UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant x | |

| Filed by a Party other than the Registrant o | |

| Check the appropriate box: | |

| x | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| o | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material under §240.14a-12 |

| HUNTSMAN CORPORATION | ||

(Name of Registrant as Specified In Its Charter)

| ||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| ||

| Payment of Filing Fee (Check the appropriate box): | ||

| x | No fee required. | |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

| (1) | Title of each class of securities to which transaction applies: | |

| (2) | Aggregate number of securities to which transaction applies: | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| (4) | Proposed maximum aggregate value of transaction: | |

| (5) | Total fee paid: | |

| ¨ | Fee paid previously with preliminary materials. | |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| (1) | Amount Previously Paid: | |

| (2) | Form, Schedule or Registration Statement No.: | |

| (3) | Filing Party: | |

| (4) | Date Filed: | |

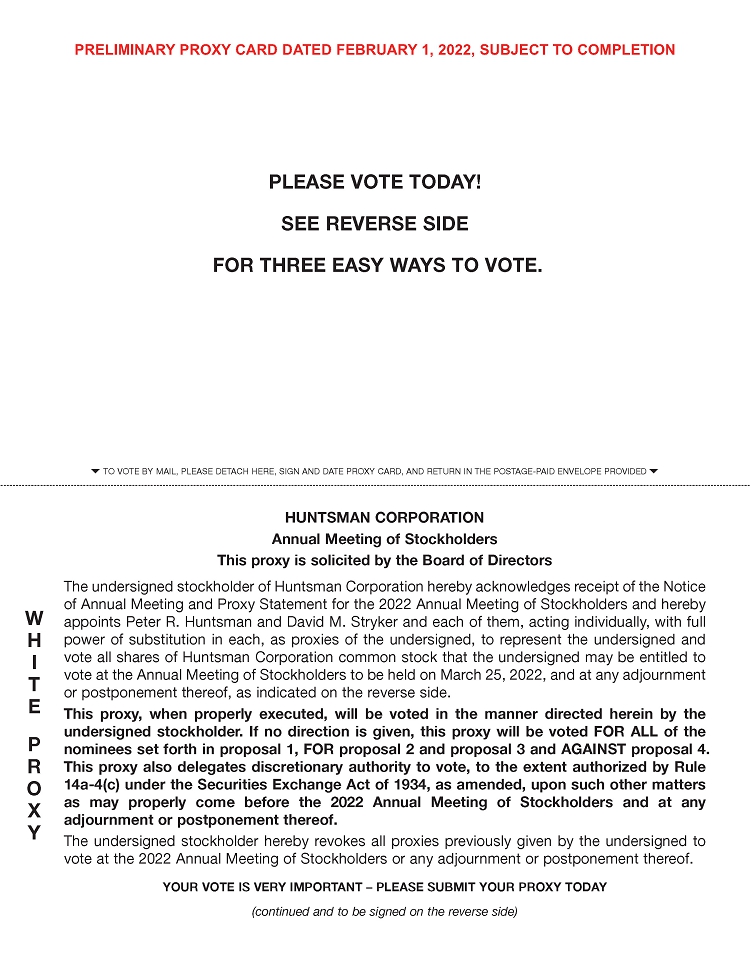

PRELIMINARY PROXY STATEMENT SUBJECT TO COMPLETION – FEBRUARY 1, 2022

AN INVITATION FROM OUR CHAIRMAN

DEAR FELLOW STOCKHOLDER:

We are pleased to invite you to attend the 2022 Annual Meeting of Stockholders of Huntsman Corporation (our “Company”), which will be held on Friday, March 25, 2022, at [●], Central Time, at [●].

It is especially important this year that you use this opportunity to take part in the affairs of our Company by voting on the business to come before the stockholders at the Annual Meeting. Starboard Value and Opportunity Master Fund Ltd and certain of its affiliates (collectively, “Starboard”) have notified us that Starboard intends to nominate candidates for election as directors at the Annual Meeting. Our Board of Directors has carefully considered the best interests of all stockholders in determining its voting recommendations. Our Board recommends that you vote FOR ALL of the nominees proposed by the Board using the enclosed WHITE proxy card and not for any of Starboard’s nominees.

We strongly urge you to read the accompanying Proxy Statement carefully and vote FOR ALL of the nominees recommended by our Board, and, in accordance with the Board’s recommendations on the other proposals, by using the enclosed WHITE proxy card. If you have voted using the proxy card sent to you by Starboard, you can subsequently revoke it by using the WHITE proxy card to vote.

Only your latest-dated vote will count - any prior proxy card may be revoked at any time prior to the Annual Meeting as described in the accompanying Proxy Statement.

If we determine to hold the Annual Meeting by means of remote communication due to concerns about COVID-19 or otherwise, we will announce the decision to do so in advance and provide details on how to participate in a press release issued by the Company. We would also file definitive additional solicitation materials with the U.S. Securities and Exchange Commission announcing that the Annual Meeting is being held exclusively by means of remote communication.

PLEASE VOTE AS SOON AS POSSIBLE

This Proxy Statement contains important information and you should read it carefully. Whether or not you plan to attend and participate in the Annual Meeting, we ask that you vote as soon as possible to ensure that your voice is heard. You may vote by proxy via the Internet or telephone, or if you received paper copies of the proxy materials via mail, you can also vote by mail by following the instructions on the proxy card or voting instruction card or the information forwarded by your broker, bank or other holder of record. For detailed information regarding voting instructions, please refer to the accompanying Proxy Statement.

If you have any questions or require assistance with voting your WHITE proxy card, please contact our proxy solicitation firm, Innisfree M&A Incorporated:

Innisfree M&A Incorporated

501 Madison Avenue, 20th Floor

New York, NY 10022

Stockholders may call toll-free at (877) 750-0926.

Banks and brokers may call collect at (212) 750-5833.

Sincerely,

PETER R. HUNTSMAN

Chairman of the Board,

President and Chief Executive Officer

HUNTSMAN 2022 PROXY

|

PRELIMINARY PROXY STATEMENT SUBJECT TO COMPLETION – FEBRUARY 1, 2022

HUNTSMAN CORPORATION NOTICE OF 2022 ANNUAL MEETING OF STOCKHOLDERS

| |

| [●] |

March 25, 2022 [●] Central Time |

TO THE STOCKHOLDERS OF HUNTSMAN CORPORATION:

We are holding the 2022 Annual Meeting of Stockholders (including any postponements, adjournments or continuations thereof, the “Annual Meeting”) for the following purposes:

| 1. | To elect as directors 10 nominees to serve until the 2023 Annual Meeting of Stockholders or her/his earlier resignation, removal or death. |

| 2. | To approve, on a non-binding advisory basis, the compensation of our named executive officers, or “NEOs.” |

| 3. | To ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the year ending December 31, 2022. |

| 4. | If properly presented at the meeting, to vote on a proposal submitted by a stockholder to lower the ownership threshold for special meetings of stockholders to 10%. |

| 5. | To transact such other business as may properly come before the Annual Meeting in accordance with our Bylaws. |

The accompanying Proxy Statement provides detailed information about the matters to be considered at the Annual Meeting. Regardless of whether you plan to attend the Annual Meeting, we hope you will read the accompanying Proxy Statement and vote as soon as possible so that your voice is heard. This Notice of 2022 Annual Meeting of Stockholders, the Annual Report on Form 10-K for the year ended December 31, 2021 and the attached Proxy Statement and form of WHITE proxy card are first being sent to stockholders of record as of [●], 2022, on or about [●], 2022.

We urge you to vote TODAY by following the instructions on the WHITE proxy card to vote on the Internet, by telephone or by completing, signing, dating and returning the WHITE proxy card in the enclosed, postage pre-paid envelope. Returning a proxy does not deprive you of your right to attend the Annual Meeting and to vote your shares at the Annual Meeting. If you are the beneficial but not record owner of your shares (that is, you hold your shares in “street name” through an intermediary such as a broker), you will receive instructions from your broker as to how to vote your shares.

Please note that Starboard Value and Opportunity Master Fund Ltd and certain of its affiliates (collectively, “Starboard”) have stated their intention to propose four of their own director nominees for election at the Annual Meeting. You may receive solicitation materials from Starboard. The Company is not responsible for the accuracy of any information provided by Starboard or its nominees contained in solicitation materials filed or disseminated by or on behalf of Starboard or any other statements that Starboard may make. The Board does NOT endorse Starboard’s nominees and strongly recommends that you NOT sign or return any blue proxy card sent to you by Starboard.

THE BOARD RECOMMENDS VOTING “FOR ALL” OF THE BOARD’S NOMINEES ON PROPOSAL 1, “FOR” PROPOSALS 2 AND 3 AND “AGAINST” PROPOSAL 4 USING THE ENCLOSED WHITE PROXY CARD.

THE BOARD ALSO URGES YOU NOT TO SIGN, RETURN

OR VOTE

ANY BLUE PROXY CARD SENT TO YOU BY STARBOARD.

If you vote, or have previously voted, using a blue proxy card sent to you by Starboard, you can subsequently revoke that proxy by following the instructions on the enclosed WHITE proxy card to vote over the Internet or by telephone or by completing, signing and dating the WHITE proxy card and mailing it in the postage pre-paid envelope provided. Only your latest dated proxy will count. Any proxy may be revoked at any time prior to its exercise at the Annual Meeting as described in the accompanying Proxy Statement.

Thank you for your continued support, interest and investment in Huntsman Corporation.

