we have reduced the number of product grades we produce, focusing on those with wider applications. This program has resulted in reduced total plant set-up times and further improved product quality, product consistency, customer service and profitability. We currently anticipate achieving additional savings of $80 million by the end of 2004.

3

Base Chemicals

We are a highly-integrated European olefins and aromatics producer. Olefins, principally ethylene and propylene, are the largest volume basic petrochemicals and are the key building blocks from which many other chemicals are made. For example, olefins are used to manufacture most plastics, resins, adhesives, synthetic rubber and surfactants that are used in a variety of end-use applications. Aromatics are basic petrochemicals used in the manufacture of polyurethane chemicals, nylon, polyester fiber and a variety of plastics.

Our olefins facility at Wilton, U.K. is one of Europe's largest single-site and lowest cost olefins facilities, according to Chem Systems. Our Wilton facility has the capacity to produce approximately 1.9 billion pounds of ethylene, 880 million pounds of propylene and 225 million pounds of butadiene per year. We sell over 80% of our ethylene and propylene volume through long-term contracts with The Dow Chemical Company, European Vinyls Corporation, ICI, BP Chemicals and others, and over 64% of our total ethylene and propylene volume is transported via direct pipelines to our customers or consumed internally. The Wilton olefins facility benefits from its feedstock flexibility and superior logistics, which allows for processing of naphthas, condensates and natural gas liquids, or NGLs.

We produce aromatics at our two integrated manufacturing facilities located in Wilton, U.K. and North Tees, U.K. According to Chem-Systems, we are Europe's largest producer of cyclohexane with 700 million pounds of annual capacity, the third largest producer of paraxylene with 800 million pounds of annual capacity and are among Europe's larger producers of benzene with 1,300 million pounds of annual capacity. We use most of the benzene produced by our aromatics business internally in the production of nitrobenzene for our polyurethane chemicals business and for the production of cyclohexane. The balance of our aromatics products is sold to several key customers.

Performance Products

Our Performance Products business is composed of the ethyleneamines business that we acquired from the Dow Chemical Company in February 2001 and the European Surfacants business that we acquired from Rhocha S.A. in April 2001.

According to Chem Systems, we are one of the world's leading producers of ethyleneamines in terms of production capacity with an estimated 20% market share. We are also a leading producer of surfacants and surfacant intermediates.

Our Performance Products business is a leading manufacturer of surfactants and surfactant intermediates in Europe and is characterized by its breadth of product offering and market coverage. Our surfactant products are primarily used in consumer detergent and industrial cleaning applications. In addition, we manufacture and market a diversified range of mild surfactants and specialty formulations for use in baby shampoos and other personal care applications. We are also a leading producer of powder and liquid laundry detergents and other cleaners. In addition, we offer a wide range of surfactants and formulated specialty products for use in various industrial applications such as leather and textile treatment, foundry and construction, agrochemicals, polymers and coatings. Our surfactant products are manufactured in seven facilities located in the U.K., France, Italy and Spain.

In order to capitalize on opportunities that exist across and within each of our three business segments, we strive to:

Company Strategies

4

the management practices that Huntsman has utilized historically in its acquired businesses by leveraging its management capabilities, experience and entrepreneurial culture to increase operating efficiencies and reduce costs. More specifically, we share services with other Huntsman companies across our business groups in the areas of manufacturing, purchasing, research and development, human resources, finance, legal and environmental, health and safety. We expect to continue to realize cost savings in these and other areas, as well as through the continuation of specific cost reduction initiatives already underway in our businesses.

Business Segment Strategies

5

Senior Notes Offering

On March 18, 2002, we sold $300 million aggregate principal amount of our 9.875% Senior Notes due 2009 in a transaction exempt from the registration requirements of the Securities Act of 1933. We used approximately $58 million of the net proceeds to repay outstanding indebtedness under the revolving portion of our senior secured credit facilities. The balance of the net proceeds was used to repay amounts due under the term loan portion of the senior secured credit facilities, eliminating scheduled term loan amortization requirements in 2002 and substantially reducing scheduled term loan amortization requirements in 2003.

Amendment of our Senior Secured Credit Facilities

On March 15, 2002, we entered into an amendment to our senior secured credit facilities. This amendment, among other things, allowed us to (i) issue the $300 million of senior notes, (ii) apply a portion of the proceeds of the offering of the senior notes to substantially reduce the amortization payments on the term loan portion of our senior secured credit facilities due in 2002 and 2003, and (iii) temporarily repay outstanding principal amounts under the revolving portion of our senior secured credit facilities. This amendment also adjusted certain financial covenant levels in 2002 and 2003. Additionally, this amendment provided that we will not, and will not permit any of our subsidiaries to, amend, modify or terminate any provisions of the recently offered senior notes.

Acquisition of Minority Interest in Tioxide Southern Africa (Pty.) Ltd.

We intend to acquire the 40% minority interest in Tioxide Southern Africa (Pty.) Ltd. that is currently held by AECI Limited. The purchase price for this interest is expected to be approximately $9 million. We expect to close this transaction during the second quarter of 2002. The closing will be subject to certain conditions, including any necessary governmental or other third-party approvals as well as the negotiation of definitive documentation. After this acquisition, Tioxide Southern Africa (Pty.) Ltd. will be an indirect, wholly-owned subsidiary of our company.

Cost Reduction Program

We have announced the first phase of a cost reduction program in our Polyurethanes business which includes the closure of our Shepton Mallet, U.K. polyols manufacturing facility by the end of 2002. During 2001, we incurred $47 million in restructuring and plant closing costs.

