Use these links to rapidly review the document

TABLE OF CONTENTS

HUNTSMAN INTERNATIONAL LLC AND SUBSIDIARIES INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

Filed Pursuant to Rule 424(b)(3)

Registration No. 333-125652

PROSPECTUS

![]()

Huntsman International LLC

Exchange Offer for

$175,000,000 73/8% Senior Subordinated Notes due 2015

and

€135,000,000 71/2% Senior Subordinated Notes due 2015

This exchange offer will expire at 5:00 p.m., New York City Time,

on August 26, 2005, unless extended.

Terms of the exchange offer:

See the "Description of New Notes" section on page 127 for more information about the new notes to be issued in this exchange offer.

This investment involves risks. See the section entitled "Risk Factors" that begins on page 13 for a discussion of the risks that you should consider prior to tendering your old notes for exchange.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or the accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is July 28, 2005

Each broker-dealer that receives new notes for its own account pursuant to the exchange offer must acknowledge that it will deliver a prospectus in connection with any resale of the new notes it receives. The letter of transmittal states that by so acknowledging and by delivering a prospectus, a broker-dealer will not be deemed to admit that it is an "underwriter" within the meaning of the Securities Act of 1933, as amended. This prospectus, as it may be amended or supplemented from time to time, may be used by a broker-dealer in connection with resales of new notes received in exchange for old notes where such old notes were acquired by the broker-dealer as a result of market-making activities or other trading activities. We have agreed that, for a period of 120 days after the consummation of the exchange offer, we will make this prospectus, as amended and supplemented, available to any broker-dealer for use in connection with any such resale. See "Plan of Distribution."

i

In this prospectus, the terms "we," "us," "our" and the "Company" refer to Huntsman International LLC, the issuer of the new notes, and its subsidiaries. The following summary highlights selected information from this prospectus and may not contain all the information that is important to you. This prospectus contains information regarding our business and detailed financial information. You should carefully read this entire document.

Our Business

We are a global manufacturer and marketer of differentiated and commodity chemicals. We manage our business through four segments: Polyurethanes, Performance Products, Pigments and Base Chemicals. We manufacture our products at facilities located primarily in North America, Europe, Asia and Africa and sell our products throughout the world.

Our Products and Segments

Our business is organized around our four segments: Polyurethanes, Performance Products, Pigments and Base Chemicals. These segments can be divided into two broad categories: differentiated and commodity. We produce differentiated products primarily in our Polyurethanes and Performance Products segments. These products serve diverse end markets and are generally characterized by historical growth in excess of GDP growth resulting from product substitution and new product development, proprietary manufacturing processes and product formulations and a high degree of customer loyalty. Demand for these products tends to be driven by the value-added attributes that they create in our customers' end-use applications. While the demand for these differentiated products is also influenced by worldwide economic conditions and GDP growth, our differentiated products have tended to produce more stable profit margins and higher demand growth rates than our commodity products.

In our commodity chemical businesses, we produce titanium dioxide derived from titanium-bearing ores in our Pigments segment and petrochemical-based olefins, aromatics and polyolefins products in our Polymers and Base Chemicals segments. Since the coatings industry consumes a substantial portion of titanium dioxide production, seasonal demand patterns in the coatings industry drive the profitability of our Pigments segment; profitability is also driven by industry-wide operating rates, with a lag of up to twelve months due to the effects of stocking and destocking by customers and suppliers. The profitability of our Base Chemicals products is cyclical and has been experiencing a down cycle for the last several years, resulting primarily from significant new capacity additions, a decrease in demand reflecting weak global economic conditions and high raw material costs. Certain industry fundamentals have recently improved and, we believe, point to increased profitability in the markets for the major commodity products that we manufacture.

Our Company

History

Our Company, Huntsman International LLC, is a Delaware limited liability company. It was formed in 1999 in connection with a transaction between Huntsman International Holdings, LLC ("HIH"), Huntsman Specialty Chemicals Corporation ("Huntsman Specialty") and Imperial Chemical Industries PLC ("ICI"). In that transaction, on June 30, 1999, HIH acquired ICI's polyurethane chemicals, selected petrochemicals and titanium dioxide ("TiO2" or "Tioxide") businesses and Huntsman Specialty's propylene oxide ("PO") business. HIH also acquired the 20% ownership interest of BP Chemicals Limited in an olefins facility located at Wilton, U.K. and certain related assets. HIH then transferred the acquired businesses to us and to our subsidiaries. In August 2000, we completed our acquisition of the Morton global TPU business from The Rohm and Haas Company; in

1

February 2001, we completed our acquisition of the global ethyleneamines business of Dow Chemical Company; and, in April 2001, we completed our acquisition of the Albright & Wilson European surfactants business from Rhodia S.A.

Recent Developments

Sale of TDI Business

On July 1, 2005, we entered into a binding agreement with BASF Corporation to sell our toluene di-isocyanate ("TDI") business. Pursuant to the agreement, we agreed to transfer our TDI customer list, customer sales contracts and other related assets. Our Geismar, Louisiana-based TDI manufacturing plant will not be sold but will be closed and dismantled. The sale closed on July 6, 2005.

We expect to incur aggregate charges of approximately $39 million in connection with the sale, including a $37 million loss in the second quarter of 2005, with the remaining $2 million to be recorded by the second quarter of 2006.

Proposed Merger of Huntsman LLC and Huntsman International

On June 17, 2005, Huntsman Corporation announced that it was soliciting consents from the holders of the outstanding senior secured and unsecured notes of Huntsman LLC ("HLLC") in connection with a proposed merger of HLLC with and into us. Both HLLC and we are currently direct or indirect wholly-owned subsidiaries of Huntsman Corporation, are financed as separate entities and have separate SEC reporting obligations. The merger will simplify Huntsman Corporation's financing and SEC reporting structure and will facilitate cost reductions for Huntsman Corporation's bank credit facilities and other financing arrangements and other organizational efficiencies.

Huntsman Corporation received the necessary consents in early July and is now seeking to obtain a new secured credit facility for HLLC and us (the "Combined Company"). Huntsman Corporation would expect to obtain the new credit facility and complete the proposed merger during the third quarter of 2005. However, no assurance can be given that the new credit facility will be obtained on terms acceptable to Huntsman Corporation, or at all. If the new credit facility is not obtained, the proposed merger will not occur.

Huntsman Corporation's 90%-owned subsidiary Huntsman Advanced Materials LLC ("AdMat") is not involved in the proposed merger and will remain a separately financed subsidiary of Huntsman Corporation. However, the consents that Huntsman Corporation received in connection with the proposed merger would also facilitate the merger of AdMat into the Combined Company under certain conditions, should Huntsman Corporation choose to pursue such a merger in the future.

Voluntary Prepayment on Senior Secured Credit Facilities

On June 6, 2005, we made a $100 million dollar equivalent voluntary prepayment to the term B loan under our senior secured credit facilities. The balance outstanding on our senior secured credit facilities as of March 31, 2005 was $1,235.9 million. After application of this prepayment, the pro forma balance as of March 31, 2005 would have been $1,135.9 million.

Huntsman Corporation Initial Public Offering

On February 16, 2005, Huntsman Corporation, our ultimate parent corporation, completed an initial public offering of 55,681,819 shares of its common stock sold by Huntsman Corporation and 13,579,546 shares of its common stock sold by a selling stockholder, in each case at a price to the public of $23 per share, and 5,750,000 shares of its 5% mandatory convertible preferred stock sold by Huntsman Corporation at a price to the public of $50 per share. Net proceeds to Huntsman Corporation from the offering were approximately $1,500 million, substantially all of which was used to

2

repay outstanding indebtedness of certain of Huntsman Corporation's subsidiaries, including HMP Equity Holdings Corporation ("HMP"), HLLC and HIH.