HUNTSMAN 2022 PROXY

| By Order of the Board of Directors, | |

| |

| David M. Stryker Secretary | |

| The Woodlands, Texas [●], 2022 |

HUNTSMAN 2022 PROXY

IMPORTANT

To help ensure that your shares are represented at the Annual Meeting, we urge you to promptly complete, sign, date and return the enclosed WHITE proxy card in the postage-paid envelope provided, or vote by telephone or the Internet as instructed on the WHITE proxy card, whether or not you plan to attend the meeting. You can revoke your proxy at any time before the proxies you appointed cast your votes.

If you have questions about how to vote your shares, please call Innisfree M&A Incorporated, the firm assisting us in the solicitation of proxies in connection with the Annual Meeting. Stockholders may call toll-free at (877) 750-0926. Banks and brokers may call collect at (212) 750-5833.

HUNTSMAN 2022 PROXY

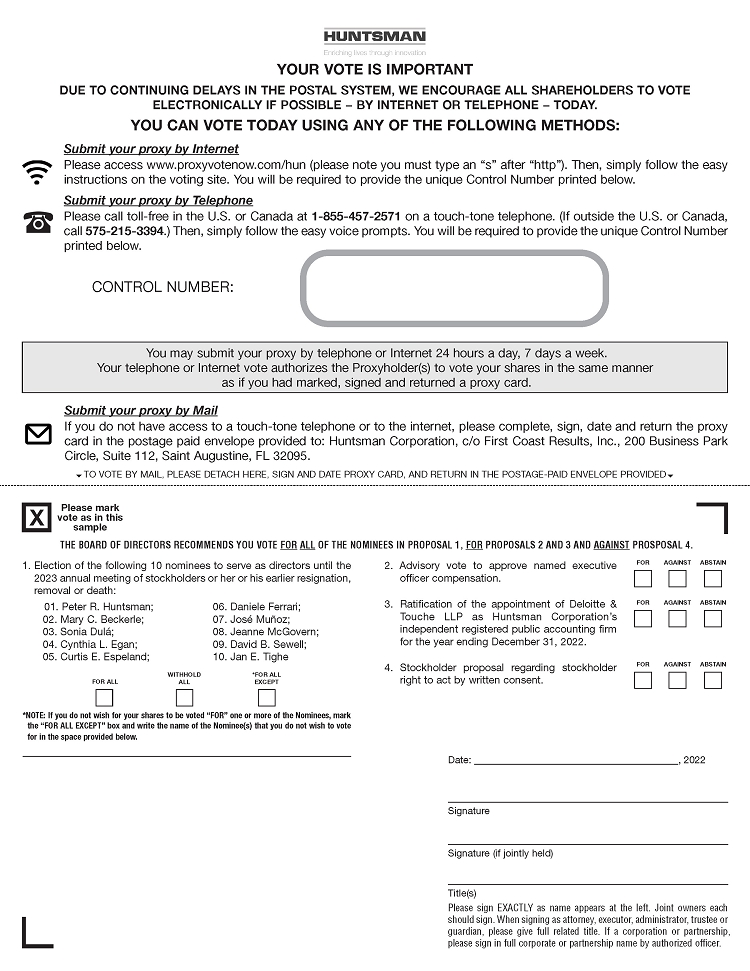

PARTICIPATE IN OUR FUTURE, VOTE NOW

Your vote is important to us and allows you to participate in the future of our Company.

Please cast your vote as soon as possible on the items listed below to ensure that your shares are represented.

PROPOSALS REQUIRING YOUR VOTE

| Board Recommendation |

Votes Required for Approval |

Unvoted Shares | Abstentions | ||

| PROPOSAL 1 | Election of Directors | FOR ALL of the nominees recommended by the Board | Plurality of votes cast | Do not count | Will have no effect on the outcome |

| PROPOSAL 2 | Non-Binding Advisory Vote on Named Executive Officer Compensation | FOR | Majority of shares present (in person or represented by proxy) and entitled to vote on the matter | Do not count | Count as a vote against |

| PROPOSAL 3 | Ratification of Independent Registered Public Accounting Firm | FOR | Majority of shares present (in person or represented by proxy) and entitled to vote on the matter | Discretionary voting not allowed to the extent you receive competing proxy materials from Starboard | Count as a vote against |

| PROPOSAL 4(1) | Stockholder Proposal to Lower Ownership Threshold for Special Meetings of Stockholders to 10% | AGAINST | Majority of shares present (in person or represented by proxy) and entitled to vote on the matter | Do not count | Count as a vote against |

| (1) | If properly presented by the stockholder proponent at the Annual Meeting. |

VOTING OPTIONS

Even if you plan to attend and participate in our Annual Meeting, please read this Proxy Statement with care, and vote by proxy to make sure your shares are represented at the Annual Meeting. In all cases, have your WHITE proxy card in hand and simply follow the instructions set forth on the enclosed WHITE proxy card.

HUNTSMAN 2022 PROXY

PROXY STATEMENT TABLE OF CONTENTS

HUNTSMAN 2022 PROXY

HUNTSMAN 2022 PROXY

| HUNTSMAN CORPORATION: PROXY STATEMENT |

PRELIMINARY PROXY STATEMENT SUBJECT TO COMPLETION – FEBRUARY 1, 2022

HUNTSMAN PROXY STATEMENT SUMMARY

To assist you in reviewing the proposals to be voted upon at the 2022 Annual Meeting of Stockholders (including any postponements, adjournments or continuations thereof, the “Annual Meeting”) of Huntsman Corporation (“Huntsman” or our “Company”), this summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all of the information you should consider. You should read the entire Proxy Statement carefully before voting.

The 2021 Annual Report on Form 10-K for the year ended December 31, 2021 (“2021 Form 10-K”), the Notice of Annual Meeting, this Proxy Statement and the accompanying form of WHITE proxy card are first being sent to stockholders of record as of [●], 2022, on or about [●], 2022.

ANNUAL MEETING DETAILS

| Date and Time | Place |

| [●] Central Time, on March 25, 2022 | [●] |

| Record Date | Common Stock Outstanding as of the Record Date |

| [●], 2022 | [●] |

MEETING AGENDA AND VOTING RECOMMENDATIONS

| Proposal | Board Recommendation | |

| 1. | Election of 10 nominees to serve as directors until the 2023 Annual Meeting of Stockholders or her/his earlier resignation, removal or death | FOR ALL nominees recommended by the Board |

| 2. | Advisory vote to approve named executive officer compensation | FOR |

| 3. | Ratification of appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the year ending December 31, 2022 | FOR |

| 4. | If properly presented at the Annual Meeting, a stockholder proposal to lower ownership threshold for special meetings of stockholders to 10% | AGAINST |

It is especially important this year that you use this opportunity to take part in the affairs of our company by voting on the business to come before the stockholders at the Annual Meeting. Starboard Value and Opportunity Master Fund Ltd and certain of its affiliates (collectively, “Starboard”) have notified us that Starboard intends to nominate candidates for election as directors at the Annual Meeting. Our Board of Directors (the “Board of Directors” or the “Board”) does not recommend Starboard’s nominees and recommends that you vote FOR ALL of the nominees proposed by the Board using the WHITE proxy card.

We strongly urge you to read this Proxy Statement carefully and vote FOR ALL of the nominees recommended by our Board, and, in accordance with the Board’s recommendations on the other proposals, by using the enclosed WHITE proxy card. If you vote, or have already voted, using the blue proxy card sent to you by Starboard, you can subsequently revoke it by using the WHITE proxy card to vote. Only your latest-dated vote will count—any prior proxy card may be revoked at any time prior to the Annual Meeting as described in the accompanying Proxy Statement.

You may receive solicitation materials from Starboard. We are not responsible for the accuracy of any information provided by Starboard or its nominees contained in solicitation materials filed or disseminated by or on behalf of Starboard or any other statements that Starboard may make.

The Board does NOT endorse STARBOARD’s nominees and strongly recommends that you NOT sign or return any BLUE proxy card sent to you by STARBOARD. If you VOTE, OR have previously voted, using a BLUE proxy card sent to you by STARBOARD, you can subsequently revoke that proxy by following the instructions on the enclosed WHITE proxy card to vote over the internet or by telephone or by completing, signing and dating the WHITE proxy card and mailing it in the postage pre-paid envelope provided. Only your latest dated proxy will count. Any proxy may be revoked at any time prior

1 | HUNTSMAN 2022 PROXY

| HUNTSMAN CORPORATION: PROXY STATEMENT |

to its exercise at the Annual Meeting as described in thIS Proxy Statement.

