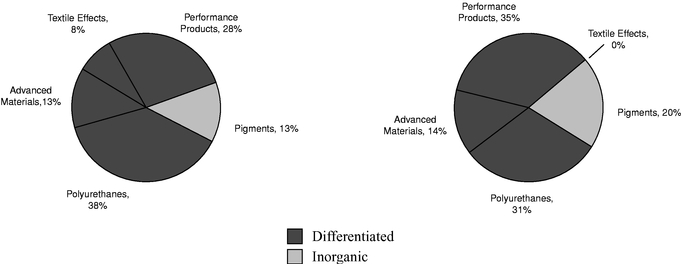

2010 Segment Revenues(1)

|

|

2010 Segment EBITDA from Continuing Operations(1)

|

||

|---|---|---|---|---|

|

||||

Use these links to rapidly review the document

TABLE OF CONTENTS

HUNTSMAN CORPORATION AND SUBSIDIARIES HUNTSMAN INTERNATIONAL LLC AND SUBSIDIARIES INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form 10-K

| (Mark One) | ||

ý |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED DECEMBER 31, 2010 |

|

OR |

||

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

| Commission File Number |

Exact Name of Registrant as Specified in its Charter, Principal Office Address and Telephone Number |

State of Incorporation/Organization |

I.R.S. Employer Identification No. |

||||

|---|---|---|---|---|---|---|---|

| 001-32427 | Huntsman Corporation 500 Huntsman Way Salt Lake City, Utah 84108 (801) 584-5700 |

Delaware | 42-1648585 | ||||

| 333-85141 | Huntsman International LLC 500 Huntsman Way Salt Lake City, Utah 84108 (801) 584-5700 |

Delaware | 87-0630358 | ||||

Securities registered pursuant to Section 12(b) of the Exchange Act:

| Registrant | Title of each class | Name of each exchange on which registered | ||

|---|---|---|---|---|

| Huntsman Corporation | Common Stock, par value $0.01 per share | New York Stock Exchange | ||

| Huntsman International LLC | None | None |

Securities registered pursuant to Section 12(g) of the Exchange Act:

| Registrant | Title of each class | |

|---|---|---|

| Huntsman Corporation | None | |

| Huntsman International LLC | None |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

| Huntsman Corporation | YES ý | NO o | ||

| Huntsman International LLC | YES o | NO ý |

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act.

| Huntsman Corporation | YES o | NO ý | ||

| Huntsman International LLC | YES o | NO ý |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days.

| Huntsman Corporation | YES ý | NO o | ||

| Huntsman International LLC | YES ý | NO o |

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

| Huntsman Corporation | YES ý | NO o | ||

| Huntsman International LLC | YES o | NO o |

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrants' knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer," and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Huntsman Corporation | Large accelerated filer ý | Accelerated filer o | Non-accelerated filer o | Smaller reporting company o | ||||

| Huntsman International LLC | Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý | Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

| Huntsman Corporation | YES o | NO ý | ||

| Huntsman International LLC | YES o | NO ý |

On June 30, 2010, the last business day of the registrants' most recently completed second fiscal quarter, the aggregate market value of voting and non-voting common equity held by non-affiliates was as follows:

| Registrant | Common Equity | Market Value Held by Nonaffiliates | ||

|---|---|---|---|---|

| Huntsman Corporation | Common Stock | $931,158,052(1) | ||

| Huntsman International LLC | Units of Membership Interest | $0(2) |

On February 7, 2011, the number of shares outstanding of each of the registrant's classes of common equity were as follows:

| Registrant | Common Equity | Outstanding | ||

|---|---|---|---|---|

| Huntsman Corporation | Common Stock | 239,699,365 | ||

| Huntsman International LLC | Units of Membership Interest | 2,728 |

This Annual Report on Form 10-K presents information for two registrants: Huntsman Corporation and Huntsman International LLC. Huntsman International LLC is a wholly owned subsidiary of Huntsman Corporation and is the principal operating company of Huntsman Corporation. The information reflected in this Annual Report on Form 10-K is equally applicable to both Huntsman Corporation and Huntsman International LLC, except where otherwise indicated.

Huntsman International LLC meets the conditions set forth in General Instructions (I)(1)(a) and (b) of Form 10-K and, to the extent applicable, is therefore filing this form with a reduced disclosure format.

Documents Incorporated by Reference

Part III: Proxy Statement for the 2011 Annual Meeting of Stockholders to be filed within 120 days of

Huntsman Corporation's fiscal year ended December 31, 2010.

HUNTSMAN CORPORATION AND SUBSIDIARIES

HUNTSMAN INTERNATIONAL LLC AND SUBSIDIARIES

2010 ANNUAL REPORT ON FORM 10-K

i

HUNTSMAN CORPORATION AND SUBSIDIARIES

HUNTSMAN INTERNATIONAL LLC AND SUBSIDIARIES

2010 ANNUAL REPORT ON FORM 10-K

With respect to Huntsman Corporation, certain information set forth in this report contains "forward-looking statements" within the meaning of the federal securities laws. Huntsman International is a limited liability company and, pursuant to Section 21E(b)2(E) of the Securities Exchange Act of 1934, as amended, the safe-harbor for certain forward-looking statements is not applicable to it.

Forward-looking statements include statements concerning our plans, objectives, goals, strategies, future events, future revenues or performance, capital expenditures, financing needs, plans or intentions relating to acquisitions or dispositions and other information that is not historical information. In some cases, forward-looking statements can be identified by terminology such as "believes," "expects," "may," "will," "should," "anticipates" or "intends" or the negative of such terms or other comparable terminology, or by discussions of strategy. We may also make additional forward-looking statements from time to time. All such subsequent forward-looking statements, whether written or oral, by us or on our behalf, are also expressly qualified by these cautionary statements.

All forward-looking statements, including without limitation management's examination of historical operating trends, are based upon our current expectations and various assumptions. Our expectations, beliefs and projections are expressed in good faith and we believe there is a reasonable basis for them, but there can be no assurance that management's expectations, beliefs and projections will result or be achieved. All forward-looking statements apply only as of the date made. We undertake no obligation to publicly update or revise forward-looking statements which may be made to reflect events or circumstances after the date made or to reflect the occurrence of unanticipated events.

There are a number of risks and uncertainties that could cause our actual results to differ materially from the forward-looking statements contained in or contemplated by this report. Any forward-looking statements should be considered in light of the risks set forth in "Part I. Item 1A. Risk Factors" and elsewhere in this report.

This report includes information with respect to market share, industry conditions and forecasts that we obtained from internal industry research, publicly available information (including industry publications and surveys), and surveys and market research provided by consultants. The publicly available information and the reports, forecasts and other research provided by consultants generally state that the information contained therein has been obtained from sources believed to be reliable. We have not independently verified any of the data from third-party sources, nor have we ascertained the underlying economic assumptions relied upon therein. Similarly, our internal research and forecasts are based upon our management's understanding of industry conditions, and such information has not been verified by any independent sources.

For convenience in this report, the terms "Company," "our," "us," or "we" may be used to refer to Huntsman Corporation and, unless the context otherwise requires, its subsidiaries and predecessors. Any references to our "Company," "we," "us" or "our" as of a date prior to October 19, 2004 (the date of our formation) are to Huntsman Holdings, LLC and its subsidiaries (including their respective predecessors). In this report, "Huntsman International" refers to Huntsman International LLC (our 100% owned subsidiary) and, unless the context otherwise requires, its subsidiaries; "HPS" refers to Huntsman Polyurethanes Shanghai Ltd. (a consolidated splitting joint venture with Shanghai Chlor-Alkali Chemical Company, Ltd); and "SLIC" refers to Shanghai Liengheng Isocyanate Investment BV (an unconsolidated manufacturing joint venture with BASF AG and three Chinese chemical companies).