Dividend to HIH

On February 28, 2005, we paid a dividend in the amount of $35 million to HIH. The dividend was used together with proceeds from the Huntsman Corporation initial public offering to redeem the HIH senior discount notes due 2009.

MDI Initiative

On March 14, 2005, we announced an initiative designed to significantly increase our global capacity for the manufacture of diphenylmethane diisocyanate ("MDI"). The initiative involves expansions at our two major MDI manufacturing facilities located in Geismar, Louisiana and Rozenburg, Netherlands. We expect that the capacity of our Geismar plant will be expanded by 130 million pounds per year to 990 million pounds per year, while the capacity of the Rozenburg plant will be expanded by 220 million pounds per year to 880 million pounds per year. The capacity expansions will be completed in increments beginning in the first quarter of 2005, with final completion expected by late 2006. These expansions are in addition to our previously announced investments in our Chinese MDI joint ventures.

Ownership

All of our membership interests are owned by HIH. Initially in 1999, HIH was owned 60% by Huntsman Specialty, 30% by ICI and 10% by institutional investors. In 2002, HMP purchased approximately 1% of the HIH membership interests held by an institutional investor. On May 9, 2003, HMP exercised an option and purchased the ICI subsidiary ("Alta One") that held ICI's 30% membership interest in HIH. At that time, HMP also purchased the remaining approximately 9% of the HIH membership interests held by institutional investors. As a result, HMP owned directly, and indirectly through its ownership of Huntsman Specialty and Alta One, 100% of the HIH membership interests.

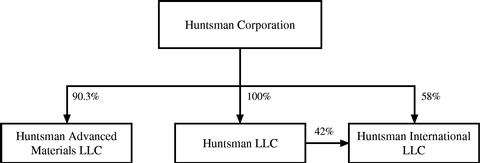

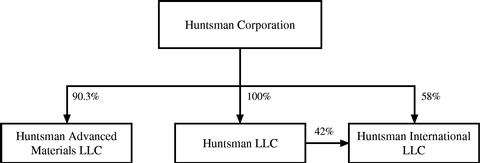

In connection with Huntsman Corporation's initial public offering, Huntsman Corporation and certain affiliates completed a series of reorganization transactions. As a result of these reorganization transactions, our Company now is owned 58% by Huntsman Corporation and 42% by Huntsman LLC. The chart below shows our current organizational structure:

Our principal executive offices are located at 500 Huntsman Way, Salt Lake City, Utah 84108, and our telephone number is (801) 584-5700.

3

The Exchange Offer

| Securities Offered | $175,000,000 aggregate principal amount of new dollar notes and €135,000,000 aggregate principal amount of new euro notes, all of which have been registered under the Securities Act of 1933, as amended (the "Securities Act"). The terms of the new notes offered in the exchange offer are substantially identical to those of the old notes, except that certain transfer restrictions, registration rights and liquidated damages provisions relating to the old notes do not apply to the new registered notes. | |||

The Exchange Offer |

We are offering to issue registered notes in exchange for a like principal amount and like denomination of our old notes. We are offering to issue these registered notes to satisfy our obligations under an exchange and registration rights agreement that we entered into with the initial purchasers of the old notes when we sold them in a transaction that was exempt from the registration requirements of the Securities Act. You may tender your old notes for exchange by following the procedures described under the heading "The Exchange Offer." |

|||

Tenders; Expiration Date; Withdrawal |

The exchange offer will expire at 5:00 p.m., New York City time, on August 26, 2005, unless we extend it. If you decide to exchange your old notes for new notes, you must acknowledge that you are not engaging in, and do not intend to engage in, a distribution of the new notes. You may withdraw any notes that you tender for exchange at any time prior to August 26, 2005. If we decide for any reason not to accept any old notes you have tendered for exchange, those notes will be returned to you without cost promptly after the expiration or termination of the exchange offer. See "The Exchange Offer—Terms of the Exchange Offer" and "—Withdrawal Rights" for a more complete description of the tender and withdrawal provisions. |

|||

Conditions to the Exchange Offer |

The exchange offer is subject to customary conditions and we may terminate or amend the exchange offer if any of these conditions occur prior to the expiration of the exchange offer. These conditions include any change in applicable law or legal interpretation or governmental or regulatory actions that would impair our ability to proceed with the exchange offer, any general suspension or general limitation relating to trading of securities on any national securities exchange or the over-the-counter market or a declaration of war or other hostilities involving the United States. We may waive any of these conditions in our sole discretion. |

|||

4

Procedures for Tendering Old Notes |

A holder who wishes to tender old dollar notes in the exchange offer must transmit to Wells Fargo Bank, N.A. (the "dollar exchange agent") an agent's message, transmitted by a book-entry transfer facility, which agent's message must be received by the dollar exchange agent prior to 5:00 p.m., New York City time, on the expiration date. In addition, the dollar exchange agent must receive a timely confirmation of book-entry transfer of the old notes into the dollar exchange agent's account at The Depository Trust Company, or DTC, under the procedures for book-entry transfers described in "The Exchange Offer—How to Tender Old Notes for Exchange." |

|||

Old dollar notes may be tendered by electronic transmission of acceptance through DTC's Automated Tender Offer Program, which we refer to as ATOP. Custodial entities that are participants in DTC must tender old notes through ATOP. A letter of transmittal need not accompany tenders effected through ATOP. Please carefully follow the instructions contained in this document on how to tender your securities. See "The Exchange Offer—DTC Book Entry Transfers." |

||||

To tender book-entry interests in old euro notes in the exchange offer, the holder of the old euro notes on the records of Euroclear or Clearstream, Luxembourg must contact either Euroclear or Clearstream, Luxembourg to arrange to block such holder's account. In lieu of delivering a letter of transmittal to Citibank, N.A. (the "euro exchange agent"), you must, unless otherwise instructed by Euroclear or Clearstream Luxembourg, notify Euroclear or Clearstream, Luxembourg, as the case may be, to deliver to the euro exchange agent prior to 5:00 p.m., New York City time, on the expiration date, a computer-generated message, in which the holder of the old euro notes acknowledges and agrees to be bound by the terms of the letter of transmittal. In all other cases, a letter of transmittal must be manually executed and received by the euro exchange agent before 5:00 p.m., New York City time, on the expiration date. |

||||

U.S. Federal Tax Consequences |

Your exchange of old notes for new notes in the exchange offer will not result in any gain or loss to you for United States federal income tax purposes. See "Material United States Federal Income Tax Consequences." |

|||

Use of Proceeds |

We will not receive any cash proceeds from the exchange offer. We will pay all expenses incident to the exchange offer. See "Use of Proceeds" for a discussion of the use of proceeds from the issuance of the old notes. |

|||

Dollar Exchange Agent |

Wells Fargo Bank, N.A. |

|||

Euro Exchange Agent |

Citibank, N.A. |

|||

5

Consequences of Failure to Exchange |

Old notes that are not tendered or that are tendered but not accepted will continue to be subject to the restrictions on transfer that are described in the legend on those notes. In general, you may offer or sell your old notes only if they are registered under, or offered or sold under an exemption from, the Securities Act and applicable state securities laws. We, however, will have no further obligation to register the old notes. If you do not participate in the exchange offer, the liquidity of your notes could be adversely affected. |