If you have any questions or require assistance with voting your WHITE proxy card, please contact our proxy solicitation firm, Innisfree M&A Incorporated:

Innisfree M&A Incorporated

501 Madison Avenue, 20th Floor

New York, NY 10022

Stockholders may call toll-free at (877) 750-0926

Banks and brokers may call collect at (212) 750-5833

2021 MILESTONES AND PERFORMANCE HIGHLIGHTS

Despite continued macroeconomic instability, we achieved many successes on the operational, governance, and value-creation fronts in 2021:

We Laid Out a Compelling Vision for Our Future and Credible Steps We Are Taking to Get There:

| • | Announced ambitious financial targets and highlighted our portfolio and strategic priorities with a well-received Investor Day in November |

| • | Unveiled a multi-year compensation plan to ensure achievement of the targets presented at Investor Day by aligning the interests of all of our Officers and Vice Presidents with the interests of all stockholders. |

| • | Expanded our cost optimization and synergies program, with a $240 million annualized run-rate to be delivered by the end of 2023, $[●] million of annualized run-rate savings achieved in 2021, and $[●] million of targeted annualized savings to be delivered by the end of 2022 |

| • | Completed the acquisition of Gabriel Performance Products for approximately $250 million to enhance our Advanced Materials product portfolio |

| • | Announced investments to expand our Performance Products portfolio, including catalysts for Polyurethane insulation, carbonates for lithium-ion electric vehicle batteries and performance amines for semiconductors |

We Took Action on Governance Initiatives That Are Important To the Board and Stockholders:

| • | Enhanced our Board by appointing Jeanne McGovern and identifying Curtis Espeland, José Muñoz and David Sewell, who were each appointed to our Board in January 2022 |

| • | Laid the foundation for our January 2022 announcement of new Board leadership, including identifying Cynthia Egan to become our next Non-Executive Vice Chair, Lead Independent Director of the Board and Chair of the Nominating and Corporate Governance Committee and Sonia Dulá to become the next Chair of the Compensation Committee |

| • | Formed a Sustainability Committee of the Board, chaired by Jan Tighe, which oversees sustainability and other related corporate social responsibilities and governance matters |

| • | Announced our aim to reach carbon neutrality by 2050 |

We Created Value For Stockholders Over and Above Our Business Operations:

| • | Won $665 million as an arbitration award against Albemarle Corporation of which $332.5 million was received in December 2021 |

| • | Returned a substantial amount of capital to our stockholders, including increasing our quarterly dividend by 15% in April 2021, distributing approximately $[●] million in dividends |

| • | In the second half of 2021, repurchased [●] million shares for approximately $[●] million |

| • | Announced a new share repurchase program in November of at least $1 billion over three years |

BOARD’S DIRECTOR NOMINEES (PROPOSAL 1)

The following table provides summary information about each of the Board’s director nominees. We ask you to vote “FOR ALL” of our director nominees using the enclosed WHITE proxy card.

| Nominee | Age | Director Since |

Principal Occupation | Committees |

| Peter R. Huntsman | 59 | 2005 | Chairman of the Board, President and Chief Executive Officer of Huntsman Corporation (our “CEO”) | Litigation & Public Policy |

2 | HUNTSMAN 2022 PROXY

| HUNTSMAN CORPORATION: PROXY STATEMENT |

| Mary C. Beckerle | 67 | 2011 | Chief Executive Officer of University of Utah Huntsman Cancer Institute | Audit, Governance |

| Sonia Dulá | 61 | 2020 | Former Vice Chairman of Bank of America, Latin America | Compensation, Sustainability |

| Cynthia L. Egan | 66 | 2020 | Former President of Retirement Plan Services of T. Rowe Price Group and Non-Executive Vice Chair and Lead Independent Director of Huntsman Corporation | Governance, Sustainability |

| Curtis E. Espeland | 57 | 2022 | Former Executive Vice President of Eastman Chemical Company | N/A |

| Daniele Ferrari | 60 | 2018 | Former Chief Executive Officer of Versalis S.p.A. | Compensation, Sustainability |

| José Muñoz | 56 | 2022 | Global Chief Operating Officer of Hyundai Motor Company | N/A |

| Jeanne McGovern | 63 | 2021 | Retired Partner, Deloitte & Touche LLP | Audit |

| David B. Sewell | 53 | 2022 | Chief Executive Officer of WestRock Company | N/A |

| Jan E. Tighe | 59 | 2019 | Retired Vice Admiral of the U.S. Navy | Audit, Sustainability |

3 | HUNTSMAN 2022 PROXY

| HUNTSMAN CORPORATION: PROXY STATEMENT |

CORPORATE GOVERNANCE HIGHLIGHTS

The Board is committed to corporate governance principles and practices that facilitate the fulfillment of its fiduciary duties to stockholders and to our Company. Key corporate governance highlights include:

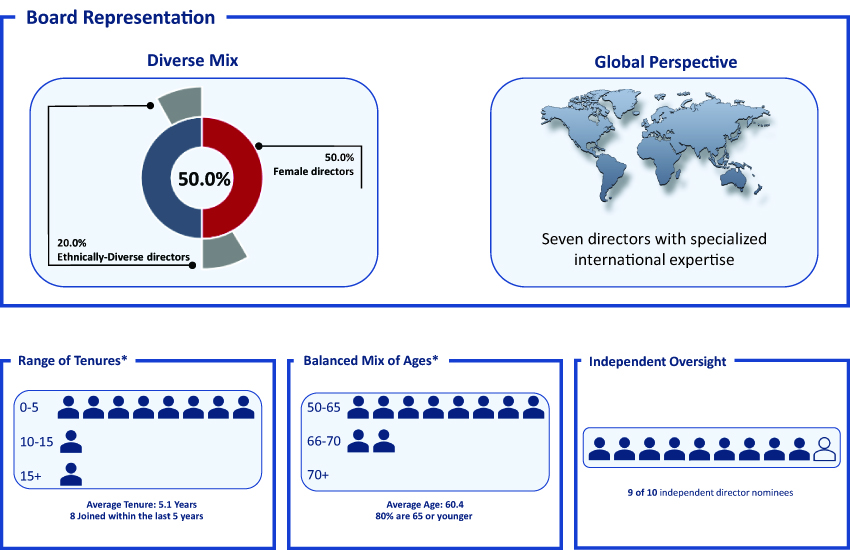

| ROBUST INDEPENDENCE AND THOUGHTFUL BOARD RENEWAL | |

| All members of our Board, except our CEO, are independent | ü |

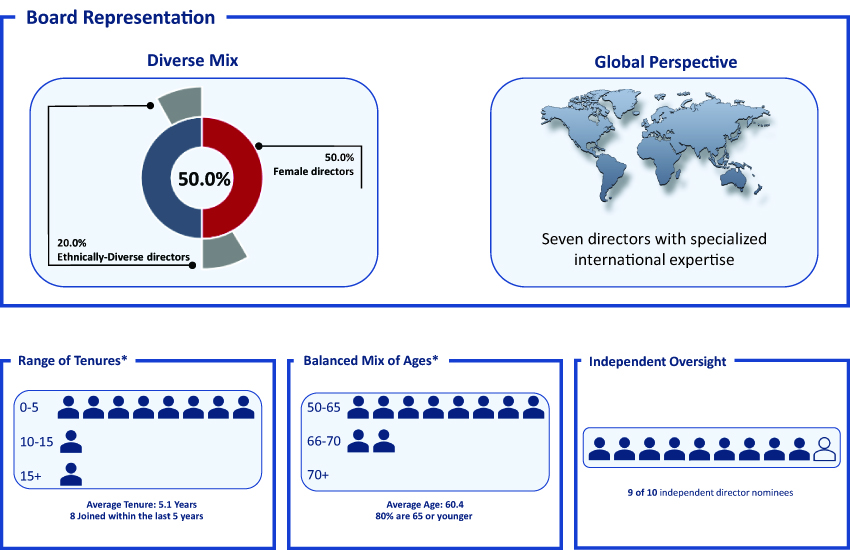

Five of our 10 director nominees are women (50.0% gender diversity), two add ethnic diversity and one adds diversity as a veteran |

ü |

| Eight new independent directors (including four women) added to the Board since 2018 | ü |

| Four of five Board committees will have women chairs, effective at the Annual Meeting; our Lead Independent Director and Non-Executive Vice Chair is female | ü |

| Selected new non-executive chairs for each of the standing Board committees within last year and named new Lead Independent Director and Non-Executive Vice Chair | ü |

| ACCOUNTABILITY TO STOCKHOLDERS | |

| Majority voting for director nominees in all uncontested elections | ü |

| Simple majority stockholder voting requirements | ü |

| Stockholders may request special meetings of stockholders at the ownership threshold of 15% (reduced in 2020 from 25%) | ü |

| Eligible stockholders may nominate director nominees through our proxy materials (proxy access) | ü |

| Robust stock ownership guidelines for directors and executive officers | ü |

| Policy prohibiting short sales by directors and executive officers | ü |

| PRUDENT RISK OVERSIGHT | |

| Separate and 100% independent Sustainability Committee provides direct oversight of sustainability and other related corporate social responsibility and governance matters | ü |

| Board and committee oversight of operational, environmental, health and safety, financial, strategic, competitive, reputational, cybersecurity, legal and regulatory risks | ü |

BOARD DIVERSITY

Director succession is a thoughtful, ongoing process at Huntsman Corporation. Our Board evaluates desired attributes in light of our strategy and evolving needs. As part of our Board’s multi-year director succession and refreshment process that began in the end of 2017, we have added eight new independent directors (including four women, two ethnically-diverse directors and one veteran) to the Board.

Our Board consists of a highly qualified, diverse group of leaders in their respective fields and is representative of an effective mix of deep Company knowledge and fresh perspective. The following graphic illustrates the diverse and well-rounded range of attributes, viewpoints and experiences of our 10 director nominees.

4 | HUNTSMAN 2022 PROXY

| HUNTSMAN CORPORATION: PROXY STATEMENT |

EXECUTIVE COMPENSATION (PROPOSAL 2)

WE ASK THAT YOU VOTE TO APPROVE OUR SAY-ON-PAY PROPOSAL

At the Annual Meeting, our stockholders will again have an opportunity to cast an advisory say-on-pay vote on the compensation paid to our named executive officers. We ask you to vote “FOR” to approve our named executive officer compensation using the enclosed WHITE proxy card. Please see “Proposal 2—Advisory Vote to Approve Named Executive Officer Compensation.” Please also read our “Compensation Discussion and Analysis” beginning on page [●] for more information regarding our executive compensation program in 2021.

