Use these links to rapidly review the document

TABLE OF CONTENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy

Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant ý | ||

Filed by a Party other than the Registrant o |

||

Check the appropriate box: |

||

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material under §240.14a-12 |

| HUNTSMAN CORPORATION | ||||

|

(Name of Registrant as Specified In Its Charter) |

||||

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

||||

Payment of Filing Fee (Check the appropriate box): |

||||

ý |

|

No fee required. |

||

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

||

| | (1) | | Title of each class of securities to which transaction applies: |

|

| | (2) | | Aggregate number of securities to which transaction applies: |

|

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|

| | (4) | | Proposed maximum aggregate value of transaction: |

|

| | (5) | | Total fee paid: |

|

o |

|

Fee paid previously with preliminary materials. |

||

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

||

|

(1) |

|

Amount Previously Paid: |

|

| | (2) | | Form, Schedule or Registration Statement No.: |

|

| | (3) | | Filing Party: |

|

| | (4) | | Date Filed: |

|

AN INVITATION FROM OUR CHAIRMAN

DEAR FELLOW STOCKHOLDER:

We are pleased to invite you to attend the 2021 Annual Meeting of Stockholders of Huntsman Corporation (our "Company"), which will be held virtually on Wednesday, April 28, 2021, at 9:00 a.m., Central Time.

At this year's Annual Meeting, we will consider the matters described in this Proxy Statement. It is important that you use this opportunity to take part in the affairs of our Company by voting on the business to come before the stockholders at the Annual Meeting.

Due to the impact of the coronavirus (COVID-19) pandemic and to support the health and well-being of our stockholders, we adopted a completely virtual format for our 2021 Annual Meeting through a live webcast. We believe this format will provide a consistent experience to our stockholders and allow stockholders to participate in the Annual Meeting regardless of location. At our virtual Annual Meeting, stockholders will be able to attend, vote their shares and submit questions by visiting www.virtualshareholdermeeting.com/HUN2021. You will not be able to attend the Annual Meeting physically.

We are sensitive to the fact that virtual meetings provide a different forum than traditional in-person meetings. As result, we are committed make every effort to ensure that stockholders will be afforded the same rights and opportunities to attend and participate in the Annual Meeting as they would at an in-person meeting. In particular, we

believe the design of our virtual platform will enhance, rather than constrain, stockholder access and participation. For example, our virtual platform will allow stockholders to vote their shares electronically during the live webcast and to submit questions for a live Q&A session that will be held at the end of the Annual Meeting.

As with our past physical annual meetings, we are committed to answering stockholders' questions in the order in which they are received, subject to the Rules of Conduct governing the Annual Meeting. We reserve the right to edit profanity or other inappropriate language and to exclude questions regarding topics that are not pertinent to meeting matters or Company business. To avoid repetition, we may group substantially similar questions together and provide a single response.

PLEASE VOTE AS SOON AS POSSIBLE

This Proxy Statement contains important information and you should read it carefully. Whether or not you plan to attend and participate in the virtual Annual Meeting, we ask that you vote as soon as possible. You may vote by proxy via the Internet or telephone, or if you received paper copies of the proxy materials via mail, you can also vote by mail by following the instructions on the proxy card or voting instruction card or the information forwarded by your broker, bank or other holder of record. For detailed information regarding voting instructions, please refer to the accompanying Proxy Statement.

![]()

PETER R. HUNTSMAN

Chairman of the Board,

President and Chief Executive Officer

HUNTSMAN 2021 PROXY

TO THE STOCKHOLDERS OF HUNTSMAN CORPORATION:

We are holding the 2021 Annual Meeting of Stockholders (the "Annual Meeting") for the following purposes:

The above matters are fully described in the accompanying Proxy Statement, which is part of this notice. We have not received notice of any other matters that may be properly presented at the Annual Meeting.

To join the live webcast and attend and participate in the virtual Annual Meeting, you will need your 16-digit control number included on your proxy card, voting instruction form or Notice of Internet Availability of Proxy Materials. For further information on how to attend and participate in the virtual Annual Meeting, please see "Additional Details Regarding the Annual Meeting" on page 8 of the Proxy Statement.

Only stockholders of record at the close of business on March 4, 2021 are entitled to vote at the Annual Meeting. A list of stockholders entitled to vote at the Annual Meeting will be available for inspection at our principal executive offices at 10003 Woodloch Forest Drive, The Woodlands, Texas 77380 for 10 days prior to the Annual Meeting, beginning on April 16, 2021. If you would like to review the stockholder list during ordinary business hours, please contact Huntsman Investor Relations via email at ir@huntsman.com.

Even if you plan to attend and participate in the Annual Meeting, please vote by proxy via the Internet or telephone, or if you received paper copies of the proxy materials by mail, you can also vote via mail by following the instructions on the proxy card or voting instruction card or the information forwarded by your broker, bank or other holder of record. Please vote as promptly as possible to ensure that your shares are represented. Even if you have voted your proxy, you may still vote electronically if you attend and participate in the Annual Meeting.

| | By Order of the Board of Directors, | |

|

|

|

|

David M. Stryker Secretary |

|

|

The Woodlands, Texas March 18, 2021 |

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to be held April 28, 2021: The Notice of 2021 Annual Meeting and Proxy Statement and the 2020 Annual Report are available free of charge at www.proxyvote.com.

HUNTSMAN 2021 PROXY

PARTICIPATE IN OUR FUTURE, VOTE NOW

Your vote is important to us and allows you to participate in the future of our Company.

Please cast your vote as soon as possible on the items listed below to ensure that your shares are represented.

PROPOSALS REQUIRING YOUR VOTE

| |

| |

| |

| |

| Board Recommendation |

| |

| Votes Required for Approval |

| |

| Unvoted Shares(1) |

| |

| Abstentions |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | | | | | | | | | | | | | | | | |

| PROPOSAL 1 | | | | Election of Directors | | | | FOR each nominee | | | | Majority of votes cast | | | | Do not count | | | | Will have no effect on the outcome |

| PROPOSAL 2 | | | Non-Binding Advisory Vote on Named Executive Officer Compensation | | | FOR | | | Majority of shares present (in person or represented by proxy) and entitled to vote | | | Do not count | | | Count as a vote against | |||||

| PROPOSAL 3 | | | | Ratification of Independent Registered Public Accounting Firm | | | | FOR | | | | Majority of shares present (in person or represented by proxy) and entitled to vote | | | | Discretionary voting allowed | | | | Count as a vote against |

| PROPOSAL 4 | | | Stockholder Proposal Regarding Stockholder Right to Act by Written Consent | | | AGAINST | | | Majority of shares present (in person or represented by proxy) and entitled to vote | | | Do not count | | | Count as a vote against | |||||

| | | | | | | | | | | | | | | | | | | | | |

VOTING OPTIONS

Even if you plan to attend and participate in our virtual Annual Meeting, please read this Proxy Statement with care, and vote using any of the following methods. In all cases, have your proxy card in hand and follow the instructions.

Please note that if you hold shares in "street name" (that is, in a brokerage account or through a bank or other nominee), you will need to follow the instructions provided to you on your voting instruction form to vote in advance of the Annual Meeting.

VISIT THE PROXY WEBSITE

Visit the proxy website: www.proxyvote.com

HUNTSMAN 2021 PROXY

|

PROXY STATEMENT TABLE OF CONTENTS

HUNTSMAN 2021 PROXY

| HUNTSMAN CORPORATION: PROXY STATEMENT SUMMARY |

HUNTSMAN PROXY STATEMENT SUMMARY

To assist you in reviewing the proposals to be voted upon at the 2021 Annual Meeting of Stockholders (the "Annual Meeting") of Huntsman Corporation ("Huntsman" or our "Company"), this summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all of the information you should consider. You should read the entire Proxy Statement carefully before voting.

For further information on how to attend and participate in the virtual Annual Meeting, please see "Additional Details Regarding the Annual Meeting" on page 8 of the Proxy Statement.