|||

Consequences of Exchanging Your Old Notes |

Based on interpretations of the SEC set forth in certain no-action letters issued to third parties, we believe that you may offer for resale, resell or otherwise transfer the new notes that we issue in the exchange offer without complying with the registration and prospectus delivery requirements of the Securities Act if you: |

|||

• |

acquire the new notes issued in the exchange offer in the ordinary course of your business; |

|||

• |

are not participating, do not intend to participate, and have no arrangement or understanding with anyone to participate, in the distribution of the new notes issued to you in the exchange offer; and |

|||

• |

are not an "affiliate" of our Company as defined in Rule 405 of the Securities Act. |

|||

If any of these conditions are not satisfied and you transfer any new notes issued to you in the exchange offer without delivering a proper prospectus or without qualifying for a registration exemption, you may incur liability under the Securities Act. We will not be responsible for, or indemnify you against, any liability you may incur. |

||||

Any broker-dealer that acquires new notes in the exchange offer for its own account in exchange for old notes which it acquired through market-making or other trading activities must acknowledge that it will deliver a prospectus when it resells or transfers any new notes. See "Plan of Distribution" for a description of the prospectus delivery obligations of broker-dealers in the exchange offer. |

||||

6

The New Notes

The terms of the new notes and those of the outstanding old notes are identical in all material respects, except:

A brief description of the material terms of the new notes follows:

| Issuer | Huntsman International LLC. | |||

Notes Offered |

$175,000,000 aggregate principal amount of 73/8% Senior Subordinated Notes due 2015. |

|||

€135,000,000 aggregate principal amount of 71/2% Senior Subordinated Notes due 2015. |

||||

Maturity |

January 1, 2015. |

|||

Interest Rate |

The new dollar notes bear interest at a rate of 73/8% per annum. The new euro notes bear interest at a rate of 71/2% per annum. |

|||

Interest Payment Dates |

We will pay interest on the notes each January 1 and July 1, beginning on July 1, 2005. |

|||

Guarantee |

The notes are guaranteed by our subsidiaries. If we cannot make payments on the notes when they are due, then our subsidiary guarantors are required to make payments on our behalf. |

|||

Optional Redemption |

Prior to January 1, 2008, we may, at our option and subject to certain requirements, use the net proceeds from (i) one or more offerings of qualified capital stock or (ii) capital contributions to our equity, to redeem up to 40% of the aggregate principal amount of the notes of either series at a redemption price equal to 107.375% (for dollar notes) or 107.500% (for euro notes) of their face amount, plus accrued and unpaid interest. See "Description of New Notes—Optional Redemption." |

|||

On or after January 1, 2010, we may redeem some or all of the notes of either series, at our option, at any time at the redemption prices listed in "Description of New Notes—Optional Redemption." |

||||

Prior to January 1, 2010, we may redeem some or all of the notes of either series, at our option, at any time at a redemption price equal to 100% of their face amount plus a "make whole" premium. See "Description of New Notes—Optional Redemption." |

||||

Ranking |

The notes will be: |

|||

• |

our general unsecured senior subordinated obligations; |

|||

7

• |

subordinated in right of payment to all our existing and future senior indebtedness and structurally subordinated to all liabilities (including trade payables) of our subsidiaries which are not guarantors (except with respect to indebtedness owed to us or other guarantors); |

|||

• |

equal in right of payment to all our existing and future senior subordinated indebtedness; and |

|||

• |

unconditionally guaranteed by the guarantors on a senior subordinated basis. |

|||

Since the notes are unsecured, in the event of a bankruptcy or insolvency, our secured lenders will have a prior secured claim to any collateral securing the debt owed to them. |

||||

The guarantees will be: |

||||

• |

the general unsecured senior subordinated obligations of the guarantors; |

|||

• |

subordinated in right of payment to all existing and future senior indebtedness of the guarantors; and |

|||

• |

equal in right of payment to all existing and future senior subordinated indebtedness of the guarantors. |

|||

Since the guarantees are unsecured obligations of each guarantor, in the event of a bankruptcy or insolvency, such guarantor's secured lenders will have a prior secured claim to any collateral securing the debt owed to them. |

||||

As of March 31, 2005, we and the guarantors had approximately $1,701.2 million of senior indebtedness outstanding (of which approximately $1,245.5 million is secured indebtedness), and our subsidiaries which are not guarantors had approximately $30.6 million of indebtedness outstanding, excluding intercompany indebtedness due to us or the guarantors. |

||||

Change of Control Offer |

If we undergo a change of control, we will be required to make an offer to purchase each holder's notes at a price equal to 101% of their face amount plus accrued and unpaid interest, if any, to the date of repurchase. See "Description of New Notes—Repurchase at the Option of Holders upon a Change of Control." |

|||

Asset Sales |

We may have to use the net proceeds from asset sales to offer to repurchase the notes under certain circumstances at their face amount, plus accrued and unpaid interest, if any, to the date of repurchase. See "Description of New Notes—Certain Covenants—Limitation on Asset Sales." |

|||

Covenants |

The indenture governing the notes contains covenants that limit our ability and the ability of certain of our subsidiaries to: |

|||

• |

incur additional indebtedness; |

|||

• |

pay dividends or distributions on, or redeem, repurchase or issue our capital stock; |

|||

8

• |

issue capital stock; |

|||

• |

make certain investments; |

|||

• |

create liens; |

|||

• |

engage in transactions with affiliates; |

|||

• |

enter into sale and leaseback transactions; |

|||

• |

merge or consolidate; and |

|||

• |

transfer or sell assets. |

|||

These covenants are subject to important exceptions and qualifications, which are described in "Description of New Notes—Certain Covenants." |

||||

Exchange Offer; Registration Rights |

Under the registration rights agreement, we have agreed to consummate the exchange offer within 45 days after the date on which the exchange offer registration statement is declared effective. In addition, we have agreed to file a "shelf registration statement" that would allow some or all of the old notes to be offered to the public if we are unable to complete the exchange offer or a change in applicable laws or legal interpretation occurs that would limit the intended effects or availability of the exchange offer. |

|||

If we fail to fulfill our obligations with respect to registration of the notes (a "registration default"), the annual interest rate on the notes will increase by 0.25% during the first 90-day period during which the registration default continues, and will increase by an additional 0.25% for each subsequent 90-day period during which the registration default continues, up to a maximum increase of 1.00% over the interest rate that would otherwise apply to the notes. As soon as we cure a registration default, the interest rates on the notes will revert to their original levels. |

||||

If we must pay additional interest, we will pay it to holders in cash on the same dates that we make other interest payments on the notes, until we correct the registration default. See "Description of New Notes—Registration Covenant; Exchange Offer." |

||||

Use of Proceeds |

We will not receive any proceeds from the issuance of the new notes. In consideration for issuing the new notes as contemplated in this prospectus, we will receive in exchange old notes in like principal amount, which will be cancelled and as such will not result in any increase in our indebtedness. See "Use of Proceeds." |

|||

Risk Factors |

You should carefully consider all the information set forth in this prospectus and, in particular, should evaluate the specific risk factors set forth under "Risk Factors," beginning on page 13, before participating in this exchange offer. |

|||

For additional information regarding the notes, see "Description of New Notes."

9

Failure to Exchange Your Old Notes

The old notes which you do not tender or we do not accept will, following the exchange offer, continue to be restricted securities. Therefore, you may only transfer or resell them in a transaction registered under or exempt from the Securities Act and all applicable state securities laws. We will issue the new notes in exchange for the old notes under the exchange offer only following the satisfaction of the procedures and conditions described under the caption "The Exchange Offer."

