UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN

PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission

Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy

Statement

☐ Definitive Additional Materials

☐ Soliciting Material Under Rule

14a-12

| huntsman corporation |

| (Name of Registrant as Specified in Its Charter) |

| |

|

STARBOARD VALUE LP

STARBOARD VALUE AND OPPORTUNITY MASTER FUND

LTD

STARBOARD VALUE AND OPPORTUNITY S LLC

STARBOARD VALUE AND OPPORTUNITY C LP

STARBOARD P FUND LP

STARBOARD VALUE P GP LLC

STARBOARD VALUE R LP

STARBOARD VALUE AND OPPORTUNITY MASTER FUND

L LP

STARBOARD VALUE L LP

STARBOARD VALUE R GP LLC

STARBOARD LEADERS ECHO II LLC

STARBOARD LEADERS FUND LP

STARBOARD VALUE A LP

STARBOARD VALUE A GP LLC

STARBOARD X MASTER FUND LTD

STARBOARD G FUND, L.P.

STARBOARD VALUE G GP, LLC

STARBOARD VALUE GP LLC

STARBOARD PRINCIPAL CO LP

STARBOARD PRINCIPAL CO GP LLC

JEFFREY C. SMITH

PETER A. FELD

JAMES L. GALLOGLY

SANDRA BEACH LIN

SUSAN C. SCHNABEL |

| (Name of Persons(s) Filing Proxy Statement, if Other Than the Registrant) |

| |

| |

| Payment of Filing Fee (Check the appropriate box): |

| |

|

| ☒ |

No fee required. |

| ☐ |

Fee computed on table below

per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

| |

(1) |

Title of each class of securities to which transaction applies: |

| |

|

|

| |

(2) |

Aggregate number of securities to which transaction applies: |

| |

|

|

| |

(3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

|

|

| |

(4) |

Proposed maximum aggregate value of transaction: |

| |

|

|

| |

(5) |

Total fee paid: |

| |

|

|

| |

|

| ☐ |

Fee paid previously with preliminary materials.

|

| ☐ |

Check box if any part of

the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously.

Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

| |

(1) |

Amount Previously Paid: |

| |

|

|

| |

(2) |

Form, Schedule or Registration Statement No.: |

| |

|

|

| |

(3) |

Filing Party: |

| |

|

|

| |

(4) |

Date Filed: |

| |

|

|

| |

|

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

| |

|

|

Starboard

Value and Opportunity Master Fund Ltd

February 10, 2022

Dear Fellow Huntsman Stockholders:

Starboard Value and

Opportunity Master Fund Ltd (together with its affiliates, “Starboard” or “we”) and the other participants in

this solicitation are the beneficial owners of an aggregate of 18,820,805 shares, or approximately 8.6%, of the outstanding common stock,

par value $0.01 per share (the “Common Stock”) of Huntsman Corporation, a Delaware corporation (“Huntsman” or

the “Company”), making us one of the Company’s largest stockholders. For the reasons set forth in the attached Proxy

Statement, we believe significant changes to the composition of the Board of Directors of the Company (the “Board”) are necessary

in order to ensure that the Company is managed and overseen in a manner consistent with your best interests. We have nominated a slate

of highly-qualified director candidates for election to the Board at the Company’s upcoming 2022 Annual Meeting of Stockholders

(the “Annual Meeting”).

Huntsman is fundamentally

a great company with strong market positions, diverse product portfolios, innovative chemistries and a difficult to replicate manufacturing

footprint. However, we believe it remains deeply undervalued with opportunities to unlock significant value that are within the control

of management and the Board. Despite promising future prospects, we believe Huntsman’s historical operating performance is the result

of subpar execution, insufficient Board oversight, and lapses in corporate governance. We believe these issues have caused Huntsman to

be valued significantly below its intrinsic value.

Despite our sincere efforts

to engage constructively with the Board regarding our concerns and the opportunities for improvement, the Board chose not to meaningfully

engage with us on these topics and instead, chose to take certain reactionary and defensive measures, which we believe were intended to

disenfranchise stockholders. These actions included:

| · | The hasty removal and replacement of three (3) of the Board’s most tenured members while suggesting

that these changes were part of a planned board refreshment process. We note that prior to these most recent changes, the Board had undergone

expansion but not meaningful refreshment – three (3) directors were appointed in the eighteen months prior to the most recent Board

changes, and all were appointed through expanding the size of the Board, which increased from eight (8) members to eleven (11) members

over that period; |

| · | The acceleration of the Annual Meeting to a much earlier date than would be typical for Huntsman. This

aggressive maneuver deliberately shortened the director nomination window for the Annual Meeting from nearly a month to just ten (10)

days following the announcement of the new Annual Meeting date; and |

| · | The refusal, despite our repeated requests and upcoming SEC mandate, to utilize a universal proxy card

for the Annual Meeting, which would have allowed stockholders to vote for those specific nominees from the total mix of candidates who

they feel would best serve the Company. |

These reactive and defensive

maneuvers were implemented with the oversight of the current Board, and we believe included the approval of at least two (2) of the Board’s

most recent director appointments, which has solidified our belief that further change is required. Stockholders deserve a board that

demands accountability, implements proper governance practices, and is committed to ensuring the best interests of all stockholders are

represented.