ANNUAL MEETING DETAILS

| Date and Time |

| |

| Virtual Meeting Site |

|---|---|---|---|---|

| | | | | |

|

Wednesday, April 28, 2021 9:00 a.m., Central Time |

|

| | www.virtualshareholdermeeting.com/HUN2021 |

| Record Date |

| |

| Common Stock Outstanding as of the Record Date |

|---|---|---|---|---|

| | | | | |

| March 4, 2021 | | | | 221,647,461 |

MEETING AGENDA AND VOTING RECOMMENDATIONS

| Proposal |

| |

| Board Recommendation |

||

|---|---|---|---|---|---|---|

| | | | | | | |

| 1. | | Election of 11 director nominees named in the Proxy Statement | | | | FOR EACH NOMINEE |

| 2. | | Advisory vote to approve named executive officer compensation | | | FOR | |

| 3. | | Ratification of appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the year ending December 31, 2021 | | | | FOR |

| 4. | | Stockholder proposal regarding stockholder right to act by written consent | | | AGAINST | |

PERFORMANCE HIGHLIGHTS IN 2020

The challenges brought on by the COVID-19 pandemic in 2020 were unlike any in our recent history. The pandemic significantly impacted the economic conditions throughout the United States and the world, including the markets in which we operate. We responded with increased cost control and lower discretionary spending, reducing capital expenditures and suspending share repurchases to preserve our strong balance sheet. We also utilized available assets to produce and donate millions of pounds of hand sanitizer around the world in order to contribute to the global fight against COVID-19. Despite the significant macroeconomic instability, we achieved many successes during 2020, which was marked with significant milestones for our Company.

1 | HUNTSMAN 2021 PROXY

HUNTSMAN CORPORATION: PROXY STATEMENT SUMMARY |

COVID-19 STAKEHOLDER RESPONSE

Huntsman has always maintained focus on the health and safety of our employees, suppliers, customers and communities. At the onset of the pandemic, we established an executive task force to closely monitor the evolving situation and implemented appropriate measures to ensure health, safety and business continuity aligned with local and federal recommendations.

As manufacturers of raw materials in critical applications that address pandemic relief and recovery, the chemical sector was designated as critical infrastructure in many of the worlds' largest economies. Many of our manufacturing facilities remained in operation throughout the pandemic, although often with only essential employees. As a critical business, our manufacturing operations quickly adjusted to the demands of the new environment and began producing hand sanitizer and other critically-need products. We donated our products and expertise to support those on the front lines of this pandemic, while also taking steps to minimize impact on our operations in support of our customers and the global industries they represent.

Employee Safety Actions

Business Continuity and Essential Products

Global Philanthropic Efforts

2 | HUNTSMAN 2021 PROXY

| HUNTSMAN CORPORATION: PROXY STATEMENT SUMMARY |

We will continue to monitor the latest updates about the global COVID-19 pandemic and will take necessary actions to safeguard the health of our employees. We are proud of what Huntsman has delivered to date and are confident that we will continue to rise to the challenges ahead.

DIRECTOR NOMINEES (PROPOSAL 1)

The following table provides summary information about each director nominee. We ask you to vote "FOR" each of our director nominees.

| Nominee |

| |

| Age |

| |

| Director Since |

| |

| Principal Occupation |

| |

| Committees |

||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | | | | | | | | | | | | | ||||||

| Peter R. Huntsman | | | | | 58 | | | | | | 2005 | | | | | Chairman of the Board, President and Chief Executive Officer of Huntsman Corporation (our "CEO") | | | | Litigation | ||

| Nolan D. Archibald | | | | 77 | | | | | 2005 | | | | Former Executive Chairman of Stanley Black & Decker | | | Compensation, Governance | ||||||

| Mary C. Beckerle | | | | | 66 | | | | | | 2011 | | | | | Chief Executive Officer of Huntsman Cancer Institute at the University of Utah | | | | Audit, Governance | ||

| M. Anthony Burns | | | | 78 | | | | | 2010 | | | | Chairman Emeritus of Ryder System, Inc. | | | Audit, Governance | ||||||

| Sonia Dulá | | | | | 60 | | | | | | 2020 | | | | | Former Vice Chairman of Bank of America, Latin America | | | | Audit, Sustainability | ||

| Cynthia L. Egan | | | | 65 | | | | | 2020 | | | | Former President of Retirement Plan Services of T. Rowe Price Group | | | Governance, Sustainability | ||||||

| Daniele Ferrari | | | | | 59 | | | | | | 2018 | | | | | Former Chief Executive Officer of Versalis S.p.A. | | | | Compensation, Sustainability | ||

| Sir Robert J. Margetts | | | | 74 | | | | | 2010 | | | | Former Deputy Chairman, OJSC Uralkali | | | Audit, Governance | ||||||

| Jeanne McGovern | | | | | 62 | | | | | | 2021 | | | | | Retired Partner, Deloitte & Touche LLP | | | | Audit | ||

| Wayne A. Reaud | | | | 73 | | | | | 2005 | | | | Trial Lawyer | | | Compensation, Litigation | ||||||

| Jan E. Tighe | | | | | 58 | | | | | | 2019 | | | | | Retired Vice Admiral of the U.S. Navy | | | | Audit, Sustainability | ||

| | | | | | | | | | | | | | | | | | ||||||

3 | HUNTSMAN 2021 PROXY

HUNTSMAN CORPORATION: PROXY STATEMENT SUMMARY |

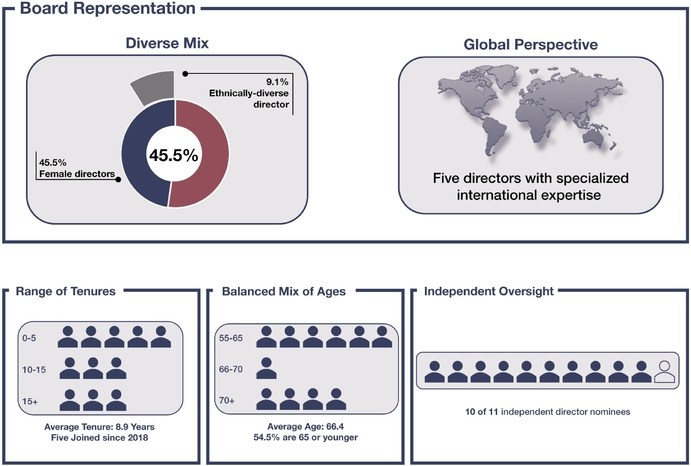

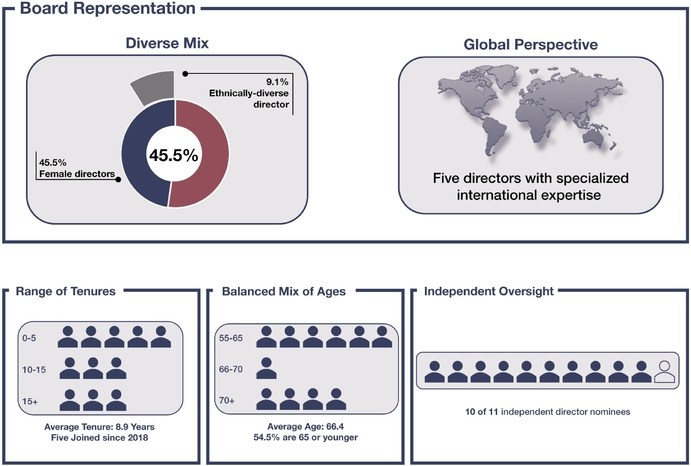

CORPORATE GOVERNANCE HIGHLIGHTS

The Board is committed to corporate governance principles and practices that facilitate the fulfillment of its fiduciary duties to stockholders and to our Company. Key corporate governance highlights include:

| | | |

| ROBUST INDEPENDENCE AND THOUGHTFUL BOARD RENEWAL | | |

All members of our Board, except our CEO, are independent |

|

ü |

Five of our 11 directors (or 45.5%) add gender diversity, and one director adds ethnic diversity |

|

ü |

Five new independent directors (including four women) added to the Board since 2018 |

|

ü |

Ongoing Board refreshment effort, led by the Chair of our Governance Committee, Nolan D. Archibald |

|

ü |

ACCOUNTABILITY TO STOCKHOLDERS |

|

|

Majority voting for director nominees in all uncontested elections |

|

ü |

Simple majority stockholder voting requirements |

|

ü |

Stockholders may request special meetings of stockholders at the ownership threshold of 15% (reduced in 2020 from 25%) |

|

ü |

Eligible stockholders may nominate director nominees through our proxy materials (proxy access) |

|

ü |

Robust stock ownership guidelines for directors and executive officers |

|

ü |

Policy prohibiting short sales by directors and executive officers |

|

ü |

PRUDENT RISK OVERSIGHT |

|

|

Newly-formed Sustainability Committee with oversight over sustainability and other related corporate social responsibility and governance matters |

|

ü |

Board and committee oversight of operational, financial, strategic, competitive, reputational, legal and regulatory risks |

|

ü |

| | | |

BOARD ADOPTED LOWER SPECIAL MEETING THRESHOLD

On October 28, 2020, our Board approved an amendment to our Bylaws that lowered the ownership threshold to call a Special Meeting of Stockholders to 15% of outstanding shares of capital stock.