Because we anticipate that most holders of the old notes will elect to exchange their old notes, we expect that the liquidity of the markets, if any, for any old notes remaining after the completion of the exchange offer will be substantially limited. Any old notes tendered and exchanged in the exchange offer will reduce the aggregate principal amount outstanding of the old notes.

Other Debt

As of March 31, 2005, we had $2,939.2 million in debt outstanding other than the old notes.

The indenture governing the notes limits our ability to incur additional debt. Consequently, we would be required to obtain an amendment of the indenture before we incurred any additional debt, other than the types of debt specifically identified in the indenture as permitted. For more information, see "Other Indebtedness and Certain Financing Arrangements" below.

10

Summary Historical Financial Data

The summary historical financial data below presents the historical financial data of our Company as of the dates and for the periods indicated. The summary financial and other data as of and for the three months ended March 31, 2005 and for the three months ended March 31, 2004 has been derived from the unaudited financial statements of our Company included elsewhere in this prospectus. The summary financial and other data as of March 31, 2004 has been derived from the unaudited financial statements of our Company. The summary financial and other data as of December 31, 2004 and December 31, 2003, and for each of the three years and the period ended December 31, 2004 has been derived from the audited financial statements of our Company included elsewhere in this prospectus.

The summary financial data set forth below should be read in conjunction with our audited and unaudited consolidated financial statements, "Management's Discussion and Analysis of Financial Condition and Results of Operations," "Unaudited Pro Forma Financial Data," and "Selected Historical Financial Data" included elsewhere in this prospectus and, in each case, any related notes thereto.

| |

Summary Historical Financial Data |

||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Three Months Ended March 31, |

Year Ended December 31, |

|||||||||||||||||||||

| |

2005 |

2004 |

2004 |

2003 |

2002 |

2001 |

2000 |

||||||||||||||||

| |

(Dollars in Millions) |

||||||||||||||||||||||

| Statements of Operations Data: | |||||||||||||||||||||||

| Revenues | $ | 1,961.9 | $ | 1,498.1 | $ | 6,503.4 | $ | 5,245.5 | $ | 4,518.1 | $ | 4,575.2 | $ | 4,447.9 | |||||||||

| Cost of goods sold | 1,605.5 | 1,350.0 | 5,678.5 | 4,661.1 | 3,902.7 | 3,990.1 | 3,705.4 | ||||||||||||||||

| Gross profit | 356.4 | 148.1 | 824.9 | 584.4 | 615.4 | 585.1 | 742.5 | ||||||||||||||||

| Operating expenses | 130.7 | 100.0 | 394.2 | 351.8 | 379.6 | 378.6 | 331.4 | ||||||||||||||||

| Restructuring, impairment and plant closing costs | 7.0 | 8.7 | 249.5 | 56.7 | 7.7 | 46.6 | — | ||||||||||||||||

| Operating income | 218.7 | 39.4 | 181.2 | 175.9 | 228.1 | 159.9 | 411.1 | ||||||||||||||||

| Interest expense—net | (63.8 | ) | (69.0 | ) | (254.2 | ) | (251.5 | ) | (245.4 | ) | (228.3 | ) | (222.4 | ) | |||||||||

| Loss on accounts receivable securitization program | (3.2 | ) | (3.5 | ) | (15.6 | ) | (32.4 | ) | (5.5 | ) | (12.8 | ) | (1.9 | ) | |||||||||

| Other (expense) income | (1.3 | ) | (0.2 | ) | (19.5 | ) | (1.3 | ) | 1.3 | (2.0 | ) | (3.2 | ) | ||||||||||

| Income (loss) before income taxes, minority interest and cumulative effect of accounting change | 150.4 | (33.3 | ) | (108.1 | ) | (109.3 | ) | (21.5 | ) | (83.2 | ) | 183.6 | |||||||||||

| Income tax (expense) benefit | (23.5 | ) | (3.6 | ) | 58.6 | (21.6 | ) | 41.5` | 26.0 | (30.1 | ) | ||||||||||||

| Minority interest in subsidiaries (income) loss | (0.1 | ) | — | — | — | 0.1 | (2.2 | ) | (2.8 | ) | |||||||||||||

| Income (loss) before cumulative effect of accounting changes | 126.8 | (36.9 | ) | (49.5 | ) | (130.9 | ) | 20.1 | (59.4 | ) | 150.7 | ||||||||||||

| Cumulative effect of accounting changes | — | — | — | — | — | (1.5 | ) | — | |||||||||||||||

| Net income (loss) | 126.8 | (36.9 | ) | (49.5 | ) | (130.9 | ) | 20.1 | (60.9 | ) | 150.7 | ||||||||||||

| Depreciation and amortization | 75.8 | 77.0 | 312.4 | 277.9 | 256.2 | 240.5 | 216.2 | ||||||||||||||||

| Interest expense, net | 63.8 | 69.0 | 254.2 | 251.5 | 245.4 | 228.3 | 222.4 | ||||||||||||||||

| Income tax expense (benefit) | 23.5 | 3.6 | (58.6 | ) | 21.6 | (41.5 | ) | (26.0 | ) | 30.1 | |||||||||||||

| EBITDA(1) | $ | 289.9 | $ | 112.7 | $ | 458.5 | $ | 420.1 | $ | 480.2 | $ | 381.9 | $ | 619.4 | |||||||||

| Other Data: | |||||||||||||||||||||||

| Capital expenditures | $ | 33.5 | $ | 38.2 | $ | 141.3 | $ | 127.4 | $ | 190.5` | $ | 291.0 | $ | 204.5 | |||||||||

| Ratio of earnings to fixed charges(2) | 3.3 | — | — | — | — | — | 1.7 | ||||||||||||||||

| Balance Sheet Data (at period end): | |||||||||||||||||||||||

| Total assets | 6,013.8 | 5,848.9 | 5,492.7 | 5,079.8 | 4,862.1 | 4,815.4 | |||||||||||||||||

| Total debt | 2,939.2 | 3,054.8 | 2,927.1 | 2,773.8 | 2,637.9 | 2,350.5 | |||||||||||||||||

11

satisfy principal and interest obligations with respect to our indebtedness. However, EBITDA should not be considered in isolation or viewed as a substitute for net income, cash flow from operations or other measures of performance as defined by generally accepted accounting principles in the U.S. ("GAAP"). Moreover, EBITDA as used herein is not necessarily comparable to other similarly titled measures of other companies due to potential inconsistencies in the method of calculation. Our management uses EBITDA to assess financial performance and debt service capabilities. In assessing financial performance, our management reviews EBITDA as a general indicator of economic performance compared to prior periods. Because EBITDA excludes interest, income taxes, depreciation and amortization, EBITDA provides an indicator of general economic performance that is not affected by debt restructurings, fluctuations in interest rates or effective tax rates, or levels of depreciation and amortization. Accordingly, our management believes this type of measurement is useful for comparing general operating performance from period to period and making certain related management decisions. EBITDA is also used by securities analysts, lenders and others in their evaluation of different companies because it excludes certain items that can vary widely across different industries or among companies within the same industry. For example, interest expense can be highly dependent on a company's capital structure, debt levels and credit ratings. Therefore, the impact of interest expense on earnings can vary significantly among companies. In addition, the tax positions of companies can vary because of their differing abilities to take advantage of tax benefits and because of the tax policies of the various jurisdictions in which they operate. As a result, effective tax rates and tax expense can vary considerably among companies. Finally, companies employ productive assets of different ages and utilize different methods of acquiring and depreciating such assets. This can result in considerable variability in the relative costs of productive assets and the depreciation and amortization expense among companies. Our management also believes that our investors use EBITDA as a measure of our ability to service indebtedness as well as to fund capital expenditures and working capital requirements. Nevertheless, our management recognizes that there are material limitations associated with the use of EBITDA in the evaluation of our Company as compared to net income, which reflects overall financial performance, including the effects of interest, income taxes, depreciation and amortization. EBITDA excludes interest expense. Because we have borrowed money in order to finance our operations, interest expense is a necessary element of our costs and ability to generate revenue. Therefore, any measure that excludes interest expense has material limitations. EBITDA also excludes taxes. Because the payment of taxes is a necessary element of our operations, any measure that excludes tax expense has material limitations. Finally, EBITDA excludes depreciation and amortization expense. Because we use capital assets, depreciation and amortization expense is a necessary element of our costs and ability to generate revenue. Therefore, any measure that excludes depreciation and amortization expense has material limitations. Our management compensates for the limitations of using EBITDA by using it to supplement GAAP results to provide a more complete understanding of the factors and trends affecting the business than GAAP results alone. Our management also uses other metrics to evaluate capital structure, tax planning and capital investment decisions. For example, our management uses credit ratings and net debt ratios to evaluate capital structure, effective tax rate by jurisdiction to evaluate tax planning, and payback period and internal rate of return to evaluate capital investments. Our management also uses trade working capital to evaluate its investment in accounts receivable and inventory, net of accounts payable.

