Use these links to rapidly review the document

TABLE OF CONTENTS

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form 10-Q

| (Mark One) | |

ý |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2005 |

|

OR |

|

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to |

|

Commission file number 333-85141

HUNTSMAN INTERNATIONAL LLC

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

87-0630358 (I.R.S. Employer Identification No.) |

500 Huntsman Way

Salt Lake City, Utah 84108

(801) 584-5700

(Address of principal executive offices and telephone number)

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES ý NO o

Indicate by check mark whether the registrant is an accelerated filer (as defined in Exchange Act Rule 12b-2). YES o NO ý

On August 10, 2005, 1,000 units of membership interest of the registrant were outstanding. There is no established trading market for the registrant's units of membership interest. All of the registrant's units of membership interest are held by an affiliate.

HUNTSMAN INTERNATIONAL LLC

QUARTERLY REPORT ON FORM 10-Q FOR THE QUARTERLY PERIOD

ENDED JUNE 30, 2005

2

HUNTSMAN INTERNATIONAL LLC AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS (UNAUDITED)

(Dollars in Millions)

| |

June 30, 2005 |

December 31, 2004 |

||||||

|---|---|---|---|---|---|---|---|---|

| ASSETS | ||||||||

| Current assets: | ||||||||

| Cash and cash equivalents | $ | 112.2 | $ | 138.0 | ||||

| Accounts receivable (net of allowance for doubtful accounts of $9.0 and $10.7, respectively) | 793.2 | 770.1 | ||||||

| Accounts receivable from affiliates | 17.0 | 35.9 | ||||||

| Inventories, net | 759.1 | 735.6 | ||||||

| Prepaid expenses | 16.0 | 30.8 | ||||||

| Deferred income taxes | 10.2 | 10.2 | ||||||

| Other current assets | 55.8 | 50.5 | ||||||

| Total current assets | 1,763.5 | 1,771.1 | ||||||

| Property, plant and equipment, net | 2,921.4 | 3,183.7 | ||||||

| Investment in unconsolidated affiliates | 151.5 | 146.2 | ||||||

| Intangible assets, net | 236.1 | 254.0 | ||||||

| Notes receivable from affiliates | — | 10.8 | ||||||

| Other noncurrent assets | 477.0 | 483.1 | ||||||

| Total assets | $ | 5,549.5 | $ | 5,848.9 | ||||

| LIABILITIES AND MEMBER'S EQUITY | ||||||||

| Current liabilities: | ||||||||

| Accounts payable | $ | 583.4 | $ | 589.2 | ||||

| Accounts payable to affiliates | 79.8 | 99.1 | ||||||

| Accrued liabilities | 324.9 | 419.7 | ||||||

| Current portion of long-term debt | 20.7 | 10.5 | ||||||

| Total current liabilities | 1,008.8 | 1,118.5 | ||||||

| Long-term debt | 2,775.1 | 3,044.3 | ||||||

| Deferred income taxes | 164.5 | 179.2 | ||||||

| Notes payable to affiliates | — | 29.9 | ||||||

| Other noncurrent liabilities | 355.4 | 269.5 | ||||||

| Total liabilities | 4,303.8 | 4,641.4 | ||||||

| Minority interests | 18.2 | 8.8 | ||||||

| Commitments and contingencies (Notes 16 and 17) | ||||||||

| Member's equity: | ||||||||

| Member's equity, 1,000 units | 1,026.1 | 1,026.1 | ||||||

| Retained earnings | 174.7 | 6.1 | ||||||

| Accumulated other comprehensive income | 26.7 | 166.5 | ||||||

| Total member's equity | 1,227.5 | 1,198.7 | ||||||

| Total liabilities and member's equity | $ | 5,549.5 | $ | 5,848.9 | ||||

See accompanying notes to unaudited condensed consolidated financial statements.

3

HUNTSMAN INTERNATIONAL LLC AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND

COMPREHENSIVE INCOME (LOSS) (UNAUDITED)

(Dollars in Millions)

| |

Three Months Ended June 30, 2005 |

Three Months Ended June 30, 2004 |

Six Months Ended June 30, 2005 |

Six Months Ended June 30, 2004 |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenues: | |||||||||||||||

| Trade sales, services and fees | $ | 1,868.4 | $ | 1,538.1 | $ | 3,750.5 | $ | 2,981.7 | |||||||

| Related party sales | 61.8 | 67.4 | 128.0 | 103.9 | |||||||||||

| Total revenues | 1,930.2 | 1,605.5 | 3,878.5 | 3,085.6 | |||||||||||

| Cost of goods sold | 1,599.8 | 1,373.2 | 3,189.1 | 2,704.4 | |||||||||||

| Gross profit | 330.4 | 232.3 | 689.4 | 381.2 | |||||||||||

| Expenses: | |||||||||||||||

| Selling, general and administrative | 95.5 | 92.8 | 182.1 | 185.8 | |||||||||||

| Research and development | 11.9 | 8.8 | 22.4 | 21.0 | |||||||||||

| Other operating (income) expense | (3.4 | ) | 24.8 | 30.2 | 19.6 | ||||||||||

| Restructuring and plant closing costs | 18.5 | 124.9 | 25.5 | 133.6 | |||||||||||

| Total expenses | 122.5 | 251.3 | 260.2 | 360.0 | |||||||||||

| Operating income (loss) | 207.9 | (19.0 | ) | 429.2 | 21.2 | ||||||||||

| Interest expense, net | (53.3 | ) | (62.9 | ) | (117.1 | ) | (131.9 | ) | |||||||

| Loss on accounts receivable securitization program | (2.4 | ) | (3.0 | ) | (5.6 | ) | (6.5 | ) | |||||||

| Other expense | (1.8 | ) | — | (3.1 | ) | (0.2 | ) | ||||||||

| Income (loss) from continuing operations before income taxes and minority interest | 150.4 | (84.9 | ) | 303.4 | (117.4 | ) | |||||||||

| Income tax expense | (33.2 | ) | (4.7 | ) | (56.7 | ) | (8.3 | ) | |||||||

| Minority interest | — | — | (0.1 | ) | — | ||||||||||

| Income (loss) from continuing operations | 117.2 | (89.6 | ) | 246.6 | (125.7 | ) | |||||||||

| Loss from discontinued operations (including loss on pending disposal of $36.4 in 2005), net of tax | (40.4 | ) | (0.9 | ) | (43.0 | ) | (1.7 | ) | |||||||

| Net income (loss) | 76.8 | (90.5 | ) | 203.6 | (127.4 | ) | |||||||||

| Other comprehensive loss | (94.6 | ) | (15.5 | ) | (139.8 | ) | (13.7 | ) | |||||||

| Comprehensive (loss) income | $ | (17.8 | ) | $ | (106.0 | ) | $ | 63.8 | $ | (141.1 | ) | ||||

See accompanying notes to unaudited condensed consolidated financial statements.

4

HUNTSMAN INTERNATIONAL LLC AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF MEMBER'S EQUITY (UNAUDITED)

(Dollars in Millions)

| |

Member's Equity |

|

Accumulated Other Comprehensive Income |

|

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Retained Earnings |

|

|||||||||||||

| |

Units |

Amount |

Total |

||||||||||||

| Balance, January 1, 2005 | 1,000 | $ | 1,026.1 | $ | 6.1 | $ | 166.5 | $ | 1,198.7 | ||||||

| Net income | — | — | 203.6 | — | 203.6 | ||||||||||

| Dividend paid to parent | — | — | (35.0 | ) | — | (35.0 | ) | ||||||||

| Other comprehensive loss | — | — | — | (139.8 | ) | (139.8 | ) | ||||||||

| Balance, June 30, 2005 | 1,000 | $ | 1,026.1 | $ | 174.7 | $ | 26.7 | $ | 1,227.5 | ||||||

See accompanying notes to unaudited condensed consolidated financial statements.