5 | HUNTSMAN 2022 PROXY

| HUNTSMAN CORPORATION: PROXY STATEMENT |

Executive Summary

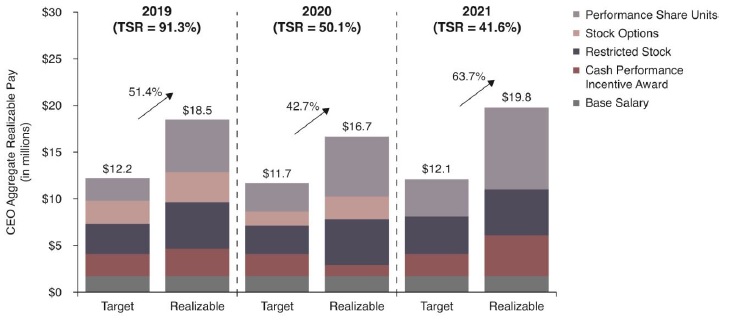

The Compensation Committee believes the design of our executive compensation program, and the Committee’s decisions, achieve its primary objective of aligning the financial interests of our NEOs with the creation of long-term stockholder value, as reflected by the pay outcomes in 2021.

| COMPANY PERFORMANCE HIGHLIGHTS | COMPENSATION STRUCTURE AND OUTCOMES |

2021 was a notable year for our Company marked with significant milestones. We delivered strong performance on key financial, strategic and ESG initiatives in 2021; highlights include:

• Financial: [●] goals for Adjusted EBITDA, Adjusted Free Cash Flow and other corporate objectives; realized significant cost savings including the acceleration of synergy capture of acquired businesses; and returned approximately $[●] million to stockholders through dividends and share repurchases; won award of $665 million in Albemarle arbitration, of which $332.5 million was received in December 2021

• Total Shareholder Return: Achieved a cumulative TSR of 84.4% for the three-year period ended December 31, 2021, which ranked third (in the 66.7th percentile) among our 2019 Performance Peers(1)

• Strategic: Initiated a strategic review process for the Textile Effects Division to continue advancing our focus on portfolio enhancement; authorized new share repurchases of $1 billion over the next three years, building on the $682 million of share repurchases we have completed since 2018; closed the acquisition of Gabriel Performance Products, further enhancing our advanced materials portfolio

• ESG: Outperformed our environmental, health and safety (“EH&S”) goals; published our 10th annual sustainability report with disclosure in line with SASB and GRI reporting standards

|

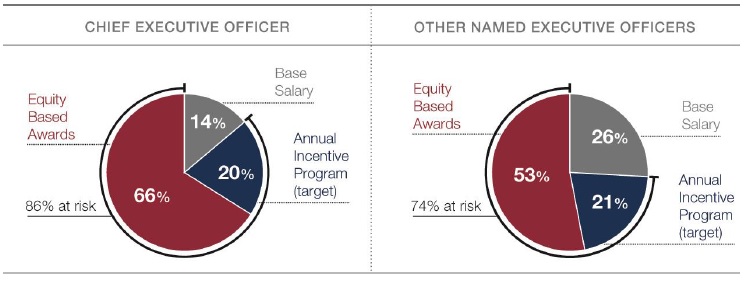

The primary objective of our executive compensation program is to align the financial interests of our NEOs with the creation of long-term stockholder value. Key features of the program include:

• Annual and long-term incentive plans designed to align executives’ pay with Company performance

• Robust compensation benchmarking against a peer group

• Comprehensive policies and practices intended to support well-informed decisions and a sound compensation governance process

During 2021, the Compensation Committee focused on responding appropriately to the continued business impacts of the pandemic while maintaining our pay-for-performance philosophy. Key decisions included:

• Approved 2021 annual cash performance award to our NEOs of between [●]% to [●]% of target incentive based on Company’s performance against preset goals

• Approved the payout of performance share units awarded in 2019 at 150% of target, reflecting our TSR performance relative to peers over the 2019-2021 period

• Implemented a broad-based multi-year incentive program conditioned on the achievement of 2021 Investor Day targets, thereby promoting transparency, ensuring objective accountability, and fostering execution

|

| (1) | For additional discussion of our three-year cumulative TSR achievement and our 2019 Performance Peers, see “—2021 Executive Compensation Decisions—Long-Term Equity Compensation—Payout of 2019 Performance Share Unit Awards.” |

New Incentive Program Strengthens Alignment of Interests

At our 2021 annual meeting, the say-on-pay proposal received the support of 78% of the votes cast. In determining executive compensation, the Compensation Committee carefully considered the say-on-pay results and the stockholder feedback we received.

In response to stockholder feedback received, the Compensation Committee has consistently implemented improvements that further align incentive payouts with the creation of stockholder value. Specifically, the Compensation Committee has incrementally increased the weighting of performance share units from 30% of equity-based incentives in 2019, to 40% in 2020, and 50% in 2021. For 2022, the Compensation Committee further increased the weighting of performance share units to 70% for 2022. The Compensation Committee believes that the increased emphasis on performance share units better incentivizes and rewards executives for actions that create sustainable stockholder value, and hence are more effective in implementing our compensation objectives.

As a part of ongoing review of our executive compensation program and the desire to better align pay outcomes across the Company with performance against preset goals, in December 2021, our Board authorized and will oversee the implementation of, a multi-year compensation plan that covers all corporate officers and vice presidents, including NEOs. The vesting of these incentives, starting in 2022, will be conditioned upon the achievement of the targets presented at our Investor Day in November 2021 with the specific intention of aligning the employees’ interests with those of all long-term stockholders.

Starting in 2022, a significant majority of the plan participants’ equity incentives will be performance-based and tied to relative Total Shareholder Return and Free Cash Flow measures. In addition, the entirety of our annual cash performance awards will be linked to the achievement of the Adjusted EBITDA margin, Optimization Program and Free Cash Flow targets set out at the Investor Day. Each of these targets builds on a multi-year effort to improve upon our 2021 performance.

We believe these changes to our executive compensation program will enhance our culture of accountability and effectively incentivize our management team to deliver on our Investor Day commitments and generate enhanced stockholder value.

6 | HUNTSMAN 2022 PROXY

| HUNTSMAN CORPORATION: PROXY STATEMENT |

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM (PROPOSAL 3)

We ask you to vote “FOR” the ratification of Deloitte & Touche LLP as our independent registered public accounting firm for the year ending December 31, 2022 using the enclosed WHITE proxy card.

STOCKHOLDER PROPOSAL to lower ownership threshold for special meeting of stockholders to 10% (PROPOSAL 4)

We ask you to vote “AGAINST” the stockholder proposal to lower ownership threshold for special meetings of stockholders to 10% using the enclosed WHITE proxy card. Please see page [●] for our Board’s Statement in Opposition.

7 | HUNTSMAN 2022 PROXY

| HUNTSMAN CORPORATION: PROXY STATEMENT |

HUNTSMAN CORPORATION PROXY STATEMENT

| PART 1 | INFORMATION ABOUT THE MEETING |

This Proxy Statement is being furnished to the stockholders of Huntsman in connection with the solicitation of proxies by the Board. The proxies are to be voted at the Annual Meeting to be held on Friday, March 25, 2022, at [●] Central Time at [●], for the purposes set forth in the accompanying Notice of Annual Meeting. The Board is not aware of any other matters to be presented at the Annual Meeting.

These materials also include a WHITE proxy card for the Annual Meeting. WHITE proxy cards are being solicited on behalf of the Board. The proxy materials include detailed information about the matters that will be discussed and voted on at the Annual Meeting and provide updated information about us that you should consider in order to make an informed decision when voting your shares.

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING AND VOTING

1. WHAT IS THE PURPOSE OF THE ANNUAL MEETING?

At the Annual Meeting, stockholders will vote upon the matters outlined in the Notice of Annual Meeting of Stockholders, which are:

| 1. | To elect as directors 10 nominees to serve until the 2023 Annual Meeting of Stockholders (the “2023 Annual Meeting”) or her/his earlier resignation, removal or death. |

| 2. | To approve, on a non-binding advisory basis, the compensation of our named executive officers, or “NEOs.” |

| 3. | To ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the year ending December 31, 2022. |

| 4. | If properly presented at the meeting, to vote on a proposal submitted by a stockholder to lower the ownership threshold for special meetings of stockholders to 10%. |

| 5. | To transact such other business as may properly come before the Annual Meeting in accordance with our Sixth Amended and Restated Bylaws of Huntsman Corporation dated June 16, 2020, as amended (our “Bylaws”). |

The Board is not aware of any other matters to be presented at the Annual Meeting. In addition, our management will respond to questions from stockholders following the adjournment of the formal business at the Annual Meeting.

The Board recommends voting “FOR ALL” of the Board’s nominees on Proposal 1, “FOR” Proposals 2 and 3 and “AGAINST” Proposal 4 using the enclosed WHITE proxy card.

2. WHEN AND WHERE WILL THE ANNUAL MEETING BE HELD?

The Annual Meeting is scheduled to be held on Friday, March 25, 2022, at [●] Central Time at [●].

Attendance at the Annual Meeting will be limited to stockholders as of the close of business on [●], 2022 (the “Record Date”), their authorized representatives and guests of the Company. Access to the Annual Meeting may be granted to others at the discretion of the Company and the chair of the Annual Meeting. In accordance with security procedures, all persons attending the Annual Meeting must present picture identification along with proof of ownership. If you are a stockholder of record, please be prepared to provide the top portion of your proxy card. If you hold your shares in “street name,” you will need to provide proof of ownership, such as a recent account statement or letter from your broker. Cameras and recording devices will not be permitted at the Annual Meeting.

