Use these links to rapidly review the document

TABLE OF CONTENTS

HUNTSMAN INTERNATIONAL LLC AND SUBSIDIARIES ITEMS 8 AND 14(a) INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form 10-K

| (Mark One) | |

ý |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2002 |

|

OR |

|

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to |

|

Commission file number 333-85141

HUNTSMAN INTERNATIONAL LLC

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

87-0630358 (I.R.S. Employer Identification No.) |

|

500 Huntsman Way Salt Lake City, Utah 84108 (801) 584-5700 (Address of principal executive offices and telephone number) |

||

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES ý NO o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the Registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K of any amendment to this Form 10-K. ý

Indicate by check mark whether the Registrant is an accelerated filer (as defined in Exchange Act Rule 12b-2). YES o NO ý

On June 28, 2002, the last business day of Registrant's second fiscal quarter, 1,000 units of membership interest of Registrant were outstanding. There is no established trading market for Registrant's units of membership interest. All of Registrant's units of membership interest are held by an affiliate. Accordingly, the market value of units of membership interest held by non-affiliates is zero.

HUNTSMAN INTERNATIONAL LLC AND SUBSIDIARIES

2002 FORM 10-K ANNUAL REPORT

HUNTSMAN INTERNATIONAL LLC AND SUBSIDIARIES

2002 FORM 10-K ANNUAL REPORT

Some of the statements contained in this report are forward-looking in nature. In some cases, you can identify forward-looking statements by terminology such as "believes," "expects," "may," "will," "should," "anticipates" or "intends" or the negative of such terms or other comparable terminology, or by discussions of strategy. You are cautioned that our business and operations are subject to a variety of risks and uncertainties, and, consequently, our actual results may materially differ from those projected by any forward-looking statements. Some of those risks and uncertainties are discussed below in "Item 7—Management's Discussion and Analysis of Financial Condition and Results of Operations—Cautionary Statement for Forward-Looking Information" and elsewhere in this report. We make no commitment to revise or update any forward-looking statements in order to reflect events or circumstances after the date any such statement is made.

Market data used throughout this report was obtained from internal Company surveys and industry surveys and publications. These industry surveys and publications generally state that the information contained therein has been obtained from sources believed to be reliable. Results of internal Company surveys contained in this report, while believed to be reliable, have not been verified by any independent outside sources. References in this report to our market position and to industry trends are based on information supplied by Nexant Chem Systems, an international consulting and research firm, and International Business Management Associates, an industry research and consulting firm. We have not independently verified such market data.

General

Our company, Huntsman International LLC, formerly known as Huntsman ICI Chemicals LLC, is a Delaware limited liability company. For convenience in this report, the terms "Company," "our," "us" or "we" may be used to refer to Huntsman International LLC and, where the context requires, its subsidiaries. Unless the context otherwise requires, references to our affiliate, Huntsman LLC (formerly named Huntsman Corporation), include its subsidiaries.

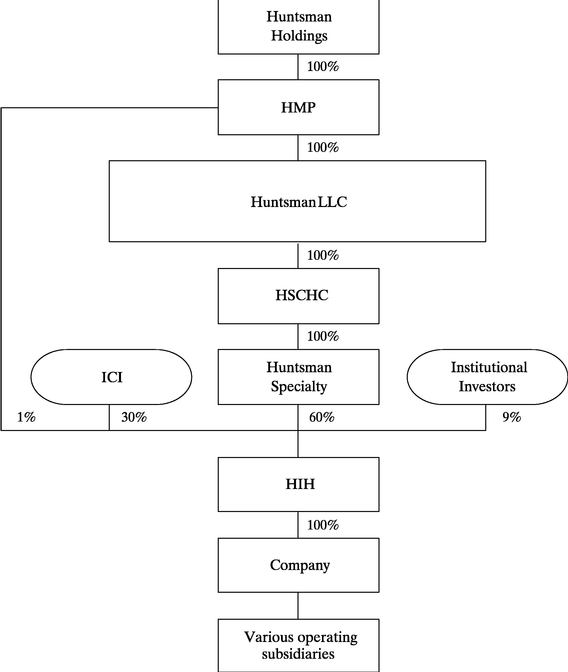

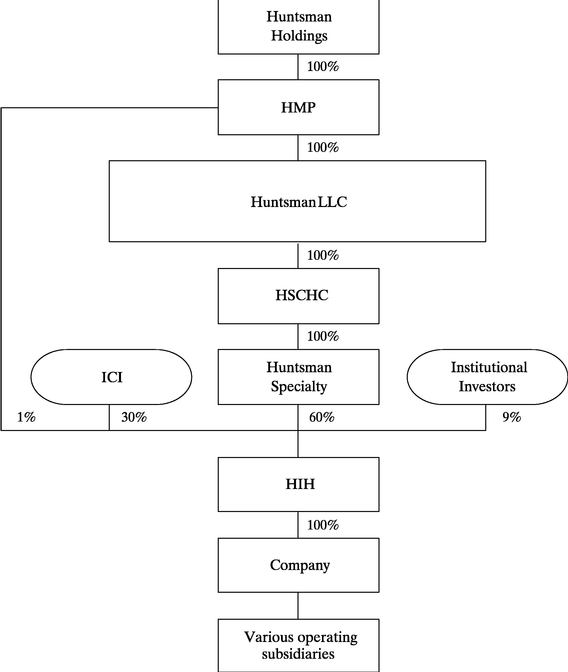

All of our membership interests are owned by Huntsman International Holdings LLC, formerly known as Huntsman ICI Holdings LLC ("HIH"). HIH is a Delaware limited liability company and its membership interests are owned 60% by Huntsman Specialty Chemicals Corporation ("Huntsman Specialty"), 30% by Imperial Chemicals Industries PLC ("ICI") and its affiliates, approximately 9% by institutional investors and approximately 1% by HMP Equity Holdings Corporation ("HMP").

Huntsman Specialty, a Delaware corporation, is owned 100% by Huntsman Specialty Chemicals Holdings Corporation, a Utah corporation ("HSCHC"), and HSCHC is owned 100% by Huntsman LLC. Huntsman LLC, a Utah limited liability company, is owned 100% by HMP. HMP is a Delaware corporation and is owned 100% by Huntsman Holdings, LLC ("Huntsman Holdings"), a Delaware limited liability company. The voting membership interests of Huntsman Holdings are owned by the Huntsman family, MatlinPatterson Global Opportunities Partners, L.P. (formerly known as CSFB Global Opportunities Partners, L.P.) ("GOP"), Consolidated Press (Finance) Limited ("CPH") and certain members of our senior management. In addition, Huntsman Holdings has issued certain non-voting preferred units to Huntsman Holdings Preferred Member LLC, which, in turn, is owned by GOP (indirectly), CPH, the Huntsman Cancer Foundation, certain members of our senior management and certain members of the Huntsman family. The Huntsman family has board and operational control

1

of our Company. The chart below shows our current company structure, together with equity interest ownership:

Our Company was formed in 1999 in connection with a transaction between HIH, Huntsman Specialty and ICI. In that transaction, on June 30, 1999, HIH acquired ICI's polyurethane chemicals, selected petrochemicals and titanium dioxide ("TiO2" or "Tioxide") businesses and Huntsman Specialty's propylene oxide ("PO") business. HIH also acquired the 20% ownership interest of BP Chemicals Limited ("BP Chemicals") in an olefins facility in Wilton, U.K. and certain related assets. HIH then transferred the acquired businesses to us and to our subsidiaries. In August 2000, we completed our acquisition of the Morton global TPU business from The Rohm and Haas Company; in February 2001, we completed our acquisition of the global ethyleneamines business of Dow Chemical Company ("Dow"); and, in April 2001, we completed our acquisition of the Albright & Wilson European surfactants business from Rhodia S.A.

We derive our revenues, earnings and cash flow from the sale of a wide variety of chemical products. We manufacture these products at facilities located in North America, Europe, Asia and Africa, and our products are sold throughout the world.