5

HUNTSMAN INTERNATIONAL LLC AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

(Dollars in Millions)

| |

Six Months Ended June 30, 2005 |

Six Months Ended June 30, 2004 |

||||||

|---|---|---|---|---|---|---|---|---|

| Operating Activities: | ||||||||

| Net income (loss) | $ | 203.6 | $ | (127.4 | ) | |||

| Adjustments to reconcile net income (loss) to net cash provided by operating activities: | ||||||||

| Depreciation and amortization | 149.2 | 156.8 | ||||||

| (Recovery of) provision for losses on accounts receivable | (6.2 | ) | 3.3 | |||||

| Noncash restructuring and plant closing costs | 0.1 | 81.1 | ||||||

| Loss on early extinguishment of debt | 3.0 | — | ||||||

| Loss on pending disposal of discontinued operations | 36.4 | — | ||||||

| Noncash interest expense | 5.5 | 10.1 | ||||||

| Deferred income taxes | 26.3 | 6.0 | ||||||

| Unrealized gains on foreign currency transactions | (4.1 | ) | (14.8 | ) | ||||

| Changes in operating assets and liabilities | ||||||||

| Accounts and notes receivables | 26.6 | (128.7 | ) | |||||

| Change in receivables sold, net | 4.1 | 29.7 | ||||||

| Inventories | (33.1 | ) | 6.9 | |||||

| Prepaid expenses | 14.0 | 3.6 | ||||||

| Other current assets | (9.4 | ) | (25.3 | ) | ||||

| Other noncurrent assets | (1.3 | ) | (8.0 | ) | ||||

| Accounts payable | (58.7 | ) | 5.5 | |||||

| Accrued liabilities | (60.4 | ) | 42.6 | |||||

| Other noncurrent liabilities | (23.4 | ) | 1.6 | |||||

| Net cash provided by operating activities | 272.2 | 43.0 | ||||||

| Investing Activities: | ||||||||

| Capital expenditures | (83.1 | ) | (60.4 | ) | ||||

| Investments in unconsolidated affiliate | (11.2 | ) | (11.8 | ) | ||||

| Net cash received from unconsolidated affiliate | 0.7 | 8.3 | ||||||

| Proceeds from sale of assets | 4.6 | — | ||||||

| Advances to unconsolidated affiliate | — | (1.2 | ) | |||||

| Net cash used in investing activities | (89.0 | ) | (65.1 | ) | ||||

| Financing Activities: | ||||||||

| Net borrowings under revolving loan facilities | — | 15.0 | ||||||

| Repayment of credit facilities | (174.9 | ) | — | |||||

| Repayment of senior notes | (4.3 | ) | — | |||||

| Net repayments of overdraft facility | — | (7.5 | ) | |||||

| Dividend paid to parent | (35.0 | ) | ||||||

| Other | 6.2 | — | ||||||

| Capital contributions received from minority shareholders | 3.6 | 2.7 | ||||||

| Net cash (used in) provided by financing activities | (204.4 | ) | 10.2 | |||||

| Effect of exchange rate changes on cash | (4.6 | ) | (0.7 | ) | ||||

| Decrease in cash and cash equivalents | (25.8 | ) | (12.6 | ) | ||||

| Cash and cash equivalents at beginning of period | 138.0 | 97.8 | ||||||

| Cash and cash equivalents at end of period | $ | 112.2 | $ | 85.2 | ||||

| Supplemental cash flow information: | ||||||||

| Cash paid for interest | $ | 106.6 | $ | 124.5 | ||||

| Cash paid for income taxes | $ | 9.5 | $ | 4.1 | ||||

See accompanying notes to unaudited condensed consolidated financial statements.

6

HUNTSMAN INTERNATIONAL LLC AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

1. General

Certain Definitions

For convenience in this report, the terms "Company," "our," "us" or "we" may be used to refer to Huntsman International LLC and, unless the context otherwise requires, its subsidiaries. In this report, "HIH" refers to Huntsman International Holdings, LLC, "Huntsman LLC" or "HLLC" refers to Huntsman LLC and, unless the context otherwise requires, its subsidiaries, "HMP" refers to HMP Equity Holdings Corporation, "Huntsman Holdings" refers to Huntsman Holdings, LLC, "Huntsman Corporation" refers to Huntsman Corporation and its predecessors, and, unless the context otherwise requires, their subsidiaries, "AdMat" refers to Huntsman Advanced Materials LLC and, unless the context otherwise requires, its subsidiaries, "MatlinPatterson" refers to MatlinPatterson Global Opportunities Partners L.P. and its affiliates and "ICI" refers to Imperial Chemical Industries PLC and, unless the context otherwise requires, its subsidiaries.

Company

We are a Delaware limited liability company and all of our membership interests are owned by HIH. All of the membership interests of HIH are owned directly and indirectly by Huntsman Corporation.

On February 16, 2005, Huntsman Corporation, our parent corporation, completed initial public offerings of (i) 55,681,819 shares of its common stock sold by Huntsman Corporation and 13,579,546 shares of its common stock sold by a selling stockholder, in each case at a price to the public of $23 per share, and (ii) 5,750,000 shares of its 5% Mandatory Convertible Preferred Stock sold by Huntsman Corporation at a price to the public of $50 per share. Net proceeds to Huntsman Corporation from the offering were approximately $1,500 million, substantially all of which has been used to repay outstanding indebtedness of certain of Huntsman Corporation's subsidiaries, including HMP, Huntsman LLC and HIH. In connection with the offering, Huntsman Corporation and certain affiliates engaged in a series of reorganization transactions. In connection with these reorganization transactions, Huntsman LLC's ownership of HIH was reduced to 42% effective February 16, 2005 from 60% as of December 31, 2004. For financial reporting purposes, this was considered a reorganization of entities under common control; and, beginning in March 2005, Huntsman LLC no longer consolidated our results of operations and has reclassified its financial statements to reflect its membership interest in HIH using the equity method for all periods presented.

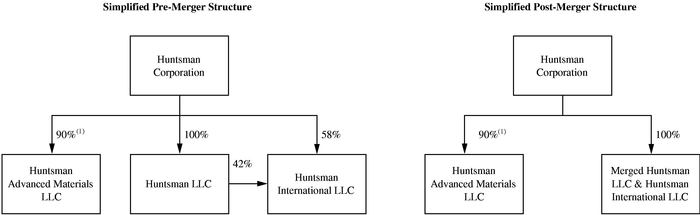

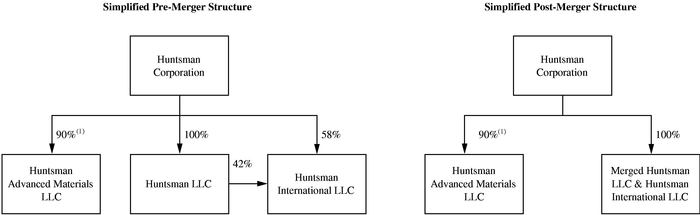

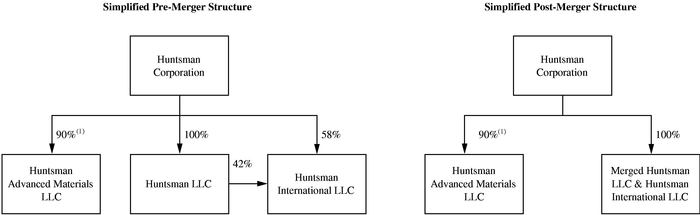

Proposed Merger with Huntsman LLC and Proposed New Credit Facility

In July 2005, Huntsman LLC obtained the required consents from the holders of its senior secured notes and its senior notes to amend certain provisions in the indentures governing its notes. The amendments will facilitate the proposed merger of Huntsman LLC with and into our Company. The proposed merger of Huntsman LLC with and into our Company will help simplify the financing and reporting structure of Huntsman Corporation and is expected to facilitate other organizational efficiencies. We have recently completed the syndication of the proposed new secured credit facility for the merged company. The proposed secured credit facility is expected to be comprised of a $1.85 billion term loan due 2012 and a $650 million revolving loan facility due 2011. Initial interest rate margins under the proposed secured credit facility are contemplated to be at LIBOR plus 1.75%. In addition, we have received a commitment to temporarily expand the commercial paper facility that is part of our accounts receivable securitization program by $50 million from $125 million to $175 million. Proceeds from the new credit facility, together with the expected increase in borrowings under the

7

accounts receivable securitization program, will be used to repay outstanding borrowings under our existing senior secured credit facilities, Huntsman LLC's senior secured credit facilities and certain other debt. We expect to complete the merger and related financing in the third quarter of 2005. However, there can be no assurances that the new facility will be obtained. If the credit facility is not obtained, the proposed merger will not occur.

The following tables provide a summary of our structure before and after the proposed merger:

Business

We are a global manufacturer and marketer of differentiated and commodity chemicals. We manage our business through four operating segments: Polyurethanes, Performance Products, Pigments and Base Chemicals. We manufacture our products at facilities located in North America, Europe, Asia and Africa and sell our products throughout the world.

Principles of Consolidation

Our consolidated financial statements include the accounts of our wholly-owned and majority-owned subsidiaries and any variable interest entities for which we are the primary beneficiary.

Interim Financial Statements

Our unaudited interim condensed consolidated financial statements were prepared in accordance with accounting principles generally accepted in the United States of America ("US GAAP") and in management's opinion, reflect all adjustments, consisting only of normal recurring adjustments necessary for a fair presentation of results of operations, financial position and cash flows for the periods presented. Results for interim periods are not necessarily indicative of those to be expected for the full year. These condensed consolidated financial statements should be read in conjunction with the audited consolidated financial statements and notes to consolidated financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2004.

Use of Estimates

The preparation of financial statements in conformity with US GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

8

Reclassifications

Certain amounts in the condensed consolidated financial statements for prior periods have been reclassified to conform with the current presentation.