In this report, we may use, without definition, the common names of competitors or other industry participants. We may also use the common names or abbreviations for certain chemicals or products. Many of these terms are defined in the Glossary of Chemical Terms found at the conclusion of "Part I. Item 1. Business" below.

ii

GENERAL

We are a global manufacturer of differentiated organic chemical products and of inorganic chemical products. Our Company, a Delaware corporation, was formed in 2004 to hold the businesses of Huntsman Holdings, LLC, a company founded by Jon M. Huntsman. Mr. Huntsman founded the predecessor to our Company in the early 1970s as a small polystyrene plastics packaging company. Since then, we have grown through a series of significant acquisitions and now own a global portfolio of businesses.

We operate all of our businesses through Huntsman International, our 100% owned subsidiary. Huntsman International is a Delaware limited liability company and was formed in 1999.

Our principal executive offices are located at 500 Huntsman Way, Salt Lake City, Utah 84108, and our telephone number at that location is (801) 584-5700.

RECENT DEVELOPMENTS

Recent Note Redemption

On January 18, 2011, Huntsman International redeemed $100 million of its 7.375% senior subordinated notes due 2015. The total redemption payment, excluding accrued interest, was $102 million, which included $2 million of call premiums. We expect to record a loss on early extinguishment of debt in the first quarter of 2011 of $3 million related to this redemption.

Announcement of Fertilizer Plant in Calais, France

In January 2011, we announced an agreement in principle to invest approximately €30 million ($40 million) to build a new magnesium sulfate fertilizer production operation at our titanium dioxide plant in Calais, France. We have approved this investment in principle; nevertheless, it is subject to certain conditions, including obtaining permits and securing additional financing.

The new fertilizer plant will use spent acid from our Calais pigment operations and will enable the closure of part of our Calais effluent treatment plant. Upon completion, the operation of the plant will deliver environmental benefits in the form of lower energy consumption and reduced carbon dioxide emissions. These environmental benefits would be coupled with cost reductions that are expected to increase the efficiency, sustainability and cost effectiveness of the entire Calais site.

Consolidation of Maleic Anhydride Manufacturing Joint Venture in 2011

We own a 50% interest in Sasol-Huntsman GmbH and Co. KG ("Sasol-Huntsman"), which has been accounted for using the equity method. Sasol-Huntsman owns and operates a maleic anhyride facility in Moers, Germany. In late February 2011, we expect a plant expansion to come online. We will begin consolidating the results of Sasol-Huntsman in the first quarter of 2011. See "Note 6. Investment in Unconsolidated Affiliates" to our consolidated financial statements.

OVERVIEW

Our products comprise a broad range of chemicals and formulations which we market globally to a diversified group of consumer and industrial customers. Our products are used in a wide range of applications, including those in the adhesives, aerospace, automotive, construction products, durable and non-durable consumer products, electronics, medical, packaging, paints and coatings, power generation, refining, synthetic fiber, textile chemicals and dye industries. We are a leading global

1

producer in many of our key product lines, including MDI, amines, surfactants, epoxy-based polymer formulations, textile chemicals, dyes, maleic anhydride and titanium dioxide. Our administrative, research and development and manufacturing operations are primarily conducted at the facilities listed in "—Item 2. Properties" below, which are located in 30 countries. As of December 31, 2010, we employed approximately 12,000 associates worldwide. Our revenues for the years ended December 31, 2010, 2009 and 2008 were $9,250 million, $7,665 million and $10,056 million, respectively.

We operate in five segments: Polyurethanes, Performance Products, Advanced Materials, Textile Effects and Pigments. In a series of transactions beginning in 2006, we sold or shutdown substantially all of our Australian styrenics, Polymers and Base Chemicals operations. We report the results of our former Australian styrenics, Polymers and Base Chemicals businesses as discontinued operations in our statements of operations. See "Note 27. Discontinued Operations" to our consolidated financial statements.

Our Products

We produce differentiated organic chemical and inorganic chemical products. Our Polyurethanes, Performance Products, Advanced Materials and Textile Effects segments produce differentiated organic chemical products and our Pigments segment produces inorganic chemical products.

Growth in our differentiated products has been driven by the substitution of our products for other materials and by the level of global economic activity. Accordingly, the profitability of our differentiated products has been somewhat less influenced by the cyclicality that typically impacts the petrochemical industry. Our Pigments business, while cyclical, is influenced by seasonal demand patterns in the coatings industry.

2010 Segment Revenues(1)

|

|

2010 Segment EBITDA from Continuing Operations(1)

|

||

|---|---|---|---|---|

|

||||

2

The following table identifies the key products, their principal end markets and applications and representative customers of each of our segments:

Segment

|

Products | End Markets and Applications | Representative Customers | |||

|---|---|---|---|---|---|---|

| Polyurethanes | MDI, PO, polyols, PG, TPU, aniline and MTBE | Refrigeration and appliance insulation, construction products, adhesives, automotive, footwear, furniture, cushioning, specialized engineering applications and fuel additives | BMW, Certainteed, Electrolux, Firestone, GE, Haier, Louisiana Pacific, Recticel, Weyerhauser | |||

Performance Products |

Amines, surfactants, LAB, maleic anhydride, other performance chemicals, EG, olefins and technology licenses |

Detergents, personal care products, agrochemicals, lubricant and fuel additives, adhesives, paints and coatings, construction, marine and automotive products and PET fibers and resins |

Chevron, Henkel, The Sun Products Corporation, Monsanto, Procter & Gamble, Unilever, Lubrizol, Reichhold, Dow, L'Oreal, Afton |

|||

Advanced Materials |

Basic liquid and solid epoxy resins; specialty resin compounds; cross-linking, matting and curing agents; epoxy, acrylic and polyurethane-based formulations |

Adhesives, composites for aerospace, automotive, and wind power generation; construction and civil engineering; industrial coatings; electrical power transmission; consumer electronics |

ABB, Akzo, BASF, Boeing, Bosch, Cytec, Dow, Hexcel, ISOLA, Omya, PPG, ASTORIT, Sanarrow, Schneider, Sherwin Williams, Siemens, Sika, Speed Fair, Syngenta, Toray |

|||

Textile Effects |

Textile chemicals and dyes |

Apparel, home and technical textiles |

Esquel Group, Alok Industries, Nice Dyeing, Fruit of the Loom, Hanesbrands, Zaber & Zubair, Aunde, Y.R.C., Guilford Mills, Tencate |

|||

Pigments |

Titanium dioxide |

Paints and coatings, plastics, paper, printing inks, fibers and ceramics |

Akzo, PPG, Clariant, Jotun, PolyOne |

Polyurethanes

General

We are a leading global manufacturer and marketer of a broad range of polyurethane chemicals, including MDI products, PO, polyols, PG and TPU. Polyurethane chemicals are used to produce rigid and flexible foams, as well as coatings, adhesives, sealants and elastomers. We focus on the higher-margin, higher-growth markets for MDI and MDI-based polyurethane systems. Growth in our Polyurethanes segment has been driven primarily by the continued substitution of MDI-based products for other materials across a broad range of applications. We operate five primary Polyurethanes manufacturing facilities in the U.S., Europe and China. We also operate 14 Polyurethanes formulation facilities, which are located in close proximity to our customers worldwide.

Our customers produce polyurethane products through the combination of an isocyanate, such as MDI or TDI, with polyols, which are derived largely from PO and EO. While the range of TDI-based products is relatively limited, we are able to produce over 2,000 distinct MDI-based polyurethane products by modifying the MDI molecule through varying the proportion and type of polyol used and by introducing other chemical additives to our MDI formulations. As a result, polyurethane products, especially those derived from MDI, are continuing to replace traditional products in a wide range of end use markets, including insulation in construction and appliances, cushioning for automotive and furniture, adhesives, wood binders, footwear and other specialized engineering applications.