Sale of Equity Interests in Our Parent Company

On November 2, 2000, ICI, Huntsman Specialty, Huntsman International Holdings and our company entered into agreements pursuant to which ICI had an option to transfer to Huntsman Specialty or its permitted designated buyers, and Huntsman Specialty or its permitted designated buyers have a right to buy, the 30% of the membership interests in Huntsman International Holdings that are indirectly held by ICI. Pursuant to these agreements, on October 30, 2001, ICI exercised its put right requiring Huntsman Specialty or its nominee to purchase ICI's equity interest in our parent company, Huntsman International Holdings. On December 20, 2001, ICI and Huntsman Specialty amended ICI's put option arrangement under these agreements to, among other things, provide that the purchase of ICI's equity interest would occur on July 1, 2003, or earlier under certain circumstances, and to provide for certain discounts to the purchase price for ICI's equity interest. The amended option agreement also requires Huntsman Specialty to cause Huntsman International Holdings to pay up to $112 million of dividends to its members, subject to certain conditions. These conditions include the receipt of consent from our senior secured lenders and our ability to make restricted payments under the indentures governing its outstanding senior notes and senior subordinated notes, as well as the

6

outstanding high yield notes of Huntsman International Holdings (the "HIH Notes"). At March 31, 2002, the terms of the indentures governing the HIH Notes do not permit it to make restricted payments. In addition, in order to secure its obligation to pay the purchase price for ICI's equity interest, Huntsman Specialty granted ICI a lien on one-half of its 60% equity interest in Huntsman International Holdings.

Certain Events Affecting Huntsman Corporation and Huntsman Polymers Corporation

We are a party to certain arrangements with Huntsman Corporation, an entity that together with its affiliates indirectly holds 60% of our membership interests. In October 2001, Huntsman Corporation engaged Dresdner Kleinwort Wasserstein, Inc. as its financial advisor and investment banker to assist it and certain of its domestic subsidiaries in identifying and exploring strategic alternatives, including developing out of court or court sanctioned financial restructuring plans. Huntsman Corporation is not in compliance with certain financial covenants in its credit facilities, but, in December 2001, entered into amendment, forbearance and waiver agreements (collectively, the "Amendment Agreement") relating to its credit facilities. Under the Amendment Agreement, existing defaults and some future defaults were waived, and the lenders agreed to forbear exercising certain rights and remedies until March 15, 2002 (the "Forbearance Period"). On March 15, 2002, the Forbearance Period was extended until June 30, 2002.

Unless Huntsman Corporation restructures its debt before June 30, 2002 or the Forbearance Period is extended beyond June 30, 2002 or the rights of Huntsman Corporation's lenders are stayed, Huntsman Corporation's lenders could pursue certain remedies including foreclosure on a pledge of Huntsman Corporation's 80.1% equity interest in Huntsman Specialty Chemicals Holdings Corporation ("HSCHC"). HSCHC owns 100% of Huntsman Specialty, which in turn owns 60% of the equity interests of Huntsman International Holdings, our direct parent. Foreclosure on the HSCHC equity would result in a change of control within the meaning of the indentures governing our senior notes and senior subordinated notes, and our senior secured credit facilities. Although there can be no assurance that Huntsman Corporation will be successful in restructuring its debt, Huntsman Corporation is currently in discussions with the agent bank concerning the amendment and restatement of its credit facilities.

Huntsman Corporation also failed to make the interest payment on its senior subordinated notes on January 1, 2002. Huntsman Corporation is discussing the possible restructuring of its indebtedness with representatives of the holder of a majority of its notes. A restructuring could result in a change of control within the meaning of the indentures governing our senior notes and senior subordinated notes, our senior secured credit facilities, as well as under the indentures governing the HIH Notes.

In connection with the December 2001 amendment of ICI's put option agreement, Huntsman Specialty pledged one-half of its 60% equity interest in Huntsman International Holdings to ICI. A foreclosure by ICI on these equity interests would result in a change of control under the indentures governing our senior notes and senior subordinated notes, our senior secured credit facilities, as well as under the indentures governing the HIH Notes. A change of control would constitute a default under the senior secured credit facilities. It would also entitle (i) the holders of our senior notes and senior subordinated notes to exercise their rights to require our company to repurchase these notes from them, and (ii) the holders of the HIH Notes to exercise their rights to require Huntsman International Holdings to repurchase the HIH Notes from them. Under such circumstances there can be no assurance that our company or Huntsman International Holdings would have sufficient funds to purchase all the notes.

Neither our company nor Huntsman International Holdings has guaranteed or provided any other credit support to Huntsman Corporation under its credit facilities or notes. No events of default under Huntsman Corporation's credit facilities or its notes, nor the exercise of any remedy by the lenders

7

thereunder will cause any cross-defaults or cross-accelerations under the indentures governing our senior notes and senior subordinated notes or under our senior secured credit facilities, except insofar as foreclosure on the stock of HSCHC would constitute a "change of control" as described in the preceding paragraphs.

On February 27, 2002, an involuntary bankruptcy petition was filed against Huntsman Polymers Corporation in the United States bankruptcy court located in Delaware by three holders of its outstanding high-yield bonds that collectively held, according to their petition, less than 1% of the outstanding Polymers Notes. On February 28, 2002, the petitioners filed a motion to dismiss their petition. A hearing on the motion took place on March 8, 2002, and the court signed an order granting petitioners' motion to dismiss the petition with prejudice.

For additional information, see "Risk Factors—Certain events affecting Huntsman Corporation could result in a "change of control" under the notes offered hereby, our outstanding senior subordinated notes and our senior secured credit facilities" and "Risk Factors—The restructuring of Huntsman Corporation could adversely affect our relationships with Huntsman Corporation and its subsidiaries; in such an event we may not be able to replace on favorable terms our contracts with them or services and facilities that they provide to us, if at all".

Huntsman Corporation is a privately owned chemical company that is controlled by Jon M. Huntsman and members of his family. Currently, affiliates of Huntsman Corporation indirectly own 60% of our membership interests. Huntsman Corporation is a global, vertically integrated company distinguished by leading market positions, breadth of product offerings, superior operating capabilities and a track record of growth. Since 1983, Huntsman Corporation and its predecessors have successfully completed over 40 acquisitions and investments in joint ventures to build a global chemicals business.