Our Bylaws previously contained a 25% ownership threshold for requesting a special meeting of stockholders. As part of our regular ongoing review of our corporate governance practices, our Board carefully considered evolving governance practices, as well as our investor feedback and previous stockholder votes on the action to adopt stockholders' right to act by written consent. As the result of this considerate process, our Board believed that a 15% threshold more appropriately struck a balance between enhancing stockholder access and minimizing the potential harms associated with allowing a small number of stockholders to call special meetings.

BOARD APPROVED FORMATION OF SUSTAINABILITY COMMITTEE

On February 16, 2021, the Board approved the formation of a Sustainability Committee of the Board to provide more focused support and oversight of our sustainability and other related corporate social responsibility and governance matters, as those matters have required increased focus and Board attention in recent years. Dr. Jan E. Tighe, Daniele Ferrari, Sonia Dulá, and Cynthia L. Egan were appointed to serve as the initial members of the Sustainability Committee, with Dr. Tighe serving as the Chair. Please see "Corporate Governance—Committees of the Board—Sustainability Committee" for additional information.

BOARD DIVERSITY

Director succession is a thoughtful, ongoing process at Huntsman Corporation. Our Board evaluates desired attributes in light of our strategy and evolving needs. As a part of the Board refreshment process, led by Nolan D. Archibald, the Chair of our Governance Committee, we added five new independent directors (including four women and an ethnically-diverse director) to the Board since 2018.

4 | HUNTSMAN 2021 PROXY

| HUNTSMAN CORPORATION: PROXY STATEMENT SUMMARY |

Our Board consists of a highly qualified, diverse group of leaders in their respective fields and is representative of an effective mix of deep Company knowledge and fresh perspective. The following graphic illustrates the diverse and well-rounded range of attributes, viewpoints and experiences of our 11 director nominees.

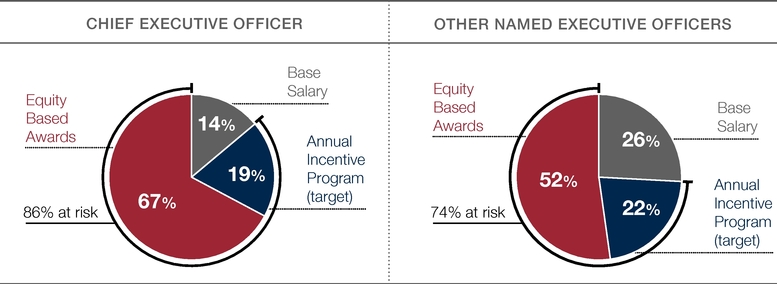

EXECUTIVE COMPENSATION (PROPOSAL 2)

WE ASK THAT YOU VOTE TO APPROVE OUR SAY-ON-PAY PROPOSAL

At our 2021 Annual Meeting, our stockholders will again have an opportunity to cast an advisory say-on-pay vote on the compensation paid to our named executive officers. We ask you to vote "FOR" to approve our named executive officer compensation. Please see "Proposal 2—Advisory Vote to Approve Named Executive Officer Compensation." Please also read our "Compensation Discussion and Analysis" beginning on page 41 for more information regarding our executive compensation program in 2020.

5 | HUNTSMAN 2021 PROXY

HUNTSMAN CORPORATION: PROXY STATEMENT SUMMARY |

EXECUTIVE SUMMARY

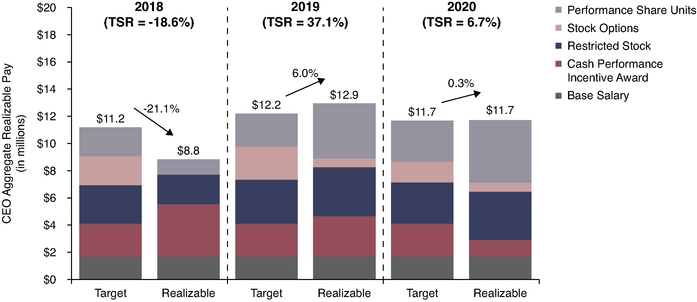

The Compensation Committee believes the design of our executive compensation program, and the Committee's decisions and outcomes in 2020, achieve its primary objective of aligning the financial interests of our NEOs with the creation of long-term stockholder value.

| COMPANY PERFORMANCE HIGHLIGHTS |

| |

| COMPENSATION STRUCTURE AND OUTCOMES |

|---|---|---|---|---|

| | | | | |

|

Despite a challenging operating environment driven by the COVID-19 pandemic, we delivered strong performance on key financial, strategic and ESG initiatives in 2020; highlights include:

• Financial: Exceeded goals for Adjusted EBITDA, Adjusted Free Cash Flow and other corporate objectives; realized significant cost-savings including the acceleration of synergy capture of newly acquired businesses; completed the sale of approximately 42.4 million ordinary shares of Venator Materials PLC; and returned approximately $240 million to stockholders through dividends and share repurchases

• Strategic: Completed the sale of our Chemical Intermediates and Surfactants businesses; nearly doubled our spray polyurethane foam business through acquisition; transformed our Advanced Materials business by announcing three separate transactions in 2020; and opened a new TEROL® polyols plant in Taiwan

• ESG: Received six Responsible Care® Certificates for Health and Safety Performance; published our annual sustainability report; and added two highly qualified and diverse directors to our Board. |

| | |

The primary objective of our executive compensation program is to align the financial interests of our NEOs with the creation of long-term stockholder value. Key features of the program include:

• Annual and long-term incentive plans designed to align executives' pay with Company performance

• A robust compensation benchmarking process against a peer group in which Huntsman is positioned near the median

• Comprehensive policies and practices intended to support well-informed decisions and a sound compensation governance process. During 2020, the Compensation Committee and management team focused on responding appropriately to the business impacts of the pandemic while maintaining our pay-for-performance philosophy. Key decisions included:

• Adjusted the performance goals for the annual cash performance awards that were originally approved in February, but ceased to provide effective incentives following the impact of the COVID-19 pandemic

- Without such mid-year adjustment, we estimate payouts of the 2020 cash performance awards would have been approximately 40% higher for most of our NEOs

• Implemented a corresponding reduction in the payout opportunity, capping annual cash performance awards at 50% of executives' individual incentive targets

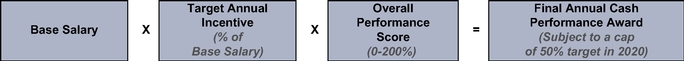

• Approved the payout of performance share units awarded in 2018 at 68.8% of target, reflecting our TSR performance relative to peers over the 2018-2020 period. For 2021 long-term equity-based compensation to our NEOs, the Compensation Committee increased the weighting of performance share units to 50% and eliminated awards of stock options. |

| | | | | |

IMPACT OF COVID-19 PANDEMIC ON COMPENSATION

While 2020 was uniquely challenging, the Compensation Committee and management team focused on responding appropriately to the business impacts of the pandemic while maintaining our philosophy of pay-for-performance in the midst of significant challenges.

We Froze Base Salaries. In response to the unprecedented challenges brought on by COVID-19, management recommended, and the Compensation Committee agreed, to suspend merit and general wage increases that would have customarily occurred at the end of the first quarter 2020 for all employees. As a result, the base salaries of our NEOs remain unchanged from 2019 levels. Mr. Huntsman's base salary has not increased since 2015.

We Reduced Target Payouts for 2020 Annual Cash Performance Awards. The Compensation Committee originally approved the design of our annual cash performance award in February 2020, before the onset of the COVID-19 global

6 | HUNTSMAN 2021 PROXY

| HUNTSMAN CORPORATION: PROXY STATEMENT SUMMARY |

pandemic. In light of the unprecedented impact of COVID-19 on the global economy and therefore on our business, the initial performance measures and goals approved by the Compensation Committee no longer reflected our business environment, and therefore ceased to provide effective incentives to our NEOs.

After COVID-19 started to impact our business, the Compensation Committee began discussions on how to continue to provide an effective incentive for performance considering the new business environment. In July 2020, after consultation with Meridian (our independent compensation consultant), the Compensation Committee re-visited and re-established the design of our annual cash performance award as described in "Compensation Discussion and Analysis—2020 Executive Compensation Decision Decisions—2020 Annual Cash Performance Award" below.

In recognition of the reduced performance goals for the 2020 annual cash performance award, the Compensation Committee restricted the annual cash awards by limiting the maximum payout opportunity to 50% of the NEO's individual incentive targets.