We are a leading North American producer of PO. We and some of our customers process PO into derivative products, such as polyols for polyurethane products, PG and various other chemical products. End uses for these derivative products include applications in the home furnishings, construction, appliance, packaging, automotive and transportation, food, paints and coatings and

3

cleaning products industries. We also produce MTBE as a co-product of our PO manufacturing process. MTBE is an oxygenate that is blended with gasoline to reduce harmful vehicle emissions and to enhance the octane rating of gasoline. See "—Environmental, Health and Safety Matters—MTBE Developments" below and "Part I. Item 1A. Risk Factors" for a discussion of legal and regulatory developments that have resulted in the curtailment and potential elimination of MTBE in gasoline in the U.S. and elsewhere. Also, see "—Manufacturing and Operations" below and "Part II. Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations" for a discussion of material changes concerning sales of MTBE.

In 1992, we were the first global supplier of polyurethane chemicals to open a technical service center in China. We have since expanded this facility to include an integrated polyurethanes formulation facility. In January 2003, we entered into two related joint ventures to build MDI production and finishing facilities near Shanghai, China. Production at our MDI finishing plant near Shanghai, China operated by HPS, a consolidated joint venture, was commissioned on June 30, 2006. Production at the MNB, aniline and crude MDI plants operated by SLIC, an unconsolidated joint venture, commenced on September 30, 2006. These world-scale facilities strengthen our ability to service our customers in the critical Chinese market and will support the significant demand growth that we believe this region will continue to experience.

Products and Markets

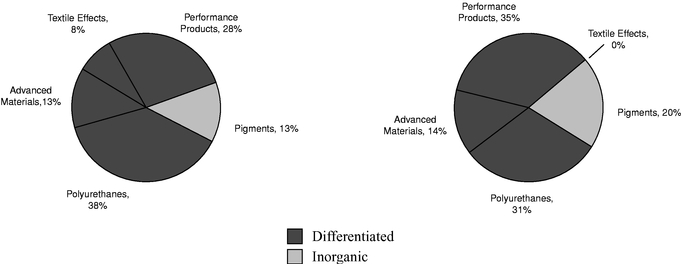

MDI is used primarily in rigid foam applications and in a wide variety of customized, higher-value flexible foam and coatings, adhesives, sealants and elastomers. Polyols, including polyether and polyester polyols, are used in conjunction with MDI and TDI in rigid foam, flexible foam and other non-foam applications. PO is one of the principal raw materials for producing polyether polyols. The following chart illustrates the range of product types and end uses for polyurethane chemicals.

Polyurethane chemicals are sold to customers who combine the chemicals to produce polyurethane products. Depending on their needs, customers will use either commodity polyurethane chemicals produced for mass sales or polyurethane systems tailored for their specific requirements. By varying the blend, additives and specifications of the polyurethane chemicals, manufacturers are able to develop and produce a breadth and variety of polyurethane products.

4

MDI. MDI has a substantially larger market size and a higher growth rate than TDI. This is primarily because MDI can be used to make polyurethanes with a broader range of properties and can therefore be used in a wider range of applications than TDI. We believe that future growth of MDI is expected to be driven by the continued substitution of MDI-based polyurethane for fiberglass and other materials currently used in rigid insulation foam for construction. We expect that other markets, such as binders for reconstituted wood board products, specialty cushioning applications and coatings will further contribute to the continued growth of MDI.

With the recent rapid growth of the developing Asian economies, the Asian markets have now become the largest market for MDI.

In addition to the Company, there are three other major global producers of MDI: Bayer, BASF and Dow. While there are also some regional producers in Asia and Europe, we believe it is unlikely that any new global producers of MDI will emerge in the foreseeable future due to the substantial requirements for entry, such as the limited availability of licenses for MDI technology and the significant capital commitment and integration that is required to develop both the necessary technology and the infrastructure to manufacture and market MDI.

TPU. TPU is a high-quality, fully formulated thermal plastic derived from the reaction of MDI or an aliphatic isocyanate with polyols to produce unique qualities such as durability, flexibility, strength, abrasion-resistance, shock absorbency and chemical resistance. We can tailor the performance characteristics of TPU to meet the specific requirements of our customers. TPU is used in injection molding and small components for the automotive and footwear industries. It is also extruded into films, wires and cables for use in a wide variety of applications in the coatings, adhesives, sealants and elastomers markets.

Polyols. Polyols are combined with MDI, TDI and other isocyanates to create a broad spectrum of polyurethane products. Demand for specialty polyols has been growing at approximately the same rate at which MDI consumption has grown.

Aniline. Aniline is an intermediate chemical used primarily to manufacture MDI. Generally, aniline is either consumed internally by the producers of the aniline or is sold to third parties under long-term supply contracts. We believe that the lack of a significant spot market for aniline means that in order to remain competitive, MDI manufacturers must either be integrated with an aniline manufacturing facility or have a long-term, cost-competitive aniline supply contract.

5

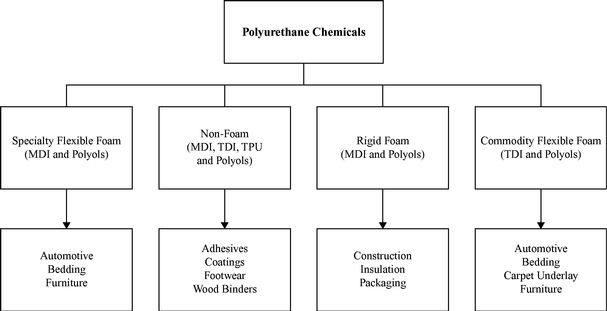

PO. PO is an intermediate chemical used mainly to produce a wide range of polyols and PG. Demand for PO depends largely on overall economic demand, especially that of consumer durables. The following chart illustrates the primary end markets and applications for PO.

MTBE. MTBE is an oxygenate that is blended with gasoline to reduce harmful vehicle emissions and to enhance the octane rating of gasoline. The use of MTBE can be controversial, and it has been effectively eliminated in the U.S. market. See "—Environmental, Health and Safety Matters—MTBE Developments" below and "Part I. Item 1A. Risk Factors." We continue to sell MTBE for use as a gasoline additive, substantially all of which is sold for use outside the U.S. See "—Manufacturing and Operations" below and "Part II. Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations."

Sales and Marketing

We manage a global work force which sells our polyurethane chemicals to over 3,500 customers in more than 90 countries. Our sales and technical resources are organized to support major regional markets, as well as key end use markets which require a more global approach. These key end use markets include the appliance, automotive, footwear, furniture and coatings, construction products, adhesives, sealants and elastomers industries.

We provide a wide variety of polyurethane solutions as components (i.e., the isocyanate or the polyol) or in the form of "systems" in which we provide the total isocyanate and polyol formulation to our customers in ready-to-use form. Our ability to deliver a range of polyurethane solutions and technical support tailored to meet our customer's needs is critical to our long term success. We have strategically located our polyurethane formulation facilities, commonly referred to in the chemicals industry as "systems houses," close to our customers, enabling us to focus on customer support and technical service. We believe this customer support and technical service system contributes to customer retention and also provides opportunities for identifying further product and service needs of customers. We manufacture polyols primarily to support our MDI customers' requirements.

We believe that the extensive market knowledge and industry experience of our sales teams and technical experts, in combination with our strong emphasis on customer relationships, have facilitated

6

our ability to establish and maintain long-term customer supply positions. Due to the specialized nature of our markets, our sales force must possess technical knowledge of our products and their applications. Our strategy is to continue to increase sales to existing customers and to attract new customers by providing innovative solutions, quality products, reliable supply, competitive prices and superior customer service.

Manufacturing and Operations

Our MDI production facilities are located in Geismar, Louisiana; Rozenburg, Netherlands; and through our joint ventures in Caojing, China. These facilities receive aniline, which is a primary material used in the production of MDI, from our facilities located in Geismar, Louisiana; Wilton, U.K.; and Caojing, China. We believe that this relative scale and product integration of our large facilities provide a significant competitive advantage over other producers. In addition to reducing transportation costs for our raw materials, integration helps reduce our exposure to cyclical prices.