2. Recently Issued Accounting Pronouncements

In January 2003, the Financial Accounting Standards Board ("FASB") issued Financial Interpretation No. ("FIN") 46, "Consolidation of Variable Interest Entities." FIN 46 addresses the requirements for business enterprises to consolidate related entities, for which they do not have controlling interests through voting or other rights, if they are determined to be the primary beneficiary as a result of variable economic interests. Transfers to a qualifying special purpose entity are not subject to this interpretation. In December 2003, the FASB issued a replacement of FIN 46 (FIN 46R) to clarify certain complexities. We were required to adopt this financial interpretation on January 1, 2005. The adoption of the standard required us to consolidate our Rubicon Inc. joint venture. See "Note 5—Investment in Unconsolidated Affiliates."

In November 2004, the FASB issued Statement of Financial Accounting Standards ("SFAS") No. 151, "Inventory Costs—an amendment of ARB No. 43." SFAS No. 151 requires abnormal amounts of idle facility expense, freight, handling costs, and wasted material to be recognized as current-period charges. It also requires that allocation of fixed production overhead to the costs of conversion be based on the normal capacity of the production facilities. The requirements of the standard will be effective for inventory costs incurred during fiscal years beginning after June 15, 2005. We are reviewing SFAS No. 151 to determine the statement's impact on our consolidated financial statements.

In December 2004, the FASB issued SFAS No. 153, "Exchanges of Nonmonetary Assets—an amendment of APB Opinion No. 29." SFAS No. 153 addresses the measurement of exchanges of nonmonetary assets and eliminates the exception from fair value measurement for nonmonetary exchanges of similar productive assets in APB Opinion No. 29 and replaces it with an exception for exchanges that do not have commercial substance. SFAS No. 153 specifies that a nonmonetary exchange has commercial substance if the future cash flows of the entity are expected to change significantly as a result of the exchange. The provisions of this standard are effective for nonmonetary exchanges occurring in fiscal periods beginning after June 15, 2005. We will apply this standard prospectively.

In December 2004, the FASB issued SFAS No. 123R, "Share Based Payment." SFAS No. 123R requires entities to measure the cost of employee services received in exchange for an award of equity instruments based on the grant-date fair value of the award. That cost will be recognized over the period during which the employee is required to provide services in exchange for the award. This standard eliminates the alternative to use the intrinsic value method of accounting for share-based payments as previously provided in APB Opinion No. 25, "Accounting for Stock Issued to Employees." We adopted SFAS No. 123R effective January 1, 2005, and have applied this standard prospectively to share-based awards issued to our employees in connection with Huntsman Corporation's initial public offering. In connection with Huntsman Corporation's initial public offering of common stock on February 16, 2005, certain of our employees received Huntsman Corporation stock options and restricted stock. Accordingly, we were allocated share-based compensation expense of $0.5 million and $0.7 million during the three and six months ended June 30, 2005, respectively. We did not have share-based awards prior to the awards issued in connection with Huntsman Corporation's initial public offering.

In March 2005, the FASB issued FIN 47, "Accounting for Conditional Asset Retirement Obligations." FIN 47 clarifies the term conditional asset retirement obligation used in SFAS No. 143, "Accounting for Asset Retirement Obligations," and clarifies when an entity would have sufficient information to reasonably estimate the fair value of an asset retirement obligation. FIN 47 is effective no later than

9

the end of December 2005. We are reviewing FIN 47 to determine its impact on our financial statements.

In March 2005, the Emerging Issues Task Force issued a preliminary consensus on issue 04-13, "Accounting for Purchase and Sales of Inventory with the Same Counterparty," that, if ratified by the FASB, would require companies to recognize an exchange of finished goods for raw materials or work-in-process within the same line of business at fair value. All other exchanges of inventory would be reflected at the recorded amount. We are evaluating the impact of this preliminary consensus to determine its impact on our results of operations.

In May 2005, the FASB issued SFAS No. 154, "Accounting Changes and Error Corrections—a replacement of APB Opinion No. 20 and FASB Statement No. 3" SFAS No. 154 requires retrospective application to prior periods' financial statements of changes in accounting principle, unless it is impracticable to determine either the period-specific effects or the cumulative effect of the change or unless specific transition provisions are proscribed in the accounting pronouncements. SFAS No. 154 does not change the accounting guidance for reporting a correction of an error in previously issued financial statements or a change in accounting estimate. SFAS No. 154 is effective for accounting changes and error corrections made after December 31, 2005. We will apply this standard prospectively.

3. Inventories

Inventories consisted of the following (dollars in millions):

| |

June 30, 2005 |

December 31, 2004 |

||||

|---|---|---|---|---|---|---|

| Raw materials and supplies | $ | 153.3 | $ | 191.4 | ||

| Work in progress | 37.6 | 45.4 | ||||

| Finished goods | 568.2 | 498.8 | ||||

| Total | $ | 759.1 | $ | 735.6 | ||

In the normal course of operations, we exchange raw materials with other companies. No gains or losses are recognized on these exchanges, and the net open exchange positions are valued at our cost. The amount included in inventory under open exchange agreements receivable by us at June 30, 2005 was $1.9 million (6.6 million pounds of feedstock and products), which represented the amount to be received by us under open exchange agreements. The amount included in inventory under open exchange agreements receivable by us at December 31, 2004 was $1.1 million (2.1 million pounds of feedstock and products).

4. Property, Plant and Equipment

The cost and accumulated depreciation of property, plant and equipment were as follows (dollars in millions):

| |

June 30, 2005 |

December 31, 2004 |

|||||

|---|---|---|---|---|---|---|---|

| Land | $ | 52.0 | $ | 56.7 | |||

| Buildings | 237.9 | 230.9 | |||||

| Plant and equipment | 3,872.8 | 4,095.9 | |||||

| Construction in progress | 213.4 | 173.2 | |||||

| Total | 4,376.1 | 4,556.7 | |||||

| Less accumulated depreciation | (1,454.7 | ) | (1,373.0 | ) | |||

| Net | $ | 2,921.4 | $ | 3,183.7 | |||

10

Depreciation expense for the three and six months ended June 30, 2005 and 2004 was $66.7 million and $72.0 million, respectively, and $135.6 million and $141.3 million, respectively.

Property, plant and equipment includes gross assets acquired under capital leases of $16.0 million and $16.6 million at June 30, 2005 and December 31, 2004, respectively; related amounts included in accumulated depreciation were $4.6 million and $5.4 million at June 30, 2005 and December 31, 2004, respectively.

5. Investment in Unconsolidated Affiliates

Our ownership percentage and investment in unconsolidated affiliates, primarily manufacturing joint ventures, were as follows (dollars in millions):

| |

June 30, 2005 |

December 31, 2004 |

||||

|---|---|---|---|---|---|---|

| Louisiana Pigment Company, L.P. (50%) | $ | 120.9 | $ | 121.6 | ||

| BASF Huntsman Shanghai Isocyanate Investment BV (50%)(a) | 25.9 | 17.9 | ||||

| Rubicon, Inc. (50%)(b) | — | 5.7 | ||||

| Others | 4.7 | 1.0 | ||||

| Total | $ | 151.5 | $ | 146.2 | ||

6. Intangible Assets

The gross carrying amount and accumulated amortization of intangible assets were as follows (dollars in millions):

| |

June 30, 2005 |

December 31, 2004 |

||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Carrying Amount |

Accumulated Amortization |

Net |

Carrying Amount |

Accumulated Amortization |

Net |

||||||||||||

| Patents, trademarks, and technology | $ | 386.5 | $ | 155.8 | $ | 230.7 | $ | 389.9 | $ | 142.7 | $ | 247.2 | ||||||

| Non-compete agreements | 49.4 | 44.0 | 5.4 | 49.9 | 43.1 | 6.8 | ||||||||||||

| Total | $ | 435.9 | $ | 199.8 | $ | 236.1 | $ | 439.8 | $ | 185.8 | $ | 254.0 | ||||||

Amortization expense for intangible assets for the three months ended June 30, 2005 and 2004 was $6.7 million and $7.2 million, respectively, and for the six months ended June 30, 2005 and 2004 was $13.6 million and $15.5 million, respectively.