STOCKHOLDER ENGAGEMENT AND RELATED CHANGES TO OUR COMPENSATION PROGRAM

At our 2020 Annual Meeting, our say-on-pay proposal received the support of 79% of the votes cast, which represented an improvement from 72% support in 2019 but was significantly lower than the 91% received in 2018. In response to the advisory say-on-pay results in 2019 and 2020, we engaged a number of our stockholders to discuss topics relevant to our compensation practices. In determining executive compensation, the Compensation Committee carefully considered the say-on-pay results and the stockholder feedback we received.

As a part of ongoing review of our executive compensation program, the Compensation Committee placed additional emphasis on tying the number of shares awarded to Company performance. In each of the last two years, the Compensation Committee incrementally increased the weighting of performance share units (from 30% of our long-term equity-based compensation in 2019 to 50% in 2021). Additionally, we eliminated awards of stock options to our NEOs in 2021, resulting in the current award mix of 50% performance share units and 50% restricted stock. The following table illustrates the evolution of our long-term equity-based compensation in the last three years.

| Fiscal Year |

| Performance Share Units |

| Stock Options |

| Restricted Stock |

| |

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | | | | | |||||||||

2019 |

| | 30 | % | | | 30 | % | | | 40 | % | | ||||

| | |||||||||||||||||

2020 |

| | 40 | % | | | 20 | % | | | 40 | % | | ||||

| | |||||||||||||||||

2021 |

| | 50 | % | | | 0 | % | | | 50 | % | | ||||

| | | | | | | | | | |||||||||

The Compensation Committee believes the enhanced mix of long-term equity-based incentives increases the emphasis on performance by further linking payouts to achievement of relative three-year TSR. Performance Share Units also better align NEO compensation with appreciation of our stock price over the long-term. Overall, we believe our compensation programs remain effective in implementing our primary compensation objectives.

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM (PROPOSAL 3)

We ask you to vote "FOR" the ratification of Deloitte & Touche LLP as our independent registered public accounting firm for the year ending December 31, 2021.

STOCKHOLDER PROPOSAL REGARDING STOCKHOLDER RIGHT TO ACT BY WRITTEN CONSENT (PROPOSAL 4)

We ask you to vote "AGAINST" the stockholder proposal regarding action by written consent. Please see page 84 for our Board of Directors' Statement in Opposition.

7 | HUNTSMAN 2021 PROXY

HUNTSMAN CORPORATION: PROXY STATEMENT |

HUNTSMAN CORPORATION PROXY STATEMENT

| | | | | | | | | | | | | | | | | |

|

PART 1 |

|

|

|

|

|

|

|

|

INFORMATION ABOUT THE MEETING |

|

|||||

| | | | | | | | | | | | | | | | | |

This Proxy Statement is being furnished to the stockholders of Huntsman in connection with the solicitation of proxies by its Board of Directors (the "Board"). The proxies are to be voted at our 2021 Annual Meeting of Stockholders (the "Annual Meeting") to be held on Wednesday, April 28, 2021, at 9:00 a.m. Central Time. Due to the impact of the coronavirus (COVID-19) pandemic and to support the health and well-being of our stockholders, we adopted a completely virtual format for our Annual Meeting through a live webcast. We believe this format will provide a consistent experience to our stockholders and allow all stockholders to participate in the Annual Meeting regardless of location. You will not be able to attend the Annual Meeting physically.

The Board is soliciting your proxy to vote your shares at the Annual Meeting. We will bear the cost of the solicitation, including the cost of the preparation, assembly, printing and, where applicable, mailing of the Notice of Annual Meeting of Stockholders, this Proxy Statement, the proxy card, the Notice of Internet Availability of Proxy Materials (the "Notice of Internet Availability") and any additional information furnished by us to our stockholders. In addition to solicitation by mail, certain of our directors, officers and employees may, without extra compensation, solicit proxies by telephone, facsimile, electronic means and personal interview. We have retained Innisfree M&A Incorporated to help us distribute and solicit proxies and agreed to pay them $17,500 and reimbursement for out-of-pocket expenses for these services. We will also make arrangements with brokerage houses, custodians, nominees and other fiduciaries to send proxy materials to their principals, and we will reimburse them for postage and clerical expenses.

Beginning on March 18, 2021, we mailed a Notice of Internet Availability to our stockholders of record and beneficial owners who owned shares of our common stock at the close of business on March 4, 2021. The Notice of Internet Availability contained instructions on how to access the proxy materials and vote online. We have made these proxy materials available to you over the Internet or, upon your request, have delivered paper versions of these materials to you by mail, in connection with the solicitation of proxies by our Board for the Annual Meeting.

Choosing to receive your future proxy materials by e-mail will save us the cost of printing and mailing documents to you. If you choose to receive future proxy materials by e-mail, you will receive an e-mail next year with instructions containing a link to those materials and a link to the proxy voting site. Your election to receive proxy materials by e-mail will remain in effect until you terminate it.

ADDITIONAL DETAILS REGARDING THE ANNUAL MEETING

ANNUAL MEETING LOG-IN INSTRUCTIONS

Because we adopted a completely virtual format for the Annual Meeting, there is no physical meeting location. To participate in the virtual Annual Meeting, holders of shares of our common stock, at the close of business on March 4, 2021 (the record date for the Annual Meeting), should log in to the live webcast of the Annual Meeting at www.virtualshareholdermeeting.com/HUN2021.

To join the live webcast and participate in the virtual Annual Meeting (e.g., submit questions and/or vote your shares), you will need your 16-digit control number included on your proxy card, voting instruction form or Notice of Internet Availability. Online access to the live webcast will open approximately 15 minutes prior to the start of the Annual Meeting. We recommend that you log in to the Annual Meeting several minutes before its scheduled start time.

8 | HUNTSMAN 2021 PROXY

| HUNTSMAN CORPORATION: PROXY STATEMENT |

If you are the representative of a trust or corporation, limited liability company, partnership or other legal entity that holds shares of our common stock, you will need the 16-digit control number included on the proxy card, voting instruction form or Notice of Internet Availability of that legal entity in order to attend and participate in the virtual Annual Meeting.

No recording of the Annual Meeting is allowed, including audio and video recording. If you are not a stockholder at the close of business on March 4, 2021 (the record date for the Annual Meeting) or do not have a control number, you will not be able to access the Annual Meeting.

STOCKHOLDER ACCESS DURING THE ANNUAL MEETING

We are sensitive to the fact that virtual meetings provide a different forum than traditional in-person meetings. As result, we are committed make every effort to ensure that stockholders will be afforded the same rights and opportunities to attend and participate in the Annual Meeting as they would at an in-person meeting. In particular, we believe the design of our virtual platform will enhance, rather than constrain, stockholder access and participation. For example, our virtual platform will allow stockholders to vote their shares electronically during the live webcast and to submit questions for a live Q&A session that will be held at the end of the Annual Meeting.

SUBMITTING QUESTIONS AND VOTING YOUR SHARES AT THE ANNUAL MEETING

Submitting Questions: Stockholders as of the record date for the Annual Meeting who attend and participate in our virtual Annual Meeting at www.virtualshareholdermeeting.com/HUN2021 will have an opportunity to submit questions via the Internet during the meeting. As with our past physical annual meetings, we are committed to answering stockholders' questions in the order in which they are received, subject to the Rules of Conduct governing the Annual Meeting. We reserve the right to edit profanity or other inappropriate language and to exclude questions regarding topics that are not pertinent to meeting matters or company business. To avoid repetition, we may group substantially similar questions together and provide a single response.

Voting Your Shares: Stockholders as of the record date for the Annual Meeting who attend and participate in our virtual Annual Meeting at www.virtualshareholdermeeting.com/HUN2021 will have an opportunity to vote their shares electronically at the virtual Annual Meeting even if they have previously submitted their votes.

TECHNICAL SUPPORT

Prior to and during the Annual Meeting, we will have technicians ready to assist you with any difficulties you may encounter. If you encounter any difficulties accessing or participating in the virtual Annual Meeting, please call the technical support number that will be available at www.virtualshareholdermeeting.com/HUN2021.

Please be sure to check in by 8:45 a.m. Central Time on April 28, 2021, the day of the Annual Meeting, so we may address any technical difficulties before the live audio webcast begins.