The following table sets forth the annual production capacity of polyurethane chemicals at each of our polyurethanes facilities:

| |

MDI | Polyols | TPU | Aniline | Nitrobenzene | PO | PG | MTBE | |||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

(millions of pounds) |

(millions of gallons) |

|||||||||||||||||||||||

Geismar, Louisiana |

970 | 160 | 715 | (2) | 953 | (2) | |||||||||||||||||||

Osnabrück, Germany |

26 | 57 | |||||||||||||||||||||||

Port Neches, Texas |

525 | 145 | 260 | ||||||||||||||||||||||

Ringwood, Illinois |

18 | ||||||||||||||||||||||||

Caojing, China |

265 | (1) | |||||||||||||||||||||||

Rozenburg, Netherlands |

880 | 130 | |||||||||||||||||||||||

Wilton, U.K. |

715 | 953 | |||||||||||||||||||||||

Total |

2,115 | 316 | 75 | 1,430 | 1,906 | 525 | 145 | 260 | |||||||||||||||||

At both our Geismar and Rozenburg facilities we utilize sophisticated proprietary technology to produce our MDI. This technology, which is also used in our Chinese joint venture, contributes to our position as a low cost MDI producer. In addition to MDI, we use a proprietary manufacturing process to manufacture PO. We own or license all technology and know-how developed and utilized at our PO facility. Our process combines isobutane and oxygen in proprietary oxidation (peroxidation) reactors, thereby forming TBHP and TBA, which are further processed into PO and MTBE, respectively. Because our PO production process is less expensive relative to other technologies and allows all of our PO co-products to be processed into saleable or useable materials, we believe that our PO production technology possesses several distinct advantages over its alternatives.

We operate polyurethane systems houses in Buenos Aires, Argentina; Deerpark, Australia; Shanghai, China; Cartagena, Colombia; Deggendorf, Germany; Thane (Maharashtra), India; Ternate, Italy; Tlalnepantla, Mexico; Mississauga, Ontario; Kuan Yin, Taiwan; Samuprakam, Thailand; Osnabrück, Germany; Dammam, Saudi Arabia and Obninsk, Russia.

7

Joint Ventures

Rubicon Joint Venture. Chemtura Corporation is our joint venture partner in Rubicon LLC, which owns aniline, nitrobenzene and DPA manufacturing facilities in Geismar, Louisiana. We are entitled to approximately 78% of the nitrobenzene and aniline production capacity of Rubicon LLC, and Chemtura Corporation is entitled to 100% of the DPA production. In addition to operating the joint venture's aniline, nitrobenzene and DPA facilities, Rubicon LLC also operates our wholly owned MDI and polyol facilities at Geismar and is responsible for providing other auxiliary services to the entire Geismar complex. As a result of this joint venture, we are able to achieve greater scale and lower costs for our products than we would otherwise have been able to obtain. Rubicon LLC is consolidated in our financial statements.

Chinese MDI Joint Ventures. In January 2003, we entered into two related joint venture agreements to build MDI production facilities near Shanghai, China. SLIC, our manufacturing joint venture with BASF AG and three Chinese chemical companies, built three plants that manufacture MNB, aniline and crude MDI. We effectively own 35% of SLIC and account for our investment under the equity method. HPS, our splitting joint venture with Shanghai Chlor-Alkali Chemical Company, Ltd, has constructed a plant to manufacture pure MDI, polymeric MDI and MDI variants. We own 70% of HPS and it is a consolidated affiliate. These projects have been funded by a combination of equity invested by the joint venture partners and borrowed funds. SLIC and HPS commenced operations during 2006. The total production capacity of the SLIC facilities is 530 million pounds per year of MDI and the production capacity of the HPS facility is 300 million pounds per year of MDI finished products.

Russian MDI, Coatings and Systems Joint Venture. In 2006, we purchased a 45% interest in International Polyurethane Investments B.V. This company's wholly-owned subsidiary, NMG is a leading polyurethanes producer headquartered in Obninsk, Russia. We account for this investment under the equity method. This joint venture, now Huntsman NMG ZAO, manufactures and markets a range of polyurethane systems in adhesives, coatings, elastomers and insulation using our MDI products.

Raw Materials

The primary raw materials for MDI-based polyurethane chemicals are benzene and PO. Benzene is a widely available commodity that is the primary feedstock for the production of MDI and aniline. Historically, benzene has been the largest component of our raw material costs. We purchase benzene from third parties to manufacture nitrobenzene and aniline, almost all of which we then use to produce MDI.

A major cost in the production of polyols is attributable to the costs of PO. The integration of our PO business with our polyurethane chemicals business gives us access to a competitively priced, strategic source of PO and the opportunity to develop polyols that enhance our range of MDI products. The primary raw materials used in our PO production process are butane/isobutane, propylene, methanol and oxygen, which accounted for 53%, 35%, 11% and 1%, respectively, of total raw material costs in 2010. We purchase our raw materials primarily under long-term contracts. While most of these feedstocks are commodity materials generally available to us from a wide variety of suppliers at competitive prices in the spot market, all the propylene used in the production of our PO is produced internally and delivered through a pipeline connected to our PO facility.

Competition

Our major competitors in the polyurethane chemicals market include BASF, Bayer, Dow, Yantai Wanhua and LyondellBasell. While these competitors and others produce various types and quantities of polyurethane chemicals, we focus on MDI and MDI-based polyurethane systems. Our polyurethane

8

chemicals business competes in two basic ways: (1) where price is the dominant element of competition, our polyurethane chemicals business differentiates itself by its high level of customer support, including cooperation on technical and safety matters; and (2) elsewhere, we compete on the basis of product performance and our ability to react quickly to changing customer needs and by providing customers with innovative solutions to their needs.

Some of our competitors in the Polyurethanes segment are among the world's largest chemical companies and major integrated petroleum companies. These competitors may have their own raw material resources. Some of these companies may be able to produce products more economically than we can. In addition, some of our competitors in this market have greater financial resources, which may enable them to invest significant capital into their businesses, including expenditures for research and development. If any of our current or future competitors in this market develop proprietary technology that enables them to produce products at a significantly lower cost, our technology could be rendered uneconomical or obsolete.

Performance Products

General

Our Performance Products segment is organized around three market areas: performance specialties, performance intermediates and maleic anhydride and licensing, and serves a wide variety of consumer and industrial end markets. In performance specialties, we are a leading global producer of amines, carbonates and certain specialty surfactants. Growth in demand in our performance specialties market tends to be driven by the end-performance characteristics that our products deliver to our customers. These products are manufactured for use in a growing number of niche industrial end uses and have been characterized by growing demand, technology substitution and stable profitability. For example, we are one of two significant global producers of polyetheramines, for which our sales volumes have grown at a compound annual rate of over 9% in the last 10 years due to strong demand in a number of industrial applications, such as epoxy curing agents, oil drilling, agrochemicals, fuel additives and civil construction materials. In performance intermediates, we consume internally produced and third-party-sourced base petrochemicals in the manufacture of our surfactants, LAB and ethanolamines products, which are primarily used in detergency, consumer products and industrial applications. We also produce EG, which is primarily used in the production of polyester fibers and PET packaging. We believe we are North America's largest and lowest-cost producer of maleic anhydride. Maleic anhydride is the building block for UPRs, which are mainly used in the production of fiberglass reinforced resins for marine, automotive and construction products. We are the leading global licensor of maleic anhydride manufacturing technology and are also the largest supplier of butane fixed bed catalyst used in the manufacture of maleic anhydride. Our licensing group also licenses technology on behalf of our other Huntsman businesses. We operate 16 Performance Products manufacturing facilities in North America, Europe, Middle East, Asia and Australia.