8 | HUNTSMAN 2022 PROXY

| HUNTSMAN CORPORATION: PROXY STATEMENT |

Even if you plan to attend the Annual Meeting, we strongly urge you to vote in advance by voting via the Internet or by telephone or by completing, signing, and dating the enclosed WHITE voting instruction form or WHITE proxy card and returning it in the postage pre-paid envelope provided, as soon as possible.

If we determine to hold the Annual Meeting by means of remote communication due to concerns about COVID-19 or otherwise, we will announce the decision to do so in advance and provide details on how to participate in a press release issued by the Company. We would also file definitive additional solicitation materials with the U.S. Securities and Exchange Commission (the “SEC”) announcing that the Annual Meeting is being held exclusively by means of remote communication.

3. WHO IS STARBOARD?

Starboard Value LP is an activist hedge fund based in New York City. Starboard has provided notice to the Company of their intent to nominate director candidates for election to the Board at the Annual Meeting. You may receive proxy solicitation materials from Starboard. The Company is not responsible for the accuracy of any information contained in any proxy solicitation materials filed or disseminated by, or on behalf of, Starboard or any other statements that they may otherwise make.

The Board does not endorse any of Starboard’s nominees and recommends that you vote “FOR ALL” the Board’s nominees, “FOR” Proposals 2 and 3 and “AGAINST” Proposal 4 using the enclosed WHITE proxy card. The Board urges you to disregard any materials and NOT to sign, return or vote using any blue proxy card sent to you by or on behalf of Starboard. Voting to “withhold” with respect to any of Starboard’s nominees on a blue proxy card sent to you by Starboard is not the same as voting for the Board’s nominees, because a vote to “withhold” with respect to any of Starboard’s nominees on Starboard’s blue proxy card will revoke any WHITE proxy you may have previously submitted. To support the Board’s nominees, you should vote “FOR ALL” the Board’s nominees on the WHITE proxy card. If you vote, or have already submitted a vote, using any blue proxy card provided by or on behalf of Starboard, you have the right to change your vote by following the instructions on the enclosed WHITE proxy card to vote by internet or telephone or by signing, dating and returning the enclosed WHITE proxy card in the postage pre-paid envelope provided or by voting at the Annual Meeting. Only your latest-dated proxy will count.

4. WHY HAVE I RECEIVED DIFFERENT COLOR PROXY CARDS?

As discussed in the previous question, Starboard has notified us that it intends to nominate candidates for election as directors at the Annual Meeting. We have provided you with the enclosed WHITE proxy card. Starboard may send you a blue proxy card. The Board recommends only using the enclosed WHITE proxy card to vote FOR ALL of the Board’s nominees for election as directors. The Board also recommends that you disregard any blue proxy cards you may receive.

Your shares may be owned through more than one brokerage or other share ownership account. In order to vote all of the shares that you own, you must use each WHITE proxy card you receive in order to vote with respect to each account by internet, by telephone or by signing, dating and returning the WHITE proxy card in the postage pre-paid envelope provided.

If Starboard proceeds with their previously announced nominations, the Company will likely conduct multiple mailings prior to the Annual Meeting date to ensure stockholders have the Company’s latest proxy information and materials to vote. The Company will send you a new WHITE proxy card with each mailing, regardless of whether you have previously voted. We encourage you to vote every WHITE proxy card you receive. The latest dated proxy you submit will be counted, and, if you wish to vote as recommended by the Board, then you should only submit WHITE proxy cards.

5. WHAT IS INCLUDED IN THE COMPANY’S PROXY MATERIALS?

The Company’s proxy materials include: (1) the Notice of Annual Meeting of Stockholders; (2) this Proxy Statement; (3) the 2021 Form 10-K; and (4) a WHITE proxy card or a WHITE voting instruction card for the Annual Meeting.

You may refer to the 2021 Form 10-K for financial and other information about our operations. The 2021 Form 10-K is not incorporated by reference into this Proxy Statement and is not deemed to be a part hereof.

9 | HUNTSMAN 2022 PROXY

| HUNTSMAN CORPORATION: PROXY STATEMENT |

6. WHAT IS A PROXY?

A proxy is your legal designation of another person to vote the stock you own. That other person is called a proxy. If you designate someone as your proxy in a written document, that document also is called a proxy or a proxy card. Peter R. Huntsman, our Chairman of the Board, President and Chief Executive Officer, also referred to herein as our “CEO,” and David M. Stryker, our Executive Vice President, General Counsel and Secretary, will serve as proxies for the Annual Meeting pursuant to the WHITE proxy cards solicited by our Board.

7. WHAT IS A PROXY STATEMENT?

A proxy statement is a document that the regulations of the SEC requires us to give you when we ask that you designate Peter R. Huntsman and David M. Stryker as proxies to vote on your behalf. This Proxy Statement includes information about the proposals to be considered at the Annual Meeting and other required disclosures, including information about the Board and our executive officers.

8. HOW CAN I ACCESS THE PROXY MATERIALS OVER THE INTERNET?

Your WHITE proxy card or WHITE voting instruction form (as applicable) contains instructions on how to view our proxy materials online at [●].

9. WHAT IS THE RECORD DATE AND WHAT DOES IT MEAN?

The Record Date for the Annual Meeting is [●], 2022. Owners of record of our Common Stock, par value $0.01 per share (“common stock”) at the close of business on the Record Date are entitled to:

| • | receive notice of the Annual Meeting; and |

| • | vote at the Annual Meeting in accordance with our Bylaws. |

At the close of business on [●], 2022, there were [●] shares of our common stock outstanding, each of which is entitled to one vote on each item of business to be conducted at the Annual Meeting. At the Annual Meeting, stockholders will collectively be able to cast [●] votes, consisting of one vote for each share of common stock outstanding on the Record Date. There is no cumulative voting, and the holders of the common stock vote together as a single class. Stockholders do not have appraisal rights under Delaware law in connection with this proxy solicitation.

10. WHO MAY ATTEND THE ANNUAL MEETING?

All stockholders of record who owned shares of common stock on the Record Date, or their duly appointed proxies, may attend the Annual Meeting, as may our invited guests. Seating is limited and admission is on a first-come, first-served basis. If you are a stockholder and attend the Annual Meeting, you will need to bring a form of personal identification (such as a driver’s license) and check in at the registration desk at the Annual Meeting. Please note that if you hold shares in “street name” (that is, in a brokerage account or through a bank or other nominee), you also will need to bring a copy of a statement reflecting your share ownership as of [●], 2022.

11. HOW MANY VOTES ARE REQUIRED TO HOLD THE ANNUAL MEETING?

The required quorum for the transaction of business at the Annual Meeting is a majority of all outstanding shares of our common stock entitled to vote in the election of directors at the Annual Meeting, represented in person or by proxy. Consequently, the presence, in person or by proxy, of the holders of at least [●] shares of our common stock is required to establish a quorum at the Annual Meeting. Shares that are voted with respect to a particular matter are treated as being present at the Annual Meeting for purposes of establishing a quorum.

12. WHAT IS THE DIFFERENCE BETWEEN A STOCKHOLDER OF RECORD AND A STOCKHOLDER WHO HOLDS STOCK IN STREET NAME?

Most stockholders hold their shares through a broker, bank or other nominee (i.e., in “street name”) rather than directly in their own name. As summarized below, there are some distinctions between shares held of record and those held in street name.

| • | Stockholders of Record. If your shares are registered directly in your name with our transfer agent, you are considered, with respect to those shares, the “stockholder of record.” |

10 | HUNTSMAN 2022 PROXY

| HUNTSMAN CORPORATION: PROXY STATEMENT |

| • | Street Name Stockholders. If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered, with respect to those shares, the beneficial owner of shares held in “street name.” If you are a street name stockholder, you will be forwarded proxy materials by your broker, bank or other nominee, which is considered, with respect to those shares, the stockholder of record. As the beneficial owner, you have the right to instruct your broker, bank or other nominee how to vote. Your broker, bank or other nominee has provided a WHITE voting instruction form for you to use in directing the broker, bank or other nominee how to vote your shares. If you fail to provide sufficient instructions to your broker, bank or other nominee, they may be prohibited from voting your shares. See “If I am a street name holder, will my shares be voted if I do not provide my proxy?” as described in Question 16 below. |

13. WHAT DIFFERENT METHODS CAN I USE TO VOTE?

Stockholders of Record: Stockholders of record may (1) vote their shares in person at the Annual Meeting by completing a ballot; or (2) submit a proxy to have their shares voted by one of the following methods:

| • | By Internet. You may submit a proxy electronically on the Internet by following the instructions provided on the enclosed WHITE proxy card. Please have your WHITE proxy card in hand when you log onto the website. Internet voting facilities will be available 24 hours a day. |

| • | By Telephone. You may submit a proxy by telephone (from U.S. and Canada only) using the toll-free number listed on the enclosed WHITE proxy card. Please have your WHITE proxy card in hand when you call. Telephone voting facilities will be available 24 hours a day. |

| • | By Mail. If you received a paper copy of the proxy materials by mail, you may indicate your vote by completing, signing and dating your WHITE proxy card and returning it in the enclosed postage-paid reply envelope. |

Street Name Stockholders: Street name stockholders may generally vote their shares or submit a proxy to have their shares voted by one of the following methods:

| • | By the Methods Listed on the Voting Instruction Form. Please refer to the WHITE voting instruction form or other information forwarded by your bank, broker or other nominee to determine whether you may submit a proxy by telephone or on the Internet, following the instructions provided by the record holder. |

| • | In Person with a Proxy from the Record Holder. You may vote in person at the Annual Meeting if you obtain a legal proxy from your bank, broker or other nominee. Please consult the WHITE voting instruction form or other information sent to you by your bank, broker or other nominee to determine how to obtain a legal proxy in order to vote in person at the Annual Meeting. |

| • | If your shares are held in “street name” and you wish to revoke a proxy, you should contact your bank, broker or nominee and follow its procedures for changing your voting instructions. |

If you hold shares in BOTH street name and as a stockholder of record, YOU MUST VOTE SEPARATELY for each set of shares.