We believe that Huntsman can

significantly improve its strategy, execution, and Board oversight, and are confident the slate of professionals we have nominated are

well-qualified to serve as directors of the Company. The four (4) director candidates we have nominated - James L. Gallogly, Sandra Beach

Lin, Susan C. Schnabel and Jeffrey C. Smith – have backgrounds spanning operations, finance, private equity, restructuring, strategic

transformation and public company governance. As a group, they have substantial and highly successful experience in the chemical, energy

and broader industrial industries. Collectively, they have decades of experience as CEOs, senior executives, chairmen and directors of

well-performing chemical and industrial companies.

Our goal is to create value

for the benefit of all stockholders. We believe a critical step towards achieving this objective is to improve the Board with directors

who have exceptionally relevant skill sets and who will provide renewed accountability, as well as a singular focus on the best interests

of common stockholders. Starboard has a long history of driving operational, financial, strategic, and governance changes that benefit

employees, customers, and stockholders. We firmly believe that with the right Board in place, Huntsman can be a best-in-class differentiated

chemicals company and generate significant value for all stockholders.

Biographies of Starboard’s nominees

(in alphabetical order):

|

James L. Gallogly

|

Operating Experience

Mr. Gallogly previously served as Chief Executive

Officer and Chairman of the Management Board of LyondellBasell Industries N.V., a global plastic, chemical and refining company.

Prior to LyondellBasell, Mr. Gallogly held several

executive roles at ConocoPhillips, an energy company, including Executive Vice President of Worldwide Exploration and Production and Executive

Vice President of Refining, Marketing and Transportation.

Public Board Experience

Mr. Gallogly previously served as a director of

Continental Resources and of E.I. du Pont de Nemours and Company.

|

|

Sandra Beach Lin

|

Operating Experience

Ms. Lin is the former President and Chief Executive

Officer of Calisolar, Inc., a global leader in the production of solar silicon.

Previously, Ms. Lin was Executive Vice President

of Celanese Corporation. Prior to Celanese, Ms. Lin held global senior executive positions at Avery Dennison Corporation, Alcoa and Honeywell

International.

Public Board Experience

Ms. Lin currently serves as a director of Trinseo

PLC, Avient Corporation and American Electric Power Company, Inc.

Ms. Lin previously served as a director of WESCO

International, Inc.

|

Susan C. Schnabel |

Operating Experience

Ms. Schnabel is the Co-Founder and Co-Managing Partner of aPriori Capital Partners L.P.

Previously, Ms. Schnabel served as Managing Director of Credit Suisse Asset Management and Co-Head of DLJ Merchant Banking. Prior to that, Ms. Schnabel served as Chief Financial Officer of PetSmart, Inc.

Public Board Experience

Ms. Schnabel currently serves as a director of Altice USA, Inc.

Ms. Schnabel previously served as a director of Versum Materials, STR Holdings, Neiman Marcus, Pinnacle Gas Resources, Rockwood Holdings and Shoppers Drug Mart Corporation (TSX).

|

|

Jeffrey C. Smith

|

Operating Experience

Mr. Smith is a Managing Member, Chief Executive Officer,

and Chief Investment Officer of Starboard Value LP.

Prior to founding Starboard, Mr. Smith was a Partner

and Managing Director of Ramius LLC, Chief Investment Officer of the Ramius Value and Opportunity Master Fund and a member of Cowen’s

Operating Committee and Cowen’s Investment Committee.

Public Board Experience

Mr. Smith currently serves as Chair of the board of

directors of Papa John’s International, Inc. and as a director of Cyxtera Technologies, Inc.

Previously, Mr. Smith served as Chair of the board

of directors of Advance Auto Parts, Darden Restaurants, and Phoenix Technologies, and has served as a director on a number of other public

company boards.

|

We believe that ten (10) of the

fourteen (14) directors currently serving on the Board will be up for election at the Annual Meeting. Through the attached Proxy Statement

and enclosed BLUE proxy card, we are soliciting proxies to elect not only our four (4) nominees, but also the candidates who have

been nominated by the Company other than Mary C. Beckerle, Daniele Ferrari, José Muñoz, and Cynthia L. Egan. Stockholders

will therefore be able to vote for the total number of directors up for election at the Annual Meeting. Stockholders should refer to the

Company’s proxy statement for the names, backgrounds, qualifications and other information concerning the Company’s nominees.

There is no assurance that any of the Company’s nominees will serve as directors if all or some of our nominees are elected.

We look forward to sharing

our detailed views on, and comprehensive plans for, Huntsman in the coming weeks and look forward to engaging with you as we approach

the Annual Meeting.

We urge you to carefully consider

the information contained in the attached Proxy Statement and then support our efforts by signing, dating, and returning the enclosed

BLUE proxy card today.

If you have already voted

for the incumbent management slate, you have every right to change your vote by signing, dating, and returning a later dated proxy or

by voting in person at the Annual Meeting.

If you have any questions

or require any assistance with your vote, please contact Okapi Partners LLC, which is assisting us, at its address and toll-free numbers

listed below.

| |

Thank you for your support. |

| |

|

| |

/s/ Jeffrey C. Smith |

| |

|

| |

Jeffrey C. Smith |

| |

Starboard Value and Opportunity Master Fund Ltd |

If you have any questions, require assistance

in voting your BLUE proxy card, or need additional copies of Starboard’s proxy materials, please contact Okapi Partners at

the phone numbers or email address listed below.