2

Our products are divided into two broad categories—differentiated and commodity chemicals. We manage our operations through our four principal operating segments: Polyurethanes, Performance Products, Pigments, and Base Chemicals. Our Polyurethanes and Performance Products businesses mainly produce differentiated products and our Pigments and Base Chemicals businesses mainly produce commodity chemicals. Among our commodity products, our Pigments business, while cyclical, tends to follow different trends and is not influenced by the same factors as our petrochemical-based commodity products. In addition, there are a limited number of significant competitors in our Pigments business, relatively high barriers to entry and strong customer loyalty. Each of our four operating segments is impacted to varying degrees by economic conditions, prices of raw materials and global supply and demand pressures.

Historically, the demand for many of the products we produce in our Polyurethanes and Performance Products segments, which accounted for approximately 59% of our revenues for 2002, has been relatively resistant to changes in global economic conditions as industry growth in product demand has been strongly influenced by continuing product substitution, innovation and new product development. The stability of demand has also benefited from the wide variety of end markets for these products. Sales volumes of our leading polyurethane product, MDI, have historically grown at rates in excess of global GDP growth. The global market for PO, also one of our polyurethane products, is influenced by supply and demand imbalances. PO demand is largely driven by growth in the polyurethane industry, and, as a result, growth rates for PO have generally exceeded GDP growth rates. A significant portion of our Performance Products is sold into consumer end use applications, including household detergents, personal care products and cosmetics. As such, demand for these products has been relatively stable and tends to be less susceptible to changes in global economic conditions.

Historically, growth in demand for pigments products, predominately TiO2, has generally moved in line with GDP growth rates. Pigment prices have historically reflected industry-wide operating rates but have typically lagged behind movements in these rates by up to twelve months due to the effects of product stocking and destocking by customers and suppliers, contract arrangements and cyclicality. The industry experiences some seasonality in its sales because sales of paints in Europe and North America, the largest end use for TiO2, are generally highest in the spring and summer months in those regions. This results in greater sales volumes in the first half of the year because the proportion of our TiO2 products sold in Europe and North America is greater than that sold in Asia and the rest of the world.

Many of the markets for our Base Chemicals products, particularly ethylene, propylene, paraxylene and cyclohexane, are cyclical and sensitive to changes in the balance between supply and demand, the price of raw materials and the level of general economic activity. Historically, these markets have experienced alternating periods of tight supply and rising prices and profit margins, followed by periods of capacity additions resulting in over-capacity and falling prices and profit margins. Demand for the majority of our Base Chemicals has generally grown at rates that are approximately equal to or slightly greater than GDP growth. Market conditions during much of the 2000 through 2002 period were characterized by a general weakening in demand and overcapacity. We believe that weak economic conditions have resulted in a contraction in production capacity. If this contraction in industry capacity is sustained and if demand growth returns to the rates which have been achieved historically, we believe that industry profitability will improve.

3

Recent Events

Amendment of HI Credit Facilities

On February 7, 2003, we amended our senior secured credit facilities (the "HI Credit Facilities"). The amendments to the HI Credit Facilities (the "HI Credit Facilities Amendments") resulted in, among other things, the following:

A copy of the HI Credit Facilities Amendments has been filed as an exhibit to this report.

Expansion of Accounts Receivable Securitization Program

We maintain a securitization program arranged by JP Morgan under which certain trade receivables are transferred to an unconsolidated special purpose entity through December 2005. On October 22, 2002, we expanded our securitization program by including the receivables of several additional subsidiaries. The commitment pertaining to the commercial paper portion of the facility was increased from $100 million to $125 million. As noted above, the HI Credit Facilities Amendments, among other things, allow up to $310 million of securitization proceeds without any mandatory prepayment requirement of our bank debt. Subject to the annual seasonality of our accounts receivable, we estimate that the total net proceeds from this program will approach $310 million in the upcoming calendar year. For more information see "Item 7—Management's Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources—Securitization of Accounts Receivable."

Pledge of the Membership Interests of our Parent Company

On November 2, 2000, ICI, Huntsman Specialty, HIH and our Company entered into agreements (the "ICI Agreements") pursuant to which ICI had an option to transfer to Huntsman Specialty or its permitted designated buyers the 30% membership interest in HIH, our parent Company, that is indirectly held by ICI (the "ICI 30% Interest"). Pursuant to these agreements, on October 30, 2001, ICI exercised its put right requiring Huntsman Specialty or its nominee to purchase the ICI 30% Interest. On December 20, 2001, ICI and Huntsman Specialty amended ICI's put option arrangement under the ICI Agreements to, among other things, provide that the purchase of the ICI 30% Interest would occur on July 1, 2003, or earlier under certain circumstances, and to provide for certain discounts to the purchase price for the ICI 30% Interest. The amended option agreement also requires Huntsman Specialty to cause HIH to pay up to $112 million of dividends to its members, subject to certain conditions. These conditions include the receipt of consent from our senior secured lenders and our ability to make restricted payments under the indentures governing our outstanding senior notes and senior subordinated notes (collectively, the "HI Notes"), as well as the outstanding high yield notes of HIH (the "HIH Notes"). At December 31, 2002, the terms of the indentures governing the HIH Notes do not permit HIH to make restricted payments. In addition, in order to secure its obligation to pay the purchase price for the ICI 30% Interest under the ICI Agreements, Huntsman Specialty

4

granted ICI a lien on 30% of the outstanding membership interests in HIH (the "HIH Pledged Interest").

GOP has also entered into an agreement with ICI (the "Option Agreement"). The Option Agreement provided BNAC, Inc. ("BNAC"), then a GOP subsidiary, with an option to acquire the ICI subsidiary that holds the ICI 30% Interest on or before May 15, 2003 upon the payment of $180 million plus accrued interest from May 15, 2002, and subject to completion of the purchase of the B Notes (as discussed below). Concurrently, BNAC paid ICI $160 million to acquire the senior subordinated reset discount notes due 2009 of HIH that were originally issued to ICI (the "B Notes"), subject to certain conditions, including the obligation to make an additional payment of $100 million plus accrued interest to ICI. The B Notes have been pledged to ICI as collateral security for such additional payment.

In connection with the restructuring of Huntsman LLC described below, all the shares in BNAC were contributed to Huntsman Holdings. Huntsman Holdings caused BNAC to be merged into HMP. HMP is a wholly-owned subsidiary of Huntsman Holdings and it now owns all the equity of Huntsman LLC. As a result of its merger with BNAC, HMP holds the interests formerly held by BNAC in the B Notes and the option to acquire the subsidiary of ICI that holds the ICI 30% Interest.

The Option Agreement does not terminate Huntsman Specialty's obligations to ICI under the ICI Agreements. However, if HMP exercises the option, the ICI Agreements would be effectively terminated. If HMP does not exercise the option, Huntsman Specialty would continue to be obligated to ICI under the ICI Agreements. Accordingly, if neither HMP exercises its option nor Huntsman Specialty otherwise satisfies its obligation to ICI with respect to ICI's put right, ICI could foreclose on the HIH Pledged Interest. Such a foreclosure by ICI could result in a "change of control" under the indentures governing the HI Notes and the HIH Notes and under the HI Credit Facilities. A "change of control" would constitute a default under the HI Credit Facilities. It would also entitle both the holders of the HI Notes and the holders of the HIH Notes to exercise their rights to require the respective company to repurchase these notes from them. Under such circumstances there can be no assurance that our Company or HIH would have sufficient funds to purchase all the notes. If HMP does not pay the additional $100 million purchase price in respect of the B Notes, ICI would have the right to foreclose on the pledge of the B Notes in its favor. While there can be no assurance that HMP will be successful in obtaining the necessary funding to complete the transactions contemplated by the Option Agreement, HMP is currently in discussions with financial institutions concerning such funding and believes it will obtain the necessary funding to complete the contemplated transactions.

If, and to the extent, the Option Agreement transactions are completed, ICI's lien on the HIH Pledged Interest would be released and, pursuant to agreements with Huntsman LLC's bank lenders, the HIH Pledged Interest would then be pledged to Huntsman LLC's bank lenders as additional collateral security for borrowings under its bank credit agreements.

Restructuring of Huntsman LLC

On September 30, 2002, Huntsman LLC and its subsidiary, Huntsman Polymers Corporation, completed debt for equity exchanges. Huntsman LLC obtained the required consent of all its bank lenders to complete this restructuring. Huntsman LLC's restructuring involved a series of transactions that resulted in, among other things, the ownership structure described in "—General" above.