We have the annual capacity to produce approximately 1.4 billion pounds of more than 250 amines and other performance chemicals. We believe we are the largest global producer of polyetheramines, propylene carbonates, ethylene carbonates, DGA® agent and morpholine, the second-largest global producer of ethyleneamines and the third-largest North American producer of ethanolamines. We also produce substituted propylamines. We use internally produced ethylene, EO, EG and PO in the manufacture of many of our amines. Our products are manufactured at our Port Neches, Conroe and Freeport, Texas facilities and at our facilities in Llanelli, U.K. Petfurdo, Hungary and Jurong Island, Singapore. Since mid-2010 we have been manufacturing ethyleneamines through our 50/50 joint venture with Zamil Group (the "Arabian Amines Company") located in Jubail, Saudi Arabia. The joint venture has the capacity to produce 60 million pounds of ethyleneamines per annum. Our amines are used in a wide variety of consumer and industrial applications, including personal care products, polyurethane

9

foam, fuel and lubricant additives, paints and coatings, composites, solvents and catalysts. Our key amines customers include Akzo, Chevron, BASF, Hercules, Afton, Unilever, Monsanto and PPG.

We have the capacity to produce approximately 2.5 billion pounds of surfactant products annually at our eight facilities located in North America, Europe and Australia. We are a leading global manufacturer of nonionic, anionic, cationic and amphoteric surfactants products and are characterized by our breadth of product offering and market coverage. Our surfactant products are primarily used in consumer detergent and industrial cleaning applications. In addition, we manufacture and market a diversified range of mild surfactants and specialty formulations for use in personal care applications. We are also a leading European producer of components for powder and liquid laundry detergents and other cleaners. We continue to strengthen and diversify our surfactant product offering into formulated specialty surfactant products, for use in various industrial applications such as leather and textile treatment, foundry and construction, agrochemicals, fuels and lubricants, polymers and coatings. We are growing our global agrochemical surfactant technology and product offerings. Our key surfactants customers include Sun Products, L'Oreal, Monsanto, Nufarm, Clorox, Henkel, Colgate, Procter & Gamble and Unilever.

We are North America's second-largest producer of LAB, with alkylation capacity of 375 million pounds per year at our plant in Chocolate Bayou, Texas. LAB is a surfactant intermediate which is converted into LAS, a major anionic surfactant used worldwide for the production of consumer, industrial and institutional laundry detergents. We also manufacture a higher-molecular-weight alkylate which is used as an additive to lubricants. Our key customers for LAB and specialty alkylates include Colgate, Lubrizol, Henkel, Procter & Gamble, Unilever and Sun Products.

We believe we are North America's largest producer of maleic anhydride, a highly versatile chemical intermediate that is used to produce UPRs, which are mainly used in the production of fiberglass reinforced resins for marine, automotive and construction products. Maleic anhydride is also used in the production of lubricants, food additives and artificial sweeteners. We have the capacity to produce approximately 340 million pounds annually at our facilities located in Pensacola, Florida and Geismar, Louisiana. We also own a 50% interest in Sasol-Huntsman, which has been accounted for using the equity method. This joint venture owns and operates a facility in Moers, Germany with an annual capacity of 137 million pounds. In late February 2011, a plant expansion will come online raising the capacity of the joint venture to 232 million pounds. We will begin consolidating the results of Sasol-Huntsman in the first quarter of 2011. We also license our maleic anhydride technology and supply our catalysts to licensees and to worldwide merchant customers. As a result of our long-standing research and development efforts aided by our pilot and catalyst preparation plants, we have successfully introduced six generations of our maleic anhydride catalysts. Patent applications have been filed for our seventh generation catalyst which should be commercially available in 2011. Revenue from licensing and catalyst comes from new plant commissioning, as well as current plant retrofits and catalyst change schedules. Our key maleic anhydride customers include AOC, Chevron, Oronite, Cook Composites, Dixie, Lubrizol, Infineum, Reichhold and Bartek.

We also have the capacity to produce approximately 945 million pounds of EG annually at our facilities in Botany, Australia and Port Neches, Texas.

10

Products and Markets

Performance Specialties. The following table shows the end-market applications for our performance specialties products:

Product Group

|

Applications | |

|---|---|---|

Specialty Amines |

liquid soaps, personal care, lubricant and fuel additives, polyurethane foams, fabric softeners, paints and coatings, refinery processing, water treating | |

Polyetheramines |

polyurethane foams and insulation, construction and flooring, paints and coatings, lubricant and fuel additives, adhesives, epoxy composites, agrochemicals, oilfield chemicals, printing inks, pigment dispersion |

|

Ethyleneamines |

lubricant and fuel additives, epoxy hardeners, wet strength resins, chelating agents, fungicides |

|

Morpholine/DGA® agent and Gas Treating |

hydrocarbon processing, construction chemicals, synthetic rubber, water treating, electronics applications, gas treatment and agriculture |

|

Carbonates |

lubricant and fuel additives, agriculture, electronics applications, textile treatment, solar panels |

|

Specialty Surfactants |

agricultural herbicides, construction, paper de-inking, lubricants |

Our performance specialties products are organized around the following end markets: coatings, polymers and resins; process additives; resources, fuels and lubricants; and agrochemicals.

Amines. Amines broadly refers to the family of intermediate chemicals that are produced by reacting ammonia with various ethylene and propylene derivatives. Generally, amines are valued for their properties as a reactive, emulsifying, dispersant, detergent, solvent or corrosion inhibiting agent. Growth in demand for amines is highly correlated with GDP growth due to its strong links to general industrial and consumer products markets. However, certain segments of the amines market, such as polyetheramines, have grown at rates well in excess of GDP growth due to new product development, technical innovation, and substitution and replacement of competing products. For example, polyetheramines are used by customers who demand increasingly sophisticated performance characteristics as an additive in the manufacture of highly customized epoxy formulations, enabling customers to penetrate new markets and substitute for traditional curing materials. As amines are generally sold based upon the performance characteristics that they provide to customer- specific end use application, pricing does not generally fluctuate directly with movements in underlying raw materials.

Morpholine/DGA® Agent. Morpholine and DGA® agent are produced as co-products by reacting ammonia with DEG. Morpholine is used in a number of niche industrial applications including rubber curing (as an accelerator) and flocculants for water treatment. DGA® agent is primarily used in gas treating, electronics, herbicides and metalworking end use applications.

Carbonates. Ethylene and propylene carbonates are manufactured by reacting EO and PO with carbon dioxide. Carbonates are used as solvents and as reactive diluents in polymer and coating applications. They are also increasingly being used as a photo-resist solvent in the manufacture of printed circuit boards, solar panels, LCD screens and the production of lithium batteries. Also, propylene carbonates have recently received approval by the U.S. Environmental Protection Agency (the "EPA") for use as a solvent in certain agricultural applications. We expect these solvents to replace traditional aromatic solvents that are increasingly subject to legislative restrictions and prohibitions.

11

Performance Intermediates. The following table sets forth the end markets for our performance intermediates products:

Product Group

|

End Markets | ||

|---|---|---|---|

| Surfactants | |||

Alkoxylates |

household detergents, industrial cleaners, anti-fog chemicals for glass, asphalt emulsions, shampoos, polymerization additives, de-emulsifiers for petroleum production |

||

Sulfonates/Sulfates |

powdered detergents, liquid detergents, shampoos, body washes, dishwashing liquids, industrial cleaners, emulsion polymerization, concrete superplasticizers, gypsum wallboard |

||

Esters and Derivatives |

shampoo, body wash, textile and leather treatment |

||

Nitrogen Derivatives |

bleach thickeners, baby shampoo, fabric conditioners, other personal care products |

||

Formulated Blends |

household detergents, textile and leather treatment, personal care products, pharmaceutical intermediates |

||

EO/PO Block Co-Polymers |

automatic dishwasher detergents |

||

Ethanolamines |

wood preservatives, herbicides, construction, gas treatment, metalworking |

||

LAB |

consumer detergents, industrial and institutional detergents, synthetic lubricants |

||

EG |

polyester fibers and PET bottle resins, antifreeze |

||

Surfactants. Surfactants or "surface active agents" are substances that combine a water soluble component with a water insoluble component in the same molecule. While surfactants are most commonly used for their detergency in cleaning applications, they are also valued for their emulsification, foaming, dispersing, penetrating and wetting properties in a variety of industries.