Okapi Partners LLC

1212 Avenue of the Americas, 24th Floor

New York, New York 10036

Stockholders may call toll-free: (877) 629-6356

Banks and brokers call: (212) 297-0720

E-mail: info@okapipartners.com

2022 ANNUAL MEETING OF STOCKHOLDERS

OF

HUNTSMAN CORPORATION

_________________________

PROXY STATEMENT

OF

STARBOARD VALUE AND OPPORTUNITY MASTER FUND LTD

_________________________

PLEASE SIGN, DATE AND MAIL THE ENCLOSED BLUE PROXY CARD TODAY

Starboard Value LP (“Starboard

Value LP”), Starboard Value and Opportunity Master Fund Ltd (“Starboard V&O Fund”), Starboard Value and Opportunity

S LLC (“Starboard S LLC”), Starboard Value and Opportunity C LP (“Starboard C LP”), Starboard P Fund LP (“Starboard

P LP”), Starboard Value P GP LLC (“Starboard P GP”), Starboard Value R LP (“Starboard R LP”), Starboard

Value and Opportunity Master Fund L LP (“Starboard L Master”), Starboard Value L LP (“Starboard L GP”), Starboard

Value R GP LLC (“Starboard R GP”), Starboard Leaders Echo II LLC (“Starboard Echo II LLC”), Starboard Leaders

Fund LP (“Starboard Leaders Fund”), Starboard Value A LP, (“Starboard A LP”), Starboard Value A GP LLC (“Starboard

A GP”), Starboard X Master Fund Ltd (“Starboard X Master”), Starboard G Fund, L.P. (“Starboard G LP”), Starboard

Value G GP, LLC (“Starboard G GP”), Starboard Value GP LLC (“Starboard Value GP”), Starboard Principal Co LP (“Principal

Co”), Starboard Principal Co GP LLC (“Principal GP”), Jeffrey C. Smith and Peter A. Feld (collectively, “Starboard”

or “we”), are significant stockholders of Huntsman Corporation, a Delaware corporation (“Huntsman” or the “Company”),

who, together with the other participants in this solicitation, beneficially own in the aggregate approximately 8.6% of the outstanding

shares of common stock, par value $0.01 per share (the “Common Stock”), of the Company.

We are seeking to elect

four (4) nominees to the Company’s Board of Directors (the “Board”) because we believe that the Board must be significantly

reconstituted to ensure that the interests of the stockholders, the true owners of Huntsman, are appropriately represented in the boardroom.

We have nominated a slate of director candidates who collectively possess decades of experience as CEOs, senior executives, chairmen

and directors of well-performing chemical and industrial companies. If elected, these directors will bring fresh perspectives, talented

leadership, accountability, and responsible oversight to the Board. We are seeking your support at the Company’s 2022 Annual Meeting

of Stockholders (including any adjournments or postponements thereof and any meeting which may be called in lieu thereof, the “Annual

Meeting”), scheduled to be held on March 25, 2022, at such time and place, to be determined by the Company, for the following purposes:1

| 1. | To elect Starboard’s director nominees, James L. Gallogly, Sandra Beach Lin, Susan C. Schnabel and

Jeffrey C. Smith (each a “Nominee” and, collectively, the “Nominees”), to hold office until the 2023 Annual Meeting

of Stockholders (the “2023 Annual Meeting”) and until their respective successors have been duly elected and qualified; |

1As of the date of this Proxy Statement, the Company’s definitive proxy statement for the Annual Meeting has not yet

been filed with the Securities and Exchange Commission. Accordingly, we have omitted certain information from this Proxy Statement that

is not yet publicly available, including the time and place of the Annual Meeting as well as the record date for the Annual Meeting,

which we expect to be included in the Company’s definitive proxy statement. Once the Company publicly discloses this information,

Starboard intends to supplement this Proxy Statement to disclose such information and make any other necessary updates and file revised

definitive materials with the Securities and Exchange Commission.

| 2. | To approve, on a non-binding advisory basis, the compensation of the Company’s named executive officers; |

| 3. | To ratify the appointment of Deloitte

and Touche LLP as the Company’s independent registered public accounting firm for the

fiscal year ending December 31, 2022; |

| 4. | If properly presented at the Annual

Meeting, to vote on a proposal submitted by a stockholder to lower the ownership threshold

for special meetings of stockholders to 10%; and |

| 5. | To transact such other business as may properly come before the Annual Meeting. |

This Proxy Statement and

the enclosed BLUE proxy card are first being furnished to stockholders on or about February 10, 2022.

The Board is currently

composed of fourteen (14) directors, each with terms expiring at the Annual Meeting. The Company has announced that four (4) of its fourteen

(14) directors, Nolan D. Archibald, M. Anthony Burns, Sir Robert J. Margetts and Wayne A. Reaud, will be retiring from the Board immediately

before the Annual Meeting, meaning ten (10) directors will be up for election at the Annual Meeting. Through the attached Proxy Statement

and enclosed BLUE proxy card, we are soliciting proxies to elect our four (4) nominees. Stockholders who enclose the BLUE

proxy card will also have the opportunity to vote for the candidates who have been nominated by the Company other than Mary C. Beckerle,

Daniele Ferrari, José Muñoz, and Cynthia L. Egan. Stockholders will therefore be able to vote for the total number of directors

up for election at the Annual Meeting. See the “Voting and Proxy Procedures” section of this Proxy Statement for additional

information. Stockholders should refer to the Company’s proxy statement for the names, backgrounds, qualifications, and other information

concerning the Company’s nominees. If elected, our Nominees will constitute a minority on the Board and there can be no guarantee

that our Nominees will be able to implement any actions that they may believe are necessary to unlock stockholder value, including the

implementation of our comprehensive plans for the Company, which we plan on releasing in the coming weeks.