14. WILL MY SHARES BE VOTED IF I DO NOTHING?

If your shares of our common stock are registered in your name, you must sign, date and return a proxy card or submit a proxy by telephone or by internet in order for your shares to be voted.

If your shares of our common stock are held in “street name,” that is, held for your account by a broker, and you do not instruct your broker how to vote your shares, then your broker would not have discretionary authority to vote your shares on Proposals 1, 2 and 4. To the extent your broker has forwarded you Starboard’s proxy materials, your broker would also not have discretionary authority to vote your shares on Proposal 3. If your shares of our common stock are held in “street name,” your broker, bank or nominee has enclosed a WHITE voting instruction form with this Proxy Statement. We strongly encourage you to authorize your broker or other nominee to vote your shares by following the instructions provided on the WHITE voting instruction form.

To return your WHITE voting instruction form to your broker or other nominee by proxy, simply sign, date and return the enclosed WHITE voting instruction form in the accompanying postage pre-paid envelope, or vote by proxy by telephone or via the Internet in accordance with the instructions on the WHITE voting instruction form. Please contact the person responsible for your account to ensure that a WHITE proxy card or WHITE voting instruction form is voted on your behalf.

11 | HUNTSMAN 2022 PROXY

| HUNTSMAN CORPORATION: PROXY STATEMENT |

We strongly urge you to vote by proxy FOR ALL of the nominees listed in Proposal 1, FOR Proposals 2 and 3, and AGAINST Proposal 4 by using the enclosed WHITE proxy card to vote TODAY by internet, by telephone or by signing, dating and returning the enclosed WHITE proxy card in the envelope provided. If your shares are held in “street name,” you should follow the instructions on the WHITE voting instruction form provided by your broker or other nominee and provide specific instructions to your broker or other nominee to vote as described above.

Even if you plan to attend the Annual Meeting, we recommend you also submit your proxy so that your vote will count if you are unable to attend the meeting. Submitting your proxy via internet, telephone or mail does not affect your ability to vote in person at the Annual Meeting.

15. WHAT IF I AM A STOCKHOLDER OF RECORD AND I DON’T SPECIFY A CHOICE FOR A MATTER WHEN RETURNING MY PROXY?

A validly executed proxy that is properly completed and submitted will be voted at the Annual Meeting in accordance with the instructions on the proxy. If you properly complete and submit a validly executed WHITE proxy card, but do not indicate how your shares should be voted and do not revoke your proxy, your shares will be voted as follows:

| • | FOR the election of all 10 of the director nominees recommended by the Board; |

| • | FOR approval, on a non-binding advisory basis, of the compensation of our NEOs; |

| • | FOR the ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the year ending December 31, 2022; and |

| • | AGAINST the stockholder proposal to lower ownership threshold for special meetings of stockholders to 10%. |

If any other business properly comes before the stockholders for a vote at the Annual Meeting, your shares will be voted at the discretion of the holders of the proxy on such matters to the extent authorized by Rule 14a-4(c). The Board knows of no matters, other than those previously described, to be presented for consideration at the Annual Meeting.

16. IF I AM A STREET NAME STOCKHOLDER, WILL MY SHARES BE VOTED IF I DO NOT PROVIDE INSTRUCTIONS?

In some cases, your shares may be voted if they are held in the name of a brokerage firm, even if you do not provide the brokerage firm with voting instructions. Specifically, brokerage firms have the authority under New York Stock Exchange (“NYSE”) rules to cast votes on certain “routine” matters if they do not receive instructions from the beneficial holder. Typically, ratification of the appointment of the independent registered public accounting firm is considered a routine matter for which a brokerage firm may vote shares for which it has not received voting instructions. This is called a “broker discretionary vote.” When a proposal is not a routine matter and a brokerage firm has not received voting instructions from the beneficial owner of the shares with respect to that proposal, the brokerage firm cannot vote the shares on that proposal. This is called a “broker non-vote.” Proposals 1, 2 and 4 are not considered routine matters. Therefore, if your broker has not provided you with competing proxy materials from Starboard and you do not provide voting instructions to your broker with respect to these matters, it will result in a broker non-vote with respect to such proposals. Broker non-votes, if any, will have no effect on the outcome of these proposals.

However, because Starboard has initiated a proxy contest and indicated its intention to deliver proxy materials to your broker to forward to you on Starboard’s behalf, with respect to accounts to which Starboard mails its proxy materials, brokers will not have discretion to vote on any of Proposals 1–4 at the Annual Meeting. As a result, if you do not instruct your broker on how to vote your shares regarding any of the matters to be presented at the Annual Meeting, then your shares may not be voted on these matters. We urge you to instruct your broker about how you wish your shares to be voted on the WHITE proxy card.

17. WHAT VOTES ARE NEEDED FOR EACH PROPOSAL TO PASS AND IS BROKER DISCRETIONARY VOTING ALLOWED?

| Proposal | Vote Required | Broker

Discretionary Vote Allowed | |

| (1) | Election of 10 director nominees | Plurality of votes cast | No |

12 | HUNTSMAN 2022 PROXY

| HUNTSMAN CORPORATION: PROXY STATEMENT |

| (2) | A non-binding advisory vote to approve the compensation of our NEOs | Majority of shares present (in person or represented by proxy) and entitled to vote on the matter | No |

| (3) | Ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the year ending December 31, 2022 | Majority of shares present (in person or represented by proxy) and entitled to vote on the matter | No (to the extent you broker has provided you with competing proxy materials from Starboard) |

| (4) | If properly presented at the meeting, a stockholder proposal to lower ownership threshold for special meetings of stockholders to 10% |

Majority of shares present (in person or represented by proxy) and entitled to vote on the matter | No |

Because we have received notice from Starboard that it intends to nominate candidates for election to the Board, the provisions of our Bylaws relating to majority voting for directors will not be applicable at the Annual Meeting and, pursuant to our Bylaws, plurality voting will instead apply.

The 10 director nominees who receive the most votes of all votes cast will be elected. If you do not vote for a particular nominee, or if you indicate on your proxy card, via the Internet or by telephone that you want to withhold authority to vote for a particular nominee, then your shares will not be voted for that nominee.

It will NOT help elect our Board’s nominees if you sign and return a blue proxy card sent by Starboard, even if you withhold on Starboard’s director nominee using Starboard’s proxy card. Doing so will cancel any previous vote you may have cast on our WHITE proxy card. The only way to support our Board’s nominees is to vote for the Board’s nominees on our WHITE proxy card and to DISREGARD, and not return, any proxy card that you receive that is not a WHITE proxy card, including any blue proxy card that you receive from Starboard.

Pursuant to our Bylaws, written notice by stockholders of qualifying nominations for election to the Board must have been received by our Secretary by January 12, 2022. We did not receive any such notices of nominations, other than the notice of nominations from Starboard, and no other nominations for election to the Board may be made by stockholders at the Annual Meeting.

18. WHAT HAPPENS IF ADDITIONAL PROPOSALS ARE PRESENTED AT THE ANNUAL MEETING?

If you grant a proxy, the persons named as proxy holders will have discretion to vote your shares on any additional matters properly presented for a vote at the Annual Meeting to the extent authorized by Rule 14a-4(c). Under the provisions of our Bylaws and Rule 14a-8 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), the deadline for notifying us of any additional proposals to be presented at the Annual Meeting has passed and, accordingly, stockholders may not present proposals at the Annual Meeting.

19. CAN I CHANGE MY VOTE AFTER SUBMITTING MY PROXY?

If you are a stockholder of record, you may revoke a previously submitted proxy at any time before the polls close at the Annual Meeting by:

| • | voting again by telephone or through the Internet; |

| • | requesting, completing and mailing in a new paper proxy card; |

| • | giving written notice of revocation to our Corporate Secretary, which must be received before the Annual Meeting, by mail to Corporate Secretary, 10003 Woodloch Forest Drive, The Woodlands, Texas 77380 or to CorporateSecretary@huntsman.com; or |

| • | attending the Annual Meeting and voting in person (merely attending the Annual Meeting will not revoke a prior submitted proxy). |

If you are a street name stockholder, you must follow the instructions to revoke your proxy, if any, provided by your bank, broker or other nominee.

20. WHO SHOULD I CALL IF I HAVE QUESTIONS ABOUT THE MEETING?

If you have any questions or require any assistance with voting your shares, or if you need additional copies of the proxy materials, please contact our proxy solicitation firm, Innisfree M&A Incorporated, at

Innisfree M&A Incorporated

501 Madison Avenue, 20th Floor

New York, NY 10022

13 | HUNTSMAN 2022 PROXY

| HUNTSMAN CORPORATION: PROXY STATEMENT |

Stockholders may call toll-free at (877) 750-0926

Banks and brokers may call collect at (212) 750-5833

Our 2021 Form 10-K, Notice of Annual Meeting of Stockholders, Proxy Statement and form of WHITE proxy card are available at [●].