Acquisition of HIH Membership Interests

In November 2002, HMP acquired a 1.1% membership interest in HIH which had been previously held by an institutional equity investor. HMP, directly and indirectly, holds approximately 61% of HIH's membership interests.

5

Chinese MDI Joint Venture

In January 2003, we entered into a joint venture agreement to build an MDI manufacturing plant near Shanghai, China with BASF and three Chinese chemical companies. A feasibility study for the project has been approved by the appropriate Chinese authorities, preliminary engineering work has commenced and a business license was issued on March 7, 2003.

The total project cost is anticipated to be approximately $1.1 billion, with one-third to be funded in the form of equity by the joint venture participants and two-thirds in the form of debt. Our share of the equity investment is expected to be approximately $75 million, of which 15% is due within the first half of 2003. The joint venture sponsors are in the process of arranging for the debt portion of the financing, which is expected to be provided by Chinese banks. Most of the debt will be off balance sheet to us and all the debt will be non-recourse to us. Our investment will be made through an unrestricted subsidiary under our HI Credit Facilities and under the indentures governing the HI Notes. A construction completion guaranty of our pro rata share of the debt is anticipated to be provided by our ultimate parent, Huntsman Holdings. Construction will likely require approximately three years, with completion estimated in 2006.

Continued Cost Reduction Initiatives

On March 11, 2003 we announced that, in our Polyurethanes segment, we are integrating our Global Flexible Products division into our Global Derivatives division. This realignment is part of a continuous drive by our Polyurethanes segment to achieve a lowest cost position, as well to address difficult global economic conditions and increased market pressures. In total, approximately 90 positions will be eliminated.

Possible Transaction Involving Vantico Group, S.A.

GOP holds certain debt securities of Vantico Group, S.A. or its affiliated companies ("Vantico"), and is engaged in discussions with Vantico about the restructuring of indebtedness of Vantico. This restructuring may include an exchange of some or all of the Vantico debt securities held by GOP for equity securities. GOP is also in discussions with Huntsman Holdings about the possible contribution of such securities to Huntsman Holdings or one of its subsidiaries, bringing Vantico within the Huntsman Holdings organization. If Vantico becomes part of the Huntsman Holdings organization, it is likely that there would be contractual arrangements between the Company and Vantico relating to management, technology and commercial arrangements. It is not expected, however, that the securities of Vantico would be contributed to the Company, nor would the Company contribute any capital or provide any credit support to Vantico.

Operating Segments

Operating segments are components of our business for which separate financial information is available that is evaluated regularly by our senior management in deciding how to allocate resources and in assessing performance. Prior to 2002, we had three operating segments classified by product types: Specialty Chemicals, Petrochemicals and Tioxide. During the first quarter 2002, we reorganized our operations under four new operating segments classified by product types: Polyurethanes (our polyurethanes and PO business); Base Chemicals (our olefins and aromatics business in the U.K.); Pigments (our TiO2 business); and Performance Products (our surfactants, ethyleneamines and other performance chemicals business). The most significant change was the split of the former Specialty Chemicals segment into two segments: Polyurethanes and Performance Products. The former Tioxide segment was renamed Pigments, and the former Petrochemicals segment was renamed Base Chemicals.

Each of these operating segments has a separate president and operating management. Segment information in this report with respect to 2001 and 2000 has been restated for comparative purposes.

6

For more information on our operating segments and geographic information, see the following and "Note 21—Industry Segment and Geographic Area Information" to our consolidated financial statements included elsewhere in this report.

Polyurethanes

Polyurethanes—General

Our polyurethanes business is composed of:

Polyurethanes. We market a complete line of polyurethane chemicals, including MDI, TDI, TPU, polyols, polyurethane systems and aniline, with an emphasis on MDI-based chemicals. Our customers produce polyurethane products through the combination of an isocyanate, such as MDI or TDI, with polyols, which are derived largely from PO and ethylene oxide. Primary polyurethane end-uses include automotive interiors, refrigeration and appliance insulation, construction products, footwear, furniture cushioning, adhesives and other specialized engineering applications.

According to Nexant Chem Systems, we own the world's two largest MDI production facilities in terms of capacity, located in Rozenburg, Netherlands and Geismar, Louisiana. These facilities receive raw materials from aniline facilities located in Wilton, U.K. and Geismar, Louisiana, which in terms of production capacity are the world's two largest aniline facilities.

PO. We are a leading producer of PO. Our customers process PO into derivative products such as polyols for polyurethane products, propylene glycol ("PG") and various other chemical products. End uses for these derivative products include applications in the home furnishings, construction, appliance, packaging, automotive and transportation, food, paints and coatings and cleaning products industries. We are also, according to Nexant Chem Systems, a leading U.S. marketer of PG, which is used primarily to produce unsaturated polyester resins for bath and shower enclosures and boat hulls, and to produce heat transfer fluids and solvents. As a co-product of our PO manufacturing process, we also produce methyl tertiary butyl ether ("MTBE"). MTBE is an oxygenate that is blended with gasoline to reduce harmful vehicle emissions and to enhance the octane rating of gasoline. See "—MTBE Developments" below for a further discussion of MTBE.

We manufacture PO and MTBE at our facility in Port Neches, Texas. The current capacity of our PO facility is approximately 525 million pounds of PO per year. We produce PG under a tolling arrangement with Huntsman LLC which has the capacity to produce approximately 130 million pounds of PG per year at a neighboring facility.

TPU. In August 2000, we completed our acquisition of the Morton global TPU business from The Rohm and Haas Company. The acquired TPU business adds production capacity in Osnabruck, Germany and Ringwood, Illinois, which complements our existing footwear-based TPU business.

Our Polyurethanes business accounted for 46%, 45% and 46% of our net sales in 2002, 2001 and 2000, respectively.

Polyurethanes—Industry Overview

The polyurethanes industry is estimated to be a $28 billion global market, consisting primarily of the manufacture and marketing of MDI, TDI and polyols, according to Nexant Chem Systems.

7

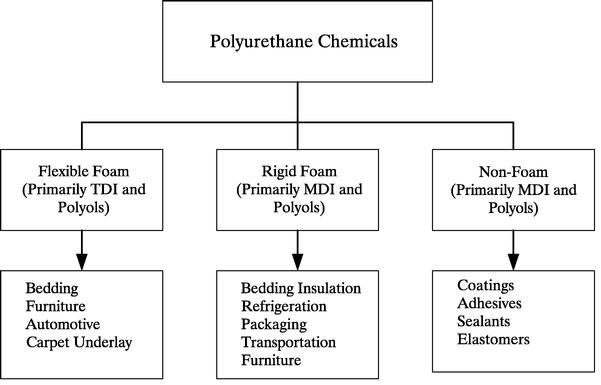

MDI is used primarily in rigid foam; conversely, TDI is used primarily in flexible foam applications that are generally sold as commodities. Polyols, including polyether and polyester polyols, are used in conjunction with MDI and TDI in rigid foam, flexible foam and other non-foam applications. TPU is used in flexible elastomers and other specialty non-foam applications. PO, one of the principal raw materials for polyurethane chemicals, is primarily used in consumer durables. The following chart illustrates the range of product types and end uses for polyurethane chemicals.

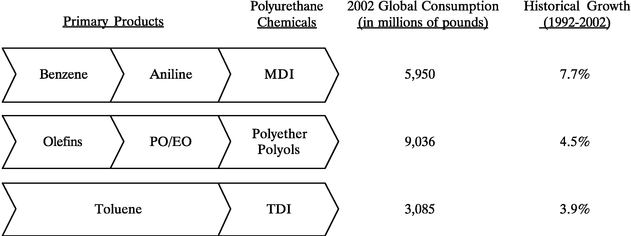

Polyurethane products are created through the reaction of MDI or TDI with a polyol. Polyurethane chemicals are sold to customers who react the chemicals to produce polyurethane products. Depending on their needs, customers will use either commodity polyurethane chemicals produced for mass sales or specialty polyurethane chemicals tailored for their specific requirements. By varying the blend, additives and specifications of the polyurethane chemicals, manufacturers are able to produce and develop a breadth and variety of polyurethane products. The following table sets forth information regarding the three principal polyurethane chemicals markets:

Source: Nexant Chem Systems

8

MDI. As reflected in the chart above, MDI has a substantially larger market size and a higher growth rate than TDI primarily because MDI can be used to make polyurethanes with a broader range of properties and can therefore be used in a wider range of applications than TDI. Nexant Chem Systems reports that future growth of MDI is expected to be driven by the continued substitution of MDI-based polyurethane for fiberglass and other materials currently used in insulation foam for construction. Other markets, such as binders for reconstituted wood board products, are expected to further contribute to the continued growth of MDI.