As of the date hereof,

the members of Starboard and the Nominees collectively beneficially own 18,820,805 shares of Common Stock (the “Starboard Group

Shares”). We intend to vote all of the Starboard Group Shares FOR the election of the Nominees, AGAINST an advisory

(non-binding) proposal concerning the Company’s executive compensation program, as described herein, FOR the ratification

of the appointment of Deloitte and Touche LLP as the Company’s independent registered public accounting firm and FOR the

stockholder proposal to lower the ownership threshold for special meetings of stockholders to 10%. While we currently intend to vote

all of the Starboard Group Shares in favor of the election of the Nominees, we reserve the right to vote some or all of the Starboard

Group Shares for some or all of the Company’s director nominees, as we see fit, in order to achieve a Board composition that we

believe is in the best interest of all stockholders. Stockholders should understand, however, that all shares of Common Stock represented

by the enclosed BLUE proxy card will be voted at the Annual Meeting as marked.

The Company has not yet

publicly disclosed the record date for determining stockholders entitled to notice of and to vote at the Annual Meeting (the “Record

Date”) or the number of shares of Common Stock outstanding as of the Record Date. Once the Company publicly discloses such information,

we intend to supplement this Proxy Statement with such information and file revised definitive materials with the Securities and Exchange

Commission (the “SEC”). The mailing address of the principal executive offices of the Company is 10003 Woodloch Forest Drive,

The Woodlands, Texas 77380.

According to the Company’s

proxy statement, holders of record of shares of Common Stock as the close of business on the Record Date are entitled to notice and to

vote at the Annual Meeting. Each outstanding share of Common Stock is entitled to one vote on each matter to be voted upon at the Annual

Meeting. As of October 20, 2021, there were 218,030,754 shares of Common Stock outstanding, which is the total number of shares of Common

Stock outstanding as reported in the Company’s Quarterly Report on Form 10-Q filed with the SEC on October 29, 2021.

THIS SOLICITATION IS BEING

MADE BY STARBOARD AND NOT ON BEHALF OF THE BOARD OF DIRECTORS OR MANAGEMENT OF THE COMPANY. WE ARE NOT AWARE OF ANY OTHER MATTERS TO

BE BROUGHT BEFORE THE ANNUAL MEETING OTHER THAN AS SET FORTH IN THIS PROXY STATEMENT. SHOULD OTHER MATTERS, WHICH STARBOARD IS NOT AWARE

OF A REASONABLE TIME BEFORE THIS SOLICITATION, BE BROUGHT BEFORE THE ANNUAL MEETING, THE PERSONS NAMED AS PROXIES IN THE ENCLOSED BLUE

PROXY CARD WILL VOTE ON SUCH MATTERS IN OUR DISCRETION.

THIS SOLICITATION IS BEING

MADE BY STARBOARD AND NOT ON BEHALF OF THE BOARD OF DIRECTORS OR MANAGEMENT OF THE COMPANY. WE ARE NOT AWARE OF ANY OTHER MATTERS TO BE

BROUGHT BEFORE THE ANNUAL MEETING OTHER THAN AS SET FORTH IN THIS PROXY STATEMENT. SHOULD OTHER MATTERS, WHICH STARBOARD IS NOT AWARE

OF A REASONABLE TIME BEFORE THIS SOLICITATION, BE BROUGHT BEFORE THE ANNUAL MEETING, THE PERSONS NAMED AS PROXIES IN THE ENCLOSED BLUE

PROXY CARD WILL VOTE ON SUCH MATTERS IN OUR DISCRETION.

STARBOARD URGES YOU TO SIGN,

DATE AND RETURN THE BLUE PROXY CARD IN FAVOR OF THE ELECTION OF THE NOMINEES.

IF YOU HAVE ALREADY

SENT A PROXY CARD FURNISHED BY COMPANY MANAGEMENT OR THE BOARD, YOU MAY REVOKE THAT PROXY AND VOTE ON EACH OF THE PROPOSALS DESCRIBED

IN THIS PROXY STATEMENT BY SIGNING, DATING, AND RETURNING THE ENCLOSED BLUE PROXY CARD. THE LATEST DATED PROXY IS THE ONLY ONE

THAT COUNTS. ANY PROXY MAY BE REVOKED AT ANY TIME PRIOR TO THE ANNUAL MEETING BY DELIVERING A WRITTEN NOTICE OF REVOCATION OR A LATER

DATED PROXY FOR THE ANNUAL MEETING OR BY VOTING IN PERSON AT THE ANNUAL MEETING.