ICI currently is the indirect owner of 30% of our membership interests. Additionally, in connection with the December 2001 amendment of ICI's put option agreement, Huntsman Specialty pledged one-half of its 60% equity interest in Huntsman International Holdings, our direct parent to ICI. 10% of our membership interests is indirectly owned collectively by BT Capital Investors, L.P., J.P. Morgan Partners (BHCA), L.P., GS Mezzanine Partners, L.P. and GSMP (HICI), Inc. Subject to certain conditions, ICI has agreed to sell its membership interests in Huntsman International Holdings to Huntsman Specialty or its designee. See "Company Background—Transaction Consideration—Sale of Equity Interests in Our Parent Company".

Our principal executive offices are located at 500 Huntsman Way, Salt Lake City, Utah 84108, and our telephone number is (801) 584-5700.

8

Securities Offered |

$300,000,000 aggregate principal amount of new 97/8% Senior Notes due 2009, all of which have been registered under the Securities Act of 1933, as amended, or the Securities Act. The terms of the new notes offered in the exchange offer are substantially identical to those of the old notes, except that certain transfer restrictions, registration rights and liquidated damages provisions relating to the old notes do not apply to the new registered notes. |

|

| The Exchange Offer | We are offering to issue registered notes in exchange for a like principal amount and like denomination of our old notes. We are offering to issue these registered notes to satisfy our obligations under an exchange and registration rights agreement that we entered into with the initial purchasers of the old notes when we sold them in a transaction that was exempt from the registration requirements of the Securities Act. You may tender your old notes for exchange by following the procedures described under the heading "The Exchange Offer". | |

| Tenders; Expiration Date; Withdrawal | The exchange offer will expire at 5:00 p.m., New York City time, on , 2002, unless we extend it. If you decide to exchange your old notes for new notes, you must acknowledge that you are not engaging in, and do not intend to engage in, a distribution of the new notes. You may withdraw any notes that you tender for exchange at any time prior to , 2002. If we decide for any reason not to accept any notes you have tendered for exchange, those notes will be returned to you without cost promptly after the expiration or termination of the exchange offer. See "The Exchange Offer—Terms of the Exchange Offer" for a more complete description of the tender and withdrawal provisions. | |

| Conditions to the Exchange Offer | The exchange offer is subject to customary conditions, some of which we may waive. | |

| U.S. Federal Tax Consequences | Your exchange of old notes for new notes in the exchange offer will not result in any gain or loss to you for U.S. federal income tax purposes. | |

| Use of Proceeds | We will not receive any cash proceeds from the exchange offer. | |

| Exchange Agent | Wells Fargo Bank Minnesota, N.A. |

9

| Consequences of Failure to Exchange | Old notes that are not tendered or that are tendered but not accepted will continue to be subject to the restrictions on transfer that are described in the legend on those notes. In general, you may offer or sell your old notes only if they are registered under, or offered or sold under an exemption from, the Securities Act and applicable state securities laws. We, however, will have no further obligation to register the old notes. If you do not participate in the exchange offer, the liquidity of your notes could be adversely affected. | |

| Consequences of Exchanging Your Notes | Based on interpretations of the staff of the SEC, we believe that you may offer for resale, resell or otherwise transfer the new notes that we issue in the exchange offer without complying with the registration and prospectus delivery requirements of the Securities Act if you: | |

| • acquire the new notes issued in the exchange offer in the ordinary course of your business; | ||

| • are not participating, do not intend to participate, and have no arrangement or understanding with anyone to participate, in the distribution of the new notes issued to you in the exchange offer; and | ||

| • are not an "affiliate" of our company as defined in Rule 405 of the Securities Act. | ||

| If any of these conditions are not satisfied and you transfer any new notes issued to you in the exchange offer without delivering a proper prospectus or without qualifying for a registration exemption, you may incur liability under the Securities Act. We will not be responsible for or indemnify you against any liability you may incur. | ||

| Any broker-dealer that acquires new notes in the exchange offer for its own account in exchange for old notes, which it acquired through market-making or other trading activities, must acknowledge that it will deliver a prospectus when it resells or transfers any new notes. See "Plan of Distribution" for a description of the prospectus delivery obligations of broker-dealers in the exchange offer. |

10

The terms of the new notes and those of the outstanding old notes are identical in all material respects, except:

A brief description of the material terms of the new notes follows:

Issuer |

Huntsman International LLC. |

|

| Notes Offered | $300,000,000 aggregate principal amount of 97/8% Senior Notes due 2009. | |

| Maturity Date | March 1, 2009. | |

| Interest Payment Dates | March 1 and September 1 of each year, commencing September 1, 2002. | |

| Guarantees | The new notes will be guaranteed by some of our subsidiaries. If we cannot make payments on the new notes when they are due, then our guarantors are required to make payments on our behalf. | |

| Optional Redemption | Before March 1, 2006, we may redeem some or all of the new notes at a redemption price equal to 100% of their face amount plus a "make whole" premium. After March 1, 2006, we may redeem the new notes, in whole or in part, at our option at any time, at the redemption prices listed in "Description of New Notes—Optional Redemption". | |

| In addition, on or before March 1, 2004, we may, at our option and subject to certain requirements, use the net proceeds from (1) one or more offerings of qualified capital stock or (ii) from capital contributions to the equity of Huntsman International to redeem up to 40% of the original aggregate principal amount of the new notes at 109.875% of their face amount, plus accrued and unpaid interest. See "Description of New Notes—Optional Redemption". | ||

| Sinking Fund | None. |

11

| Ranking of the new notes | The new notes are unsecured senior obligations of our company and our guarantors. | |

| The new notes are: | ||

| • effectively junior in right of payment to all our existing and future secured indebtedness to the extent of the value of the assets securing such indebtedness and to all of our subsidiaries' liabilities (including payments on our senior secured credit facilities and trade payables); | ||

| • equal in right of payment to all our existing and future senior unsecured indebtedness; and | ||

| • senior in right of payment to all our existing and future senior subordinated indebtedness, including our senior subordinated notes; and | ||

| • senior in right of payment to any of our future indebtedness that is expressly subordinated to the new notes. | ||