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING AND VOTING

1. WHAT IS THE PURPOSE OF THE ANNUAL MEETING?

At the Annual Meeting, stockholders will vote upon the matters outlined in the Notice of Annual Meeting of Stockholders, which are: (1) the election of the 11 director nominees named in this Proxy Statement; (2) a non-binding advisory vote to approve the compensation of our named executive officers, also referred to herein as our "NEOs;" (3) the ratification of Deloitte & Touche LLP as our independent registered public accounting firm for the year ending December 31, 2021; (4) if properly presented at the meeting, a stockholder proposal regarding stockholder right to act by written consent; and (5) the consideration of any other matters properly presented at the Annual Meeting in accordance with our Sixth Amended and Restated Bylaws of Huntsman Corporation dated June 16, 2020, as amended (our "Bylaws"). The Board is not aware of any other matters to be presented at the Annual Meeting. In addition, our management will respond to questions from stockholders following the adjournment of the formal business at the Annual Meeting.

9 | HUNTSMAN 2021 PROXY

HUNTSMAN CORPORATION: PROXY STATEMENT |

2. WHY IS THE COMPANY USING A COMPLETELY VIRTUAL FORMAT FOR THE ANNUAL MEETING THIS YEAR?

Due to the impact of the coronavirus (COVID-19) pandemic and to support the health and well-being of our stockholders, we adopted a completely virtual format for our Annual Meeting through a live webcast. We believe this format will provide a consistent experience to our stockholders and allow stockholders to participate in the Annual Meeting regardless of location.

3. WHAT IS INCLUDED IN THE PROXY MATERIALS?

The proxy materials include: (1) the Notice of Annual Meeting of Stockholders; (2) this Proxy Statement; and (3) the 2020 Annual Report. If you requested a paper copy of these materials by mail, the proxy materials also include a proxy card or a voting instruction card for the Annual Meeting.

You may refer to the 2020 Annual Report for financial and other information about our operations. The 2020 Annual Report is not incorporated by reference into this Proxy Statement and is not deemed to be a part hereof.

4. WHAT IS A PROXY?

A proxy is your legal designation of another person to vote the stock you own. That other person is called a proxy. If you designate someone as your proxy in a written document, that document also is called a proxy or a proxy card. Peter R. Huntsman, our Chairman of the Board, President and Chief Executive Officer, also referred to herein as our "CEO," and David M. Stryker, our Executive Vice President, General Counsel and Secretary, will serve as proxies for the Annual Meeting pursuant to the proxy card solicited by our Board.

5. WHAT IS A PROXY STATEMENT?

A proxy statement is a document that the regulations of the U.S. Securities and Exchange Commission (the "SEC") require us to give you when we ask that you designate Peter R. Huntsman and David M. Stryker as proxies to vote on your behalf. This Proxy Statement includes information about the proposals to be considered at the Annual Meeting and other required disclosures, including information about the Board and our executive officers.

6. HOW CAN I ACCESS THE PROXY MATERIALS OVER THE INTERNET?

Your Notice of Internet Availability, proxy card or voting instruction card (as applicable) contains instructions on how to:

If you choose to access future proxy materials electronically, you will receive an e-mail with instructions containing a link to the website where those materials are available and a link to the proxy voting website. Your election to access proxy materials by e-mail will remain in effect until you terminate it.

7. WHAT IS THE RECORD DATE AND WHAT DOES IT MEAN?

The record date for the Annual Meeting is March 4, 2021. Owners of record of our common stock at the close of business on the record date are entitled to:

At the close of business on March 4, 2021, there were 221,647,461 shares of our common stock outstanding, each of which is entitled to one vote on each item of business to be conducted at the Annual Meeting.

8. WHO MAY ATTEND THE ANNUAL MEETING?

All stockholders of record who owned shares of common stock at the close of business on March 4, 2021, or their duly appointed proxies, may attend the Annual Meeting and any adjournments or postponements thereof, as may our invited guests. To join the live webcast and participate in the virtual Annual Meeting (e.g., submit questions and/or vote your shares), you will need your 16-digit control number included on your proxy card, voting instruction form or Notice of Internet Availability. Online

10 | HUNTSMAN 2021 PROXY

| HUNTSMAN CORPORATION: PROXY STATEMENT |

access to the live webcast will open approximately 15 minutes prior to the start of the Annual Meeting. We recommend that you log in to the Annual Meeting several minutes before its scheduled start time.

If you are not a stockholder at the close of business on March 4, 2021 (the record date for the Annual Meeting) or do not have a control number, you will not be able to access the Annual Meeting.

9. HOW MANY VOTES ARE REQUIRED TO HOLD THE ANNUAL MEETING?

The required quorum for the transaction of business at the Annual Meeting is a majority of all outstanding shares of our common stock entitled to vote in the election of directors at the Annual Meeting, represented in person or by proxy. Consequently, the presence, in person or by proxy, of the holders of at least 110,823,731 shares of our common stock is required to establish a quorum at the Annual Meeting. Shares that are voted with respect to a particular matter are treated as being present at the Annual Meeting for purposes of establishing a quorum.

10. WHAT IS THE DIFFERENCE BETWEEN A STOCKHOLDER OF RECORD AND A STOCKHOLDER WHO HOLDS STOCK IN STREET NAME?

Most stockholders hold their shares through a broker, bank or other nominee (i.e., in "street name") rather than directly in their own name. As summarized below, there are some distinctions between shares held of record and those held in street name.

11. WHAT DIFFERENT METHODS CAN I USE TO VOTE?

Stockholders of Record: Stockholders of record may (1) vote their shares electronically at the Annual Meeting by completing a ballot; or (2) submit a proxy to have their shares voted by one of the following methods:

Street Name Stockholders: Street name stockholders may generally vote their shares or submit a proxy to have their shares voted by one of the following methods:

If you hold shares in BOTH street name and as a stockholder of record, YOU MUST VOTE SEPARATELY for each set of shares.

11 | HUNTSMAN 2021 PROXY

HUNTSMAN CORPORATION: PROXY STATEMENT |

Even if you plan to attend the Annual Meeting, we recommend you also submit your proxy so that your vote will count if you are unable to attend the meeting. Submitting your proxy via Internet, telephone or mail does not affect your ability to vote electronically at the Annual Meeting.

12. WHAT IF I AM A STOCKHOLDER OF RECORD AND I DON'T SPECIFY A CHOICE FOR A MATTER WHEN RETURNING MY PROXY?

A validly executed proxy that is properly completed and submitted will be voted at the Annual Meeting in accordance with the instructions on the proxy. If you properly complete and submit a validly executed proxy, but do not indicate any contrary voting instructions, your shares will be voted as follows:

If any other business properly comes before the stockholders for a vote at the meeting, your shares will be voted at the discretion of the holders of the proxy. The Board knows of no matters, other than those previously described, to be presented for consideration at the Annual Meeting.

13. IF I AM A STREET NAME STOCKHOLDER, WILL MY SHARES BE VOTED IF I DO NOT PROVIDE INSTRUCTIONS?

In some cases, your shares may be voted if they are held in the name of a brokerage firm, even if you do not provide the brokerage firm with voting instructions. Specifically, brokerage firms have the authority under New York Stock Exchange ("NYSE") rules to cast votes on certain "routine" matters if they do not receive instructions from the beneficial holder. For example, ratification of the appointment of the independent registered public accounting firm is considered a routine matter for which a brokerage firm may vote shares for which it has not received voting instructions. This is called a "broker discretionary vote." When a proposal is not a routine matter and a brokerage firm has not received voting instructions from the beneficial owner of the shares with respect to that proposal, the brokerage firm cannot vote the shares on that proposal. This is called a "broker non-vote." The election of directors, the advisory vote to approve NEO compensation and the stockholder proposal regarding stockholder right to act by written consent are not considered routine matters. Therefore, if you are a street name stockholder and do not provide voting instructions to your broker with respect to these matters, it will result in a broker non-vote with respect to such proposals. Broker non-votes will have no effect on the outcome of these proposals.

14. WHAT VOTES ARE NEEDED FOR EACH PROPOSAL TO PASS AND IS BROKER DISCRETIONARY VOTING ALLOWED?

| Proposal |

| |

| Vote Required |

| |

| Broker Discretionary Vote Allowed |

||

|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | | | | | | |

| (1) | | Election of 11 director nominees | | | | Majority of the votes cast | | | | No |

| (2) | | A non-binding advisory vote to approve the compensation of our NEOs | | | Majority of shares present (in person or represented by proxy) and entitled to vote | | | No | ||

| (3) | | Ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the year ending December 31, 2021 | | | | Majority of shares present (in person or represented by proxy) and entitled to vote | | | | Yes |

| (4) | | Stockholder proposal regarding stockholder right to act by written consent | | | Majority of shares present (in person or represented by proxy) and entitled to vote | | | No | ||

| | | | | | | | | | | |

12 | HUNTSMAN 2021 PROXY

| HUNTSMAN CORPORATION: PROXY STATEMENT |

15. WHAT HAPPENS IF ADDITIONAL PROPOSALS ARE PRESENTED AT THE ANNUAL MEETING?

If you grant a proxy, the persons named as proxy holders will have discretion to vote your shares on any additional matters properly presented for a vote at the Annual Meeting. Under the provisions of our Bylaws and Rule 14a-8 promulgated under the Securities Exchange Act of 1934, the deadline for notifying us of any additional proposals to be presented at the Annual Meeting has passed and, accordingly, stockholders may not present proposals at the Annual Meeting.