12

You should carefully consider the risks described below in addition to all other information provided to you in this prospectus before participating in this exchange offer. Any of the following risks could materially and adversely affect our business, financial condition or results of operations.

Risks Related to Our Business

Our available cash and access to additional capital may be limited by our substantial leverage, which could restrict our ability to grow our businesses.

We have a substantial amount of indebtedness outstanding. As of March 31, 2005, we had total consolidated outstanding indebtedness of approximately $2,939.2 million (including the current portion of long-term debt) and a debt to total capitalization ratio of approximately 70%. We may incur substantial additional debt from time to time for a variety of purposes. Our outstanding debt could have important consequences for our businesses, including:

We require substantial capital to finance our operations and continued growth, and we may incur substantial additional debt from time to time for a variety of purposes, including acquiring additional businesses. However, the indentures governing the notes and our outstanding senior notes and senior subordinated notes and our senior secured credit facilities all contain restrictive covenants. Among other things, these covenants limit or prohibit our ability to incur more debt; make prepayments of other debt, including our outstanding senior notes and our senior subordinated notes; pay dividends, redeem stock or make other distributions; issue capital stock; make investments; create liens; enter into transactions with affiliates; enter into sale and leaseback transactions; and merge or consolidate and transfer or sell assets. Additionally, our senior secured credit facilities provide that we will not, and will not permit any of our subsidiaries to, amend, modify or terminate any provisions of the notes or our outstanding senior notes or senior subordinated notes. Also, if we undergo a change of control, the indentures governing the notes and our outstanding senior notes and senior subordinated notes may require us to make an offer to purchase such notes. Under these circumstances, we may also be required to repay indebtedness under our senior secured credit facilities prior to the notes. In this event, we may not have the financial resources necessary to purchase such notes, which would result in an event of default under the indentures governing such notes. See "Description of New Notes."

We have no scheduled principal payments under our senior secured credit facilities until the second quarter of 2006. Our annual scheduled principal payments under our senior secured credit facilities will be approximately $12.5 million per year. Our $375 million revolving facility matures in September 2008. Our ability to make scheduled payments of principal and interest on, or to refinance, our debt (including the notes) depends on our future performance, which, to a certain extent, is subject to economic, competitive, regulatory and other factors beyond our control. We cannot guarantee that

13

we will have sufficient cash from our operations or other sources to service our debt (including the notes). If our cash flow and capital resources are insufficient to fund our debt service obligations, we may be forced to reduce or delay capital expenditures, sell assets or seek to obtain additional equity capital or restructure or refinance our debt. We cannot guarantee that such alternative measures would be successful or would permit us to meet our scheduled debt service obligations. In the absence of operating results and resources, we could face substantial liquidity problems and might be required to dispose of material assets or operations to meet our debt service obligations. We cannot guarantee our ability to consummate any asset sales or that any proceeds from an asset sale would be sufficient to meet the obligations then due.

If we are unable to generate sufficient cash flow or are otherwise unable to obtain the funds required to meet payments of principal and interest on our indebtedness, or if we otherwise fail to comply with the various covenants in the instruments governing our indebtedness, we could be in default under the terms of those instruments. In the event of a default, a holder of the indebtedness could elect to declare all the funds borrowed under those instruments to be due and payable together with accrued and unpaid interest, the lenders under our senior secured credit facilities could elect to terminate their commitments thereunder and we could be forced into bankruptcy or liquidation. Any of the foregoing consequences could have a material adverse effect on our business, results of operations and financial condition and on our ability to make payments on the notes.

If our subsidiaries do not make sufficient distributions to us, then we will not be able to make payment on our debt, including the notes.

The notes are the exclusive obligations of our company and the guarantors of the notes and not of any of our other subsidiaries. Because a significant portion of our operations are conducted by our subsidiaries, our cash flow and our ability to service indebtedness, including our ability to pay the interest on and principal of the notes at maturity, are dependent to a large extent upon cash dividends and distributions or other transfers from our subsidiaries. In addition, we must first pay amounts due on our senior indebtedness, including our outstanding senior notes, prior to making payments on the notes. Any payment of dividends, distributions, loans or advances by our subsidiaries to us could be subject to restrictions on dividends or repatriation of earnings under applicable local law, monetary transfer restrictions and foreign currency exchange regulations in the jurisdictions in which our subsidiaries operate, and any restrictions imposed by the current and future debt instruments of our subsidiaries. In addition, payments to us by our subsidiaries are contingent upon our subsidiaries' earnings.

Our subsidiaries are separate and distinct legal entities and, except for the guarantors of the notes, have no obligation, contingent or otherwise, to pay any amounts due on the notes or to make any funds available therefor, whether by dividends, loans, distributions or other payments, and do not guarantee the payment of interest on, or principal of, the notes. Any right that we have to receive any assets of any of our subsidiaries that are not guarantors upon the liquidation or reorganization of any such subsidiary, and the consequent right of holders of notes to realize proceeds from the sale of their assets, will be structurally subordinated to the claims of that subsidiary's creditors, including trade creditors and holders of debt issued by that subsidiary. The guarantees are unsecured senior subordinated obligations of the guarantors, subordinated to all senior indebtedness of the guarantors, and in the event of the bankruptcy or insolvency of a guarantor, such guarantor's secured lenders will have a prior secured claim to any collateral securing the debt owed to them.

Demand for some of our products is cyclical, and we may experience prolonged depressed market conditions for our products, which may adversely affect our ability to make payments on the notes.

Historically, the markets for many of our products, particularly our commodity products, have experienced alternating periods of tight supply, causing prices and profit margins to increase, followed

14

by periods of capacity additions, resulting in oversupply and declining prices and profit margins. Several of our markets have experienced conditions of oversupply, and the profitability of our products in these markets has been depressed in recent years. We cannot guarantee that future growth in demand for these products will be sufficient to alleviate any existing or future conditions of excess industry capacity or that such conditions will not be sustained or further aggravated by anticipated or unanticipated capacity additions or other events.

