Exhibit 99.1

NEWS

Release

![]()

| FOR IMMEDIATE RELEASE February 10, 2004 |

Media Contact: Don Olsen (713) 235-6000 |

Finance Contact: Kimo Esplin (801) 584-5700 |

HMP EQUITY HOLDINGS RESTATES THIRD QUARTER RESULTS

Houston, TX—HMP Equity Holdings Corporation ("HMP") today reported that it will restate its third quarter 2003 financial statements and those of its subsidiaries, Huntsman International Holdings LLC ("HIH"), Huntsman International LLC ("Huntsman International") and Huntsman LLC. The restatements are required primarily to correct an accounting error at Huntsman International which resulted from the implementation of and transition to a new SAP-based enterprise resource planning ("ERP") system for Huntsman International's propylene oxide product line earlier in the year and also to adjust certain other items which, if considered in relation to the financial statements taken as a whole, are not material.

In February 2004, Huntsman International discovered an error in how it had accounted for product exchange balances under a toll processing agreement with a customer. The error was caused by the use of an incorrect exchange factor in Huntsman International's new SAP-based ERP system for its propylene oxide product line.

The effect of the restatement on the results of operations of HMP is to reduce third quarter 2003 reported EBITDA by $12.7 million, to $157.3 million from $170.0 million, and to increase net loss by $12.3 million, to $98.0 million from $85.7 million. The effect of the restatement on the results of operations of HIH is to reduce third quarter 2003 reported EBITDA by $12.7 million, to $91.5 million from $104.2 million, and to increase net loss by $12.3 million to $58.9 million from $46.6 million. The effect the restatement on the results of operations of HI is to reduce third quarter 2003 reported EBITDA by $12.7 million, to $91.5 million from $104.2 million, and to increase net loss by $12.3 million, to $32.3 million from $20.0 million. The effect of the restatement on the results of operations of Huntsman LLC is to reduce third quarter 2003 reported EBITDA by $7.8 million, to $164.7 million from $172.5 million, and to increase net loss by $7.4 million, to $60.6 million from $53.2 million.

The following table reconciles EBITDA to net income (loss) for the companies impacted by the restatement of third quarter 2003 reported earnings:

| |

HMP |

HIH |

Huntsman International |

Huntsman LLC |

|||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

As Restated |

As Reported |

As Restated |

As Reported |

As Restated |

As Reported |

As Restated |

As Reported |

|||||||||||||||||

| |

(In Millions) |

||||||||||||||||||||||||

| Net income (loss) | $ | (98.0 | ) | $ | (85.7 | ) | $ | (58.9 | ) | $ | (46.6 | ) | $ | (32.3 | ) | $ | (20.0 | ) | $ | (60.6 | ) | $ | (53.2 | ) | |

| Interest expense, net | 138.9 | 139.3 | 88.0 | 88.4 | 61.4 | 61.8 | 122.7 | 123.1 | |||||||||||||||||

| Income tax (benefit) expense | 2.2 | 2.2 | (5.3 | ) | (5.3 | ) | (5.3 | ) | (5.3 | ) | 2.1 | 2.1 | |||||||||||||

| Depreciation and amortization | 114.2 | 114.2 | 67.7 | 67.7 | 67.7 | 67.7 | 100.5 | 100.5 | |||||||||||||||||

| EBITDA(1) | $ | 157.3 | $ | 170.0 | $ | 91.5 | $ | 104.2 | $ | 91.5 | $ | 104.2 | $ | 164.7 | $ | 172.5 | |||||||||

Included in EBITDA are the following items of income (expense):

| |

HMP |

HIH |

Huntsman International |

Huntsman LLC |

|||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

As Restated |

As Reported |

As Restated |

As Reported |

As Restated |

As Reported |

As Restated |

As Reported |

|||||||||||||||||

| |

(In Millions) |

||||||||||||||||||||||||

| Foreign exchange gains—unallocated | $ | 10.1 | $ | 10.1 | $ | 8.7 | $ | 8.7 | $ | 8.7 | $ | 8.7 | $ | 10.1 | $ | 10.1 | |||||||||

| Asset write-down | (3.0 | ) | — | (3.0 | ) | — | (3.0 | ) | — | (3.0 | ) | — | |||||||||||||

| Loss on sale of accounts receivable | (5.9 | ) | (5.9 | ) | (5.9 | ) | (5.9 | ) | (5.9 | ) | (5.9 | ) | (5.9 | ) | (5.9 | ) | |||||||||

| Contract termination costs—net | (0.9 | ) | (0.9 | ) | — | — | — | — | — | — | |||||||||||||||

| Purchase accounting adj.—inventory valuation | (1.0 | ) | (1.0 | ) | — | — | — | — | — | — | |||||||||||||||

| Restructuring expenses | $ | (4.8 | ) | $ | (4.8 | ) | $ | (4.8 | ) | $ | (4.8 | ) | $ | (4.8 | ) | $ | (4.8 | ) | $ | (4.8 | ) | $ | (4.8 | ) | |

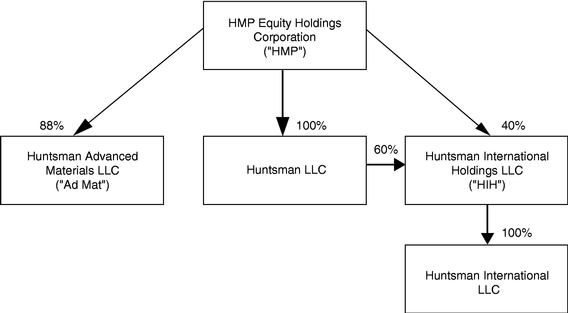

Huntsman Companies—Abbreviated Organization Chart

In connection with the restatements, HIH and Huntsman International have filed amendments to their third quarter results on Form 10-Q/A with the U.S. Securities and Exchange Commission (the "SEC"). HMP and Huntsman LLC have circulated to investors revised quarterly reports for the third quarter. All such reports are available on the Company's website at www.huntsman.com. Additionally, Huntsman LLC intends to file an amendment to its registration statement on Form S-4, which had been previously filed but which has not yet been declared effective by the SEC, to reflect the restatement as soon as possible.

We do not expect this restatement to affect the timing of the release of our full year and fourth quarter 2003 results, which are expected to be released in mid-March.

**********

2

Questions regarding the above information should be directed to the following:

| Kimo Esplin Executive Vice President & CFO Tel: 801-584-5861 Email: kimo esplin@huntsman.com |

Curt Dowd Vice President, Finance Tel: 801-584-5826 Email: curt dowd@huntsman.com |

|

Sean Douglas Vice President and Treasurer Tel: 801-584-5743 Email: sean douglas@huntsman.com |

John Heskett Vice President, Corporate Development Tel: 801-584-5768 Email: john heskett@huntsman.com |

3