14 | HUNTSMAN 2022 PROXY

| HUNTSMAN CORPORATION: PROXY STATEMENT |

BACKGROUND OF THE SOLICITATION

The Board of Directors, through its Nominating & Corporate Governance Committee, initiated a Board refreshment process in connection with the retirement of Jon Huntsman Sr. and the appointment of Peter Huntsman as Chairman of the Board at the end of 2017. Since that time and up through the first week of January 2022, Huntsman has been engaged in an active and public director identification and succession plan focused on recruiting new Board members possessing the independence, background, experience and expertise needed to provide oversight and support for Huntsman’s continuing efforts to upgrade and streamline its portfolio.

Supported by a leading international and independent search firm, the Board’s refreshment process has resulted in the Board appointing eight new independent directors since March 2018 and having six directors transition off the Board during the same period, including the four directors retiring from the Board in connection with the Annual Meeting. As the Board noted when it recommended in May 2020 that then-Lead Independent Director Nolan Archibald be granted a waiver of the Board’s retirement policy: “[T]he Board refreshment process is fully underway and Mr. Archibald’s continued engagement with the professional search firm retained to assist the Company in identifying additional high-quality candidates and with the candidates themselves, will provide critical continuity and stability to the process.”

More specifically, the following independent director appointments and retirements, among others, ensure the Board continues to have the right combination of experience, expertise, qualifications, continuity and backgrounds, including diversity, to drive profitable growth for stockholders and best oversee the Company’s strategic initiatives.

| · | In March 2018, the Board appointed Daniele Ferrari, who currently sits on the Compensation Committee and Sustainability Committee; |

| · | In February 2019, the Board appointed U.S. Navy (retired) Vice Admiral Jan Tighe, who currently chairs the Sustainability Committee and sits on the Audit Committee; |

| · | In June 2020, the Board appointed Cynthia Egan, who currently chairs the Nominating and Corporate Governance Committee and serves as Non-Executive Vice Chair and Lead Independent Director, and Sonia Dulá, who is Chair Apparent of the Compensation Committee and sits on the Sustainability Committee; |

| · | In February 2021, the Board appointed Jeanne McGovern, who currently chairs the Audit Committee; |

| · | In January 2022, the Board appointed David B. Sewell, José Muñoz and Curtis E. Espeland; and |

| · | In January 2022, after having successfully shepherded the transformation of the Board since 2018, four directors – Nolan D. Archibald, M. Anthony Burns, Sir Robert J. Margetts, and Wayne Reaud – announced they would transition off the Board at the Annual Meeting. |

On July 30, 2021, the Company issued a press release reporting its second quarter earnings and noted that it intended to “showcase our strategic initiatives and the continued transformation of the entire portfolio at our New York City Investor Day on November 9, 2021.”

On September 27, 2021, representatives of Starboard had a call with Peter R. Huntsman, the Company’s Chairman of the Board, President and Chief Executive Officer, and Ivan M. Marcuse, the Company’s Vice President of Investor Relations, and informed them that Starboard would be filing a Schedule 13D later that day. On the call, Starboard asked and the Company agreed to schedule an in-person meeting in the following weeks to discuss the Company.

Later that day, Starboard filed a Schedule 13D with the SEC disclosing an 8.4% ownership stake in the Company.

On September 30, 2021, the Company closed its fiscal third quarter and later disclosed in its third quarter earnings release that the Company’s net income for the period improved year-over-year from $57 million to $225 million, and its diluted earnings per share for the period increased year-over-year from $0.22 to $0.94 per share.

On October 5, 2021, representatives of Starboard called Mr. Huntsman to inform the Company that Starboard would be publicly discussing Huntsman at the annual 13D Monitor Active-Passive Investor Summit (the “13D Monitor Conference”) being held the following day.

15 | HUNTSMAN 2022 PROXY

| HUNTSMAN CORPORATION: PROXY STATEMENT |

On October 6, 2021, Jeffrey C. Smith, Chief Executive Officer and Chief Investment Officer of Starboard, “presented” Huntsman as one of Starboard’s top investment ideas at the 13D Monitor Conference.

On October 25, 2021, Messrs. Huntsman and Marcuse and Philip M. Lister, the Company’s Executive Vice President and Chief Financial Officer, met with Mr. Smith and his Starboard colleagues Gavin Molinelli, Patrick Sullivan and Jonathan Yu, at the Company’s headquarters to discuss Starboard’s views on the Company.

On October 29, 2021, the Company issued its third quarter earnings press release announcing, among other things that it had: (1) improved third quarter 2021 earnings; (2) repurchased approximately $102 million of its shares in the quarter following reactivation of the share repurchase program that had been paused at the onset of the COVID-19 pandemic; and (3) obtained the prior day a significant arbitration award against Albemarle for fraud and breach of contract and had been awarded in excess of $600 million (the “Albemarle Settlement”) of which the Company expected to net in excess of $400 million after attorney’s fees.

On November 1, 2021, following the Company’s third quarter 2021 earnings announcement, Mr. Marcuse and other members of the Company’s investor relations team had a call with representatives of Starboard to further discuss the Company.

On November 4, 2021, Mr. Marcuse had a call with a representative of Starboard during which Starboard asked to review in advance the Investor Day materials then being prepared for the Company’s previously disclosed November 9, 2021 Investor Day. The next day, the Company entered into a standard Non-Disclosure Agreement with Starboard to facilitate Starboard’s review of the Company’s Investor Day materials. On November 7, 2021, representatives of the Company and Starboard, including Messrs. Smith and Huntsman, met to discuss the Company’s Investor Day materials, with the Company providing Starboard a full opportunity to share its thoughts on the materials.

On November 9, 2021, the Company held its Investor Day announcing ambitious commitments to the Company’s strategic objectives, which included growing its differentiated portfolio, improving its EBITDA margin, generating free cash flow margins above 40%, maintaining an investment grade balance sheet, and returning capital to shareholders through a newly announced $1 billion share repurchase program.

On November 17, 2021, Mr. Huntsman reached out to Mr. Smith to offer a one-on-one meeting to discuss further the Company and Starboard’s plans with respect to the Company.

On December 9, 2021, Mr. Huntsman met with Mr. Smith in New York City. Among other topics, Mr. Smith raised the status and composition of the Company’s Board of Directors. Mr. Huntsman indicated that the Board planned to continue in the near term the refreshment process that the Company had initiated at the end of 2017. Mr. Smith thereafter offered his views on Board membership generally, noting his own practice of meeting personally with and vetting any Board candidate he nominated to ensure the candidate’s independence and competence.

In this context, Mr. Huntsman asked Mr. Smith to provide him the names of any candidates that Starboard would like to suggest so that the Board’s Nominating and Corporate Governance Committee could consider them in the ordinary course alongside the candidates previously identified by the Company’s leading international search firm. Mr. Smith responded that Starboard had assembled a slate of candidates for the Board but declined to provide any of their names to Mr. Huntsman. Mr. Smith also stated his view that at least half of the Company’s current Board members would be replaced by candidates to be nominated by Starboard.

On December 14, 2021, Mr. Smith emailed Mr. Huntsman and asked to schedule a meeting with Mr. Huntsman and any additional members of the Board to further discuss Mr. Smith’s views on Board refreshment.

On December 20, 2021, Mr. Huntsman and Ms. Egan, an independent member of the Board who would be named Non-Executive Vice Chair of the Board and Chair of the Nominating and Corporate Governance Committee two weeks later, had a call with Messrs. Smith, Molinelli, Sullivan and Yu of Starboard to discuss the Company and the composition of its Board. Mr. Huntsman and Ms. Egan again reminded Mr. Smith and the Starboard representatives that the Company’s long-standing Board refreshment plan was still ongoing in the near term and reiterated Mr. Huntsman’s earlier request to Mr. Smith for the names of any candidates that Starboard wished to propose for consideration by the Board’s Nominating and Corporate Governance Committee. Mr. Smith and the Starboard representatives expressed Starboard’s intent to take a significant role in proposing new candidates for the Board – not only to

16 | HUNTSMAN 2022 PROXY

| HUNTSMAN CORPORATION: PROXY STATEMENT |

join as members but also to take over leadership positions on various Board committees – and indicated again that while they had candidates to propose, they were declining to disclose the names of any of these proposed candidates.

On December 22, 2021, Mr. Huntsman and Mr. Smith had a call during which Mr. Smith indicated that Starboard would be requesting the Company’s D&O questionnaire and other forms required for a potential nomination (the “Nomination Documents”).

The next morning, December 23, 2021, Starboard delivered a letter to the Company requesting the Nomination Documents.

On December 28, 2021, the Company issued a press release announcing: (1) that it had initiated a review of strategic options for its Textile Effects Division; and (2) that the Board implemented a management-proposed multi-year compensation plan designed to drive accountability and align the incentives of Company’s management team with the targets presented at Investor Day.

On December 30, 2021, the Company provided copies of the Nomination Documents to Starboard.