11

7. Other Noncurrent Assets

Other noncurrent assets consisted of the following (dollars in millions):

| |

June 30, 2005 |

December 31, 2004 |

||||

|---|---|---|---|---|---|---|

| Prepaid pension costs | $ | 250.4 | $ | 266.0 | ||

| Debt issuance costs, net | 43.9 | 52.5 | ||||

| Capitalized turnaround costs, net | 57.2 | 72.7 | ||||

| Spare parts inventory, net | 63.1 | 56.7 | ||||

| Other noncurrent assets | 62.4 | 35.2 | ||||

| Total | $ | 477.0 | $ | 483.1 | ||

8. Accrued Liabilities

Accrued liabilities consisted of the following (dollars in millions):

| |

June 30, 2005 |

December 31, 2004 |

||||

|---|---|---|---|---|---|---|

| Payroll and related costs | $ | 81.3 | $ | 112.1 | ||

| Interest | 70.6 | 62.8 | ||||

| Volume rebate accruals | 41.2 | 64.1 | ||||

| Income tax payable | 33.4 | 26.7 | ||||

| Taxes (other than income tax) | 24.2 | 36.5 | ||||

| Restructuring and plant closing costs | 51.0 | 87.6 | ||||

| Environmental accruals | 6.6 | 5.7 | ||||

| Other accrued liabilites | 16.6 | 24.2 | ||||

| Total | $ | 324.9 | $ | 419.7 | ||

9. Other Noncurrent Liabilities

Other noncurrent liabilities consisted of the following (dollars in millions):

| |

June 30, 2005 |

December 31, 2004 |

||||

|---|---|---|---|---|---|---|

| Pension liabilities | $ | 241.1 | $ | 168.6 | ||

| Restructuring and plant closing costs | 24.3 | 19.0 | ||||

| Other postretirement benefits | 11.8 | 12.2 | ||||

| Environmental accruals | 12.0 | 15.5 | ||||

| Other noncurrent liabilities | 66.2 | 54.2 | ||||

| Total | $ | 355.4 | $ | 269.5 | ||

12

10. Restructuring and Plant Closing Costs

As of June 30, 2005 and December 31, 2004, accrued restructuring and plant closing costs by type of cost and activity consisted of the following (dollars in millions):

| |

Workforce reductions |

Demolition and decommissioning |

Non-cancelable lease costs |

Other restructuring costs |

Total(1) |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Accrued liabilities as of December 31, 2004 | $ | 82.9 | $ | 4.8 | $ | 5.1 | $ | 13.8 | $ | 106.6 | ||||||

| 2005 charges for 2003 activities | 13.2 | — | — | 1.7 | 14.9 | |||||||||||

| 2005 charges for 2004 activities | 10.0 | 0.2 | 0.1 | 0.6 | 10.9 | |||||||||||

| Reversal of reserves no longer required | — | — | — | (0.4 | ) | (0.4 | ) | |||||||||

| 2005 payments for 2003 activities | (12.6 | ) | — | — | (1.3 | ) | (13.9 | ) | ||||||||

| 2005 payments for 2004 activities | (35.1 | ) | — | — | (0.7 | ) | (35.8 | ) | ||||||||

| Foreign currency effect on reserve balance | (7.0 | ) | — | — | — | (7.0 | ) | |||||||||

| Accrued liabilities as of June 30, 2005 | $ | 51.4 | $ | 5.0 | $ | 5.2 | $ | 13.7 | $ | 75.3 | ||||||

| |

June 30, 2005 |

December 31, 2004 |

||||

|---|---|---|---|---|---|---|

| Accrued liabilities by activities were as follows: | ||||||

| 2003 activities | $ | 23.6 | $ | 22.6 | ||

| 2004 activities | 55.0 | 80.3 | ||||

| Foreign currency effect on reserve balance | (3.3 | ) | 3.7 | |||

| Total | $ | 75.3 | $ | 106.6 | ||

Details with respect to our reserves for restructuring and plant closing costs are provided below by segments and activity (dollars in millions):

| |

Polyurethanes |

Performance Products |

Pigments |

Base Chemicals |

Total |

|||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Accrued liabilities as of December 31, 2004 | $ | 19.0 | $ | 50.5 | $ | 22.0 | $ | 15.1 | $ | 106.6 | ||||||||

| 2005 charges for 2003 activities | 3.3 | — | 11.6 | — | 14.9 | |||||||||||||

| 2005 charges for 2004 activities | 1.1 | — | 5.7 | 4.1 | 10.9 | |||||||||||||

| Reversal of reserves no longer required | — | (0.4 | ) | — | — | (0.4 | ) | |||||||||||

| 2005 payments for 2003 activities | (3.8 | ) | (0.8 | ) | (9.3 | ) | — | (13.9 | ) | |||||||||

| 2005 payments for 2004 activities | (3.6 | ) | (12.5 | ) | (8.9 | ) | (10.8 | ) | (35.8 | ) | ||||||||

| Foreign currency effect on reserve balance | (1.4 | ) | (3.1 | ) | (2.0 | ) | (0.5 | ) | (7.0 | ) | ||||||||

| Accrued liabilities as of June 30, 2005 | $ | 14.6 | $ | 33.7 | $ | 19.1 | $ | 7.9 | $ | 75.3 | ||||||||

| Current portion of restructuring reserve | $ | 6.2 | $ | 23.8 | $ | 13.1 | $ | 7.9 | $ | 51.0 | ||||||||

| Long-term portion of restructuring reserve | 8.4 | 9.9 | 6.0 | — | 24.3 | |||||||||||||

| Estimated additional future charges for current restructuring projects: | ||||||||||||||||||

| Estimated additional charges within one year | ||||||||||||||||||

| Cash charges | $ | 3.0 | $ | — | $ | 7.8 | $ | 1.9 | $ | 12.7 | ||||||||

| Estimated additional charges beyond one year | ||||||||||||||||||

| Cash charges | $ | — | $ | — | $ | 13.1 | $ | 4.6 | $ | 17.7 | ||||||||

As of June 30, 2005 and December 31, 2004, we had reserves for restructuring and plant closing costs of $75.3 million and $106.6 million, respectively. During the six months ended June 30, 2005, we

13

recorded additional net charges of $25.5 million consisting of $25.4 million payable in cash and $0.1 million of non-cash charges, for workforce reductions, demolition and decommissioning and other restructuring costs associated with closure or curtailment of activities at our smaller, less efficient manufacturing facilities. During the first six months of 2005, we made cash payments against these reserves of $49.7 million.

As of December 31, 2004, our Polyurethanes segment reserve consisted of $19.0 million related to various restructuring programs, including the closure of our West Deptford, New Jersey site (as announced in 2004), restructuring activities at the Rozenburg, Netherlands site (as announced in 2003), workforce reductions throughout our Polyurethanes segment (as announced in 2003), and the closure of our Shepton Mallet, U.K. site (as announced in 2002). During the six months ended June 30, 2005, our Polyurethanes segment recorded restructuring charges of $4.4 million related to these activities which was payable in cash, recorded a non-cash credit of $0.3 million to reverse reserves no longer required and made cash payments of $7.4 million. These restructuring activities are expected to result in additional restructuring charges of approximately $3 million. During the six months ended June 30, 2004 our Polyurethanes segment recorded restructuring charges of $22.9 million.

As of December 31, 2004, our Performance Products segment reserve consisted of $50.5 million related to various restructuring programs across our European surfactants business, including the closure of substantially all of our Whitehaven, U.K. surfactants facility. These restructuring activities are not expected to result in additional restructuring charges. During the six months ended June 30, 2005, our Performance Products segment recorded a non-cash restructuring charge of $0.4 million, a credit of $0.4 million to reverse reserves no longer required and made cash payments of $13.3 million. During the six months ended June 30, 2004, our Performance products segment recorded restructuring charges of $0.4 million.

As of December 31, 2004, our Pigments segment reserve consisted of $22.0 million related to its global workforce reductions announced in 2003 and the reduction of its titanium dioxide ("TiO2") production capacity announced in 2004. During the six months ended June 30, 2005, our Pigments segment recorded restructuring charges of $17.3 million related to these restructuring activities, all of which was payable in cash, and made cash payments of $18.2 million. These restructuring activities are expected to result in additional restructuring charges of approximately $17 million through 2006. During July 2005, our Pigments and Base Chemicals segments announced that they would establish a single U.K. headquarters in Teesside, U.K. This will result in the closure of our Pigment segment's Billingham, U.K. headquarters and the creation of a new support center for both businesses. This restructuring activity is expected to result in additional restructuring charges of approximately $8 million, approximately $4 million of which will be incurred by our Pigments segment and approximately $4 million by the Base Chemicals segment. During the six months ended June 30, 2004, the Pigments segment recorded restructuring charges of $108.1 million.

As of December 31, 2004, our Base Chemicals segment reserve consisted of $15.1 million related primarily to workforce reductions arising from the announced change in work shift schedules and in the engineering and support functions at our Wilton and North Tees, U.K. facilities. During the six months ended June 30, 2005, our Base Chemicals segment recorded restructuring charges of $4.1 million, all of which was payable in cash, and made cash payments of $10.8 million. These restructuring activities are expected to result in additional restructuring charges of approximately $2 million through 2006.