Demand growth for surfactants is relatively stable and exhibits little cyclicality. The main consumer product applications for surfactants can demand new formulations with improved performance characteristics, which affords considerable opportunity for innovative surfactants manufacturers like us to provide surfactants and blends with differentiated specifications and properties. For basic surfactants, pricing tends to have a strong relationship to underlying raw material prices and usually lags raw material price movements.

Ethanolamines. Ethanolamines are a range of chemicals produced by the reaction of EO with ammonia. They are used as intermediates in the production of a variety of industrial, agricultural and consumer products. There are a limited number of competitors due to the technical and cost barriers to entry. Growth in this sector has typically been higher than GDP but saw a decline in late 2009 followed by a recovery in demand in 2010. We believe the ethanolamines market in North America is currently balanced.

LAB. LAB is a surfactant intermediate which is produced through the reaction of benzene with either normal paraffins or linear alpha olefins. Nearly all the LAB produced globally is converted into LAS, a major anionic surfactant used worldwide for the production of consumer, industrial and institutional laundry detergents.

12

Three major manufacturers lead the traditional detergency market for LAB in North America: Procter & Gamble, Henkel and The Sun Products Corp. We believe that two-thirds of the LAB global capacity lies in the hands of ten producers, with three or four major players in each of the three regional markets. Although the North American market for LAB is mature, we expect Latin American and other developing countries to grow as detergent demand grows at a faster rate than GDP. However, growth in demand for specialty alkylates for use in lubricants is expected to be higher than GDP. We have developed a unique manufacturing capability for a high molecular weight alkylate for this market. With a significant technical barrier to entry, our specialty alkylate capability has allowed us greater diversity in our portfolio and strengthened our competitive position versus LAB-only producers.

EG. We consume our internally produced EO to produce three types of EG: MEG, DEG and TEG. MEG is consumed primarily in the polyester (fiber and bottle resin) and antifreeze end markets and is also used in a wide variety of industrial applications including synthetic lubricants, plasticizers, solvents and emulsifiers. DEG is consumed internally for the production of Morpholine/DGA® agent and polyols. TEG is used internally for the production of polyols and is sold into the market for dehydration of natural gas. We continue to optimize our EO and EG operations depending on the fundamental market demand for EG.

Maleic Anhydride and Licensing. The following table sets forth the end markets for our maleic anhydride products:

Product Group

|

End Markets | |

|---|---|---|

Maleic anhydride |

boat hulls, automotive, construction, lubricant and fuel additives, countertops, agrochemicals, paper, and food additives | |

Maleic anhydride catalyst and technology licensing |

maleic anhydride, BDO and its derivatives, and PBT manufacturers |

Maleic anhydride is a chemical intermediate that is produced by oxidizing either benzene or normal butane through the use of a catalyst. The largest use of maleic anhydride in the U.S. is in the production of UPRs, which we believe account for approximately 22% of North American maleic anhydride demand. UPR is the main ingredient in fiberglass reinforced resins, which are used for marine and automotive applications and commercial and residential construction products.

Our maleic anhydride technology is a proprietary fixed bed process with solvent recovery and is characterized by low butane consumption and an energy- efficient, high-percentage-recovery solvent recovery system. This process competes against two other processes, the fluid bed process and the fixed bed process with water recovery. We believe that our process is superior in the areas of feedstock and energy efficiency and solvent recovery. The maleic anhydride-based route to BDO manufacture is currently the preferred process technology and is favored over the other routes, which include PO, butadiene and acetylene as feedstocks. As a result, the growth in demand for BDO has resulted in increased demand for our maleic anhydride technology and catalyst.

Total North American demand for maleic anhydride in 2010 was approximately 547 million pounds. Over time, demand for maleic anhydride has generally grown at rates that slightly exceed GDP growth. However, given its dependence on the UPR market, which is heavily influenced by construction end markets, demand for this application can be cyclical. Generally, changes in price have resulted from changes in industry capacity utilization as opposed to changes in underlying raw material costs.

On April 1, 2008, we announced that Sasol-Huntsman, our 50/50 maleic anhydride joint venture located in Moers, Germany, would be expanding its manufacturing capacity by approximately 100 million pounds per year. The new capacity will come online in the first quarter of 2011. The joint

13

venture received secured nonrecourse financing that together with its cash flows from operations was used to fund the expansion.

Sales and Marketing

We sell over 2,000 products to over 4,000 customers globally through our Performance Products marketing groups, which have extensive market knowledge, considerable chemical industry experience and well established customer relationships.

Our performance specialties markets are organized around end use market applications, such as coatings, polymers and resins and agrochemical. In these end uses, our marketing efforts are focused on how our product offerings perform in certain customer applications. We believe that this approach enhances the value of our product offerings and creates opportunities for ongoing differentiation in our development activities with our customers. Our performance intermediates and maleic anhydride groups organize their marketing efforts around their products and geographic regions served. We also provide extensive pre- and post-sales technical service support to our customers where our technical service professionals work closely with our research and development functions to tailor our product offerings to meet our customers unique and changing requirements. Finally, these technical service professionals interact closely with our market managers and business leadership teams to help guide future offerings and market approach strategies.

In addition to our focused direct sales efforts, we maintain an extensive global network of distributors and agents that also sell our products. These distributors and agents typically promote our products to smaller end use customers who cannot be served cost effectively by our direct sales forces.

Manufacturing and Operations

Our Performance Products segment has the capacity to produce more than seven billion pounds annually of a wide variety of specialty, intermediate and commodity products and formulations at 16 manufacturing locations in North America, Europe, Asia and Australia.

These production capacities are as follows:

| |

Current capacity | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Product Area

|

North America | EAME | APAC | Total | ||||||||||

| |

(millions of pounds) |

|||||||||||||

Performance Specialties |

||||||||||||||

Amines |

706 | 186 | (1) | 40 | 932 | |||||||||

Carbonates |

77 | 77 | ||||||||||||

Specialty surfactants |

100 | 175 | 70 | 345 | ||||||||||

Performance Intermediates |

||||||||||||||

EG |

890 | 55 | 945 | |||||||||||

EO |

1,000 | 100 | 1,100 | |||||||||||

Ethanolamines |

400 | 400 | ||||||||||||

Ethylene |

400 | 400 | ||||||||||||

LAB |

375 | 375 | ||||||||||||

Propylene |

300 | 300 | ||||||||||||

Surfactants |

470 | 1,675 | 30 | 2,175 | ||||||||||

Maleic anhydride |

340 | 137 | (2) | 477 | ||||||||||

14

from our consolidated 50/50 joint venture Arabian Amines Company located in Jubail, Saudi Arabia.

Our surfactants and amines facilities are located globally, with broad capabilities in amination, sulfonation and ethoxylation. These facilities have a competitive cost base and use modern manufacturing units that allow for flexibility in production capabilities and technical innovation. Through the major restructuring of our surfactant operations, we have significantly improved the competitiveness of our surfactants business.

Our primary ethylene, propylene, EO, EG and ethanolamines facilities are located in Port Neches, Texas alongside our Polyurethanes' PO/MTBE facility. The Port Neches, Texas facility benefits from extensive logistics infrastructure, which allows for efficient sourcing of other raw materials and distribution of finished products.

Our LAB facility in Chocolate Bayou, Texas and our maleic anhydride facility in Pensacola, Florida are both located within large, integrated petrochemical manufacturing complexes operated by Ascend. We believe this results in greater scale and lower costs for our products than we would be able to obtain if these facilities were stand-alone operations.