16. CAN I CHANGE MY VOTE AFTER SUBMITTING MY PROXY?

If you are a stockholder of record, you may revoke a previously submitted proxy at any time before the polls close at the Annual Meeting by:

If you are a street name stockholder, you must follow the instructions to revoke your proxy, if any, provided by your bank, broker or other nominee.

17. WHAT DOES IT MEAN IF I RECEIVE MORE THAN ONE NOTICE OF INTERNET AVAILABILITY OR MORE THAN ONE SET OF PROXY MATERIALS?

It means that you have multiple accounts with our transfer agent, Computershare, and/or brokers, banks or other nominees. Please vote all of your shares. We recommend that you contact Computershare and/or your broker, bank or other nominee (as applicable) to consolidate as many accounts as possible under the same name and address. If you have multiple accounts with Computershare that you want to consolidate, please submit your request by mail to Computershare Trust Company, N.A., P.O. Box 505000, Louisville, KY 40233-5000, or by telephone at 1-866-210-6997. Computershare may also be reached through its website at www.computershare.com.

13 | HUNTSMAN 2021 PROXY

HUNTSMAN CORPORATION: PROXY STATEMENT |

| | | | | | | | | | | | | | | | | |

|

PART 2 |

|

|

|

|

|

|

|

|

BOARD OF DIRECTORS |

|

|||||

| | | | | | | | | | | | | | | | | |

Presented below is information with respect to our 11 nominees to be elected as directors at this year's Annual Meeting. The information presented below for each director includes the specific experience, qualifications, attributes and skills that led us to the conclusion that such director should serve on the Board.

PETER R. HUNTSMAN |

Peter R. Huntsman, 58, has served as a senior executive and a director of the Company and various of its affiliates since 1994. He presently serves as the Company's President and Chief Executive Officer and, additionally, as Chairman of the Board, a position he has held since January 2018. Mr. Huntsman sits on the Board's Litigation and Public Policy Committee.

Mr. Huntsman began his career at the Company's Olympus Oil subsidiary in 1983 and, starting in 1987, took on a series of general management positions with various operating subsidiaries, each with increasing scope and responsibility, before being appointed President and Chief Operating Officer in 1994. He was appointed Chief Executive Officer in 2000. In addition to serving on the Company's Board, he also serves as a director and a member of the Audit Committee of Venator Materials PLC, a publicly-traded global pigments company headquartered in the UK, which separated from the Company in 2017.

Mr. Huntsman has developed broad and deep experience across the many facets of the global chemical industry while serving in both operational and executive leadership positions in the United States and abroad. He has built valuable and enduring relationships with customers, suppliers, labor unions, political leaders, NGO's and the communities in which the Company operates around the world. He is widely recognized as a leader by his peers and was recently elected Vice Chairman of the Board of Directors of the American Chemistry Council, the chemical industry's principle trade, education, and advocacy association representing more than $550 billion in enterprise value, where he also sits on the Executive Committee. He will begin serving a one-year term as ACC's Chairman of the Board in 2022.

Supporting the communities in which Huntsman operates through charitable giving and civic engagement has been an important element of the Company's culture since it was founded 50 years ago. Mr. Huntsman is the Chairman and CEO of the Huntsman Cancer Foundation, which raises funds to support the ongoing research, treatment, and educational programs of the world-renowned Huntsman Cancer Institute. He is also CEO of the Huntsman Foundation, which recently committed $150 million to the University of Utah to establish the Huntsman Mental Health Institute with the express expectation that the Institute will become a nationally-recognized leader in mental health research, care, education and community outreach. Mr. Huntsman also serves on various oversight boards and leadership councils of several academic, health and hospital services, and charitable institutions, including the Board of Overseers of the Wharton School of Business at the University of Pennsylvania; the Memorial Hermann Health Systems Board of Directors; the Board of Directors for the Cynthia Woods Mitchell Pavilion; and the Board of Advisors for Interfaith of The Woodlands. He also contributes to a number of domestic and international humanitarian projects funded by the Huntsman family and other Huntsman family companies.

The Board has concluded that Mr. Huntsman should continue to serve as Chairman of the Board and a director for the following reasons among others. His demonstrated competence in managing through the strategic, operational, financial, regulatory, and governance challenges facing the Company brings invaluable insight to the Board in the ordinary course. His global experience and diverse expertise, developed while serving in a wide variety of functional and executive management positions, likewise ensure that the exercise of the Board's oversight responsibility at the highest levels is well supported. Finally, his engagement and widely-recognized stature in the industry globally ensure that the Company's views and interests are well-represented on issues of critical importance at every level.

14 | HUNTSMAN 2021 PROXY

| HUNTSMAN CORPORATION: PROXY STATEMENT |

NOLAN D. ARCHIBALD |

Nolan D. Archibald, 77, has been a director of the Company since March 2005 and currently serves as Vice Chairman of the Board and Lead Independent Director. Mr. Archibald also serves as Chairman of the Nominating and Corporate Governance Committee and as a member of the Compensation Committee.

Mr. Archibald was the Chairman and Chief Executive Officer of Black & Decker Corporation from 1987 to 2010. During that time, he led a transformation of Black & Decker into one of the most innovative product companies in the United States, driving significant growth through new products and consistently ranking among the top recipient of patents granted by the U.S. Patent and Trademark Office. He led the relaunch of the DeWalt brand in 1992 and built what became the world's largest professional power tools brand. In 2010, Mr. Archibald co-engineered the merger of Black & Decker with Stanley Works, a combination that significantly increased stockholder value, and served as Executive Chairman of the Board of the combined company. He also chaired the Cost Synergy Committee that drove further stock price appreciation through significant cost reductions. Mr. Archibald has been cited by Business Week as one of the top six managers in the United States and Fortune Magazine as one of the country's "Ten Most Wanted" executives.

Mr. Archibald has extensive experience serving as a director on the Board of Directors of other large public companies in a variety of industries. These include Lockheed Martin Corporation where he chaired the Nominating and Corporate Governance Committee and served as Lead Independent Director through 2018, Brunswick Corporation, where he sat on the Executive Committee and chaired the Finance Committee through 2018, and ITT Corporation.

The Board has concluded that Mr. Archibald should continue to serve as Vice Chairman of the Board and Lead Independent Director for the following reasons among others. His extensive executive level management experience, his success at Black & Decker and, after the merger, Stanley Black & Decker, and his service on the Boards of ITT, Brunswick, and Lockheed Martin, where he was Lead Independent Director, bring a wealth of knowledge and expertise to the Board in the ordinary course. He provides the Board significant CEO-level leadership experience and demonstrated competencies in product innovation, retail and other consumer branding, marketing, and strategic planning, all of which are significant as Huntsman continues to shift its portfolio further downstream into markets closer to the consumer and driven by innovation. Most recently, he has been providing significant leadership and guidance to Executive Management and Divisional management in the Polyurethanes Division as it continues to expand the recently acquired and industry-leading spray polyurethane foam insulation businesses operating under the Huntsman Building Solutions brand through innovative go-forward branding and globalization strategies.

Working with the Chairman of the Board, Mr. Archibald, as Chair of the Nominating and Corporate Governance Committee, has been instrumental in bringing unique talents and diverse perspectives, to the Board over the past three years. The Company has added five new independent directors to date, including four women, all of whom bring new capabilities to the Board. Mr. Archibald's continued and direct involvement with the onboarding and integration of these new directors, as well as his engagement with the Board in the exercise of its oversight responsibilities in the ordinary course, provides continuity and stability during this important period.

15 | HUNTSMAN 2021 PROXY

HUNTSMAN CORPORATION: PROXY STATEMENT |

DR. MARY C. BECKERLE |

Dr. Mary Beckerle, 66, has served as a director since May 2011 and sits on both the Audit Committee and the Nominating and Corporate Governance Committee. She is an internationally recognized academic and research scientist who has served as Chief Executive Officer of the Huntsman Cancer Institute at the University of Utah since 2006. She joined the faculty at the University of Utah in 1986 and is a Distinguished Professor of Biology and Oncological Sciences and the Associate Vice President for Cancer Affairs.