On January 1, 2022, the Board held a meeting to consider, among other things, the appointment of new directors, new Board leadership positions, and the date of the Annual Meeting. During this meeting, the Board evaluated the recommendation of the Nominating and Corporate Governance Committee to appoint three new director candidates identified by a leading international search firm and vetted over the past months as part of the Board’s multi-year refreshment process. Specifically, the Board discussed and evaluated various factors, including the background, independence, and qualifications of each of Curtis Espeland, José Muñoz and David Sewell, including Mr. Espeland’s experience at Eastman Chemical Company, his extensive financial and accounting expertise, and his public company board experience; Mr. Muñoz’s significant operational and executive level experience worldwide in the automotive industry, including in his current role as Chief Operating Officer of Hyundai Motor Company; and Mr. Sewell’s nearly 15 years of senior executive leadership and operational experience at major materials companies, including in his current position as Chief Executive Officer of WestRock and his prior position as Chief Operating Officer of The Sherwin-Williams Company. The Board then approved the appointments of Messrs. Espeland and Muñoz effective immediately and, as Mr. Sewell had indicated his preference to receive formal approval from the WestRock’s board of directors before joining the Company’s Board, his appointment as well, contingent on approval of WestRock’s board.

The Board also considered the timing of the 2022 Annual Meeting and concluded that it would be in the stockholders’ best interests to set a date as soon as reasonably practicable so that stockholders could decide the composition of the Board as early as possible, the Company’s management could focus without distraction on executing the strategic initiatives outlined at the Investor Day and the recently-announced strategic review for the Textile Effects Division, and to minimize other potential disruption and distraction from a potential proxy fight with Starboard. The Board specifically took into account Starboard’s statements to the Company in early December that it already had specific candidates that it intended to nominate and Starboard’s request for the Nomination Documents before the nomination window even opened, all of which indicated to the Board that Starboard was ready to make nominations at this time and would not be impeded in making director nominations by the nomination deadline that would result from a proposed March 25, 2022 annual meeting date.

On January 2, 2022, the Company issued a press release announcing certain corporate governance enhancements and the most recent Board refreshment, including: (1) the appointments of Mr. Espeland and Mr. Muñoz to the Board; (2) the appointment of Ms. Egan as Lead Independent Director, Non-Executive Vice Chair of the Board and Chair of the Nominating and Corporate Governance Committee; (3) the addition of Ms. Dulá to the Compensation Committee and her being named as the Committee’s intended Chair upon Mr. Reaud’s future retirement; (4) the transition of three existing directors, Mr. Archibald, Mr. Burns and Sir Robert J. Margetts, off of the Board at the Annual Meeting; and (5) the determination by the Board that it would no longer grant waivers to non-executive directors of the Company’s director retirement policy requiring them to resign after their 75th birthday. In addition, the Company also announced that it would hold the Annual Meeting on March 25, 2022.

Over the next two days, January 3 and January 4, 2022, Mr. Huntsman and Mr. Smith had a series of discussions during which Mr. Smith conveyed his views on a potential framework for a negotiated resolution and avoidance of a proxy fight, including his view that he no longer required a majority of the Board be replaced by Starboard nominees. Mr. Smith instead proposed, among other things, that the Company agree to add three unidentified Starboard nominees to the Board and to have two incumbent directors – to be identified by Starboard at a later date – resign from the Board. To facilitate the Board’s prompt

17 | HUNTSMAN 2022 PROXY

| HUNTSMAN CORPORATION: PROXY STATEMENT |

consideration of Mr. Smith’s newly proposed framework, Mr. Huntsman asked him for the names of Starboard’s three proposed nominees and the two current Board members Starboard would have resign, explaining that such information would be necessary for the Board to give thoughtful and appropriate consideration to Mr. Smith’s proposal. Mr. Smith responded that Starboard had all of the names in mind but he was not prepared to provide that information to the Company unless and until the Company agreed to his framework.

On January 6, 2022, in a subsequent discussion with Mr. Huntsman, Mr. Smith indicated for the first time that his prior demand for three Starboard directors could potentially be reduced to two. Mr. Huntsman then asked Mr. Smith whether this demand for two directors might be satisfied by the addition of one of Mr. Smith’s candidates and one of the Company’s candidates who satisfied Mr. Smith’s standards for independence and competency. Mr. Smith responded that such a construct “could be a possibility.”

Following these calls, between January 4, 2022, and January 7, 2022, Starboard’s lawyers at Olshan Frome Wolosky LLP, had several discussions with the Company’s outside lawyers at Kirkland & Ellis LLP. The lawyers discussed, among other things, (1) the foregoing proposed framework for a negotiated resolution, with Starboard finally disclosing the identities of three proposed nominees – Jeffrey C. Smith, Sandra Beach Lin and James L. Gallogly– on January 5, 2022, (2) Starboard’s intent to submit a nomination notice in the upcoming days, and (3) Starboard’s request to use a universal proxy card, which the Company – after noting, among other things, Starboard’s prior public statements of concern about how a universal proxy card could thwart the will of a majority of stockholders – considered but ultimately did not accept.

On January 7, 2022, WestRock’s board of directors approved Mr. Sewell joining the Company’s Board and his prior appointment to the Board became immediately effective.

On January 7, 2022, not even 48 hours after learning the identities of Starboard’s three proposed candidates, the Company’s Nominating and Corporate Governance Committee also interviewed Starboard candidates Sandra Beach Lin and James L. Gallogly. During the interview, Ms. Beach Lin informed the Committee that she had never met Mr. Smith and, further, that she had refused a compensation agreement offered by Starboard for being a Starboard nominee (which was accepted by Mr. Gallogly). Following the interviews, the Company informed Starboard that its Company’s Nominating and Corporate Governance Committee and the Board would be open to considering having Ms. Beach Lin join the Board as part of a negotiated resolution with Starboard to avoid a proxy fight.

On January 8, 2022, Mr. Huntsman had a call with Mr. Smith to discuss the Board’s latest director appointments, including David Sewell, whose appointment had not yet been publicly announced. During the call, Mr. Huntsman communicated the Board’s potential interest in having Starboard director nominee Ms. Beach Lin join the Board as part of a negotiated resolution with Starboard and being announced as a new Board member at the same time as Mr. Sewell, consistent with the discussions between Messrs. Huntsman and Smith on January 6, 2022. Mr. Huntsman thereafter agreed to facilitate a call – at Mr. Smith’s specific request – between Mr. Smith and Mr. Sewell for the purpose of permitting Mr. Smith to assess whether Mr. Sewell satisfied Mr. Smith’s stated criteria for board membership and whose appointment could thus be included in a joint announcement along with the addition of a Starboard candidate as part of a potential negotiated resolution to prevent a proxy fight. That call was scheduled the next day and Mr. Smith indicated that he would reach back out to Mr. Huntsman thereafter.

As part of the potential negotiated resolution Mr. Huntsman and Mr. Smith had been discussing, Mr. Huntsman called Ms. Beach Lin the same day to discuss the feedback he had received about her from Ms. Egan, Chair of the Nominating and Corporate Governance Committee.

As agreed, on January 9, 2022, Mr. Smith, who was joined by Mr. Molinelli, spoke with Mr. Sewell regarding his recent appointment to the Board. At the outset, Mr. Smith indicated that Mr. Sewell appeared to be a good nominee for the Huntsman Board and that Starboard might even have an interest in nominating him to other boards in the future. Mr. Smith and Mr. Molinelli went on to express their views about the Company’s interaction with Starboard up until then. Mr. Sewell responded that he could not comment on these matters since he had not been engaged in the earlier interaction in any respect. Mr. Smith also indicated to Mr. Sewell that Starboard intended to run a proxy fight with the Company and that new directors, including Mr. Sewell, could be targeted.

Mr. Smith never reached back out to Mr. Huntsman after talking to Mr. Sewell and, to date, has not called him or left a message.

On January 10, 2022, Ms. Egan had a call with Ms. Beach Lin to discuss the possibility of Ms. Beach Lin potentially joining the Board as part of an overall potential negotiated resolution to avoid a proxy fight between Huntsman and Starboard.

18 | HUNTSMAN 2022 PROXY

| HUNTSMAN CORPORATION: PROXY STATEMENT |

On January 11, 2022, the Company issued a press release announcing (1) the appointment of Mr. Sewell to the Board and (2) the decision of Wayne Reaud, Chair of the Litigation and Public Policy and Compensation committees of the Company, to retire from the Board at the Annual Meeting.

On January 12, 2022, Starboard delivered a notice of director nominations to the Company and publicly issued a letter to the Board, identifying Jeffrey C. Smith, Sandra Beach Lin, Susan C. Schnabel and James L. Gallogly as Starboard’s nominees for election to the Board at the Annual Meeting. On the same day, Starboard issued a press release announcing the foregoing nominations and filed an amendment to its Schedule 13D with the SEC.

Later on January 12, 2022, the Company issued a press release highlighting strategic actions the Company had recently taken to enhance stockholder value, including (1) initiating a strategic review process for the Textile Effects Division to continue advancing the Company’s focus on portfolio enhancement, (2) authorizing new share repurchases of $1 billion over the next three years, (3) implementing a multi-year incentive compensation program for all Company officers and vice presidents that ties the vast majority of their incentive compensation to the achievement of the Investor Day targets, and (4) substantially completing the Board refreshment process that began at the end of 2017 by adding three highly-qualified and independent directors – Mr. Sewell, Mr. Muñoz and Mr. Espeland – who were identified by a leading international search firm.

On January 19, 2022, Starboard delivered a letter to the Company requesting the inspection of certain stockholder list materials and related information pursuant to Section 220 of the Delaware General Corporation Law (the “Books and Records Demand”).

On January 20, 2022, Starboard filed its preliminary proxy statement with the SEC.

On January 26, 2022, the Company’s outside counsel responded, on behalf of the Company, to the Books and Records Demand.

On January 26, 2022, the Company, in accordance with the Company’s Bylaws, sent Starboard a letter requesting that each of Starboard’s nominees provide certain supplemental information.