According to Nexant Chem Systems, global consumption of MDI grew at a compound annual rate of approximately 7.7% over the past decade. This growth rate is the result of the broad end-uses for MDI and its superior performance characteristics relative to other polymers. The U.S. and European markets consume the largest quantities of MDI. With the recent recovery of the Asian economies, the Asian markets are becoming an increasingly important market for MDI and we believe that demand for MDI in Asia will continue to increase as its less developed economies continue to mature.

There are four major producers of MDI: Bayer, our Company, BASF and Dow. We believe it is unlikely that any new major producers of MDI will emerge due to the substantial requirements for entry, including the limited availability of licenses for MDI technology and the substantial capital commitment that is required to develop both the necessary technology and the infrastructure to manufacture and market MDI.

The price of MDI tends to vary by region and by product type. In the Americas, the margin between MDI prices and raw material costs has remained relatively stable over the last ten years. In Europe, these margins have tended to be higher on average but with slightly greater volatility due to occasional supply and demand imbalances. The volatility in margins has been highest in Asia, primarily due to the region's status as a net importer of MDI. As a result, Asia has excess supply in times of surplus in the Americas and Europe and shortage in times of strong global demand. Historically, oversupply of MDI has been rapidly absorbed due to the high growth rate of MDI consumption.

TDI. The TDI market generally grows at a rate consistent with GDP. The four largest TDI producers supply approximately 60% of global TDI demand, according to Nexant Chem Systems. The consumers of TDI consist primarily of numerous manufacturers of flexible foam blocks sold for use as furniture cushions and mattresses. Flexible foam is typically the first polyurethane market to become established in developing countries, and, as a result, development of TDI demand typically precedes MDI demand.

TPU. TPU is a high quality material with unique qualities such as durability, flexibility, strength, abrasion-resistance, shock absorbency and chemical resistance. We can tailor the performance characteristics of TPU to meet the specific requirements of our customers, such as for use in injection molding and components for the automotive and footwear industries. It is also extruded into films and profiles and finds a wide variety of applications in the coatings, adhesives, sealants and elastomers ("CASE") markets.

Polyols. Polyols are reacted with isocyanates, primarily MDI and TDI, to produce finished polyurethane products. In the U.S., approximately 77% of all polyols produced are used in polyurethane applications, according to Nexant Chem Systems. Approximately two-thirds of the polyols used in polyurethane applications are processed with TDI to produce flexible foam blocks and the remaining one-third is processed in various applications that meet the specific needs of individual customers. The creation of a broad spectrum of polyurethane products is made possible through the different combinations of the various polyols with MDI, TDI and other isocyanates. The market for specialty polyols that are reacted with MDI has been growing at approximately the same rate at which MDI consumption has been growing. We believe that the growth of commodity polyols demand has paralleled the growth of global GDP.

9

Aniline. Aniline is an intermediate chemical used primarily as a raw material to manufacture MDI. Approximately 80% of all aniline produced is consumed by MDI producers, while the remaining 20% is consumed by synthetic rubber and dye producers. Generally, most aniline produced is either consumed downstream by the producers of the aniline or is sold to third parties under long-term supply contracts. The lack of a significant spot market for aniline means that, in order to remain competitive, MDI manufacturers must either be integrated with an aniline manufacturing facility or have a long-term cost-competitive aniline supply contract.

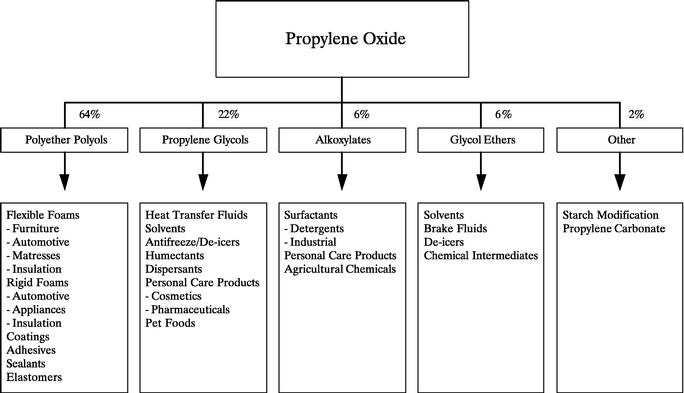

PO. Demand for PO depends largely on overall economic demand, especially that of consumer durables. Consumption of PO in the U.S. represents approximately one-third of global consumption. According to Nexant Chem Systems, U.S. consumption of PO has grown at approximately a 3.7% compound annual rate over the past twelve years. The following chart illustrates the primary end markets and applications for PO, and their respective percentage of total PO consumption:

Source: Nexant Chem Systems

Two U.S. producers, Lyondell and Dow, account for approximately 90% of North American PO production. We believe that Dow consumes approximately 70% of their North American PO production in their North American downstream operations, and that approximately 50% of Lyondell's North American PO production is consumed internally or sold to Bayer, which acquired Lyondell's polyols business on March 31, 2000.

MTBE. We currently use our entire production of tertiary butyl alcohol ("TBA"), a co-product of our PO production process to produce MTBE. MTBE is an oxygenate that is blended with gasoline to reduce harmful vehicle emissions and to enhance the octane rating of gasoline. Historically, the refining industry utilized tetra ethyl lead as the primary additive to increase the octane rating of gasoline until health concerns resulted in the removal of tetra ethyl lead from gasoline. This led to the increasing use of MTBE as a component in gasoline during the 1980s. U.S. consumption of MTBE grew at a compound annual rate of 15.2% in the 1990s due primarily to the implementation of federal environmental standards that require improved gasoline quality through the use of oxygenates. MTBE

10

has experienced strong growth due to its ability to satisfy the oxygenation requirement of the Clean Air Act Amendments of 1990 with respect to exhaust emissions of carbon monoxide and hydrocarbon emissions from automobile engines. Some regions of the U.S. have adopted this oxygenate requirement to improve air quality even though they may not be mandated to do so by the Clean Air Act. While this trend has further increased MTBE consumption, the use of MTBE is becoming increasingly controversial and may be substantially curtailed or eliminated in the future by legislation or regulatory action. See, "—MTBE Developments" below.

Polyurethanes—Sales and Marketing

We manage a global sales force at 45 locations with a presence in 33 countries, which sells our polyurethanes to over 2,000 customers in 67 countries. Our sales and technical resources are organized to support major regional markets, as well as key end-use markets which require a more global approach. These key end-use markets include the appliance, automotive, footwear, furniture and CASE industries.

Approximately 50% of our polyurethane chemicals sales are in the form of "systems" in which we provide the total isocyanate and polyol formulation to our customers in a ready-to-use form. Our ability to supply polyurethane systems is a critical factor in our overall strategy to offer comprehensive product solutions to our customers. We have strategically located our polyol blending facilities, commonly referred to in the chemicals industry as "systems houses," close to our customers, enabling us to focus on customer support and technical service. We believe this customer support and technical service system contributes to customer retention and also provides opportunities for identifying further product and service needs of customers. We intend to increase the utilization of our systems houses to produce and market greater volumes of polyols and MDI polyol blends.

We have entered into contractual arrangements with Huntsman LLC under which Huntsman LLC provides us with all of the management, sales, marketing and production personnel required to operate our PO business and our MTBE business. See "Item 7—Management's Discussion and Analysis of Financial Condition and Results of Operations—Cautionary Statement for Forward-Looking Information" and "Item 13—Certain Relationships and Related Transactions." We believe that the extensive market knowledge and industry experience of the sales executives and technical experts provided to us by Huntsman LLC, in combination with our strong emphasis on customer relationships, have facilitated our ability to establish and maintain long-term customer contracts. Due to the specialized nature of our markets, our sales force must possess technical knowledge of our products and their applications. Our strategy is to continue to increase sales to existing customers and to attract new customers by providing quality products, reliable supply, competitive prices and superior customer service.