| Ranking of the Guarantees | The guarantees are: | |

| • effectively junior in right of payment to all the existing and future secured indebtedness of our guarantors to the extent of the value of the assets securing such indebtedness; | ||

| • equal in right of payment to all the existing and future senior indebtedness of our guarantors; | ||

| • senior in right of payment to all the existing and future senior subordinated indebtedness of our guarantors, including their guarantees of our senior subordinated notes; and | ||

| • senior in right of payment to all of their future indebtedness that is expressly subordinated to the guarantees. | ||

| Change of Control | If we go through a change of control, we must make an offer to repurchase the new notes at 101% of their face amount plus accrued and unpaid interest, if any, to the date of repurchase. See "Description of New Notes—Repurchase at the Option of Holders upon Change of Control". | |

| Asset Sales | We may have to use the net proceeds from asset sales to offer to repurchase the new notes under certain circumstances at their face amount, plus accrued and unpaid interest. See "Description of New Notes—Certain Covenants—Limitation on Asset Sales". |

12

| Certain Covenants | The indenture governing the new notes contains certain covenants that, among other things, limit our ability and the ability of certain of our subsidiaries to: | |

| • incur more debt; | ||

| • pay dividends, redeem stock or make other distributions; | ||

| • issue capital stock; | ||

| • make certain investments; | ||

| • create liens on subordinated indebtedness; | ||

| • enter into transactions with affiliates; | ||

| • enter into sale and leaseback transactions; | ||

| • merge or consolidate; and | ||

| • transfer or sell assets. | ||

| These covenants are subject to a number of important qualifications and limitations. See "Description of New Notes—Certain Covenants". | ||

| Registration Covenant; Exchange Offer | We have agreed to consummate the exchange offer within 45 days after the effective date of our registration statement. In addition, we have agreed, in certain circumstances, to file a "shelf registration statement" that would allow some or all of the new notes to be offered to the public. | |

| If we fail to fulfill our obligations with respect to registration of the new notes (a "registration default"), the annual interest rates on the affected notes will increase by 0.25% during the first 90-day period during which the registration default continues, and will increase by an additional 0.25% for each subsequent 90-day period during which the registration default continues, up to a maximum increase of 1.00% over the interest rates that would otherwise apply to the new notes. As soon as we cure a registration default, the accretion rates on the affected notes will revert to their original levels. | ||

| Upon consummation of the exchange offer, holders of old notes will no longer have any rights under the exchange and registration rights agreement, except to the extent that we have continuing obligations to file a shelf-registration statement. |

13

| For additional information concerning the above, see "Description of New Notes—Form, Denomination, Book-Entry Procedures and Transfer—Registration Covenant; Exchange Offer". | ||

| Further Issuances | Under the indenture, we will be entitled to issue additional notes. Any issuance of additional notes will be subject to our compliance with the covenant described below under "Description of New Notes—Certain Covenants—Limitation on Incurrence of Additional Indebtedness". All notes will be substantially identical in all material respects, other than issuance dates, and will constitute the same series of notes, including for purposes of redemption and voting. | |

| Use of Proceeds | We will not receive any proceeds from the exchange offer. We used the net proceeds from the sale of the old notes to repay certain outstanding indebtedness under our senior secured credit facilities. See "Use of Proceeds". |

Failure to Exchange Your Old Notes

The old notes which you do not tender or we do not accept will, following the exchange offer, continue to be restricted securities. Therefore, you may only transfer or resell them in a transaction registered under or exempt from the Securities Act and all applicable state securities laws. We will issue the exchange notes in exchange for the old notes under the exchange offer only following the satisfaction of the procedures and conditions described in the caption "The Exchange Offer".

Because we anticipate that most holders of the old notes will elect to exchange their old notes, we expect that the liquidity of the markets, if any, for any old notes remaining after the completion of the exchange offer will be substantially limited. Any old notes tendered and exchanged in the exchange offer will reduce the aggregate principal amount outstanding of the old notes.

14

Summary Historical and Pro Forma Financial Data

The summary financial data set forth below presents the historical financial data of our company and Huntsman Specialty, our predecessor, as of the dates and for the periods indicated. In accordance with U.S. GAAP, Huntsman Specialty is considered the acquirer of the businesses transferred to us in connection with our transactions with ICI and Huntsman Specialty and with BP Chemicals at the close of business on June 30, 1999 because the shareholders of Huntsman Specialty acquired majority control of the businesses transferred to us. The summary financial and other data as of and for the three months ended March 31, 2001 and 2002 has been derived from the unaudited financial statements of our company included elsewhere in this prospectus. The summary financial and other data as of and for the six month period ended December 31, 1999 and as of and for the years ended December 31, 2000 and 2001 has been derived from the audited financial statements of our company included elsewhere in this prospectus. The summary financial data as of and for the year ended December 31, 1998 and as of and for the six month period ended June 30, 1999 has been derived from audited financial statements of Huntsman Specialty. The summary financial data as of June 30, 1999 has been derived from the unaudited financial statements of Huntsman Specialty.

The summary unaudited pro forma financial data prepared by us and shown below gives effect to the offering of the senior notes in March 2002 and the issuance of € 250 million in senior subordinated notes in March and May 2001. The summary unaudited pro forma statement of operations data for the three months ended March 31, 2002 and for the year ended December 31, 2001 give effect to the above transactions as if they had occurred on January 1, 2001. The summary unaudited pro forma financial data does not purport to be indicative of the results of operations of future periods or indicative of results that would have occurred had our transactions discussed above been consummated on the dates indicated. The pro forma and other adjustments, as described in the accompanying notes to the summary unaudited pro forma statement of operations data, are based on available information and certain assumptions that we believe are reasonable.

You should read the summary historical and unaudited pro forma financial data in conjunction with "Management's Discussion and Analysis of Financial Condition and Results of Operations", "Unaudited Pro Forma Financial Data", the audited and unaudited financial statements of our company and the audited and unaudited combined financial statements of the polyurethane chemicals, selected petrochemicals and TiO2 businesses of ICI, included elsewhere in this prospectus.