Dr. Beckerle has served on the Advisory Committee to the Director of the National Institute of Health, on the Board of Directors of the American Association for Cancer Research, as the President of the American Society for Cell Biology, and as the Chair of the American Cancer Society Council for Extramural Grants. She currently serves on several scientific advisory boards, including the Medical Advisory Board of the Howard Hughes Medical Institute, the Board of Scientific Advisors of the National Cancer Institute (USA) and the External Advisory Board of the Dana Farber/Harvard Cancer Center. She is also a member of the Cancer Policy and Advisory boards at Duke University, Georgetown University, University of Pennsylvania, and the National Center for Biological Sciences in Bangalore (India).

Dr. Beckerle held a Guggenheim Fellowship at the Curie Institute in Paris in 1999 and is an elected Fellow of the American Academy of Arts and Sciences and the American Philosophical Society. She received the Utah Governor's Medal for Science and Technology in 2001, the Sword of Hope Award from the American Cancer Society in 2004, and the Alfred G. Knudson Award in Cancer Genetics from the National Cancer Institute in 2018.

In addition to serving on the Company's Board, Dr. Beckerle has been a director of Johnson & Johnson since 2015. J&J is a U.S.-based multinational engaged in the manufacture and marketing of medical devices, pharmaceuticals and consumer-packaged goods and one of the ten largest publicly-traded companies in the United States measured by market capitalization. Dr. Beckerle chairs J&J's Science, Technology and Sustainability Committee and also serves on the Regulatory Compliance Committee. She has been named as a National Association of Corporate Directors Directorship 100 awardee, which recognizes leading corporate directors and others who significantly impact boardroom practices and performance.

The Board has concluded that Dr. Beckerle should continue to serve as a director for the following reasons among others. Her deep knowledge of chemical and other sciences utilized in the field of cancer treatment and research, her familiarity with regulatory affairs and compliance oversight associated with chemicals, pharmaceuticals, and medical devices, and her executive management experience at the Huntsman Cancer Institute enable her to provide valuable insight and guidance to the Board in all these areas. This experience and expertise likewise enhance her value to the Audit Committee, which exercises oversight responsibility for enterprise risk assessment and material risk mitigation, key areas of focus for the Committee and the chemical industry more generally.

Her tenure as the CEO of the Huntsman Cancer Institute, an NIH-designated Comprehensive Cancer Center (which puts HCI in the top 4% of more than 1,500 cancer centers nationwide) enables her to contribute extensive management skills and broad experience in both operational and strategic areas relevant to the Company's operations. Likewise, Dr. Beckerle's service on the board of Johnson & Johnson, which is widely recognized as a leader in corporate governance best practices, including her leadership of J&J's Science, Technology and Sustainability Committee, enables her to bring a unique and valuable perspective to her service on the Company's Board and its committees.

16 | HUNTSMAN 2021 PROXY

| HUNTSMAN CORPORATION: PROXY STATEMENT |

M. ANTHONY BURNS |

M. Anthony Burns, 78, has been a director of the Company and the Chair of the Audit Committee since 2010, during which time he helped oversee the transformation of the Company's balance sheet and improvement of its credit rating to investment grade. Mr. Burns also sits on the Board's Nominating and Corporate Governance Committee.

Mr. Burns served as Chairman of the Board, CEO, President and COO of Ryder System, Inc., a multi-billion dollar publicly-traded transportation and logistics services company, between 1979 and 2002, and since 2002 he has been Chairman Emeritus. He was a three-time recipient of Financial World magazine's CEO of the Year Award during his tenure at Ryder and was named "CEO of the Decade" in the Transportation, Freight & Leasing sector. Before joining Ryder, Mr. Burns held several senior financial management positions at Mobil Oil Corporation.

Mr. Burns has also acquired extensive public company board level experience over a wide range of global industries over the course of his career. He served on the boards of J.P. Morgan Chase, Stanley Black & Decker, JC Penney, and Pfizer, and he chaired audit committees at all but Pfizer. At Pfizer, Mr. Burns served as Chairman of the compensation committee.

Mr. Burns is a Life Trustee of the University of Miami in Florida and has been active in charitable, cultural, and civic organizations both nationally and in Florida. He served on the boards of United Way of America, American Red Cross, National Urban League, and the Boy Scouts of America, as well as on the Foundation Board for the Malcolm Baldridge National Quality Award. Mr. Burns also co-chaired The Business Roundtable, a nonprofit association whose members are exclusively CEOs of major United States companies. In his home state of Florida, he served as chairman of the Capital Campaign for the Performing Arts Center of Greater Miami, board chairman and campaign chairman of the United Way of Miami-Dade County, and president of the Boy Scouts of America South Florida Council. In recognition of his extensive charitable work in the aftermath of Hurricane Andrew, Mr. Burns was named by the American Red Cross as its Humanitarian of the Year.

The Board has concluded that Mr. Burns should continue to serve as a director for the following reasons among others. His CEO and other executive management level experience allows him to contribute steady leadership, strategic insight and valuable oversight at the Board level on key strategic, financial and enterprise risk-related issues regularly facing the Company. Mr. Burns' extensive experience on the audit committees at JP Morgan Chase, Stanley Black & Decker, and JC Penney, all of which he chaired, and at Pfizer, provided him broad financial management, internal control expertise, and deep familiarity with global enterprise risk management and related systems. Finally, his continued service as Chair of the Company's Audit Committee will help ensure a steady and orderly transition while the Committee's newest members become more familiar with the Company's financial management and systems of internal controls.

17 | HUNTSMAN 2021 PROXY

HUNTSMAN CORPORATION: PROXY STATEMENT |

SONIA DULÁ |

Sonia Dulá, 60, joined the Board of Directors in June 2020 and serves on the Audit Committee and the Sustainability Committee.

Ms. Dulá served as Vice Chairman of Bank of America, Latin America, and headed the Global Corporate and Investment Banking Division for the region, a position to which she was appointed in 2013, prior to retiring in 2018. Before that, Ms. Dulá led Merrill Lynch's Wealth Management Division in Latin America and was responsible for the Latin America Corporate and Investment Banking Division. Prior to joining Bank of America, Ms. Dulá served as Chief Executive Officer of Grupo Latino de Radio, the owner/operator of more than 500 radio stations in Latin America and the U.S. Hispanic market, co-founded two internet companies, Internet Group of Brazil and Obsidiana, and served as Chief Executive Officer of Telemundo Studio Mexico. She began her career as an investment banker at Goldman Sachs, based in London and New York, and rising to leadership positions. She graduated from Harvard with a degree in Economics and earned her MBA from Stanford University.

In addition to serving on the Company's Board of Directors, Ms. Dulá serves on the Board and the Audit Committee of Hemisphere Media Group, Inc., a publicly-traded Spanish language media company, and on the Board of Acciona, S.A., a publicly-traded renewable energy and infrastructure developer headquartered in Spain. Prior to 2021, she served on the Board of Promotora de Informaciones (PRISA) S.A., a leading Spanish and Portuguese-language media and education group, where she sat on the Audit and Executive Committees, and chaired the Nominating, Compensation and Corporate Governance Committee. Ms. Dulá also serves as a member of the Latin America Strategic Advisory Board of Banco Itaú, is a life member of the Council on Foreign Relations, and previously sat on the boards of the Council of the Americas, Women's World Banking, and the Arsht Center for the Performing Arts. In 2018, Ms. Dulá ranked 4th on Fortune's list of the 50 Most Powerful Latinas.

The Board has concluded that Ms. Dulá should continue to serve as a director for the following reasons, among others. Her extensive international experience and expertise in finance and investment banking provide valuable judgement and insight to the Board and executive management, as the Company continues to pursue future strategic opportunities for growth and transformation. Additionally, her entrepreneurial and executive leadership experience in Latin America bring a unique perspective to the Board, which will benefit from such experience as the Company continues to execute the strategic repositioning of our downstream business.

Finally, her service on the Board of Acciona, S.A., a publicly-traded developer of sustainable infrastructure projects and solutions, especially in the renewable energy space, will provide valuable insight and support in connection with her prospective service on the Sustainability Committee.

18 | HUNTSMAN 2021 PROXY

| HUNTSMAN CORPORATION: PROXY STATEMENT |

CYNTHIA L. EGAN |

Cynthia Egan, 65, joined the Board of Directors in 2020, bringing perspective of large institutional investors to the Company's boardroom for the first time, and serves on the Nominating and Corporate Governance Committee and the Sustainability Committee.