Based on current production levels, we have entered into long-term contracts to sell 45% of our PO to a customer through 2007. The balance of our PO is used internally or sold to a number of industrial accounts. Other contracts provide for the sale of our MTBE production to Texaco and BP Amoco. More than 70% of our annual MTBE production is committed to Texaco and BP Amoco, with our contract with Texaco expiring in 2007. In addition, over 40% of our current annual PG production is sold pursuant to long-term contracts.

11

Polyurethanes—Manufacturing and Operations

Our primary polyurethanes facilities are located at Geismar, Louisiana, Port Neches, Texas, Rozenburg, Netherlands and Wilton, U.K. The following chart provides information regarding the capacities of some of our key facilities:

| |

MDI |

TDI |

Polyols |

TPU |

Aniline |

Nitrobenzene |

PO |

PG |

MTBE |

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

(pounds in millions) |

(gallons in millions) |

||||||||||||||||

| Geismar, Louisiana(1) | 860 | 90 | 160 | 890 | (2) | 1,200 | (2) | |||||||||||

| Osnabrück, Germany | 20 | 30 | ||||||||||||||||

| Port Neches, Texas | 525 | 145 | 260 | |||||||||||||||

| Ringwood, Illinois | 20 | |||||||||||||||||

| Rozenburg, Netherlands | 660 | 120 | ||||||||||||||||

| Wilton, U.K. | 660 | 890 | ||||||||||||||||

| Total | 1,520 | 90 | 300 | 50 | 1,550 | 2,080 | 525 | 145 | 260 | |||||||||

Since 1996, over $600 million has been invested to improve and expand our MDI production capabilities through the rationalization of older, less efficient facilities and the modernization of newer facilities. We expect to pursue future plant expansions and capacity modification projects when justified by market conditions.

In addition to MDI, we produce TDI and polyols at our Geismar facility and polyols and polyol blends at our Rozenburg facility. We manufacture TDI and polyols primarily to support our MDI customers' requirements. We believe the combination of our PO business, which produces the major feedstock for polyols, with our polyols business creates an opportunity to expand our polyols business and market greater volumes of polyols through our existing sales network and customer base.

We use a proprietary manufacturing process to manufacture PO. We own or license all technology, know-how and patents developed and utilized at this facility. Our process reacts isobutane and oxygen in proprietary oxidation (peroxidation) reactors, thereby forming tertiary butyl hydroperoxide and TBA which are further processed into PO and MTBE, respectively. Because our PO production process is less expensive relative to other technologies and allows all of our PO co-products to be processed into saleable or useable materials, we believe that our PO production technology possesses several distinct advantages over its alternatives.

Rubicon Joint Venture. We are a 50% joint venture owner, along with Crompton Corp., of Rubicon, Inc., which owns aniline, nitrobenzene and diphenylamine ("DPA") manufacturing facilities in Geismar, Louisiana. In addition to operating our 100% owned MDI, TDI and polyol facilities at Geismar, Rubicon also operates the joint venture's owned aniline, nitrobenzene and DPA facilities and is responsible for providing other auxiliary services to the entire Geismar complex. We are entitled to approximately 80% of the nitrobenzene and aniline production capacity of Rubicon, and Crompton Corp. is entitled to 100% of the DPA production. As a result of this joint venture, we are able to

12

achieve greater scale and lower costs for our products than we would otherwise have been able to obtain.

Raw Materials. The primary raw materials for polyurethane chemicals are benzene and PO. Benzene is a widely-available commodity that is the primary feedstock for the production of MDI. Approximately one-third of the raw material cost of MDI is attributable to the cost of benzene. Our integration with our suppliers of benzene, nitrobenzene and aniline provides us with a competitively priced supply of feedstocks and reduces our exposure to supply interruption.

A major cost in the production of polyols is attributable to the costs of PO. We believe that the integration of our PO business with our polyurethane chemicals business will give us access to a competitively priced, strategic source of PO and the opportunity to further expand into the polyol market. The primary raw materials used in our PO production process are butane/isobutane, propylene, methanol and oxygen, which accounted for 52%, 29%, 16% and 3%, respectively, of total raw material costs in 2002. We purchase our raw materials primarily under long-term contracts. While most of these feedstocks are commodity materials generally available to us from a wide variety of suppliers at competitive prices in the spot market, we purchase all of the propylene used in the production of our PO from Huntsman LLC, and through Huntsman LLC's pipeline, which is the only propylene pipeline connected to our PO facility.

Polyurethanes—Competition

Competitors in the polyurethane chemicals business include leading worldwide chemical companies such as BASF, Bayer, Dow and Lyondell. While these competitors produce various types and quantities of polyurethane chemicals, we focus on MDI and MDI-based polyurethane systems. We compete based on technological innovation, technical assistance, customer service, product reliability and price. In addition, our polyurethane chemicals business also differentiates itself from its competition in the MDI market in two ways: (1) where price is the dominant element of competition, our polyurethane chemicals business differentiates itself by its high level of customer support including cooperation on technical and safety matters; and (2) elsewhere, we compete on the basis of product performance and our ability to react to customer needs, with the specific aim of obtaining new business through the solution of customer problems. Nearly all the North American PO production capacity is located in the U.S. and controlled by three producers, Lyondell, Dow and us. We compete based on price, product performance and service.

Polyurethanes—MTBE Developments

The presence of MTBE in some groundwater supplies in California and other states (primarily due to gasoline leaking from underground storage tanks) and in surface water (primarily from recreational watercraft) has led to public concern about MTBE's potential to contaminate drinking water supplies. Heightened public awareness regarding this issue has resulted in state, federal and foreign initiatives to rescind the federal oxygenate requirements for reformulated gasoline or restrict or prohibit the use of MTBE in particular. For example, the California Air Resources Board adopted regulations that would prohibit the addition of MTBE to gasoline as of January 1, 2004. Certain other states have also taken actions to restrict or eliminate the future use of MTBE. In connection with the proposed ban, the State of California requested that the U.S. Environmental Protection Agency (the "EPA") waive the federal oxygenated fuels requirements of the federal Clean Air Act for gasoline sold in California. The EPA denied the State's request on June 12, 2001. Certain of the state bans have been challenged in court as unconstitutional (in light of the Clean Air Act). We are unable to predict what the short- and long- term effects of these matters will be.

Bills have been introduced in the U.S. Congress to accomplish similar goals of curtailing or eliminating the oxygenated fuels requirements in the Clean Air Act, or of curtailing MTBE use. To

13

date, no such legislation has become law. Whether a ban or substantial restrictions on MTBE use will become law in the future is unknown at this time.

In addition, on March 20, 2000, the EPA announced its intention, through an advanced notice of proposed rulemaking, to phase out the use of MTBE under authority of the federal Toxic Substances Control Act. In its notice, the EPA also called on the U.S. Congress to restrict the use of MTBE under the Clean Air Act. Any phase-out of or future regulation of MTBE in California (in which a significant amount of MTBE is consumed), in other states, or nationally may result in a significant reduction in demand for our MTBE and may result in a material loss in revenues or material costs or expenditures.

In Europe, the European Union (the "EU") issued a final risk assessment report on MTBE on September 20, 2002. While no ban of MTBE was recommended, several risk reduction measures relating to storage and handling of MTBE-containing fuel were recommended. Separate from EU action, Denmark entered into a voluntary agreement with refiners to reduce the sale of MTBE in Denmark. Under the agreement, use of MTBE in 92- and 95-octane gasoline in Denmark ceased by May 1, 2002; however, MTBE will still be an additive in a limited amount of 98-octane gasoline sold in about 100 selected service stations in Denmark.

In the event that there should be a phase-out of MTBE in the United States, we believe we will be able to export MTBE to Europe or elsewhere or use our co-product tertiary butyl alcohol ("TBA") to produce saleable products other than MTBE. We believe that our low production costs at the PO/MTBE facility will put us in a favorable position relative to other higher cost sources (primarily, on-purpose manufacturing). If we opt to produce products other than MTBE, necessary modifications to our facilities may require significant capital expenditures and the sale of the other products may produce a materially lower level of cash flow than the sale of MTBE.