15

| |

Pro Forma |

Three Months Ended |

Huntsman International |

Huntsman Speciality |

|||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Three Months Ended Mar. 31, 2002 |

Year Ended Dec. 31, 2001 |

Mar. 31, 2002 |

Mar. 31, 2001 |

Year Ended Dec. 31, 2001 |

Year Ended Dec. 31, 2000 |

Six Months Ended Dec. 31, 1999 |

Six Months Ended June 30, 1999 |

Year Ended Dec. 31, 1998 |

||||||||||||||||||||

| |

(in millions) |

|

|

|

|

(in millions) |

|||||||||||||||||||||||

| Statement of Operations Data: | |||||||||||||||||||||||||||||

| Revenues | $ | 998 | $ | 4,575 | $ | 998 | 1,152 | $ | 4,575 | $ | 4,448 | $ | 1,997 | $ | 192 | $ | 339 | ||||||||||||

| Cost of goods sold | 872 | 3,990 | 872 | 986 | 3,990 | 3,706 | 1,602 | 134 | 277 | ||||||||||||||||||||

| Gross profit | 126 | 585 | 126 | 166 | 585 | 742 | 395 | 58 | 62 | ||||||||||||||||||||

| Operating expenses | 101 | 425 | 101 | 97 | 425 | 331 | 198 | 5 | 8 | ||||||||||||||||||||

| Operating income | 25 | 160 | 25 | 69 | 160 | 411 | 197 | 53 | 54 | ||||||||||||||||||||

| Interest expense—net | 52 | 241 | 50 | 60 | 228 | 222 | 104 | 18 | 40 | ||||||||||||||||||||

| Loss on sale of accounts receivable | 4 | 13 | 4 | 2 | 13 | 2 | — | — | — | ||||||||||||||||||||

| Other expense (income) | (1 | ) | 2 | (1 | ) | (6 | ) | 2 | 3 | (7 | ) | — | (1 | ) | |||||||||||||||

| Income (loss) before income taxes | (30 | ) | (96 | ) | (28 | ) | 13 | (83 | ) | 184 | 100 | 35 | 15 | ||||||||||||||||

| Income tax expense (benefit) | (31 | ) | (26 | ) | (31 | ) | 2 | (26 | ) | 30 | 18 | 13 | 6 | ||||||||||||||||

| Minority interest in subsidiaries | 1 | — | 1 | 3 | 2 | 1 | 1 | 2 | 1 | ||||||||||||||||||||

| Net income (loss) before accounting change | — | $ | (68 | ) | 2 | 10 | $ | (59 | ) | $ | 151 | $ | 81 | $ | 22 | $ | 9 | ||||||||||||

| Cumulative effect of accounting change | — | (2 | ) | — | (2 | ) | (2 | ) | — | — | — | — | |||||||||||||||||

| Net income (loss) | $ | 63 | $ | (70 | ) | $ | 2 | $ | 8 | $ | (61 | ) | $ | 151 | $ | 81 | $ | 22 | $ | 9 | |||||||||

| Other Data: | |||||||||||||||||||||||||||||

| Depreciation and amortization | — | $ | 240 | $ | 63 | $ | 58 | $ | 240 | $ | 216 | $ | 105 | $ | 16 | $ | 31 | ||||||||||||

| EBITDA(1) | $ | 84 | 385 | 84 | 131 | 385 | 622 | 309 | 69 | 86 | |||||||||||||||||||

| Net cash provided by (used in) operating activities | (26 | ) | (42 | ) | 412 | 256 | 40 | 46 | |||||||||||||||||||||

| Net cash used in investing activities | (47 | ) | (252 | ) | (356 | ) | (2,519 | ) | (4 | ) | (10 | ) | |||||||||||||||||

| Net cash provided by (used in) financing activities | 42 | 296 | (131 | ) | 2,402 | (34 | ) | (43 | ) | ||||||||||||||||||||

| Capital expenditures | 47 | 46 | 205 | 132 | 4 | 10 | |||||||||||||||||||||||

| Ratio of earnings to fixed charges(2) | — | 1.2x | — | 1.8x | 1.9x | 2.9x | 1.4x | ||||||||||||||||||||||

Balance Sheet Data (at period end): |

|||||||||||||||||||||||||||||

| Working capital(3) | $ | 348 | $ | 617 | $ | 231 | $ | 274 | $ | 370 | $ | 28 | $ | 28 | |||||||||||||||

| Total assets | 4,792 | 4,886 | 4,862 | 4,815 | 4,818 | 578 | 578 | ||||||||||||||||||||||

| Long-term debt(4) | 2,695 | 2,615 | 2,638 | 2,350 | 2,505 | 396 | 428 | ||||||||||||||||||||||

| Total liabilities(5) | 3,819 | 2,818 | 3,870 | 3,686 | 3,714 | 528 | 547 | ||||||||||||||||||||||

| Stockholders' and members' equity | 973 | 1,068 | 992 | 1,129 | 1,104 | 50 | 31 | ||||||||||||||||||||||

The following other adjustments to pro forma EBITDA do not qualify as pro forma adjustments under the SEC's rules (principally Article 11 of Regulation S-X).

| |

Pro Forma Three Months Ended March 31, 2002 |

Pro Forma Year Ended December 31, 2001 |

||||||

|---|---|---|---|---|---|---|---|---|

| (in millions) |

|

|

||||||

| EBITDA: | ||||||||

| Polyurethanes | 87 | $ | 243 | |||||

| Pigments | 11 | 138 | ||||||

| Base chemicals | (7 | ) | 14 | |||||

| Performance products | 7 | 17 | ||||||

| Unallocated administrative and other items(6) | (14 | ) | (27 | ) | ||||

| Pro forma EBITDA | 84 | 385 | ||||||

| Loss on sale of accounts receivable | 4 | 13 | ||||||

| Pro forma adjusted EBITDA | $ | 88 | $ | 398 | ||||

16

You should carefully consider the risks described below in addition to all other information provided to you in this prospectus before deciding whether to purchase the notes.