We derive a substantial portion of our revenue from sales of commodity products, including most of the products of our Base Chemicals and Pigments segments, which generated approximately 47% of our revenue for the year ended December 31, 2004. Due to the commodity nature of these products, competition in these markets is based primarily on price and to a lesser extent on performance, product quality, product deliverability and customer service. As a result, we may not be able to protect our market position for these products by product differentiation and may not be able to pass on cost increases to our customers. Historically, the prices for our commodity products have been cyclical and sensitive to relative changes in supply and demand, the availability and price of feedstocks and general economic conditions. Our other products may be subject to these same factors, but, typically, the impact of these factors is greatest on our commodity products.

We depend on several key customers in our Base Chemicals segment, the loss of whom could have a material adverse effect on our business, results of operations and financial condition and on our ability to make payments on the notes.

Sales of certain of our products, particularly ethylene and propylene in our Base Chemicals segment, are, and historically have been, dependent upon the continued demand from several key customers. This is a common characteristic in the Base Chemicals business. Six customers are expected to account for approximately 73% of our ethylene sales in 2005, and four customers are expected to account for approximately 93% of our propylene sales in 2005. Accordingly, the loss of any of our key Base Chemicals customers could have a material adverse effect on our business, results of operations, financial condition, liquidity and on our ability to make payments on the notes.

A major customer of our Base Chemicals segment has indicated that, upon termination of our existing contract as of December 31, 2005, it will discontinue purchasing ethylene and propylene from us. We expect this customer to purchase approximately 18% of our 2005 ethylene production and approximately 19% of our 2005 propylene production pursuant to such contract. We believe the expected market conditions in Europe for ethylene and propylene will be such that we will be able to sell, upon expiration of the contract, a substantial portion of the ethylene and propylene such customer historically purchased at prices that generate margins comparable to those historically obtained on sales to such customer. However, if market demand for ethylene or propylene in Europe is weaker than expected, we may experience difficulty in selling the ethylene and propylene historically purchased by such customer, or we may have difficulty selling such ethylene and propylene at comparable margins. Failure to sell such ethylene or propylene, or the failure to receive comparable margins for such ethylene and propylene, could have a material adverse effect on our business, results of operations, financial condition, liquidity and on our ability to make payments on the notes.

We have announced plans to construct a low-density polyethylene facility at our Wilton, U.K. site with annual production capacity of 900 million pounds. We expect this facility to be operational in late 2007, and, when completed, we expect that it will consume approximately 50% of our annual ethylene output, although we can give you no assurance that it will do so.

15

Significant price volatility or interruptions in supply of our raw materials may result in increased costs that we may be unable to pass on to our customers, which could negatively affect our ability to make payments on the notes.

The prices of the raw materials that we purchase from third parties are cyclical and volatile. We purchase a substantial portion of these raw materials from third party suppliers, and the cost of these raw materials represents a substantial portion of our operating expenses. The prices for a number of these raw materials generally follow price trends of, and vary with market conditions for, crude oil and natural gas feedstocks, which are highly volatile and cyclical. In recent periods, we have experienced significantly higher crude oil prices, which have resulted in increased raw material prices.

Although we frequently enter into supply agreements to acquire these raw materials, these agreements typically provide for market-based pricing and provide us only limited protection against price volatility. While we attempt to match cost increases with corresponding product price increases, we are not always able to raise product prices immediately or at all. Timing differences between raw material prices, which may change daily, and contract product prices, which in many cases are negotiated only monthly or less often, have had and may continue to have a negative effect on our cash flow. If any of our suppliers is unable to meet its obligations under present supply agreements, we may be forced to pay higher prices to obtain the necessary raw materials from other sources and we may not be able to increase prices for our finished products to recoup the higher raw materials cost. In addition, if any of the raw materials that we use become unavailable within the geographic area from which they are now sourced, then we may not be able to obtain suitable and cost effective substitutes. Any cost increase that we are not able to pass on to our customers or any interruption in supply of raw materials could have a material adverse effect on our business, results of operations, financial condition, liquidity and on our ability to make payments on the notes.

The industries in which we compete are highly competitive, and we may not be able to compete effectively with our competitors that have greater financial resources, which could have a material adverse effect on our business, results of operations and financial condition and on our ability to make payments on the notes.

The industries in which we operate are highly competitive. Among our competitors are some of the world's largest chemical companies and major integrated petroleum companies that have their own raw material resources. Some of these companies may be able to produce products more economically than we can. In addition, some of our competitors have greater financial resources, which may enable them to invest significant capital into their businesses, including expenditures for research and development. If any of our current or future competitors develops proprietary technology that enables them to produce products at a significantly lower cost, our technology could be rendered uneconomical or obsolete. Moreover, certain of our businesses use technology that is widely available. Accordingly, barriers to entry, apart from capital availability, are low in certain product segments of our business, and the entrance of new competitors into the industry may reduce our ability to capture improving profit margins in circumstances where capacity utilization in the industry is increasing. Further, petroleum-rich countries have become more significant participants in the petrochemical industry and may expand this role significantly in the future. Increased competition in any of our businesses could compel us to reduce the prices of our products, which could result in reduced profit margins and loss of market share and have a material adverse effect on our business, results of operations, financial condition, liquidity and on our ability to make payments on the notes.

Our operations involve risks that may increase our operating costs, which could have a material adverse effect on our business, results of operations and financial condition and on our ability to make payments on the notes.

Although we take precautions to enhance the safety of our operations and minimize the risk of disruptions, our operations are subject to hazards inherent in the manufacturing and marketing of

16

differentiated and commodity chemical products. These hazards include: pipeline leaks and ruptures; explosions; fires; severe weather and natural disasters; mechanical failures; unscheduled downtimes; labor difficulties; transportation interruptions; remediation complications; chemical spills; discharges or releases of toxic or hazardous substances or gases; storage tank leaks; and other risks. Some of these hazards can cause bodily injury and loss of life, severe damage to or destruction of property and equipment and environmental damage, and may result in suspension of operations and the imposition of civil or criminal penalties and liabilities. Furthermore, we are subject to present and future claims with respect to workplace exposure, exposure of contractors on our premises as well as other persons located nearby, workers' compensation and other matters.

We maintain property, business interruption and casualty insurance policies which we believe are in accordance with customary industry practices, but we are not fully insured against all potential hazards and risks incident to our business. As a result of market conditions, premiums and deductibles for certain insurance policies can increase substantially and, in some instances, certain insurance may become unavailable or available only for reduced amounts of coverage. If we were to incur a significant liability for which we were not fully insured, it could have a material adverse effect on our business, results of operations, financial condition, liquidity and on our ability to make payments on the notes.

In addition, we are subject to various claims and litigation in the ordinary course of business. We maintain insurance to cover many of our potential losses, but we are subject to various self-retentions and deductibles under our insurance. In conjunction with many of our past acquisitions, we have obtained indemnity agreements from the prior owners addressing liabilities that may arise from operations and events prior to our ownership. We are a party to several pending lawsuits and proceedings. It is possible that a judgment could be rendered against us in these cases or others in which we could be uninsured or not covered by indemnity and beyond the amounts that we currently have reserved or anticipate incurring for such matters.

Material weaknesses in our internal controls could result in material misstatements in our financial statements, cause investors to lose confidence in our reported financial information and result in a lower trading price of our securities.

In connection with the audit of the financial statements of our parent and its subsidiaries (the "Huntsman Companies" or "Group") for the year ended December 31, 2003, the Group's independent registered public accounting firm, or auditors, identified several matters that they deemed to be "material weaknesses" in the Group's internal controls as defined in standards established by the American Institute of Certified Public Accountants. The principal material weakness identified by the auditors was that the Group's controllership function did not have an adequate formal process in place to gather the data required to prepare the financial statements and disclosures required for the numerous financial reporting requirements of the Huntsman Companies. The auditors noted that these material weaknesses had led to restatements of the financial statements of certain of the Huntsman Companies, including us, in recent periods.