Important Notice Regarding the Availability

of Proxy Materials for the Annual Meeting—This Proxy Statement and our BLUE proxy card are available at

www.shareholdersforhuntsman.com

IMPORTANT

Your vote is important,

no matter how few shares of Common Stock you own. Starboard urges you to sign, date, and return the enclosed BLUE proxy card today to

vote FOR the election of the Nominees and in accordance with Starboard’s recommendations on the other proposals on the agenda for

the Annual Meeting.

| · | If your shares of Common Stock are registered in your own name, please sign and date the enclosed BLUE

proxy card and return it to Starboard, c/o Okapi Partners LLC (“Okapi Partners”) in the enclosed postage-paid envelope

today. |

| · | If

your shares of Common Stock are held in a brokerage account or bank, you are considered the

beneficial owner of the shares of Common Stock, and these proxy materials, together with

a BLUE voting form, are being forwarded to you by your broker or bank. As a beneficial

owner, you must instruct your broker, trustee or other representative how to vote. Your broker

cannot vote your shares of Common Stock on your behalf without your instructions. |

| · | Depending upon your broker or custodian, you may be able to vote either by toll-free telephone or by the

Internet. Please refer to the enclosed voting form for instructions on how to vote electronically. You may also vote by signing, dating

and returning the enclosed voting form. |

Since only your latest dated

proxy card will count, we urge you not to return any proxy card you receive from the Company. Even if you return the management proxy

card marked “withhold” as a protest against the incumbent directors, it will revoke any proxy card you may have previously

sent to us. Remember, you can vote for our four (4) Nominees only on our BLUE proxy card. So please make certain that the latest

dated proxy card you return is the BLUE proxy card.

If you have any questions,

require assistance in voting your BLUE proxy card, or need additional copies of Starboard’s proxy materials, please contact

Okapi Partners at the phone numbers or email address listed below.

Okapi Partners LLC

1212 Avenue of the Americas, 24th Floor

New York, New York 10036

Stockholders may call toll-free: (877) 629-6356

Banks and brokers call: (212) 297-0720

E-mail: info@okapipartners.com

Background

to the Solicitation

The following is a chronology of material events leading up to this

proxy solicitation:

| · | On September 27, 2021, representatives of Starboard had a call with Peter R. Huntsman, the Company’s

Chairman of the Board, President and Chief Executive Officer, and Ivan M. Marcuse, the Company’s Vice President of Investor Relations,

to inform the Company that Starboard was one of its largest stockholders and would be filing a Schedule 13D later that day. On the call,

both parties agreed to schedule an in-person meeting in the following weeks to discuss the Company’s performance. |

| · | Later on September 27, 2021, Starboard filed a Schedule 13D with the SEC disclosing an 8.4% ownership

position in the Company. |

| · | On October 5, 2021, representatives of Starboard had a call with Mr. Huntsman to inform the Company that

Starboard would be publicly discussing Huntsman as one of its top investment ideas at the annual 13D Monitor Active-Passive Investor Summit

being held the following day. |

| · | On October 6, 2021, Jeffrey C. Smith, Chief Executive Officer and Chief Investment Officer of Starboard,

presented Huntsman as one of Starboard’s top investment ideas at the annual 13D Monitor Active-Passive Investor Summit. |

| · | On October 14, 2021, a meeting between representatives of Starboard and the Company was scheduled at the

Company’s Woodlands, Texas headquarters to discuss the Company’s performance. This meeting was subsequently rescheduled by

the Company due to an unexpected conflict. |

| · | On October 25, 2021, representatives of Starboard had a meeting with Messrs. Huntsman and Marcuse and

Philip M. Lister, the Company’s Executive Vice President and Chief Financial Officer, at the Company’s headquarters

to discuss the Company’s performance. |

| · | On November 1, 2021, following the Company’s Q3 2021 earnings announcement, representatives of Starboard

had a video call with Mr. Marcuse and other members of the Company’s Investor Relations team to further discuss the Company’s

performance. |

| · | Between November 4, 2021 and November 7, 2021, Starboard participated in calls with Mr. Huntsman, Mr.

Lister, and Mr. Marcuse regarding the Investor Day scheduled on November 9. During this process, Starboard executed a Non-Disclosure Agreement

with the Company in order to review a draft of the Company’s Investor Day Presentation and to discuss with, and provide recommendations

to, the Company. |

| · | On November 10, 2021, representatives of Starboard had a call with Mr. Marcuse to discuss comments made

by management at the Company’s Investor Day which was held on the day prior. |

| · | On December 9, 2021, a representative of Starboard had a private meeting with Mr. Huntsman in New York

City to discuss the Company’s performance and requested further discussions on working together to improve the Board. |

| · | On December 20, 2021, representatives of Starboard had a video call with Mr. Huntsman and director Cynthia

L. Egan to discuss the Company’s performance and Board composition. On the call, Starboard expressed its desire to have a significant

role in proposing new candidates as part of a much-needed Board refreshment. Mr. Huntsman and Ms. Egan indicated they would respond to Starboard after conferring with the Board regarding Starboard’s request. |

| · | On December 22, 2021, a representative of Starboard had a call with Mr. Huntsman to inform the

Company that Starboard would be requesting forms required for a potential nomination, but reiterated to Mr. Huntsman that Starboard

remained hopeful that a constructive solution could be reached on the topic of Board refreshment, and looked forward to the Board’s response regarding Starboard’s request on December 20, 2021. |

| · | On December 23, 2021, Starboard delivered a letter to the Company requesting certain nominee forms, as

referenced in the Company’s Sixth Amended and Restated Bylaws (the “Bylaws”) to be completed by each of the Nominees

in connection with the delivery of Starboard’s notice of stockholder nominations (the “Nomination Documents”). |

| · | On December 30, 2021, the Company provided copies of the Nomination Documents. |

| · | On Sunday, January 2, 2022, the Company announced that the Annual Meeting would be held “as expeditiously as possible” on March 25, 2022 and as

a result, curtailed the timeframe under the Bylaws for stockholders to submit nominations of director candidates to just ten (10) days

from the announcement. In past years, Huntsman had typically held its Annual Meeting at the end of April or in early May, and provided

stockholders thirty-one (31) days to submit director nominations or other stockholder proposals. In addition, the press release announced

the appointment of two (2) new directors, Curtis E. Espeland and José Muñoz, and the retirement of three (3) incumbent directors,