Demand for some of our products is cyclical and we may experience prolonged depressed market conditions for our products.

A substantial portion of our revenue is attributable to sales of products, including most of the products of our Base Chemicals business, the prices of which have been historically cyclical and sensitive to relative changes in supply and demand, the availability and price of feedstocks and general economic conditions. Historically, the markets for some of our products, including most of the products of our Base Chemicals business, have experienced alternating periods of tight supply, causing prices and profit margins to increase, followed by periods of capacity additions, resulting in oversupply and declining prices and profit margins. Currently, several of our markets are experiencing periods of oversupply, and the pricing of our products in these markets is depressed. We cannot guarantee that future growth in demand for these products will be sufficient to alleviate any existing or future conditions of excess industry capacity or that such conditions will not be sustained or further aggravated by anticipated or unanticipated capacity additions or other events. In addition, sales of certain of our products, including a substantial portion of our petrochemical products, are dependent upon the continued demand from several key customers. Bassell, a major customer of our Base Chemicals business, has announced the closure of its Wilton, U.K., polypropylene facility. Bassell has also indicated that it intends to stop purchasing propylene from us after our current contract with Bassell expires on December 31, 2003. In 2001, Bassell purchased 350 million pounds of propylene or approximately 40% of our output.

We have substantial debt that we may be unable to service and that restricts our activities, which could adversely affect our ability to meet our obligations.

We have incurred substantial debt in connection with our transactions with ICI and Huntsman Specialty and with BP Chemicals, as well as in connection with our recent acquisitions. As of March 31, 2002, we had total outstanding indebtedness of $2,695 million (including the current portion of long-term debt) and a debt to total capitalization ratio of approximately 73%. We require substantial capital to finance our operations and continued growth, and we may incur substantial additional debt from time to time for a variety of purposes, including acquiring additional businesses. However, the indentures governing our outstanding senior notes and senior subordinated notes and our senior secured credit facilities all contain restrictive covenants. Among other things, these covenants limit or prohibit our ability to incur more debt; make prepayments of other debt, including our senior notes and senior subordinated notes, in whole or in part; pay dividends, redeem stock or make other distributions; issue capital stock; make investments; create liens; enter into transactions with affiliates; enter into sale and leaseback transactions; and merge or consolidate and transfer or sell assets. Additionally, our senior secured credit facilities provide that we will not, and will not permit any of our subsidiaries to, amend, modify or terminate any provisions of our senior notes or senior subordinated notes. Also, if we undergo a change of control, the indentures governing our outstanding senior notes and senior subordinated notes require us to make an offer to purchase the notes. Under these circumstances, we may also be required to repay indebtedness under our senior secured credit facilities to the extent of the value of the assets securing such indebtedness. In this event, we may not have the financial resources necessary to purchase our notes or repay indebtedness under our senior secured credit facilities, which would result in an event of default. See "Description of New Notes".

17

The degree to which we have outstanding debt could have important consequences for our business, including:

Our ability to make scheduled payments of principal and interest on, or to refinance, our debt depends on our future financial performance, which, to a certain extent, is subject to economic, competitive, regulatory and other factors beyond our control. We cannot guarantee that we will have sufficient cash from our operations or other sources to service our debt. If our cash flow and capital resources are insufficient to fund our debt service obligations, we may be forced to reduce or delay capital expenditures, sell assets or seek to obtain additional equity capital or restructure or refinance our debt. We cannot guarantee that such alternative measures would be successful or would permit us to meet our scheduled debt service obligations. In the absence of operating results and resources, we could face substantial liquidity problems and might be required to dispose of material assets or operations to meet our debt service obligations. We cannot guarantee our ability to consummate any asset sales or that any proceeds from an asset sale would be sufficient to meet the obligations then due.

If we are unable to generate sufficient cash flow and we are unable to obtain the funds required to meet payments of principal and interest on our indebtedness, or if we otherwise fail to comply with the various covenants in the instruments governing our indebtedness, including those under our senior secured credit facilities and the indentures governing our outstanding senior notes and senior subordinated notes, we could be in default under the terms of those agreements. In the event of a default by us, a holder of the indebtedness could elect to declare all of the funds borrowed under those agreements to be due and payable together with accrued and unpaid interest, the lenders under our senior secured credit facilities could elect to terminate their commitments thereunder and we could be forced into bankruptcy or liquidation. Any default under the agreements governing our indebtedness could have a material adverse effect on our ability to pay principal and interest on the notes and on the market value of the notes.

Certain events affecting Huntsman Corporation could result in a "change of control" under our senior notes, our senior subordinated notes and our senior secured credit facilities.

The exercise of remedies by the lenders under Huntsman Corporation's existing senior secured credit facilities (the "Existing HC Credit Facilities") or a restructuring of the indebtedness of Huntsman Corporation could result in a "change of control" under our senior notes, our senior subordinated notes and our senior secured credit facilities. A "change of control" would constitute a default under our senior secured credit facilities. It would also entitle the holders of our senior notes and our senior subordinated notes to exercise their rights to require us to repurchase those notes from them. Under such circumstances we may not have sufficient funds to purchase all the notes. In addition, a change of control might affect our ability to maintain the commercial arrangements with our affiliated companies described in "—The restructuring of Huntsman Corporation could adversely affect our relationship with Huntsman Corporation and its subsidiaries; in such event we may not be able to replace on favorable terms our contracts with them or services and facilities that they provide to us, if at all."

18

We are party to certain arrangements with Huntsman Corporation, an entity that together with its affiliates indirectly holds 60% of our membership interests. In October 2001, Huntsman Corporation engaged Dresdner Kleinwort Wasserstein, Inc. as its financial advisor and investment banker to assist it and certain of its domestic subsidiaries in identifying and exploring strategic alternatives, including developing out of court or court sanctioned financial restructuring plans. Huntsman Corporation is not in compliance with certain financial covenants in its credit facilities, but, in December 2001, entered into amendment, forbearance and waiver agreements (collectively, the "Amendment Agreement") relating to its credit facilities. Under the Amendment Agreement, existing defaults and some future defaults were waived, and the lenders agreed to forbear exercising certain rights and remedies until March 15, 2002 (the "Forbearance Period"). On March 15, 2002, the Forbearance Period was extended until June 30, 2002.