In 2008, we formed Arabian Amines Company, a joint venture with the Zamil Group, which has constructed an ethyleneamines manufacturing plant in Jubail, Saudi Arabia. Trial production commenced in the second quarter of 2010, and, beginning July 2010, Arabian Amines Company generated significant revenues from the sale of product. The plant has an approximate annual capacity of 60 million pounds. We will purchase and sell all of the production from this joint venture. Arabian Amines Company was accounted for under the equity method during its development stage. We began consolidating this joint venture beginning July 1, 2010.

Raw Materials

We have the capacity to use approximately 850 million pounds of ethylene each year produced in part at our Port Neches, Texas facility in the production of EO and ethyleneamines. We consume all of our EO in the manufacture of our EG, surfactants and amines products. We also use internally produced PO and DEG in the manufacture of these products. We have the capacity to produce 400 million pounds of ethylene and 300 million pounds of propylene, depending on feedstocks, at our Port Neches, Texas facility. All of the ethylene is used in the production of EO and substantially all of the propylene is consumed by the PO unit at Port Neches operated by our Polyurethanes business. We purchase or toll the remainder of our ethylene and propylene requirements from third parties.

In addition to internally produced raw materials, our performance specialties market purchases over 250 compounds in varying quantities, the largest of which includes ethylene dichloride, caustic soda, synthetic alcohols, paraffin, nonyl phenol, ammonia, hydrogen, methylamines and acrylonitrile. The majority of these raw materials are available from multiple sources in the merchant market at competitive prices.

In our performance intermediates market, our primary raw materials, in addition to internally produced and third-party sourced EO and ethylene, are synthetic and natural alcohols, paraffin, alpha olefins, benzene and nonyl phenol. All of these raw materials are widely available in the merchant market at competitive prices.

15

Maleic anhydride is produced by the reaction of n-butane with oxygen using our proprietary catalyst. The principal raw material is n-butane which is purchased pursuant to long-term contracts and delivered to our Pensacola, Florida site by barge and to our facility in Geismar, Louisiana via pipeline. Our maleic anhydride catalyst is toll-manufactured by BASF under a long-term contract according to our proprietary methods. These raw materials are available from multiple sources at competitive prices.

Competition

In our performance specialties market, there are few competitors for many of our products due to the considerable customization of product formulations, the proprietary nature of many of our product applications and manufacturing processes and the relatively high research and development and technical costs involved. Some of our global competitors include BASF, Air Products, Dow, Tosoh, and Akzo. We compete primarily on the basis of product performance, new product innovation and, to a lesser extent, on the basis of price.

There are numerous global producers of many of our performance intermediates products. Our main competitors include global companies such as Dow, Sasol, BASF, Petresa, Clariant, Shell, Stepan and Kao, as well as various smaller or more local competitors. We compete on the basis of price with respect to the majority of our product offerings and, to a lesser degree, on the basis of product availability, performance and service with respect to certain of our more value-added products.

In our maleic anhydride market, we compete primarily on the basis of price, customer service and plant location. Our competitors include Lanxess, Flint Hills Resources and Ashland. We are the leading global producer of maleic anhydride catalyst. Competitors in our maleic anhydride catalyst market include Scientific Design and Polynt. In our maleic anhydride technology licensing market, our primary competitor is Scientific Design. We compete primarily on the basis of technological performance and service.

The market in which our Performance Products segment operates is highly competitive. Among our competitors in this market are some of the world's largest chemical companies and major integrated petroleum companies that have their own raw material resources. Some of these companies may be able to produce products more economically than we can. In addition, some of our competitors in this market have greater financial resources, which may enable them to invest significant capital into their businesses, including expenditures for research and development. If any of our current or future competitors in this market develop proprietary technology that enables them to produce products at a significantly lower cost, our technology could be rendered uneconomical or obsolete.

Advanced Materials

General

Our Advanced Materials segment is a leading global manufacturer and marketer of technologically advanced epoxy, acrylic and polyurethane-based polymer products. We focus on formulations and systems that are used to address customer-specific needs in a wide variety of industrial and consumer applications. Our products are used either as replacements for traditional materials or in applications where traditional materials do not meet demanding engineering specifications. For example, structural adhesives are used to replace metal rivets and advanced composites are used to replace traditional aluminum panels in the manufacture of aerospace components. Our Advanced Materials segment is characterized by the breadth of our product offering, our expertise in complex chemistry, our long-standing relationships with our customers, our ability to develop and adapt our technology and our applications expertise for new markets and new applications.

We operate synthesis, formulating and production facilities in North America, Europe, Asia, South America and Africa. We market over 3,000 products to more than 3,000 customers in the following

16

end-markets: civil engineering, shipbuilding and marine maintenance, consumer appliances, food and beverage packaging, industrial appliances, consumer/do it yourself ("DIY"), aerospace, DVD, LNG transport, electrical power transmission and distribution, printed circuit boards, consumer and industrial electronics, wind power generation, automotive, recreational sports equipment, medical appliances, design studios and prototype manufacturers.

Products and Markets

Our product range spans from basic liquid and solid resins, to specialty components like curing agents, matting agents, accelerators, cross-linkers, reactive diluents, thermoplastic polyamides and additives. In addition to these components, which we typically sell to formulators in various industries, we also produce and sell ready to use formulated polymer systems.

Base Resins and Specialty Component Markets. Our products are used for the protection of steel and concrete substrates, such as flooring, metal furniture and appliances, buildings, linings for storage tanks and food and beverage cans, and the primer coat of automobile bodies and ships. Epoxy-based surface coatings are among the most widely used industrial coatings due to their structural stability and broad application functionality combined with overall economic efficiency.

Base resins and specialty components are also used for composite applications. A structural composite is made by combining two or more different materials, such as fibers, resins and other specialty additives, to create a product with enhanced structural properties. Specifically, structural composites are lightweight, high-strength, rigid materials with high resistance to chemicals, moisture and high temperatures. Our product range comprises basic and advanced epoxy resins, curing agents and other advanced chemicals, additives and formulated polymer systems. The four key target markets for our structural composites are aerospace, windmill blades for wind power generation, general industrial and automotive applications, and recreational products (mainly sports equipment such as skis). Structural composites continue to substitute for traditional materials, such as metals and wood, in a wide variety of applications due to their light weight, strength and durability.

Formulated Systems. The structural adhesives market requires high-strength "engineering" adhesives for use in the manufacture and repair of items to bond various engineering substrates. Our business focus is on engineering adhesives based on epoxy, polyurethane, acrylic and other technologies which are used to bond materials, such as steel, aluminum, engineering plastics and composites in substitution of traditional joining techniques. Our Araldite® brand name has considerable value in the industrial and consumer adhesives markets. In many countries, Araldite® branded products are known for their high-performance adhesive capabilities, and we generally believe that this is the value-added segment of the market where recognition of our long-standing Araldite® brand is a key competitive advantage. Packaging is a key characteristic of our adhesives products. Our range of adhesives is sold in a variety of packs and sizes, targeted to three specific end-markets and sold through targeted routes to market:

17

and Selleys. These products are sold globally through a number of major retail outlets, often under the Araldite® brand name.

Our electrical materials are formulated polymer systems, which make up the insulation materials used in equipment for the generation, transmission and distribution of electrical power, such as transformers, switch gears, ignition coils, sensors, motors and magnets, and for the protection of electrical and electronic devices and components. The purpose of these products is to insulate, protect or shield either the environment from electrical current or electrical devices from the environment, such as temperature or humidity. Our electrical insulating materials target two key market segments: the heavy electrical equipment market and the light electrical equipment market.