Nolan Archibald, M. Anthony Burns and Sir Robert Margetts, at the expiration of each of their terms immediately prior to the Annual Meeting,

purportedly pursuant to the Company’s director retirement policy notwithstanding the fact that the Company had previously waived

such policy for each of Messrs. Archibald and Burns for years. In addition, the press release announced that Wayne A. Reaud would be “stepping

down from the Board at or before the 2023 Annual Meeting of Stockholders when he will reach the retirement age.” |

| · | Between January 3, 2022 and January 11, 2022: |

| o | Counsel for Starboard had several discussions with counsel for the Company requesting the Company’s

agreement to the use of a universal proxy card in connection with the Annual Meeting, which the Company ultimately refused. Starboard

requested the use of a universal proxy card because it is widely acknowledged as a governance best practice and offers stockholders the

greatest flexibility to vote for their preferred mix of director nominees. The Board’s refusal to use a universal proxy card is also

perplexing given that the SEC has already adopted rules requiring the use of a universal proxy card for

all contested annual meeting elections after August 31, 2022. |

| o | Following the Company’s non-response to Starboard’s initial request on December 20, 2021 to

work constructively with the Board on a refreshment, and the Company’s subsequent announcement to: (i) add two (2) directors to

the Board; and (ii) shorten the timing of the Annual Meeting and the director nomination window, representatives of Starboard again contacted

representatives of the Company to request a potential collaborative solution. |

| o | Representatives of the Company had a call with representatives of Starboard informing them that the Board

would only be interested in interviewing James L. Gallogly and Sandra Beach Lin. |

| o | Starboard agreed to allow for the Company to interview each of Mr. Gallogly and Ms. Lin, with the understanding

that Starboard would not find a proposed solution acceptable unless, at a minimum, two (2) of Starboard’s candidates were chosen

for the Board. |

| o | In a separate call, Mr. Huntsman informed Mr. Smith that the Board would not be interested in meeting

with Mr. Smith and would not be considering him as a potential director candidate. |

| o | Subsequent to the Board’s interviews with both Mr. Gallogly and Ms. Lin, the Company informed Starboard

that David B. Sewell would be appointed to the Board immediately, but there would also be interest in having only Ms. Lin join the Board.

Starboard informed the Company that it considered the Company’s proposal to be insufficient and not in the best interest of stockholders. |

| o | Mr. Smith requested that Mr. Huntsman speak with Mr. Gallogly, given Mr. Gallogly’s qualifications and significant interest

in serving on the Board. Mr. Huntsman refused. |

| o | In a separate call, Mr. Smith requested to speak with Mr. Sewell and spoke with Mr. Sewell. |

| · | On January 11, 2022, the Company issued a press release announcing that it had appointed Mr. Sewell to

the Board. Contrary to the January 3 announcement contemplating that Mr. Reaud would retire from the Board “at or before the 2023

Annual Meeting when he will reach the retirement age”, the Company announced that Mr. Reaud would be retiring from the Board at

the end of his current term immediately before the Annual Meeting. |

| · | On

January 12, 2022, Starboard delivered a letter to the Company, in accordance with the Company’s

organizational documents, nominating Mr. Gallogly, Ms. Lin, Ms. Schnabel and Mr. Smith for

election to the Board at the Annual Meeting (the “Nomination Notice”). |

| · | Also on January 12, 2022, Starboard issued a press release announcing its nomination of the Nominees and

its delivery of a letter to Mr. Huntsman, with a copy to the Board. In the letter, Starboard expressed its frustration with the Company’s

history of missed execution, unfulfilled promises and corporate governance deficiencies, including the Board’s recent reactive maneuvers

that Starboard believes were designed to disenfranchise the Company’s stockholders. In the letter, Starboard reiterated its willingness

to engage with the Company to find a mutually agreeable resolution. |

| · | Later on January 12, 2022, Starboard filed Amendment No. 1 to its Schedule 13D with the SEC announcing

its nomination of the Nominees. |

| · | Also on January 12, 2022, the Company issued a press release in response to the nominations announced

by Starboard. |

| · | On

January 19, 2022, Starboard delivered a letter to the Company requesting the inspection of

certain stockholder list materials and related information pursuant to Section 220 of the

Delaware General Corporation Law (the “Books and Records Request”). |

| · | On

January 20, 2022, Starboard filed its preliminary proxy statement with the SEC. |

| · | On

January 26, 2022, the Company responded to Starboard’s Books and Records Request. |

| · | Also

on January 26, 2022, the Company delivered a letter (the “Request Letter”) to

Starboard responding to the Nomination Notice, which included numerous requests for additional

information regarding Starboard and the Nominees as a result of purported questions that

arose upon the Company’s review of the Nomination Notice and in connection with its

prior interviews of Mr. Gallogly and Ms. Lin during what Starboard had thought were good

faith settlement discussions with the Company. The Request Letter further alleges that the

information requested by the Company is a condition to the nominations pursuant to the Nomination