Furthermore, we cannot give any assurance that we will not be named in litigation relating to the environmental effects of MTBE or that such litigation will not have a material adverse effect on our business, financial condition, results of operations or cash flows. See "Item 7—Management's Discussion and Analysis of Financial Condition and Results of Operations—Cautionary Statement for Forward-Looking Information—Pending or future litigation or legislative initiatives related to MTBE may subject us to products or environmental liability or materially adversely affect our sales."

Performance Products

Performance Products—General

Our performance products business is composed of:

Surfactants. Surfactants or "surface active agents" are substances which combine a water-soluble component with a water insoluble component in the same molecule. While surfactants are most commonly used for their detergency in cleaning applications, they are also valued for their emulsification, foaming, dispersing, penetrating and wetting properties in a variety of industries.

We have the capacity to produce approximately 1.6 billion pounds of surfactant products annually at our six facilities located in the U.K., France, Italy and Spain. Our surfactants business is a leading manufacturer of surfactants and surfactant intermediates in Europe and is characterized by its breadth of product offering and market coverage. Our surfactant products are primarily used in consumer detergent and industrial cleaning applications. In addition, we manufacture and market a diversified range of mild surfactants and specialty formulations for use in shampoos and other personal care applications. We are also a leading producer of powder and liquid laundry detergents and other cleaners. In addition, we offer a wide range of surfactants and formulated specialty products for use in

14

various industrial applications such as leather and textile treatment, foundry and construction, agrochemicals, polymers and coatings.

The primary raw materials for our surfactants business are linear alkylbenzene, ethylene oxide, natural alcohols, caustic soda and fatty acids. All of these raw materials are widely available in the merchant market at competitive prices.

The table below identifies the major surfactant product groups that we produce and some common applications.

| Product Group |

Application |

|

|---|---|---|

| Alkoxylates | household detergents industrial cleaners shampoos polymerization additives |

|

Sulfonates/Sulfates |

powdered detergents liquid detergents dishwashing liquids industrial cleaners emulsion polymerization concrete superplasticizers gypsum wallboard agricultural adjuvants for herbicides |

|

Esters and Derivatives |

shampoo body wash other personal care products textile and leather treatment |

|

Nitrogen Derivatives |

bleach thickeners shampoo fabric conditioners other personal care products and applications |

|

Formulated Blends |

household detergents textile and leather treatment personal care products and applications foundry catalysts concrete additives pharmaceutical intermediates |

|

EO/PO Block Co-Polymers |

automatic dishwasher |

Ethyleneamines. Ethyleneamines are highly versatile performance chemicals with a wide variety of end-use applications, including lube oil additives, epoxy hardeners, wet strength resins, chelating agents and fungicides.

We have the capacity to produce approximately 160 million pounds of ethyleneamines annually at our facilities located at Freeport, Texas and Terneuzen, Netherlands. When we acquired our ethyleneamines business, we added production capacity in Freeport, Texas and a long-term supply arrangement for up to 50% of the existing production capacity of Dow's ethyleneamines plant in

15

Terneuzen, Netherlands. Customers use these products in a wide variety of applications as shown below.

| Product |

Applications |

|

|---|---|---|

| Ethyleneamines | lube oil additives epoxy hardeners wet strength resins chelating agents fungicides |

The primary raw materials for ethyleneamines are ethylene dichloride and caustic soda. We have entered into long-term arrangements for the supply of ethylene dichloride and caustic soda from Dow, which produces these raw materials at facilities that are in close proximity to our Freeport, Texas manufacturing facility.

Our Performance Products business accounted for 13%, 10% and 1% of net sales in 2002, 2001 and 2000, respectively.

Performance Products—Industry Overview

Surfactants. Growth in demand for surfactants is highly correlated with GDP due to its strong links with the household cleaning and general industrial markets; nevertheless, certain segments of the surfactants market, including personal care, are expected to grow faster than GDP.

Demand growth for surfactants is viewed as being relatively stable and exhibits little cyclicality. The main consumer product applications for surfactants can demand new formulations with unproved performance characteristics, and as a result lifetimes for these consumer end-products can often be quite short. This affords considerable opportunity for surfactants manufacturers to provide surfactants and blends with differentiated specifications and properties. For basic surfactants, pricing tends to have a strong relationship to underlying raw material prices and usually lags petrochemical price movements.

Ethyleneamines. Ethyleneamines are a component of the amines market. Amines broadly refer to the family of intermediate chemicals that are produced by reacting ammonia with various ethylene and propylene derivatives. Generally, amines are valued for their properties as reactive, emulsifying, dispersant, detergent, solvent or corrosion inhibitor agents. Similar to surfactants, growth in demand for amines is highly correlated with GDP due to its strong links to general industrial and consumer products markets. As amines are generally sold based upon the performance characteristics that they provide to customer-specific end use application, pricing for amines tends to be stable and does not generally fluctuate with movements in underlying raw materials.

Performance Products—Sales and Marketing

We sell our products to customers globally through a commercial organization which has extensive market knowledge, lengthy industry experience and long-standing customer relationships. Our sales force is organized into specialized teams tailored to each market segment's specific needs, thereby enhancing customer service. In addition to direct sales efforts, we also sell some of our products through a network of distributors.

We also provide extensive pre-and post-sales technical service support to our customers. Our technical service professionals bring sophisticated skills to our customers and are well regarded within their field of expertise. Moreover, these professionals help tailor application of our products to meet our customers' unique needs and interact closely with our cross-functional business teams.

16

Performance Products—Manufacturing and Operations

We have the capacity to produce approximately 1.6 billion pounds of surfactant products annually at our six facilities located in the U.K. (at Whitehaven), France (at Lavera and St. Mihiel), Spain (at Barcelona), and Italy (at Castiglione and Patrica), and a research facility located in the U.K. (at Oldbury). Our surfactants facilities are well located in Europe, with broad capabilities in conversion, sulfonation and ethoxylation. The surfactants facilities have a competitive cost base and use modern production tools that allow for flexibility in production capabilities and technical innovation. We continue to evaluate the feasibility of restructuring our Whitehaven, UK facility with a goal of reducing the operating cost of the facility.

We have the capacity to produce approximately 160 million pounds of ethyleneamines annually at our facilities located at Freeport, Texas and Terneuzen, Netherlands. When we acquired our ethyleneamines business, we acquired a long-term supply arrangement for up to 50% of the existing production capacity of Dow's ethyleneamines plant in Terneuzen, Netherlands.

Performance Products—Competition

There are numerous surfactants producers in Europe and worldwide. Our main competitors include worldwide leading chemical companies such as Sasol, BASF, Shell, Cognis, Clariant, AKZO Nobel, Dow, as well as various smaller or more local competitors. We compete on the basis of price with respect to our basic surfactant product offering and, in addition to price, on the basis of performance and service with respect to our specialty and blended surfactant products. Our main competitors in ethyleneamines include BASF, Dow and AKZO Nobel.

Pigments

Pigments—General

Our Pigments business, which operates under the trade name "Tioxide," is among the largest producers in the world, with an estimated 13% market share, according to International Business Management Associates and has the largest production capacity for TiO2 in Europe. TiO2 is a white pigment used to impart whiteness, brightness and opacity to products such as paints, plastics, paper, printing inks, synthetic fibers and ceramics. In addition to its optical properties, TiO2 possesses traits such as stability, durability and non-toxicity, making it superior to other white pigments. According to International Business Management Associates, global consumption of TiO2 has grown at approximately a 2.9% compound annual rate during the past decade, which is in line with global GDP growth for that period.

We offer an extensive range of products that are sold worldwide to over 3,000 customers in all major TiO2 end markets and geographic regions. The geographic diversity of our manufacturing facilities allows our Pigments business to service local customers, as well as global customers that require delivery to more than one location. Our Pigments business has an aggregate annual nameplate capacity of approximately 596,000 tonnes at our eight production facilities. Five of our TiO2 manufacturing plants are located in Europe, one is in North America, one is in Asia, and one is in South Africa. Our North American operation consists of a 50% interest in a manufacturing joint venture with NL Industries, Inc.

17

We recently commissioned a new TiO2 manufacturing plant at our Greatham, U.K. facility. This new plant allowed us to close an older, higher cost plant located at Greatham and increased our annual production capacity of the facility to 100,000 tonnes of chloride-based TiO2. In addition, we are in the process of expanding our Huelva, Spain plant by 17,000 tonnes by late 2005.