14

Outstanding debt consisted of the following (dollars in millions):

| |

June 30, 2005 |

December 31, 2004 |

||||||

|---|---|---|---|---|---|---|---|---|

| HI Credit Facilities: | ||||||||

| Term B loan | $ | 1,132.7 | $ | 1,314.1 | ||||

| HI Senior Notes | 455.4 | 456.0 | ||||||

| HI Subordinated Notes | 1,158.1 | 1,242.0 | ||||||

| Other debt | 49.6 | 42.7 | ||||||

| Total Debt | 2,795.8 | 3,054.8 | ||||||

| Less current portion | (20.7 | ) | (10.5 | ) | ||||

| Long Term Debt | $ | 2,775.1 | $ | 3,044.3 | ||||

HI Credit Facilities

As of June 30, 2005, we had senior secured credit facilities (the "HI Credit Facilities") which consisted of a revolving loan facility of up to $375 million maturing in September 2008 (the "HI Revolving Facility"), which includes a $50 million multicurrency revolving loan facility available in euros, GBP Sterling and U.S. dollars, and a term loan B facility consisting of a $1,082.5 million term portion and a €41.6 million (approximately $50.2 million) term portion (the "HI Term Facility"). On March 24, 2005 and June 6, 2005, we made voluntary payments of $75.0 million and $100 million dollar equivalents, respectively, on the HI Term Facility. The maturity of the HI Term Facility is December 31, 2010; provided that the maturity will be accelerated to December 31, 2008 if we have not refinanced all of the outstanding HI Senior Notes and the HI Subordinated Notes (as defined below) on or before December 31, 2008 on terms satisfactory to the administrative agent under the HI Credit Facilities. Scheduled amortization of the HI Term Facility is approximately $11.4 million per annum commencing June 30, 2006, with the remaining unpaid balance due at maturity. The HI Credit Facilities allow us to borrow up to $100 million secured by letters of credit; however, the $375 million revolving credit facility is reduced dollar-for-dollar by any letters of credit outstanding. As of June 30, 2005, there were no loans outstanding on the HI Revolving Facility, and there were $6.9 million in letters of credit outstanding.

Interest rates for the amended and restated HI Credit Facilities are based upon, at our option, either a eurocurrency rate (LIBOR) or a base rate (prime) plus the applicable spread. The applicable spreads vary based on a pricing grid, depending on the loan facility and whether specified conditions have been satisfied, in the case of eurocurrency-based term loans, from 2.25% to 2.50% per annum for term B dollar loans and from 3.00% to 3.25% per annum for term B euro loans, and, in the case of base rate term loans, from 1.00% to 1.25% per annum for term B dollar loans. The applicable spread for eurocurrency-based revolving loans ranges from 2.25% to 3.25% and for base rate revolving loans from 1.00% to 2.00%. As of June 30, 2005, the weighted average interest rate on the HI Credit Facilities was approximately 5.5%, excluding the impact of interest rate hedges.

The HI Credit Facilities are secured by a first priority lien on substantially all our assets and all the assets of our domestic subsidiaries and certain of our foreign subsidiaries. The HI Credit Facilities are also guaranteed by HIH, our domestic subsidiaries and certain of our foreign subsidiaries (the "HI Guarantors").

The agreements governing the HI Credit Facilities contain customary financial covenants; covenants relating to the incurrence of debt, the purchase and sale of assets, limitations on investments and affiliate transactions; change in control provisions; events of default provisions; and acceleration

15

provisions. Management believes that we are in compliance with the covenants of the HI Credit Facilities.

HI Senior Notes and HI Subordinated Notes

In March 2002, we sold $300 million aggregate principal amount of HI Senior Notes that are due in 2009. On April 11, 2003, we sold an additional $150 million aggregate principal amount of the HI Senior Notes at an issue price of 105.25%. Net proceeds from the sale of these notes were used to repay amounts outstanding under the HI Credit Facilities. The HI Senior Notes are unsecured obligations. Interest on the HI Senior Notes is payable semiannually in March and September. The HI Senior Notes are redeemable after March 1, 2006 at 104.937% of the original aggregate principal amount thereof, declining ratably to par on and after March 1, 2008.

On December 17, 2004, we completed an offering of $175 million of our 7.375% senior subordinated notes due 2015 and €135 million of our 7.5% senior subordinated notes due 2015 (the "HI Senior Subordinated Notes due 2015"). We used all of the net proceeds to redeem part of our outstanding 10.125% senior subordinated notes due 2009 (the "HI Senior Subordinated Notes due 2009" and, together with the HI Senior Subordinated Notes due 2015, the "HI Senior Subordinated Notes"). Prior to the partial redemptions discussed below, we had outstanding $600 million and € 450 million of the HI Senior Subordinated Notes due 2009. The HI Senior Subordinated Notes due 2009 became redeemable on July 1, 2004 at 105.063% of the principal amount thereof, which declines ratably to par on and after July 1, 2007. We redeemed $231 million and €77 million of Senior Subordinated Notes due 2009 on December 31, 2004 and $2.9 million and €1.0 million of Senior Subordinated Notes due 2009 on January 3, 2005. In connection with these redemptions, we paid approximately $17.0 million and $0.2 million in U.S. dollar equivalents in redemption premiums on December 31, 2004 and January 3, 2005, respectively.

As of December 31, 2004, following the December 31, 2004 partial redemption of the HI Senior Subordinated Notes due 2009, we had outstanding $369 million and €373 million of Senior Subordinated Notes due 2009 and $175 million and €135 million of HI Senior Subordinated Notes due 2015, for a combined total of $544 million and €508 million of HI Senior Subordinated Notes plus $5.3 million of unamortized premium. As of June 30, 2005, we had outstanding $366.1 million and €372.0 million of HI Senior Subordinated Notes due 2009 and $175 million and €135 million of HI Senior Subordinated Notes due 2015, for a combined total of $541.1 million and €507.0 million of HI Senior Subordinated Notes plus $4.3 million of unamortized premium. The $175 million and €135 million HI Senior Subordinated Notes due 2015 are redeemable on or after January 1, 2010 at 103.688% and 103.750%, respectively, of the principal amount thereof, which declines ratably to par on and after January 1, 2013. In addition, at any time prior to January 1, 2008, we may redeem up to 40% of the original aggregate principal amount of the $175 million and €135 million Senior Subordinated Notes due 2015 at redemption prices of 107.375% and 107.5% plus accrued and unpaid interest, respectively. The HI Senior Subordinated Notes are unsecured and interest is payable semiannually in January and July of each year.

The HI Senior Notes and the HI Senior Subordinated Notes contain covenants relating to the incurrence of debt, limitations on distributions, asset sales and affiliate transactions, among other things. They also contain a change of control provision requiring us to offer to repurchase the HI Senior Notes and the HI Subordinated Notes upon a change of control. Management believes that we are in compliance with the covenants of the HI Senior Notes and the HI Senior Subordinated Notes.

16

Other Debt

We maintain a $25 million multicurrency overdraft facility used for the working capital needs for our European subsidiaries (the "HI European Overdraft Facility"). As of June 30, 2005 and December 31, 2004, there were no borrowings outstanding under the HI European Overdraft Facility.

Included within Other Debt is debt associated with one of our Chinese MDI joint ventures. In January 2003, we entered into a joint venture agreement with Shanghai Chlor-Alkali Chemical Company, Ltd. to build MDI production facilities near Shanghai, China. We own 70% of Huntsman Polyurethanes Shanghai Ltd. ("Consolidated Chinese Splitting JV"), which is a consolidated affiliate. On September 19, 2003, the Consolidated Chinese Splitting JV obtained secured financing for the construction of the production facilities, consisting of various committed loans in the aggregate amount of approximately $119 million in U.S. dollar equivalents. As of June 30, 2005, there were $12.0 million outstanding in U.S. dollar borrowings and 80.0 million in RMB borrowings ($9.7 million) under these facilities. The interest rate on these facilities is LIBOR plus 0.48% for U.S. dollar borrowings and 90% of the Peoples Bank of China rate for RMB borrowings. As of June 30, 2005, the interest rate for U.S. dollar borrowings was approximately 4.0% and was 5.5% for RMB borrowings. The loans are secured by substantially all the assets of the Consolidated Chinese Splitting JV and will be repaid in 16 semiannual installments beginning no later than June 30, 2007. The financing is non-recourse to us, but is guaranteed during the construction phase by affiliates of the Consolidated Chinese Splitting JV, including Huntsman Corporation, as the successor to Huntsman Holdings. Huntsman Corporation has unconditionally guaranteed 70% of any amounts due and unpaid by the Consolidated Chinese Splitting JV under the loans described above (except for the VAT facility, which is not guaranteed). Huntsman Corporation's guarantees remain in effect until the Consolidated Chinese Splitting JV has (i) commenced production at at least 70% of capacity for at least 30 days, and (ii) achieved a debt service coverage ratio of at least 1.5:1. Our Chinese MDI joint ventures are unrestricted subsidiaries under the HI Credit Facilities and under the indentures governing the HI Senior Notes and the HI Subordinated Notes.