Notice being deemed properly brought before the Annual Meeting. |

| · | On

February 1, 2022, Starboard delivered a letter to the Company responding to the Request Letter,

stating that the Request Letter includes a substantial number of questions wholly unrelated

to the Nominees’ eligibility and qualifications to serve on the Board and improperly

seeks information that well exceeds Starboard’s disclosure obligations as a nominating

stockholder. Starboard further expressed its concerns that the Company is attempting to use

certain nominee interviews that were conducted in furtherance of trying to reach a mutual

resolution as a back door to inappropriately extract additional information of the Nominees,

thereby underscoring Starboard’s belief that the Board was not engaging in good faith

negotiations with Starboard. Notwithstanding Starboard’s belief that the Request Letter

serves no legitimate purpose other than an attempt to frustrate a stockholder’s long-standing

right to nominate director candidates, Starboard voluntarily provided some clarifying information

to further support the exemplary qualifications of the Nominees. |

| · | Also

on February 1, 2022, the Company filed its preliminary proxy statement with the SEC. |

| · | On

February 3, 2022, Starboard filed amendment no. 1 to its preliminary proxy statement

with the SEC. |

| · | On February 10, 2022, Starboard filed this definitive proxy statement with the SEC. |

REASONS FOR THE SOLICITATION

We believe Huntsman has significantly

underperformed and has failed to create meaningful value for long-term stockholders. We believe this underperformance is the result of

poor management execution, insufficient Board oversight, and lapses in corporate governance.

As background, Huntsman was

founded as a family-owned company in the early 1970s, and conducted an Initial Public Offering (the “IPO”) in 2005. Over the

past seventeen years as a publicly-traded entity, the Company’s key management and Board leadership roles have remained largely

unchanged. CEO Peter Huntsman has been at the Company’s helm since 2000, while a majority of the Board’s leadership positions

have, until very recently, been held by directors with decade-long tenures. As a result, we believe the Board and management team have

had ample opportunity to execute against their vision for the Company, and demonstrate to stockholders that they are the right stewards

of stockholder capital.

Unfortunately, we believe

the Board has presided over years of poor operating performance, missed financial targets, and broken promises. Yearly restructuring

initiatives have seemingly not led to meaningful Adjusted EBITDA margin improvement and we see little evidence that a decade-long sizeable

valuation discount to peers has been addressed. Despite the Company’s disappointing financial track record, the Board has seemingly

taken few actions to hold management accountable, and despite recent and reactionary changes to the Board, the Board has continued to

make poor governance decisions.

We invested in Huntsman because

we believe with greater urgency, accountability, and governance, the Company has the potential to be a best-in-class differentiated chemicals

manufacturer given its strong market positions, diverse product portfolios, innovative chemistries and difficult to replicate manufacturing

footprint. While our interactions over the past few months with both management and the Board have yielded several constructive commitments

– more ambitious financial targets, more stockholder-friendly capital allocation decisions, and more aligned executive compensation

plans – the Company’s recent maneuvering to shorten the stockholder nomination deadline, while abruptly appointing three

(3) new directors to the Board during our ongoing engagement, lead us to question whether the Board has genuine intent to hold management

accountable for those commitments. We believe stockholders deserve a Board that demands accountability and is committed to taking proactive

measures with the best interests of stockholders in mind at all times. We are deeply concerned that continued complacency and deference

to management will jeopardize the tremendous value creation opportunity we believe is possible at Huntsman.

We are therefore soliciting

your support at the Annual Meeting to elect our four (4) highly qualified Nominees – James L. Gallogly, Sandra Beach Lin, Susan

C. Schnabel and Jeffrey C. Smith - who we believe would not only bring significant and relevant experience to the Board, but also a commitment

to demand accountability and promote a results-driven culture at Huntsman. The Nominees were carefully selected and possess skill sets

in areas that we believe are directly relevant to Huntsman’s business and its current challenges and opportunities.

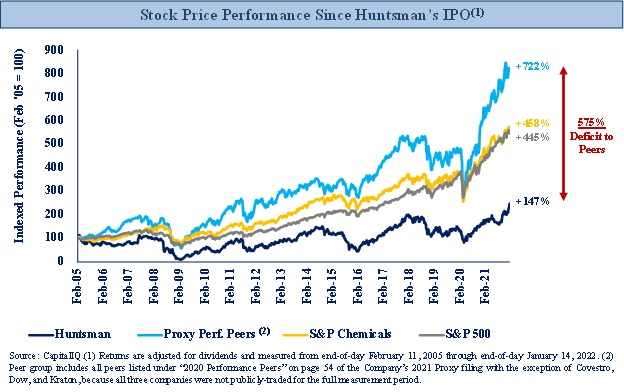

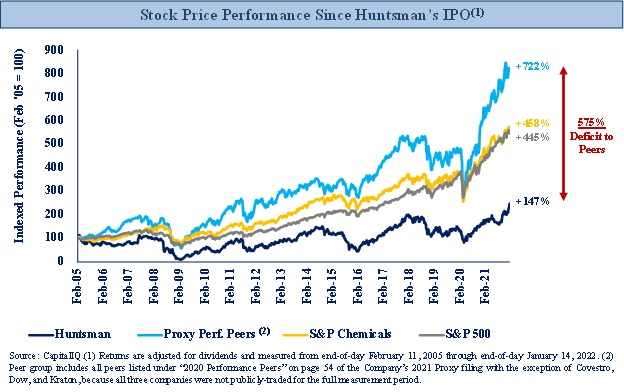

Long-Term Stockholders Have Suffered From

Significant Stock Price Underperformance

Since the IPO, the

Company’s stock price has significantly underperformed its Proxy Performance Peers, and both the chemicals and broader

market indices.