We are among the world's lowest cost TiO2 producers, according to International Business Management Associates. By 2000, our comprehensive cost reduction program eliminated approximately $120 million of annualized costs since 1996. We have recently initiated a series of new cost rationalization initiatives, referred to as our "High Force" project, which are targeted to achieve additional savings of $80 million by the end of 2004.

Our Pigments business accounted for 19%, 19% and 22% of our net sales in 2002, 2001 and 2000, respectively.

Pigments—Industry Overview

Global consumption of TiO2 was 3.9 million tonnes in 2002 according to International Business Management Associates. The historical long-term growth rate for global TiO2 consumption generally has been in line with global GDP growth. Although short-term influences such as customer and producer stocking and de-stocking activities in response to changes in capacity utilization and price may distort this trend, over the long-term, GDP growth is the primary underlying factor influencing growth in TiO2 demand. The TiO2 industry experiences some seasonality in its sales because paint sales generally peak during the spring and summer months in the northern hemisphere, resulting in greater sales volumes during the first half of the year.

The global TiO2 market is characterized by a small number of large global producers. The TiO2 industry currently has five major producers (DuPont, Millennium Chemicals, our Company, Kerr-McGee and NL Industries), which account for approximately 80% of the global market share, according to International Business Management Associates. No producer has announced greenfield TiO2 capacity in the last few years. Based upon current price levels and the long lead times for planning, governmental approvals and construction, additional greenfield capacity is not expected in the near future. According to International Business Management Associates, prices of TiO2 are expected to be positively affected by limited investment in new capacity.

There are two manufacturing processes for the production of TiO2, the sulfate process and the chloride process. Most recent capacity additions have employed the chloride process technology and, currently, the chloride process accounts for approximately 64% of global production capacity according to International Business Management Associates. However, the global distribution of sulfate and chloride-based TiO2 capacity varies by region, with the sulfate process being predominant in Europe, our primary market. The chloride process is the predominant process used in North America and both processes are used in Asia. While most end-use applications can use pigments produced by either process, market preferences typically favor products that are locally available.

Pigments—Sales and Marketing

Approximately 90% of our TiO2 sales are made through our direct sales and technical services network, enabling us to cooperate more closely with our customers and to respond to our increasingly global customer base. Our concentrated sales effort and local manufacturing presence have allowed us to achieve leading market shares in a number of the countries where we manufacture TiO2.

In addition, we have focused on marketing products to higher growth industries. For example, we believe that our Pigments business is well-positioned to benefit from the projected growth in the plastics sector, which, according to International Business Management Associates, is expected to grow

18

faster than the overall TiO2 market over the next several years. The table below summarizes the major end markets for our Pigments products:

| End Markets |

% of 2002 Sales Volume |

||

|---|---|---|---|

| Paints and Coatings | 58 | % | |

| Plastics | 32 | % | |

| Inks | 5 | % | |

| Other | 5 | % |

Pigments—Manufacturing and Operations

Our Pigments business has eight manufacturing sites in seven countries with a total nameplate capacity of 596,000 tonnes per year. Approximately 73% of our TiO2 capacity is located in Western Europe. The following table presents information regarding our TiO2 facilities:

| Region |

Site |

Annual Capacity |

Process |

|||

|---|---|---|---|---|---|---|

| |

|

(tons) |

|

|||

| Western Europe | Calais, France Greatham, U.K. Grimsby, U.K. Huelva, Spain Scarlino, Italy |

100,000 100,000 80,000 80,000 80,000 |

Sulfate Chloride Sulfate Sulfate Sulfate |

|||

| North America | Lake Charles, Louisiana(1) | 60,000 | Chloride | |||

| Asia | Teluk Kalung, Malaysia | 56,000 | Sulfate | |||

| Southern Africa | Umbogintwini, South Africa(2) | 40,000 | Sulfate | |||

| 596,000 | ||||||

Joint Ventures. We own a 50% interest in a manufacturing joint venture located in Lake Charles, Louisiana. The remaining 50% interest is held by our joint venture partner, Kronos Louisiana, Inc., a wholly-owned subsidiary of NL Industries, Inc. We share production offtake and operating costs of the plant equally with Kronos, though we market our share of the production independently. The operations of the joint venture are under the direction of a supervisory committee on which each partner has equal representation.

Raw Materials. The primary raw materials used to produce TiO2 are titanium-bearing ores. There are a limited number of ore suppliers and we purchase ore under long-term supply contracts. The cost of titanium-bearing ores has been relatively stable in comparison to TiO2 prices. Titanium-bearing ore represents approximately 40% of TiO2 pigment direct production costs. We have recently renegotiated several of our primary ore purchasing contracts, which are expected to reduce our variable costs in the future.

TiO2 producers extract titanium from ores and process it into pigmentary TiO2 using either the chloride or sulfate process. Once an intermediate TiO2 pigment has been produced, it is "finished" into

19

a product with specific performance characteristics for particular end-use applications. The finishing process is common to both the sulfate and chloride processes and is a major determinant of the final product's performance characteristics.

The sulfate process generally uses less-refined ores that are cheaper to purchase but produce more co-product than the chloride process. Co-products from both processes require treatment prior to disposal in order to comply with environmental regulations. In order to reduce our disposal costs and to increase our cost competitiveness, we have developed and marketed the co-products of our Pigments business. We now sell over 50% of the co-products generated by our business.

Pigments—Competition

The global markets in which our Pigments business operates are highly competitive. The primary factors of competition are price, product quality and service. The major global producers against whom we compete are DuPont, Millennium Chemicals, Kerr-McGee Chemicals and NL Industries. We believe that our competitive production costs, combined with our presence in numerous local markets, give us a competitive advantage, particularly with respect to those global customers demanding presence in the various regions in which they conduct business.

Base Chemicals

Base Chemicals—General

We are a highly-integrated European olefins and aromatics producer. Olefins, principally ethylene and propylene, are the largest volume basic petrochemicals and are the key building blocks from which many other chemicals are made. For example, olefins are used to manufacture most plastics, resins, adhesives, synthetic rubber and surfactants that are used in a variety of end-use applications. Aromatics are basic petrochemicals used in the manufacture of polyurethane chemicals, nylon, polyester fiber and a variety of plastics.

Olefins. Our olefins facility at Wilton, U.K. is one of Europe's largest single-site and lowest cost olefins facilities, according to Nexant Chem Systems. Our Wilton facility has the capacity to produce approximately 1.9 billion pounds of ethylene, 880 million pounds of propylene and 225 million pounds of butadiene per year. We sell over 80% of our ethylene and propylene volume through long-term contracts with Dow, European Vinyls Corporation, ICI, BP Chemicals and others, and over 64% of our total ethylene and propylene volume is transported via direct pipelines to our customers. The Wilton olefins facility benefits from its feedstock flexibility and superior logistics, which allows for processing of naphthas, condensates and natural gas liquids ("NGLs").

Aromatics. We produce aromatics at our two integrated manufacturing facilities located in Wilton, U.K. and North Tees, U.K. According to Nexant Chem Systems, we are a leading European producer of cyclohexane with 700 million pounds of annual capacity, a leading producer of paraxylene with 800 million pounds of annual capacity and are among Europe's larger producers of benzene with 1,300 million pounds of annual capacity. We use most of the benzene produced by our aromatics business internally in the production of nitrobenzene for our polyurethane chemicals business and for the production of cyclohexane. The balance of our aromatics products are sold to several key customers. We are in the process of evaluating to what extent we will need to spend additional capital at our aromatics manufacturing facilities to increase the efficiency and performance of such facilities.

Our Base Chemicals business accounted for 22%, 26% and 31% of net sales in 2002, 2001 and 2000, respectively.

20

Base Chemicals—Industry Overview

Petrochemical markets are essentially global commodity markets. However, the olefins market is subject to some regional price differences due to the more limited inter-regional trade resulting from the high costs of product transportation. The global petrochemicals market is cyclical and is subject to pricing swings due to supply and demand imbalances, feedstock prices (primarily driven by crude oil prices) and general economic conditions.

According to Nexant Chem Systems, the petrochemical industry is at or near its cyclical trough following a period of oversupply in the last few years and supply and demand characteristics are currently expected to improve in coming years, which should result in improved performance.