Ms. Egan spent a large part of her professional career in the investment management industry, retiring as President of Retirement Plan Services for T. Rowe Price Group, a global investment management organization in 2012, after serving in that capacity for five years. After leaving T. Rowe Price, Ms. Egan spent one year as a Senior Advisor to the U.S. Department of the Treasury where she advised senior level agency employees on domestic employment retirement security. Before joining T. Rowe Price, Ms. Egan held progressively more senior-level leadership positions with Fidelity Investments, a multinational financial services corporation, including Executive Vice President and Head of Fidelity Institutional Services Company, President of the Fidelity Charitable Gift Fund, and Executive Vice President of Fidelity Management Research Company. She was the founding chair of the T. Rowe Price Women's Roundtable and the founding co-chair of the Council for Women of Boston College. She started her career at the Federal Reserve Board of Governors in 1980 and worked at KPMG Peat Marwick and Bankers Trust before joining Fidelity in 1989.

In 2015, Ms. Egan joined the Board of Directors at The Hanover Insurance Group, one of the largest publicly-traded insurance companies in the United States, where she served as chair of the Compensation Committee before also becoming Vice Chair of the Board in 2020 and then Chair of the Board of Directors at the end of last year. Ms. Egan also chairs the Hanover Board's Compensation and Human Capital Committee. In addition to her board service at the Company and Hanover, Ms. Egan also serves as a director of the BlackRock Fixed Income Funds Complex and The Unum Group. She previously served on the board of Envestnet, an NYSE-listed company providing wealth management technology and products to financial advisors and institutions. Ms. Egan currently Chairs the Board of Visitors of the University of Maryland School of Medicine and has served on the boards of the Walters Art Museum and The St. Paul's School for Boys.

The Board has concluded that Ms. Egan should continue to serve as a director for the following reasons among others. Her substantial expertise and diverse experience gained during her career in the institutional investment and mutual fund industries, including her executive management level experience at T. Rowe Price and Fidelity, provide the Board and executive management a unique perspective and fully align with the Company's long-term strategy to ensure the Board and management remain focused on the priorities of Company stockholders, including leading institutions. Additionally, Ms. Egan brings to the Board substantial experience, including director-level oversight, and familiarity of developing issues and trends in the areas of human capital management and other governance-related matters.

19 | HUNTSMAN 2021 PROXY

HUNTSMAN CORPORATION: PROXY STATEMENT |

DANIELE FERRARI |

Daniele Ferrari, 59, joined the Board in March 2018 and sits on the Company's Compensation and Sustainability Committees. He previously served on the Board's Audit Committee.

Mr. Ferrari was employed as Chief Executive Officer of Versalis S.p.A., one of Europe's largest chemical companies, from 2011 through the end of 2020. He also served as Chairman of the Board of Directors of Matrìca S.p.A., a Versalis joint-venture with Novamont, an industry leader in bio-plastics and green chemistry. Matrìca is on the cutting edge of the renewable chemistry industry, operating an integrated "green" chemistry complex in Port Torres, Italy, where it develops state-of-the-art products characterized by biodegradability and low toxicity, and sourced from vegetable-based raw materials harvested from an integrated agricultural production chain. Matrìca is a leading provider of sustainable solutions in the chemical industry, combining renewability and high performance.

Mr. Ferrari was employed as a senior executive at the Company earlier in his career and has more than 35 years of operating and executive experience in the chemical industry. He worked for Imperial Chemical Industries (ICI) and Agip Petroli, a subsidiary of Eni S.p.A., a leading international oil and gas company, before joining the Company in 1997 where he ultimately became President of the Performance Products division. He recently became a senior advisor to SK Capital Partners, a private equity investment firm focused on specialty materials, chemicals and pharmaceuticals, and he sits on the board of directors of Venator Materials PLC, a stand-alone, publicly-traded global pigments company, which separated from Huntsman in 2017 and where he serves on the Compensation and Nominating and Corporate Governance Committees.

More recently, Mr. Ferrari served as President of the European Chemical Industry Council, Europe's leading trade association for the chemical industry, where he represented 29,000 chemical firms and interacted on their behalf with international and EU governmental and regulatory institutions, NGO's, international media, and other industry stakeholders. He is currently vice-president of CEFIC, member of the Executive Committee and chair of the Nominating Committee. He also served as President of PlasticsEurope Bruxelles, the association of European plastics manufacturers. Additionally, Mr. Ferrari served as a board member of the recently-created Alliance to End Plastics Waste, a global not-for-profit organization composed of more than 40 global companies that committed more than $1 billion over the next five years to help eliminate plastic waste in partnership with the financial community, various governmental agencies, and several NGO's. He is also board member of the OUEBP (Oxford University Business Economics Program).

The Board has concluded that Mr. Ferrari should continue to serve as a director for the following reasons among others. His operational and executive leadership in the chemical industry globally enables him to provide the Board and Company management valuable insight into the business in the ordinary course and effective oversight of the Company's strategic business plans. Further, the breadth of his experience and relationships he developed dealing with United Nations sustainable development goals, the Circular Economy process more broadly, and both regulatory and market-driven demand to develop eco-friendly and renewable chemistry solutions all provide Mr. Ferrari unique perspective into the key operational and functional challenges facing the Company, especially those relating sustainability, including GHG, water and waste management. And, finally, his strategic leadership of Versalis' global repositioning and rebranding provided him valuable experience, insight and contacts within the sector that further enhance Board oversight of the Company's own repositioning and rebranding efforts in downstream markets.

20 | HUNTSMAN 2021 PROXY

| HUNTSMAN CORPORATION: PROXY STATEMENT |

SIR ROBERT J. MARGETTS |

Sir Robert Margetts ("Sir Rob"), 74, has been a director of the Company since August 2010 and serves on the Nominating and Corporate Governance Committee and the Audit Committee, where he has been designated a financial expert under the Sarbanes-Oxley Act.

Sir Rob has more than 50 years of operating and executive level experience in the chemical industry, starting at the beginning of his career with Imperial Chemical Industries (ICI), a multinational chemical company based in the United Kingdom where he ultimately rose to become Executive Vice Chairman of the Board. Before becoming Vice Chairman, Sir Rob held a number of leadership positions within executive management with responsibilities for the global research, technology, engineering and manufacturing functions, including process safety and major hazard operations. Sir Rob also had executive level responsibility for many of ICI's global business units and, ultimately, became responsible at the Board level for a strategic divestment program that led to ICI's transformation into a specialty chemical company, raising $10 billion in more than 30 separate transactions, including sales of ICI's global polyurethanes, petrochemical and titanium dioxide businesses to Huntsman.

Sir Rob also has substantial board and oversight experience in the financial services and investment management sector and in other industries relevant to the Company's supply chain. In 2000, he was elected Chairman of the Board of Legal & General PLC, a multinational financial services firm founded in 1836, where he oversaw a global portfolio with more than £500 billion in assets under management. He also served as Chairman of the Board of the BOC Group PLC, a publicly-traded industrial gas business in the UK, that was ultimately sold to Linde AG for a substantial premium to stockholders. Since that time, he served as the Senior Independent Director of two global mining companies, Anglo American PLC and PJSC Uralkali, and on the Boards of Directors of Wellstream PLC and Falk Renewables PLC. Sir Rob previously served as Vice Chairman and Lead Independent Director of Venator Materials PLC, and he is founder and chairman of Ensus Ltd, a major bioethanol and protein producer and part of the CropEnergies Group, one of Europe's leading manufacturers of sustainably-produced bioethanol for the fuel sector today.

Over the course of his career, Sir Rob has played an active role in the development and implementation of public policy in the United Kingdom, especially in the areas of climate change and sustainability. He served as Chairman of the Natural Environment Research Council, a non-departmental government agency responsible for national investment in the sciences relating to climate change and the environment. More recently, he established and then chaired the Energy Technologies Institute, a public-private partnership charged with development and demonstration of new low carbon energy technologies. These, and Sir Rob's many other contributions to public life through science and engineering, were formally recognized when he was awarded the rank of Commander of the Most Excellent Order of the British Empire (CBE) and a Knighthood for his distinguished service to business, the economy, science and technology. He is likewise the recipient of many Honorary Fellowships, Doctorates and other awards, including membership in the Fellowship of the Royal Academy of Engineering (FREng), an honor given by the Royal Academy of Engineering to recognize the best and brightest engineers, inventors and technologists in the UK and around the world.