Maturities

The scheduled maturities of our debt are as follows (dollars in millions):

| Year ending December 31: |

|

|||

|---|---|---|---|---|

| 2005 | $ | 8.4 | ||

| 2006 | 13.6 | |||

| 2007 | 13.2 | |||

| 2008 | 13.4 | |||

| 2009 | 1,289.0 | |||

| Later Years | 1,458.2 | |||

| Total | $ | 2,795.8 | ||

12. Derivative Instruments and Hedging Activities

We are exposed to market risks, such as changes in interest rates, foreign exchange rates, and commodity pricing risks. From time to time we enter into transactions, including transactions involving derivative instruments, to manage exposures. We manage interest rate exposure through a program designed to reduce the impact of fluctuations in variable interest rates and to meet the requirements of certain financing agreements.

17

Interest Rate Hedging

Through our borrowing activities, we are exposed to interest rate risk. Such risk arises due to the structure of our debt portfolio, including the duration of the portfolio and the mix of fixed and floating interest rates. Prior to the amendment and restatement of the HI Credit Facilities on July 13, 2004, the HI Credit Facilities required that a certain portion of debt be at fixed rates through either interest rate hedges or through other means that provided a similar effect. Effective July 13, 2004, the HI Credit Facilities no longer require interest rate hedging. In recent years, we have issued fixed rate debt in the form of the HI Senior Notes and HI Subordinated Notes that serves to reduce overall risk to interest fluctuations.

As of June 30, 2005 and December 31, 2004, there were no swap agreement liabilities. The change in the liability resulted in interest income for the six months ended June 30, 2004 of $1.6 million.

Commodity Price Hedging

During the three months ended June 30, 2005 and the three months ended June 30, 2004, the Company recorded an increase of $8.6 million and an increase of $0.7 million, respectively, in cost of goods sold related to net gains and losses from settled contracts, net gains and losses in fair value price hedges, and the change in fair value on commodity price hedges not designated as hedges as defined in SFAS No. 133.

During the six months ended June 30, 2005 and the six months ended June 30, 2004, the Company recorded an increase of $11.3 million and of $3.3 million, respectively, in cost of goods sold related to net gains and losses from settled contracts, net gains and losses in fair value price hedges, and the change in fair value on commodity price hedges not designated as hedges as defined in SFAS No. 133.

Foreign Currency Rate Hedging

We may enter into foreign currency derivative instruments to minimize the short-term impact of movements in foreign currency rates. These contracts are not designated as hedges for financial reporting purposes and are recorded at fair value. As of June 30, 2005 and December 31, 2004 and for the six months ended June 30, 2005 and 2004, the fair value, change in fair value, and realized gains (losses) of outstanding foreign currency rate hedging contracts were insignificant.

Net Investment Hedging

As of June 30, 2005, we have designated €176.6 million of our euro-denominated debt as a hedge of our net investment in foreign operations. Currency effects on net investment hedges for the three months ended June 30, 2005 and 2004 produced a gain of $15.7 million and a gain of $3.8 million, respectively, and for the six months ended June 30, 2005 and 2004, respectively, a gain of $45.7 million and a gain of $19.0 million in other comprehensive loss (foreign currency translation adjustments). As of June 30, 2005 and December 31, 2004, there was a cumulative net loss recorded in other comprehensive income (loss) of approximately $142.8 million and $188.5 million, respectively. During the first quarter of 2005, we dedesignated €275 million of euro-denominated debt as a net investment hedge and on April 1, 2005, we dedesignated an additional €97 million of euro-denominated debt as a net investment hedge. These actions resulted in approximately $40.4 million less foreign currency losses during the six months ended June 30, 2005.

On December 10, 2004, we entered into a cross-currency interest rate swap. The cross-currency swap requires us to pay euros and receive U.S. dollars at the maturity date of January 1, 2010. The U.S. dollar notional amount is $175 million and bears interest at a fixed rate of approximately 7.4%, payable semiannually on January 1 and July 1. The euro notional amount is approximately €132 million and bears interest at a blended fixed rate of approximately 6.6%, payable semiannually on January 1

18

and July 1. We have designated this cross-currency swap as a hedge of our net investment in euro-denominated operations.

13. Securitization of Accounts Receivable

On December 21, 2000, we initiated an accounts receivable securitization program under which we grant an undivided interest in certain of our trade receivables to a qualified off-balance sheet entity (the "Receivables Trust") at a discount. This undivided interest serves as security for the issuance of commercial paper and medium-term notes by the Receivables Trust.

At June 30, 2005 and December 31, 2004, the Receivables Trust had approximately $194.4 million and $208.4 million, respectively in U.S. dollar equivalents in medium-term notes outstanding and approximately $18.1 million in U.S. dollar equivalents and nil, respectively in commercial paper outstanding. The medium-term notes have a scheduled maturity date of September 15, 2006. Our commercial paper facility has a maturity date of June 30, 2007 and provides for the issuance of both Euro- and U.S. dollar-denominated commercial paper up to a U.S. dollar equivalent of $125 million. We recently received a commitment to temporarily expand the commercial paper facility by $50 million to $175 million upon completion of the proposed merger of Huntsman LLC with and into our Company. The $50 million expansion would be available through March 31, 2006. Under the terms of the agreements, we and our subsidiaries continue to service the receivables in exchange for a fee of 1% of the outstanding receivables, and we are subject to recourse provisions.

Our retained interest in receivables (including servicing assets) subject to the program was approximately $336.7 million and $327.6 million as of June 30, 2005 and December 31, 2004, respectively. The value of the retained interest is subject to credit and interest rate risk. For the six months ended June 30, 2005 and 2004, new sales of accounts receivable sold into the program totaled approximately $2,890.8 million and $2,379.6 million, respectively, and cash collections from receivables sold into the program that were reinvested totaled $2,834.9 million and $2,335.1 million, respectively. Servicing fees received during the six months ended June 30, 2005 and 2004 were approximately $3.1 million and $2.6 million, respectively.

We incur losses on the accounts receivable securitization program for the discount on receivables sold into the program and fees and expenses associated with the program. We also retain responsibility for the economic gains and losses on forward contracts mandated by the terms of the program to hedge the currency exposures on the collateral supporting the off-balance sheet debt issued. Gains and losses on forward contracts included as a component of the loss on accounts receivable securitization program were nil and a loss of $1.2 million for the six months ended June 30, 2005 and 2004, respectively. As of each of June 30, 2005 and December 31, 2004, the fair value of the open forward currency contracts was nil.

The key economic assumptions used in valuing the residual interest are presented below:

| |

June 30, 2005 |

|

|---|---|---|

| Weighted average life (in months) | Approx. 1.5 | |

| Credit losses (annual rate) | Less than 1% | |

| Discount rate (annual rate) | Approx. 1% |

A 10% and 20% adverse change in any of the key economic assumptions would not have a material impact on the fair value of the retained interest. Total receivables over 60 days past due as of June 30, 2005 and December 31, 2004 were $15.5 million and $12.1 million, respectively.

19

14. Employee Benefit Plans

Components of the net periodic benefit costs for the three and six months ended June 30, 2005 and 2004 were as follows (dollars in millions):

| |

Defined Benefit Plans |

Other Postretirement Benefit Plans |

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Components of net periodic benefit cost |

Three Months Ended June 30, 2005 |

Three Months Ended June 30, 2004 |

Three Months Ended June 30, 2005 |

Three Months Ended June 30, 2004 |

||||||||||

| Service cost | $ | 10.4 | $ | 9.7 | $ | — | $ | 0.1 | ||||||

| Interest cost | 20.8 | 18.2 | 0.1 | 0.2 | ||||||||||

| Expected return on assets | (24.6 | ) | (20.2 | ) | — | — | ||||||||

| Amortization of prior service cost | 0.1 | 0.1 | — | — | ||||||||||

| Amortization of actuarial loss | 6.2 | 5.0 | — | (0.1 | ) | |||||||||

| Net periodic benefit cost | $ | 12.9 | $ | 12.8 | $ | 0.1 | $ | 0.2 | ||||||

| |

Defined Benefit Plans |

Other Postretirement Benefit Plans |

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Components of net periodic benefit cost |