In connection with the audit of the Group's financial statements for the year ended December 31, 2004, the auditors did not identify any matters that they deemed to be material weaknesses. In conducting their audit, however, the auditors did not undertake to audit the Group's internal controls, and thus we cannot give any assurance that they would not have noted additional material weaknesses, or reiterated the material weaknesses described above, had they done so. Nor can we give any assurance that the auditors will not note additional material weaknesses, or reiterate the material weaknesses described above, in future audits of the Group's financial statements. Any such material weaknesses could cause us to fail to meet our reporting obligations or result in material misstatements in our financial statements.

17

The Group has engaged Ernst & Young LLP to assist the Group's management in its evaluation of the Group's internal controls in preparation for the periodic management evaluations and annual auditor attestation reports regarding the effectiveness of its "internal control over financial reporting" that will be required when the SEC's rules under Section 404 of the Sarbanes-Oxley Act of 2002 become applicable to the Group beginning with its Annual Reports on Form 10-K for the year ending December 31, 2006 to be filed in the first quarter of 2007. We cannot give any assurance, however, that the Group's internal controls will be effective when Section 404 becomes applicable to it. Ineffective internal controls could cause investors to lose confidence in our reported financial information and could result in a lower trading price for our securities.

Our ability to repay our debt may be adversely affected if our joint venture partners do not perform their obligations or we have disagreements with them.

We conduct a substantial amount of our operations through our joint ventures. Our ability to meet our debt service obligations depends, in part, upon the operation of our joint ventures. If any of our joint venture partners fails to observe its commitments, that joint venture may not be able to operate according to its business plans or we may be required to increase our level of commitment to give effect to those plans. In general, joint venture arrangements may be affected by relations between the joint venture partners. Differences in views among the partners may, for example, result in delayed decisions or in failure to agree on significant matters. Such circumstances may have an adverse effect on the business and operations of the joint ventures, adversely affecting the business and operations of our company. If we cannot agree with our joint venture partners on significant issues, we may experience a material adverse effect on our business, results of operations, financial condition, liquidity and on our ability to make payments on the notes.

If we are unable to maintain our relationships with Huntsman LLC then we may not be able to replace on favorable terms our contracts with them or the services and facilities that they provide, if at all.

We have entered and will continue to enter into certain agreements, including service, supply and purchase contracts with Huntsman LLC. If Huntsman LLC or any of its affiliates fails to perform its obligations under any of these agreements, or if any of these agreements terminate or we are otherwise unable to obtain the benefits thereunder for any reason, there could be a material adverse effect on our business, results of operations and financial condition and on our ability to make payments on the notes if we are unable to obtain similar service, supply or purchase contracts on the same terms from third parties. For example, we have only one operating facility for our production of propylene oxide, which is located in Port Neches, Texas. The facility is dependent on the existing infrastructure and adjacent facilities of Huntsman LLC for certain utilities, raw materials, product distribution systems and safety systems. In addition, we depend upon employees of Huntsman LLC to operate our Port Neches facility. We purchase all of the propylene used in the production of propylene oxide through Huntsman LLC's pipeline, which is the only existing propylene pipeline connected to our propylene oxide facility. If we were required to obtain propylene from another source, we would need to make a substantial investment in an alternative pipeline. This could have a material adverse effect on our business, results of operations and financial condition and on our ability to make payments on the notes.

We are subject to many environmental and safety regulations that may result in unanticipated costs or liabilities, which could have a material adverse effect on our business, results of operations and financial condition and on our ability to make payments on the notes.

We are subject to extensive federal, state, local and foreign laws, regulations, rules and ordinances relating to pollution, protection of the environment and the generation, storage, handling, transportation, treatment, disposal and remediation of hazardous substances and waste materials. Actual or alleged violations of environmental laws or permit requirements could result in restrictions or

18

prohibitions on plant operations, substantial civil or criminal sanctions, as well as, under some environmental laws, the assessment of strict liability and/or joint and several liability. Moreover, changes in environmental regulations could inhibit or interrupt our operations, or require us to modify our facilities or operations. Accordingly, environmental or regulatory matters may cause us to incur significant unanticipated losses, costs or liabilities, which could have a material adverse effect on our business, results of operations, financial condition and liquidity.

In addition, we could incur significant expenditures in order to comply with existing or future environmental or safety laws. Capital expenditures and costs relating to environmental or safety matters will be subject to evolving regulatory requirements and will depend on the timing of the promulgation and enforcement of specific standards which impose requirements on our operations. Therefore, we cannot assure you that capital expenditures and costs beyond those currently anticipated will not be required under existing or future environmental or safety laws.

Furthermore, we may be liable for the costs of investigating and cleaning up environmental contamination on or from our properties or at off-site locations where we disposed of or arranged for the disposal or treatment of hazardous materials or from disposal activities that pre-dated the purchase of our businesses. We cannot assure you that additional costs and expenditures beyond those currently anticipated will not be incurred to address all such known and unknown situations under existing and future environmental law.

For additional information, see "Business—Environmental, Health and Safety Matters" below.

Existing or future litigation or legislative initiatives restricting the use of MTBE in gasoline may subject us or our products to environmental liability or materially adversely affect our sales and costs.

We produce methyl tertiary butyl ether, or MTBE, an oxygenate that is blended with gasoline to reduce vehicle air emissions and to enhance the octane rating of gasoline. The use of MTBE is controversial in the U.S. and elsewhere and may be substantially curtailed or eliminated in the future by legislation or regulatory action. For example, California, New York and Connecticut have adopted rules that prohibit the use of MTBE in gasoline sold in those states as of January 1, 2004. Overall, states that have taken some action to prohibit or restrict the use of MTBE in gasoline account for a substantial portion of the "pre-ban" U.S. MTBE market. Additional phase-outs or other future regulation of MTBE may result in a significant reduction in demand for our MTBE, a material loss in revenues or material increase in compliance costs or expenditures. In addition, a number of lawsuits have been filed, primarily against gasoline manufacturers, marketers and distributors, by persons seeking to recover damages allegedly arising from the presence of MTBE in groundwater. While we have not been named as a defendant in any litigation concerning the environmental effects of MTBE, we cannot provide assurances that we will not be involved in any such litigation or that such litigation will not have a material adverse effect on our business, results of operations, financial condition, liquidity or on our ability to make payments on the notes.

For additional information, see "Business—Environmental, Health and Safety Matters—MTBE Developments."

Our results of operations may be adversely affected by fluctuations in currency exchange rates and international business risks.

We conduct a significant portion of our business outside the U.S. Our operations outside the U.S. are subject to risks normally associated with international operations. These risks include the need to convert currencies which may be received for our products into currencies required to pay our indebtedness or into currency in which we purchase raw materials or pay for services, which could result in a gain or loss depending on fluctuations in exchange rates. In addition, we translate our local currency financial results into U.S. dollars based on average exchange rates prevailing during the

19

reporting period or the exchange rate at the end of that period. During times of a strengthening U.S. dollar, our reported international sales and earnings may be reduced because the local currency may translate into fewer U.S. dollars.

Other risks of international operations include trade barriers, tariffs, exchange controls, national and regional labor strikes, social and political risks, general economic risks and required compliance with a variety of foreign laws, including tax laws and the difficulty of enforcing agreements and collecting receivables through foreign legal systems. The occurrence of these risks could adversely affect the businesses of our international subsidiaries, which could significantly affect their ability to make distributions to us.