As shown in the following table, ethylene is the largest petrochemicals market and paraxylene has been the fastest growing:

| Product |

2001 Global Market size |

Historic Growth, (1992-2001) |

Markets |

Applications |

||||

|---|---|---|---|---|---|---|---|---|

| |

(Billions of Pounds) |

|

|

|

||||

| Ethylene | 197 | 4.6 | % | polyethylene, ethylene oxide, polyvinyl chloride, alpha olefins, styrene | packaging materials, plastics, housewares, beverage containers, personal care | |||

Propylene |

112 |

5.4 |

% |

polypropylene, propylene oxide, acrylonitrile, isopropanol |

clothing fibers, plastics, automotive parts, foams for bedding and furniture |

|||

Butadiene |

18 |

3.2 |

% |

SBR rubber, polybutadiene, SB latex |

automotive, carpet |

|||

Benzene |

68 |

2.0 |

% |

polyurethanes, polystyrene, cyclohexane, cumene |

appliances, automotive components, detergents, personal care, packaging materials, carpet |

|||

Paraxylene |

37 |

10.1 |

% |

polyester, purified terephthalic acid ("PTA") |

fibers, textiles, beverage containers |

|||

Cyclohexane |

8 |

1.3 |

% |

nylon 6, nylon 6,6 |

fibers, resins |

Source: Nexant Chem Systems

The ethylene market in Western Europe is supplied by numerous producers, none of whom has a dominant position in terms of its share of Western European production capacity. We believe that the top three Western European producers of ethylene are BP, Dow and EniChem. Olefins capacity in Western Europe has expanded moderately in recent years primarily through implementation of low-cost process improvement projects at existing units. No greenfield olefins capacity has been constructed in Western Europe since 1994.

Like the ethylene market, the aromatics market, which is comprised of benzene and paraxylene, in Western Europe is served by several major producers, including, according to Nexant Chem Systems, Dow, AtoFina, Shell, EniChem, ExxonMobil and BASF. We believe that both the benzene and paraxylene markets are currently in a period of overcapacity. The increasing restrictions imposed by

21

regulatory authorities on the aromatics content of gasoline in general, and the benzene content in particular, have led to an increase in supply of aromatics in recent years. In our opinion, global paraxylene demand will grow largely as a result of the global economic growth. As a result of these dynamics, according to Nexant Chem Systems, margins in the aromatics industry, particularly those in paraxylene, are expected to continue to exhibit characteristic cyclicality and recover from currently depressed cyclical lows as polyester growth drives a rebalancing of supply and demand.

Base Chemicals—Sales and Marketing

In recent years, our sales and marketing efforts have focused on developing long-term contracts with customers to minimize our selling expenses and administration costs. In 2002, over 80% of our primary petrochemicals sales volume was made under long-term contracts. We delivered over 60% of our petrochemical products volume in 2002 by pipeline, and we delivered the balance of our products by road and ship to either the U.K. or export markets, primarily in continental Western Europe.

Base Chemicals—Manufacturing and Operations

We produce olefins at our facility in Wilton, U.K. In addition, we own and operate two integrated aromatics manufacturing facilities at our Wilton and North Tees sites at Teesside, U.K. Information regarding these facilities is set forth in the following chart:

| Location |

Product |

Annual Capacity |

||

|---|---|---|---|---|

| |

|

(millions of pounds) |

||

| Wilton, U.K. | Ethylene Propylene Butadiene Paraxylene |

1,900 880 225 800 |

||

North Tees, U.K. |

Benzene Cyclohexane |

1,300 700 |

The Wilton olefins facility's flexible feedstock capability, which permits it to process naphtha, condensates and NGL feedstocks, allows us to take advantage of favorable feedstock prices arising from seasonal fluctuations or local availability. According to Nexant Chem Systems, the Wilton olefins facility is one of Europe's most cost efficient olefins manufacturing facilities on a cash cost of production basis. In addition to our manufacturing operations, we also operate an extensive logistics operations infrastructure in North Tees. This infrastructure includes both above and below ground storage facilities, jetties and logistics services on the River Tees. These operations reduce our raw material costs by providing greater access and flexibility for obtaining feedstocks.

Raw Materials. Teesside, situated on the northeast coast of England, is near a substantial supply of oil, gas and chemical feedstocks. Due to our location at Teesside, we have the option to purchase feedstocks from a variety of sources. However, we have elected to procure the majority of our naphtha, condensates and NGLs from local producers, as they have been the most economical sources. In order to secure the optimal mix of the required quality and type of feedstock for our petrochemical operations at fully competitive prices, we regularly engage in the purchase and sale of feedstocks and hedging activities.

Base Chemicals—Competition

The markets in which our petrochemicals business operates are highly competitive. Our competitors in the olefins and aromatics business are frequently some of the world's largest chemical companies such as BP Amoco, Dow, ExxonMobil and Shell. The primary factors for competition in this

22

business are price, service and reliability of supply. The technology used in these businesses is widely available and licensed.

Significant Customers

In 2002, sales for our Polyurethanes, Base Chemicals, Pigments and Performance Products businesses to ICI and its affiliates accounted for approximately 6% of our consolidated revenue. In 2001, sales to ICI and its affiliates accounted for approximately 6% of our consolidated revenue. ICI indirectly owns 30% of our membership interests. See "Item 13—Certain Relationships and Related Transactions" for a further discussion of our relationship with ICI. In 2002, our Base Chemicals business had sales to two significant customers, which amounted to 14.1% and 14.8%, respectively, of our sales for our Base Chemicals segment.

Research and Development

In 2002, 2001 and 2000, we spent approximately $55 million, $63 million and $59 million, respectively, on research and development of our products.

Intellectual Property Rights

Proprietary protection of our processes, apparatuses, and other technology and inventions is important to our businesses. For our Polyurethanes business, we own approximately 200 U.S. patents and pending U.S. patent applications (including provisional applications), and more than 1360 foreign counterparts, including both issued patents and pending patent applications. For our Pigments business, we have approximately 15 U.S. patents and pending patent applications and approximately 160 foreign counterparts. For our Base Chemicals business, we own approximately 35 patents and pending applications (both U.S. and foreign). In our Performance Products business, we have approximately 50 U.S. patents and pending patent applications and approximately 710 foreign counterparts.

In addition to our own patents and patent applications and proprietary trade secrets and know-how, we have entered into certain licensing arrangements that authorize us to use certain trade secrets, know-how and related technology and/or operate within the scope of certain patents owned by other entities. We also license and sub-license certain intellectual property rights to affiliates and to third parties. In connection with our transactions with HIH, ICI and Huntsman Specialty (under the terms of a Technology Transfer Agreement and a PO/MTBE Technology Transfer Agreement), we have licensed back to ICI and Huntsman LLC (on a non-exclusive basis) certain intellectual property rights for use in their respective retained businesses, and ICI and Huntsman LLC have each licensed certain retained intellectual property to us.

For our Polyurethanes business, we have brand names for a number of our products, and we own approximately 28 U.S. trademark registrations and applications for registration currently pending at the United States Patent and Trademark Office, and approximately 1,150 foreign counterparts, including both registrations and applications for registration. For our Pigments business, we have approximately 150 trademark registrations and pending applications, approximately 110 of which relate to the trademark "Tioxide." Our Base Chemicals business is not dependent on the use of trademarks. For our Performance Products business, we have brand names for a number of our products, and we own approximately 7 U.S. trademark registrations and applications for registration currently pending at the United States Patent and Trademark Office, and approximately 930 foreign counterparts, including both registrations and applications for registration. We have entered into a trademark license agreement with Huntsman Group Intellectual Property Holdings Corporation under which we have obtained the rights to use the trademark "Huntsman," subject to certain restrictions.

23

Employees

We employed approximately 7,200 people as of December 31, 2002. Additionally, over 800 people are employed by our joint ventures. Approximately 84% of our employees, including employees of our joint ventures, work outside the United States. Approximately 53% of our employees are covered by collective bargaining agreements. In the ordinary course of our business we use the services of independent contractors. We believe that our relations with our employees are good.

Huntsman LLC provides management and administrative services to us and also provides operating services for our PO business. See "Item 13—Certain Relationships and Related Transactions."

Environmental Regulations