Six Months Ended June 30, 2005 |

Six Months Ended June 30, 2004 |

Six Months Ended June 30, 2005 |

Six Months Ended June 30, 2004 |

||||||||||

| Service cost | $ | 20.8 | $ | 19.4 | $ | — | $ | 0.2 | ||||||

| Interest cost | 41.6 | 36.3 | 0.2 | 0.4 | ||||||||||

| Expected return on assets | (49.2 | ) | (40.3 | ) | — | — | ||||||||

| Amortization of prior service cost | 0.2 | 0.2 | — | (0.1 | ) | |||||||||

| Amortization of actuarial loss | 12.4 | 10.0 | — | 0.1 | ||||||||||

| Net periodic benefit cost | $ | 25.8 | $ | 25.6 | $ | 0.2 | $ | 0.6 | ||||||

15. Other Comprehensive Loss

The components of other comprehensive loss were as follows (dollars in millions):

| |

Accumulated Other Comprehensive Income (Loss) |

Other Comprehensive Income (Loss) |

Other Comprehensive Income (Loss) |

||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

June 30, 2005 |

December 31, 2004 |

Three Months Ended June 30, 2005 |

Three Months Ended June 30, 2004 |

Six Months Ended June 30, 2005 |

Six Months Ended June 30, 2004 |

|||||||||||||

| Foreign currency translation adjustments | $ | 111.2 | $ | 270.3 | $ | (106.2 | ) | $ | (16.1 | ) | $ | (159.1 | ) | $ | (19.5 | ) | |||

| Additional minimum pension liability, net of tax benefit of $6.8 million as of June 30, 2005 and $29.3 million as of December 31, 2004 | (98.2 | ) | (93.2 | ) | — | (2.7 | ) | (5.0 | ) | — | |||||||||

| Additional minimum pension liability—unconsolidated affiliate | (0.8 | ) | (5.8 | ) | — | — | 5.0 | — | |||||||||||

| Unrealized gain (loss) on securities | 0.3 | 0.9 | (0.1 | ) | 0.9 | (0.6 | ) | 0.8 | |||||||||||

| Net unrealized gain (loss) on derivative instruments | 14.2 | (5.7 | ) | 11.7 | 2.4 | 19.9 | 5.0 | ||||||||||||

| Total | $ | 26.7 | $ | 166.5 | $ | (94.6 | ) | $ | (15.5 | ) | $ | (139.8 | ) | $ | (13.7 | ) | |||

20

Items of other comprehensive loss of our Company and our consolidated affiliates have been recorded net of tax, with the exception of the foreign currency translation adjustments related to subsidiaries with earnings permanently reinvested. The tax effect is determined based upon the jurisdiction where the income or loss was recognized and is net of valuation allowances that have been recorded.

16. Commitments and Contingencies

Purchase Commitments

We have various purchase commitments extending through 2023 for materials, supplies and services entered into in the ordinary course of business. The purchase commitments are contracts that require minimum volume purchases. Certain contracts allow for changes in minimum required purchase volumes in the event of a temporary or permanent shutdown of a facility. The contractual purchase price for substantially all of these contracts is variable based upon market prices, subject to annual negotiations. We have also entered into a limited number of contracts which require minimum payments, even if no volume is purchased. These contracts approximate $143 million in 2005, declining to approximately $17 million after 2009. Historically, we have not made any minimum payments under our take or pay contracts without taking product.

Legal Matters

Certain claims have been filed against us relating to discoloration of unplasticized polyvinyl chloride products allegedly caused by our titanium dioxide ("Discoloration Claims"). Substantially all of the titanium dioxide that is the subject of these claims was manufactured prior to our acquisition of our titanium dioxide business from ICI in 1999. Net of amounts we have received from insurers and pursuant to contracts of indemnity, we have paid approximately $15.8 million in costs and settlement amounts for Discoloration Claims as of June 30, 2005.

The following table presents information about the number of Discoloration Claims for the period indicated. Claims include all claims for which service has been received by us, and each such claim represents a plaintiff who is pursuing a claim against us.

| |

Six months ended June 30, 2005 |

|

|---|---|---|

| Claims filed during period | 0 | |

| Claims resolved during period | 1 | |

| Claims unresolved at end of period | 2 |

In March 2005, one of the Discoloration Claims that was unresolved as of December 31, 2004 was amended to assert additional damages of approximately $52.2 million. During the six months ended June 30, 2005, we settled a claim for approximately $0.9 million, all of which is indemnified and for which we are currently seeking reimbursement. The two Discoloration Claims unresolved as of June 30, 2005 asserted aggregate damages of approximately $52.2 million. A liability has been accrued for these claims. Based on our understanding of the merits of these claims and our rights under contracts of indemnity and insurance, we do not believe that the net impact on our financial condition, results of operations or liquidity will be material.

While additional Discoloration Claims may be made in the future, we cannot reasonably estimate the amount of loss related to such claims. Although we may incur additional costs as a result of future claims (including settlement costs), based on our history with Discoloration Claims to date, the fact that substantially all of the titanium dioxide that has been the subject of these Discoloration Claims was manufactured and sold more than five years ago, and the fact that we have rights under contract to indemnity, including from ICI, we do not believe that any unasserted possible Discoloration Claims, if

21

any, will have a material impact on our financial condition, results of operations, or liquidity. Based on this conclusion and our inability to reasonably estimate our expected costs with respect to these unasserted possible claims, we have made no accruals in our financial statements as of June 30, 2005 for costs associated with unasserted possible Discoloration Claims, if any.

Certain insurers have denied coverage with respect to certain Discoloration Claims. We brought suit against these insurers to recover the amounts we believe are due to us. The court found in favor of the insurers. That decision was appealed to the Court of Appeal, which also found in favor of the insurers. We intend to apply for leave to appeal to the House of Lords.

We are a party to various other proceedings instituted by private plaintiffs, governmental authorities, and others arising under provisions of applicable laws, including various environmental, products liability, and other laws. Except as otherwise disclosed in this report, we do not believe that the outcome of any of these matters will have a material adverse effect on our financial condition, results of operations or liquidity. See "Note 17—Environmental, Health and Safety Matters."

17. Environmental, Health and Safety Matters

General

We are subject to extensive federal, state, local and foreign laws, regulations, rules and ordinances relating to pollution, protection of the environment, and the generation, storage, handling, transportation, treatment, disposal, and remediation of hazardous substances and waste materials. In the ordinary course of business, we are subject to frequent environmental inspections and monitoring and occasional investigations by governmental enforcement authorities. In addition, our production facilities require operating permits that are subject to renewal, modification and, in certain circumstances, revocation. Actual or alleged violations of environmental laws or permit requirements could result in restrictions or prohibitions on plant operations, substantial civil or criminal sanctions, as well as, under some environmental laws, the assessment of strict liability and/or joint and several liability. Moreover, changes in environmental regulations could inhibit or interrupt our operations, or require us to modify our facilities or operations. Accordingly, environmental or regulatory matters may cause us to incur significant unanticipated losses, costs or liabilities.

Environmental, Health and Safety Systems

We are committed to achieving and maintaining compliance with all applicable environmental, health, and safety ("EHS") legal requirements, and we have developed policies and management systems that are intended to identify the multitude of EHS legal requirements applicable to our operations, enhance compliance with applicable legal requirements, ensure the safety of our employees, contractors, community neighbors, and customers and minimize the production and emission of wastes and other pollutants. Although EHS legal requirements are constantly changing and are frequently difficult to comply with, these EHS management systems are designed to assist us in our compliance goals while also fostering efficiency and improvement and minimizing overall risk to us.

EHS Capital Expenditures

We may incur future costs for capital improvements and general compliance under EHS laws, including costs to acquire, maintain and repair pollution control equipment. For the six months ended June 30, 2005 and 2004, our capital expenditures for EHS matters totaled $8.8 million and $9.8 million, respectively. Since capital expenditures for these matters are subject to evolving regulatory requirements and depend, in part, on the timing, promulgation and enforcement of specific requirements, we cannot provide assurance that our recent expenditures will be indicative of future amounts required under EHS laws.

22

Governmental Enforcement Proceedings

On occasion, we receive notices of violation, enforcement and other complaints from regulatory agencies alleging non-compliance with applicable EHS law. By way of example, we are aware of the individual matters set out below, which we believe to be the most significant presently pending matters and unasserted claims. Although we may incur costs or penalties in connection with the governmental proceedings discussed below, based on currently available information and our past experience, we believe that the ultimate resolution of these matters will not have a material impact on our results of operations, financial position, or liquidity.

In the third quarter of 2004, our Jefferson County, Texas facilities received notification from the Texas Commission on Environmental Quality ("TCEQ") of potential air emission violations relating to the operation of cooling towers at three of our plants and alleged upset air emissions. TCEQ proposed penalties of $0.2 million for the alleged upset violations and $0.1 million for the alleged cooling tower violations. Negotiations are anticipated between us and TCEQ with respect to the resolution of these alleged violations. We do not believe that the resolution of these matters will have a material adverse impact on our results of operations, financial position or liquidity.

Remediation Liabilities

We have incurred, and we may in the future incur, liability to investigate and clean up waste or contamination at our current or former facilities, or facilities operated by third parties at which we may have disposed of waste or other materials. Similarly, we may incur costs for the cleanup of wastes that were disposed of prior to the purchase of our businesses. Under some circumstances, the scope of our liability may extend to damages to natural resources. Specifically, under the U.S. Comprehensive Environmental Response, Compensation and Liability Act of 1980, as amended ("CERCLA"), and similar state laws, a current or former owner or operator of real property may be liable for remediation costs regardless of whether the release or disposal of hazardous substances was in compliance with law at the time it occurred, and a current owner or operator may be liable regardless of whether it owned or operated the facility at the time of the release. In addition, under the U.S. Resource Conservation and Recovery Act of 1976, as amended ("RCRA"), and similar state laws, we may be required to remediate contamination originating from our properties as a condition to our hazardous waste permit. In many cases, our potential liability arising from historical contamination is based on operations and other events occurring prior to our ownership of the relevant facility. In these situations, we frequently obtained an indemnity agreement from the prior owner addressing remediation liabilities arising from pre-closing conditions. We have successfully exercised our rights under these contractual covenants for a number of sites, and where applicable, mitigated our ultimate remediation liability. We cannot assure you, however, that all of such matters will be subject to indemnity or that our existing indemnities will be sufficient to cover our liabilities for such matters.