Our business is dependent on our intellectual property. If our patents are declared invalid or our trade secrets become known to our competitors, our ability to compete may be adversely affected.

Proprietary protection of our processes, apparatuses and other technology is important to our business. Consequently, we may have to rely on judicial enforcement of our patents and other proprietary rights. While a presumption of validity exists with respect to patents issued to us in the U.S., there can be no assurance that any of our patents will not be challenged, invalidated, circumvented or rendered unenforceable. Furthermore, if any pending patent application filed by us does not result in an issued patent, or if patents are issued to us, but such patents do not provide meaningful protection of our intellectual property, then our ability to compete may be adversely affected. Additionally, our competitors or other third parties may obtain patents that restrict or preclude our ability to lawfully produce or sell our products in a competitive manner, which could have a material adverse effect on our business, results of operations, financial condition, liquidity and on our ability to make payments on the notes.

We also rely upon unpatented proprietary know-how and continuing technological innovation and other trade secrets to develop and maintain our competitive position. While it is our policy to enter into confidentiality agreements with our employees and third parties to protect our intellectual property, these confidentiality agreements may be breached, may not provide meaningful protection for our trade secrets or proprietary know-how, or adequate remedies may not be available in the event of an unauthorized use or disclosure of such trade secrets and know-how. In addition, others could obtain knowledge of such trade secrets through independent development or other access by legal means. The failure of our patents or confidentiality agreements to protect our processes, apparatuses, technology, trade secrets or proprietary know-how could have a material adverse effect on our business, results of operations, financial condition, liquidity and on our ability to make payments on the notes.

Loss of key members of our management could adversely affect our business.

We depend on the continued employment and performance of our senior executives and other key members of management. If any of these individuals resigns or becomes unable to continue in his present role and is not adequately replaced, our business operations could be materially adversely affected. In addition, the achievement of our financial goals requires significant management time and, to the extent that members of senior management are unavailable, for any reason, including allocation of management time to other companies, such as Huntsman LLC and Huntsman Advanced Materials LLC ("AdMat"), that are now or may become part of the Huntsman organization, our business could be adversely affected. We generally do not have employment agreements with, and we do not maintain any "key man" life insurance for, any of our executive officers.

Certain events could result in a change of control or default under our existing indebtedness or the notes.

Huntsman LLC indirectly owns approximately 42% of the equity interests in our parent HIH. Huntsman LLC issued its senior secured notes, which are secured by, among other things, a pledge of

20

approximately 42% of the equity interests of HIH. Huntsman LLC's credit facilities are also secured by, among other things, a pledge of apprximately 42% of the equity interests of HIH. In the case of an event of default under Huntsman LLC's senior secured notes or its credit facilities, the trustee under the indenture governing the Huntsman LLC senior secured notes, acting on behalf of the holders of the Huntsman LLC senior secured notes, or the lenders under the Huntsman LLC credit facilities, could exercise remedies against the collateral securing the Huntsman LLC senior discount notes or the Huntsman LLC credit facilities, as the case may be, including the pledged equity interests. Sale of the pledged equity interests, whether as a result of foreclosure or in connection with bankruptcy or similar proceedings or otherwise, could result in an event of default under our senior secured credit facilities and a change of control under the indentures governing our senior notes, our senior subordinated notes and the notes offered hereby. In such case, the lenders under our senior secured credit facilities could exercise their rights thereunder, including the acceleration of all amounts outstanding. In addition, the holders of our senior notes and our senior subordinated notes and the notes offered hereby would have the right to require us to repurchase their notes at 101% of the aggregate principal amount. There can be no assurance that we will have funds available to pay all amounts outstanding under our senior secured credit facilities in the event of acceleration or to complete repurchases of such notes.

Terrorist attacks, such as the attacks that occurred on September 11, 2001, the continuing military action in Iraq, general instability in various OPEC member nations, the threat of other attacks or acts of war in the U.S. and abroad and increased security regulations related to our industry could adversely affect our business.

The attacks of September 11, 2001, and subsequent events, including the continuing military action in Iraq, have caused instability in the U.S. and other financial markets and have led, and may continue to lead, to further armed hostilities, prolonged military action in Iraq, or further acts of terrorism in the U.S. or abroad, which could cause further instability in financial markets. Current regional tensions and conflicts in various OPEC member nations, including the continuing military action in Iraq, have caused, and may cause further, increases in raw material costs, particularly crude oil and natural gas feedstocks, which are used in our operations. The uncertainty surrounding the continuing military action in Iraq and the threat of further armed hostilities or acts of terrorism may impact any or all of our physical facilities and operations, which are located in North America, Europe, Asia, Africa, South America and the Middle East, or those of our customers. Furthermore, the terrorist attacks, subsequent events and future developments in any of these areas may result in reduced demand from our customers for our products. In addition, local, state and federal governments have begun a regulatory process that could lead to new regulations impacting the security of chemical plant locations and the transportation of hazardous chemicals, which could result in higher operating costs. These developments will subject our worldwide operations to increased risks and, depending on their magnitude, could have a material adverse effect on our business, results of operations, financial condition, liquidity and on our ability to make payments on the notes.

Future acquisitions, partnerships and joint ventures may require significant resources and/or result in unanticipated adverse consequences that could adversely affect our business, results of operations and financial condition and on our ability to make payments on the notes.

In the future we may seek to grow our company and businesses by making acquisitions or entering into partnerships and joint ventures. Any future acquisition, partnership or joint venture may require that we make a significant cash investment, issue stock or incur substantial debt. In addition, acquisitions, partnerships or investments may require significant managerial attention, which may be diverted from our other operations. These capital, equity and managerial commitments may impair the operation of our businesses. Furthermore, any future acquisitions of businesses or facilities could entail a number of additional risks, including:

21

We have incurred indebtedness to finance past acquisitions. We may finance future acquisitions with additional indebtedness. We could face the financial risks associated with incurring additional indebtedness such as reducing our liquidity and access to financing markets and increasing the amount of cash flow required to service such indebtedness, which could adversely affect our ability to make payments on the notes.

Risks Related to the Notes

Despite our current levels of indebtedness, we may incur substantially more debt, which could further increase the risks associated with our substantial indebtedness.

Although the agreements governing our outstanding indebtedness contain, and the indenture governing the notes contains, restrictions on the incurrence of additional indebtedness by us and our restricted subsidiaries, these restrictions are subject to a number of qualifications and exceptions, and the indebtedness incurred in compliance with these restrictions could be substantial. As of March 31, 2005, we had approximately $367.8 million available for additional revolving borrowings, or, within limits, issuances of letters of credit under our senior secured credit facilities. In addition to amounts that may be borrowed under our senior secured credit facilities, the indenture governing the notes also will allow us and our restricted subsidiaries to borrow significant amounts of money from other sources and will place no restrictions on borrowings by our unrestricted subsidiaries. Also, these restrictions do not prevent us from incurring obligations that do not constitute "indebtedness" as defined in the relevant agreement. If new debt is added to the current debt levels, the related risks that we now face could intensify.

We may incur substantial amounts of additional senior secured and unsecured indebtedness as a result of guarantees of such indebtedness of our direct or indirect parent following an initial public offering of common stock of such parent. Our guarantee of such indebtedness which is secured will be effectively senior to the notes to the extent of the value of the property or assets securing such indebtedness. Our guarantee of unsecured indebtedness will rank pari passu with the notes. The indenture does not contain restrictions on such parent company and in certain circumstances the guarantees that we and the guarantors are permitted to issue in respect of such parent company's debt that may be senior in right of payment to the notes or the guarantees of the notes, as the case may be.