Unless Huntsman Corporation restructures its debt before June 30, 2002 or the Forbearance Period is extended beyond June 30, 2002 or the rights of Huntsman Corporation's lenders are stayed, Huntsman Corporation's lenders could pursue certain remedies including foreclosure on a pledge of Huntsman Corporation's 80.1% equity interest in Huntsman Specialty Chemicals Holdings Corporation ("HSCHC"). HSCHC owns 100% of Huntsman Specialty, which in turn owns 60% of the equity interests of Huntsman International Holdings, our direct parent. Foreclosure on the HSCHC equity would result in a change of control within the meaning of the indentures governing our senior notes and senior subordinated notes, and our senior secured credit facilities. Although there can be no assurance that Huntsman Corporation will be successful in restructuring its debt, Huntsman Corporation is currently in discussions with the agent bank concerning the amendment and restatement of its credit facilities.

Huntsman Corporation also failed to make the interest payment on its senior subordinated notes on January 1, 2002. Huntsman Corporation is discussing the possible restructuring of its indebtedness with representatives of the holder of a majority of its notes. A restructuring could result in a change of control within the meaning of the indentures governing our senior notes and senior subordinated notes, our senior secured credit facilities, as well as under the indentures governing the HIH Notes.

In connection with the December 2001 amendment of ICI's put option agreement, Huntsman Specialty pledged one-half of its 60% equity interest in Huntsman International Holdings to ICI. A foreclosure by ICI on these equity interests would result in a change of control under the indentures governing our senior notes and senior subordinated notes, our senior secured credit facilities, as well as under the indentures governing the HIH Notes.

A change of control would constitute a default under the senior secured credit facilities. It would also entitle (i) the holders of our senior notes and senior subordinated notes to exercise their rights to require our company to repurchase these notes from them, and (ii) the holders of the HIH Notes to exercise their rights to require Huntsman International HIH to repurchase the Holdings Notes from them. Under such circumstances there can be no assurance that our company or Huntsman International Holdings would have sufficient funds to purchase all the notes.

Neither we nor Huntsman International Holdings has guaranteed or provided any other credit support to Huntsman Corporation under its credit facilities or notes. No events of default under Huntsman Corporation's credit facilities or its notes, nor the exercise of any remedy by the lenders thereunder will cause any cross-defaults or cross-accelerations under the indentures governing our senior notes and senior subordinated notes or under our senior secured credit facilities, except insofar as foreclosure on the stock of HSCHC would constitute a "change of control" as described in the preceding paragraphs.

19

The restructuring of Huntsman Corporation could adversely affect our relationships with Huntsman Corporation and its subsidiaries; in such an event we may not be able to replace on favorable terms our contracts with them or the services and facilities that they provide to us, if at all.

We have entered and will continue to enter into certain agreements, including service, supply and purchase contracts with Huntsman Corporation, and its affiliates. If, as a result of a court sanctioned financial restructuring at Huntsman Corporation, such agreements are terminated, rejected or restructured, there could be a material adverse effect on our business, financial condition, results of operations or cash flows if we are unable to obtain similar service, supply or purchase contracts on the same terms from third parties. For example, we have only one operating facility for our production of PO, which is located in Port Neches, Texas. The facility is dependent on Huntsman Petrochemical Corporation's existing infrastructure and its adjacent facilities for certain utilities, raw materials, product distribution systems and safety systems. In addition, we depend upon employees of Huntsman Petrochemical Corporation, a subsidiary of Huntsman Corporation, to operate our Port Neches facility. We purchase all of the propylene used in the production of PO through Huntsman Petrochemical Corporation's pipeline, which is the only existing propylene pipeline connected to our PO facility. If we were required to obtain propylene from another source, we would need to make a substantial investment in an alternative pipeline. This could have a material adverse effect on our business, financial condition, results of operations or cash flows. See "Certain Relationships and Related Transactions".

If our subsidiaries do not make sufficient distributions to us, then we will not be able to make payment on our debt.

Our debt is the exclusive obligation of our company and any guarantors thereof and not of any of our other subsidiaries. Because a significant portion of our operations are conducted by our subsidiaries, our cash flow and our ability to service indebtedness, are dependent to a large extent upon cash dividends and distributions or other transfers from our subsidiaries. Any payment of dividends, distributions, loans or advances by our subsidiaries to us could be subject to restrictions on dividends or repatriation of earnings under applicable local law, monetary transfer restrictions and foreign currency exchange regulations in the jurisdictions in which our subsidiaries operate, and any restrictions imposed by the current and future debt instruments of our subsidiaries. In addition, payments to us by our subsidiaries are contingent upon our subsidiaries' earnings.

Our subsidiaries are separate and distinct legal entities and, except for the guarantors of our notes, have no obligation, contingent or otherwise, to pay any amounts due pursuant to our debt or to make any funds available therefore, whether by dividends, loans, distributions or other payments, and do not guarantee the payment of interest on, or principal of, our debt. Any right that we have to receive any assets of any of our subsidiaries that are not guarantors upon the liquidation or reorganization of any such subsidiary, and the consequent right of holders of our debt to realize proceeds from the sale of their assets, will be junior to the claims of that subsidiary's creditors, including trade creditors and holders of debt issued by that subsidiary. In addition, the guarantees of our debt are subordinated to all indebtedness of each guarantor that is secured to the extent of the value of the assets securing such indebtedness.

The significant price volatility of many of our raw materials may result in increased costs.

The prices for a large portion of our raw materials are cyclical. Recently, prices for oil and natural gas, two key raw materials, have fluctuated dramatically. While we attempt to match raw material price increases with corresponding product price increases, we are not able to immediately raise product prices and, ultimately, our ability to pass on increases in the cost of raw materials to our customers is greatly dependent upon market conditions.