Products for the heavy electrical equipment market segment are used in power plant components, devices for power grids and insulating parts and components. In addition, there are numerous devices, such as motors and magnetic coils used in trains and medical equipment, which are manufactured using epoxy and related technologies. Products for the light electrical equipment market segment are used in applications such as industrial automation and control, consumer electronics, car electronics and electrical components. The end customers in the electrical insulating materials market encompass the relevant original equipment manufacturer ("OEM") as well as numerous manufacturers of components used in the final products. We also develop, manufacture and market materials used in the production of printed circuit boards. Our products are ultimately used in industries ranging from telecommunications and personal computer mother board manufacture to automotive electronic systems manufacture. Soldermasks are our most important product line in printed circuit board technologies, particularly in Europe. Sales are made mainly under the Probimer®, Probimage®, and Probelec® trademarks. Our Probimer® trademark is a widely recognized brand name for soldermasks.

We produce polyurethane-based and epoxy formulated polymer systems used in the production of models, prototypes, patterns, molds and a variety of related products for design, prototyping and short-run manufacture. Our products are used extensively in the automotive, aerospace and industrial markets as productivity tools to quickly and efficiently create accurate prototypes and develop experimental models, and to lower the cost of manufacturing items in limited quantities primarily using computer-aided-design techniques. We separate the overall tooling and modeling materials market into two distinct groups—standard tooling and modeling materials and stereolithography technology.

Our standard tooling and modeling materials are polymer-based materials used by craftsmen to make the traditional patterns, molds, models, jigs and fixtures required by the foundry, automotive, ceramics and other such industries. Stereolithography is a technology that is used to accurately produce physical three-dimensional models directly from computer-aided-design data without cutting, machining or tooling. The models are produced by selectively curing a light-sensitive liquid resin with a laser beam. We sell our stereolithography products to customers in the aerospace, appliance, automotive, consumer, electronics and medical markets.

Sales and Marketing

We maintain multiple routes to market to service our diverse customer base. These routes to market range from using our own direct sales force for targeted, technically-oriented distribution to mass general distribution. Our direct sales force focuses on engineering solutions for decision-makers at major customers who purchase significant amounts of product from us. We use technically-oriented specialist distributors to augment our sales effort in niche markets and applications where we do not believe it is appropriate to develop direct sales resources. We use mass general distribution channels to sell our products into a wide range of general applications where technical expertise is less important to the user of the products to reduce our overall selling expenses. We believe our use of multiple routes to market enables us to reach a broader customer base at an efficient cost.

18

We conduct sales activities through dedicated regional sales teams in the Americas; Europe, Africa, the Middle East and India ("EAMEI"); and Asia. Our global customers are covered by key account managers who are familiar with the specific requirements of these clients. The management of long-standing customer relationships, some of which are 20 to 30 years old, is at the heart of the sales and marketing process. We are also supported by a strong network of distributors. We serve a highly fragmented customer base.

For our consumer DIY "Do It Yourself" range, we have entered into exclusive branding and distribution arrangements with, for example, Selleys in Australia. Under these arrangements, our distribution partners fund advertising and sales promotions, negotiate and sell to major retail chains, own inventories and provide store deliveries (and sometimes shelf merchandising) in exchange for a reliable, high-quality supply of Araldite® branded, ready-to-sell packaged products.

Manufacturing and Operations

We are a global business serving customers in three principal geographic regions: EAMEI, the Americas, and Asia. To service our customers efficiently, we maintain manufacturing plants around the world with a strategy of global, regional and local manufacturing employed to optimize the level of service and minimize the cost to our customers. The following table summarizes the plants that we operate:

Location

|

Description of Facility | |

|---|---|---|

| Bad Saeckingen, Germany | Formulating Facility | |

Bergkamen, Germany |

Synthesis Facility |

|

Chennai, India(1) |

Resins and Synthesis Facility |

|

Duxford, U.K. |

Formulating Facility |

|

East Lansing, Michigan, U.S. |

Formulating Facility |

|

Istanbul, Turkey(2) |

Formulating Facility |

|

Los Angeles, California, U.S. |

Formulating Facility |

|

McIntosh, Alabama, U.S. |

Resins and Synthesis Facility |

|

Monthey, Switzerland |

Resins and Synthesis Facility |

|

Pamplona, Spain |

Resins and Synthesis Facility |

|

Panyu, China(2)(3) |

Formulation and Synthesis Facility |

|

Sadat City, Egypt |

Formulating Facility |

|

Taboão da Serra, Brazil |

Formulating Facility |

Our facilities in Asia and India are well-positioned to take advantage of the market growth that is expected in these regions. Furthermore, we believe that we are the largest producer of epoxy resin compounds in India.

19

Raw Materials

The principal raw materials we purchase for the manufacture of basic and advanced epoxy resins are epichlorohydrin, bisphenol A and BLR. We also purchase amines, polyols, isocyanates, acrylic materials, hardeners and fillers for the production of our formulated polymer systems and complex chemicals and additives. Raw material costs constitute a sizeable percentage of sales for certain applications. We have supply contracts with a number of suppliers. The terms of our supply contracts vary, but, in general, these contracts contain provisions that set forth the quantities of product to be supplied and purchased and formula-based pricing.

Additionally, we produce some of our most important raw materials, such as BLR and its basic derivatives, which are the basic building blocks of many of our products. We are the fourth largest producer of BLR in the world. Approximately 50% of the BLR we produce is consumed in the production of our formulated polymer systems. The balance of our BLR is sold as liquid or solid resin in the merchant market, allowing us to increase the utilization of our production plants and lower our overall BLR production cost. We believe that manufacturing a substantial proportion of our principal raw material gives us a competitive advantage over other epoxy-based polymer systems formulators, most of whom must buy BLR from third-party suppliers. This position helps protect us from pricing pressure from BLR suppliers and aids in providing us a stable supply of BLR in difficult market conditions.

We consume certain amines produced by our Performance Products segment and isocyanates produced by our Polyurethanes segment, which we use to formulate Advanced Materials products.

Competition

The market in which our Advanced Materials segment operates is highly competitive, and is dependent on significant capital investment, the development of proprietary technology, and maintenance of product research and development. Among our competitors in this market are some of the world's largest chemical companies and major integrated companies that have their own raw material resources.

Competition in our basic liquid and solid epoxy resins group is primarily driven by price, and is increasingly more global with industry consolidation in the North American and European markets and the emergence of new competitors in Asia. Our major competitors include Dow, Momentive, BASF, Kukdo, Leuna and NanYa.

Competition in our specialty components and structural composites product group is primarily driven by product performance, applications expertise and customer certification. Our competitive strengths include our strong technology base, broad range of value-added products, leading market positions, diverse customer base and reputation for customer service. Major competitors include Air Products, Arizona, Momentive, BASF, Cray Valley, Evonics, DIC, Dow, Mitsui, Sumitomo and NanYa.

Competition in our formulation product group is primarily based on technology, know-how, applications and formulations expertise, product reliability and performance, process expertise and technical support. This product group covers a wide range of industries and the key competition factors vary by industry. Our competitive strengths result from our focus on defined market needs, our long-standing customer relationships, product reliability and technical performance, provision of high level service and recognition as a quality supplier in our chosen sectors. We operate dedicated

20

technology centers in Basel, Switzerland; The Woodlands, Texas; and Panyu, China in support of our product and technology development. Our major competitors can be summarized as follows:

Formulation Product Group

|

Competition | |

|---|---|---|

| Adhesives applications | Henkel/Loctite, ITW, National Starch, Sika, 3M | |

Electrical insulating materials |

Altana, Hexion, Schenectady, Wuxi, Dexter-Hysol, Hitachi Chemical, Nagase Chemtex, Toshiba Chemical |

|

Printed circuit board materials |

Coates, Goo, Peters, Taiyo Ink, Tamura |

|

Tooling and modeling solution. |

Axson, DSM, Sika |

Textile Effects

General

Our Textile Effects segment is the leading global market share provider for textile chemicals and dyes. Our textile solutions enhance the color of finished textiles and improve such performance characteristics as wrinkle resistance and the ability to repel water and stains. Our Textile Effects segment is characterized by the breadth of our product offering, our long-standing relationships with our customers, our ability to develop and adapt our technology and our applications expertise for new markets and new applications.