Environmental Reserves

We have established financial reserves relating to anticipated environmental cleanup obligations, site reclamation and closure costs and known penalties. Liabilities are recorded when potential liabilities are either known or considered probable and can be reasonably estimated. Our liability estimates are based upon available facts, existing technology, and past experience. On a consolidated basis, we have accrued approximately $18.6 million and $21.2 million for environmental liabilities as of June 30, 2005 and December 31, 2004, respectively. Of these amounts, approximately $6.6 million and $5.7 million are classified as accrued liabilities on our condensed consolidated balance sheets as of June 30, 2005 and December 31, 2004, respectively, and approximately $12.0 million and $15.5 million are classified as other noncurrent liabilities on our condensed consolidated balance sheets as of June 30, 2005 and December 31, 2004, respectively. In certain cases, our remediation liabilities are

23

payable over periods of up to 30 years. We may incur losses for environmental remediation in excess of the amounts accrued; however, we are not able to estimate the maximum amount of such losses.

Regulatory Developments

Under the European Union ("EU") Integrated Pollution Prevention and Control Directive ("IPPC"), EU member governments are to adopt rules and implement a cross-media (air, water and waste) environmental permitting program for individual facilities. While the EU countries are at varying stages in their respective implementation of the IPPC permit program, we have submitted all necessary IPPC permit applications required to date, and in some cases received completed permits from the applicable government agency. We expect to submit all other IPPC applications and related documents on a timely basis as the various countries implement the IPPC permit program. Although we do not know with certainty what each IPPC permit will require, we believe, based upon our experience with the permits received to date, that the costs of compliance with the IPPC permit program will not be material to our results of operations, financial position or liquidity.

In October 2003, the European Commission adopted a proposal for a new EU regulatory framework for chemicals. Under this proposed new system called "REACH" (Registration, Evaluation and Authorization of Chemicals), companies that manufacture or import more than one ton of a chemical substance per year would be required to register such manufacture or import in a central database. The REACH initiative, as proposed, would require risk assessment of chemicals, preparations (e.g., soaps and paints) and articles (e.g., consumer products) before those materials could be manufactured or imported into EU countries. Where warranted by a risk assessment, hazardous substances would require authorizations for their use. This regulation could impose risk control strategies that would require capital expenditures by us. As proposed, REACH would take effect in three primary stages over the eleven years following the final effective date (assuming final approval). The impacts of REACH on the chemical industry and on us are unclear at this time because the parameters of the program are still being actively debated.

MTBE Developments

We currently market approximately 95% of our MTBE to customers located in the U.S. for use as a gasoline additive. The presence of MTBE in some groundwater supplies in California and other U.S. states (primarily due to gasoline leaking from underground storage tanks) and in surface water (primarily from recreational watercraft) has led to public concern about MTBE's potential to contaminate drinking water supplies. Heightened public awareness regarding this issue has resulted in state, federal and foreign initiatives to rescind the federal oxygenate requirements for reformulated gasoline or restrict or prohibit the use of MTBE in particular. For example, California, New York and Connecticut have adopted rules that prohibit the use of MTBE in gasoline sold in those states. Overall, states that have taken some action to prohibit or restrict the use of MTBE in gasoline account for a substantial portion of the "pre-ban" U.S. MTBE market. Thus far, attempts by others to challenge these state bans in federal court under the reformulated gasoline provisions of the federal Clean Air Act have been unsuccessful.

In August 2005, the Energy Policy Act of 2005 was signed into law. The new law will likely have an adverse impact on our MTBE business in the U.S., although a full evaluation of the law's provisions is underway and the extent of potential impacts, if any, is unclear. The new legislation mandates increased use of renewable fuels and eliminates the oxygenate requirement for reformulated gasoline established by the 1990 Clean Air Act Amendments, and the combination of these two provisions could substantially reduce the market for MTBE in the U.S. However, unlike previously proposed federal legislation, the new law does not purport to ban the use of MTBE as a motor vehicle fuel additive. Thus, we do not believe it will prevent us from either manufacturing MTBE in our plants or offering MTBE for sale in the U.S. A significant reduction in demand for our MTBE could result in a material

24

loss in revenues or material costs or expenditures. As an alternative to selling our MTBE in the U.S., we believe we will be able to export MTBE to Europe, Asia or Latin America, although this may produce a lower level of cash flow than the sale of MTBE in the U.S. We may also elect to use all or a portion of our precursor TBA to produce saleable products other than MTBE. If we opt to produce products other than MTBE, necessary modifications to our facilities may require significant capital expenditures and the sale of the other products may produce a materially lower level of cash flow than the sale of MTBE.

In September 2002, the EU issued a final risk assessment report on MTBE. No ban of MTBE was recommended for Europe, although several risk reduction measures relating to storage and handling of MTBE-containing fuel were recommended.

A number of lawsuits have been filed, primarily against gasoline manufacturers, marketers and distributors, by persons seeking to recover damages allegedly arising from the presence of MTBE in groundwater. We have not been named as a defendant in any litigation concerning the environmental effects of MTBE. However, we cannot provide assurances that we will not be involved in any such litigation or that such litigation will not have a material adverse effect on our results of operations, financial position or liquidity.

18. Other Operating (Income) Expense

Other operating (income) expense consisted of the following (dollars in millions):

| |

Three Months Ended June 30, |

Six Months Ended June 30, |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2005 |

2004 |

2005 |

2004 |

|||||||||

| Foreign exchange (gains) losses, net | $ | (9.5 | ) | $ | (3.2 | ) | $ | 14.4 | $ | (9.3 | ) | ||

| Legal settlements, net of recoveries | — | 14.9 | — | 14.9 | |||||||||

| Information systems implementation costs | — | 5.4 | — | 5.4 | |||||||||

| Other | 6.1 | 7.7 | 15.8 | 8.6 | |||||||||

| Total other operating (income) expense | $ | (3.4 | ) | $ | 24.8 | $ | 30.2 | $ | 19.6 | ||||

19. Income Taxes

Income tax expense was $33.2 million and $56.7 million for the three and six months ended June 30, 2005, respectively, and $4.7 million and $8.3 million for the three and six months ended June 30, 2004, respectively. Our company and its U.S. subsidiaries are organized as limited liability companies. These entities are treated as a partnership for U.S. income tax purposes, and therefore are not subject to U.S. federal tax on their income. Subsidiaries outside the U.S. are generally taxed on the income generated in the local country. In addition, our tax obligations are affected by the mix of income and losses in the tax jurisdictions in which we operate.

We use the asset and liability method of accounting for income taxes. Deferred income taxes reflect the net tax effects of temporary differences between the carrying amounts of assets and liabilities for financial and tax reporting purposes. We evaluate the resulting deferred tax assets to determine whether it is more likely than not that they will be realized. Valuation allowances have been established against certain of the non-U.S. net deferred tax assets due to the uncertainty of realization. Valuation allowances are reviewed each period on a tax jurisdiction by jurisdiction basis to analyze whether there is sufficient positive or negative evidence to support a change in judgment about the realizability of the related deferred tax asset in future years.

25

During the second quarter of 2005, we concluded negotiations to sell our toluene di-isocyanate ("TDI") business to BASF, effective July 6, 2005. The sale involves the transfer of our TDI customer list and sales contracts. We further agreed to discontinue the use of our remaining TDI assets, including our Geismar, Louisiana TDI manufacturing equipment. TDI has been accounted for as a discontinued operation under SFAS No. 144, "Accounting for the Impairment or Disposal of Long-Lived Assets." Accordingly, the following results of TDI have been presented as discontinued operations in the accompanying condensed consolidated statement of operations (dollars in millions):

| |

Three Months Ended June 30, 2005 |

Three Months Ended June 30, 2004 |

Six Months Ended June 30, 2005 |

Six Months Ended June 30, 2004 |

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenues | $ | 9.8 | $ | 18.2 | $ | 23.4 | $ | 36.2 | |||||

| Costs and expenses | (13.8 | ) | (19.1 | ) | (30.0 | ) | (37.9 | ) | |||||

| Loss on pending disposal | (36.4 | ) | — | (36.4 | ) | — | |||||||

| Operating loss | (40.4 | ) | (0.9 | ) | (43.0 | ) | (1.7 | ) | |||||

| Income tax expense | — | — | — | — | |||||||||

| Loss from discontinued operations, net of tax | $ | (40.4 | ) | $ | (0.9 | ) | $ | (43.0 | ) | $ | (1.7 | ) | |