20

The industries in which we compete are highly competitive and we may not be able to compete effectively with our competitors that are larger and have greater resources.

The industries in which we operate are highly competitive. Among our competitors are some of the world's largest chemical companies and major integrated petroleum companies that have their own raw material resources. Some of these companies may be able to produce products more economically than we can. In addition, many of our competitors are larger and have greater financial resources, which may enable them to invest significant capital into their businesses, including expenditures for research and development. If any of our current or future competitors develop proprietary technology that enables them to produce products at a significantly lower cost, our technology could be rendered uneconomical or obsolete. Moreover, certain of our businesses use technology that is widely available. Accordingly, barriers to entry, apart from capital availability, are low in certain product segments of our business, and the entrance of new competitors into the industry may reduce our ability to capture improving profit margins in circumstances where capacity utilization in the industry is increasing. Further, petroleum-rich countries have become more significant participants in the petrochemical industry and may expand this role significantly in the future. Any of these developments would have a significant impact on our ability to enjoy higher profit margins during periods of increased demand. See "Risk Factors—Demand for some of our products is cyclical and we may experience prolonged depressed market conditions for our products, which may adversely affect our ability to make payments on the notes."

If we are unable to integrate successfully the businesses that we acquire, then our ability to make payments on our debt service obligations may be impaired.

We have recently acquired new businesses, such as Dow's ethyleneamines business, Rohm and Haas' TPU business and Rhodia S.A.'s European surfactants business. We may acquire additional businesses in the future. You should consider the risks we will encounter during our process of integrating these acquired businesses and during the continued integration of our businesses following the June 30, 1999 transaction, including:

The full benefit of the businesses that we acquire generally requires the integration of administrative functions and the implementation of appropriate operations, financial and management systems and controls. If we are unable to integrate our various businesses effectively, our business, financial condition, results of operations and cash flows may suffer.

Part of our business strategy may include expansion through strategic acquisitions. We cannot be certain that we will be able to identify suitable acquisition candidates, negotiate acquisitions on terms acceptable to us or obtain the necessary financing to complete any acquisition. In addition, the negotiation and consummation of any acquisition and the integration of any acquired business may divert our management from our day to day operations, which could have an adverse effect on our business.

21

Our ability to repay our debt may be adversely affected if our joint venture partners do not perform their obligations or we have disagreements with them.

We conduct a substantial amount of our operations through our joint ventures. Our ability to meet our debt service obligations depends, in part, upon the operation of our joint ventures. If any of our joint venture partners fails to observe its commitments, that joint venture may not be able to operate according to its business plans or we may be required to increase our level of commitment to give effect to those plans. In general, joint venture arrangements may be affected by relations between the joint venture partners. Differences in views among the partners may, for example, result in delayed decisions or in failure to agree on significant matters. Such circumstances may have an adverse effect on the business and operations of the joint ventures, adversely affecting the business and operations of our company. If we cannot agree with our joint venture partners on significant issues, we may experience a material adverse effect on our business, financial condition, results of operations or cash flows.

Terrorist attacks, such as the attacks in New York and Washington, D.C., on September 11, 2001, and other attacks or acts of war may adversely affect the markets in which we operate, our operations and our profitability.

On September 11, 2001, the United States was the target of terrorist attacks of unprecedented scope. These attacks have caused major instability in the U.S. and other financial markets. Leaders of the U.S. government have announced their intention to actively pursue those behind the attacks and to possibly initiate broader action against global terrorism. The attacks and any response may lead to further armed hostilities or to further acts of terrorism in the United States or elsewhere, and such developments would likely cause further instability in financial markets. In addition, armed hostilities and further acts of terrorism may directly impact our physical facilities and operations, which are located in North America, Central America, South America, Europe, Africa, Australia, Asia and the Middle East, or those of our clients. Furthermore, the recent terrorist attacks and future developments may result in reduced demand from our clients for our products or may negatively impact our clients' ability to outsource. These developments will subject our worldwide operations to increased risks and, depending on their magnitude, could have a material adverse effect on our business and your investment.

Pending or future litigation or legislative initiatives related to MTBE may subject us to products or environmental liability or materially adversely affect our sales.

The presence of MTBE in groundwater in some regions of California and other states (primarily due to gasoline leaking from underground storage tanks) and in surface water (primarily from recreational water craft) has led to public concern about MTBE's potential to contaminate drinking and other water supplies. California has sought to ban MTBE use commencing in 2004. Heightened public awareness has resulted in several other state, federal and foreign initiatives and proposed legislation to rescind the oxygenate requirements for reformulated gasoline, or to restrict or prohibit the use of MTBE in particular. Ongoing debate regarding this issue is continuing at all levels of government in the United States, including Congress.

In Europe, Denmark proposed to the EU that a directive be issued, taking effect in 2005, allowing individual EU countries to ban the use of MTBE. No other EU member state joined Denmark's proposal. The EU issued a risk assessment of MTBE on November 7, 2001. While, no ban of MTBE was recommended, several risk reduction measures relating to storage and handling of MTBE-containing fuel were recommended. Separate from EU action, Denmark entered into a voluntary agreement with refiners to reduce the sale of MTBE in Denmark. Under this agreement, use of MTBE in 92- and 95-octane gasoline in Denmark will cease by May 1, 2002; however, MTBE will still be an additive in a limited amount of 98-octane gasoline sold in 100 selected service stations in Denmark.

22

Any phase-out of or prohibition against the use of MTBE could result in a significant reduction in demand for our MTBE. In that event, we may be required to make significant capital expenditures to modify our PO production process to make alternative co-products other than MTBE. In addition, we could incur a material loss in revenues or material costs or expenditures in the event of a widespread decrease or cessation of use of MTBE.

Furthermore, we cannot give any assurance that we will not be named in litigation by citizens groups, municipalities or others relating to the environmental effects of MTBE, or that such litigation will not have a material adverse effect on our business, financial condition, results of operations or cash flows.

For additional information on recent developments concerning MTBE, see "Business—Polyurethanes—MTBE Developments".