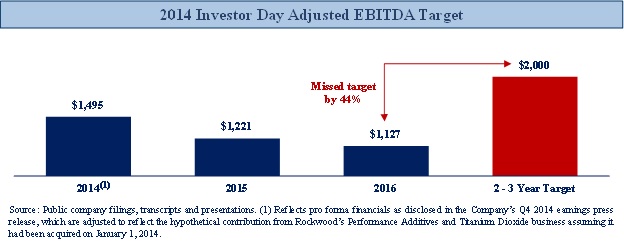

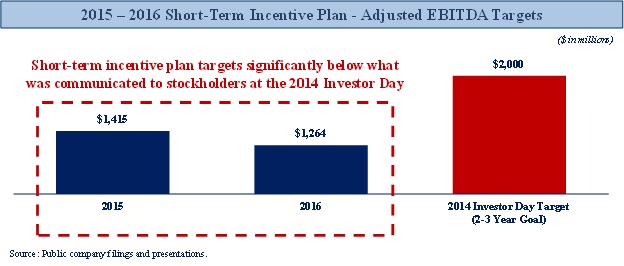

The Company Has Repeatedly Missed Its Financial

Commitments to Stockholders

Over the past decade, the

Company has repeatedly made financial commitments to stockholders, and consistently failed to deliver on those commitments. In particular,

the Company presented Adjusted EBITDA targets to stockholders at three sequential Investor Days – 2014, 2016, and 2018 – and

failed to achieve all three targets.

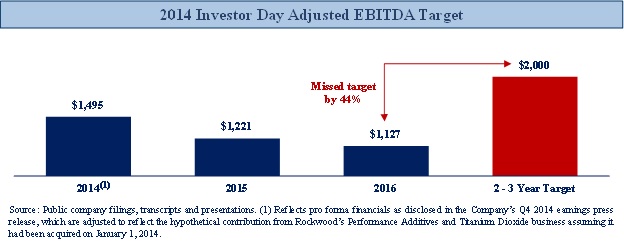

At Huntsman’s 2014

Investor Day, the Company committed to achieving $2.0 billion of Adjusted EBITDA over the following two to three years. Unfortunately,

Adjusted EBITDA declined by more than $350 million between 2014 and 2016, ending with only $1.1 billion, which was approximately 44%

below the $2.0 billion target that had previously been presented to stockholders.

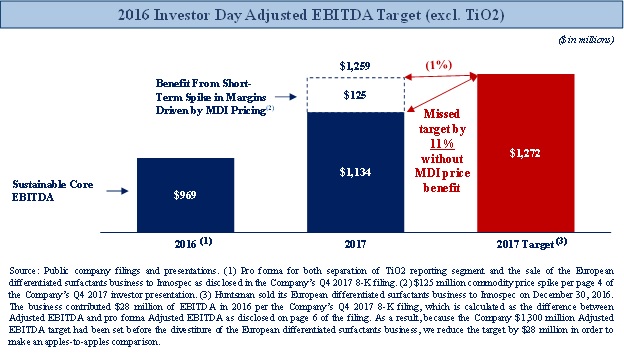

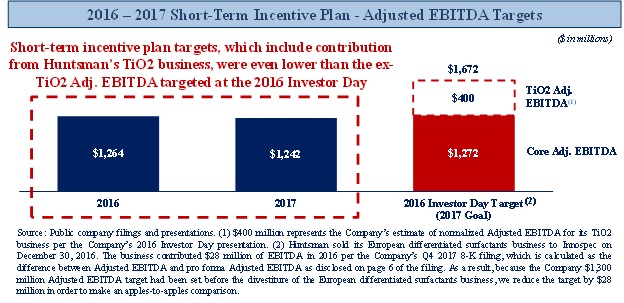

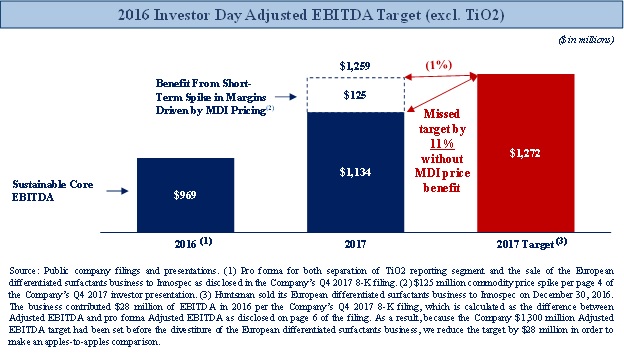

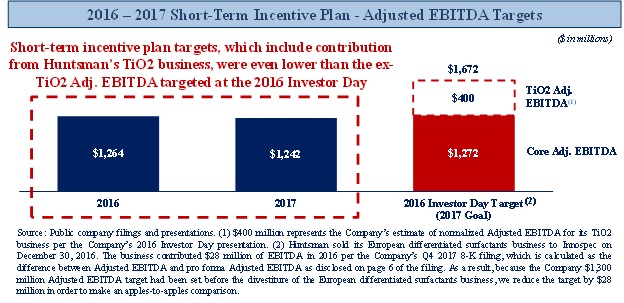

At Huntsman’s 2016

Investor Day, the Company believed it could achieve $1.7 billion of Adjusted EBITDA by the end of 2017 if conditions in its volatile

titanium dioxide (“TiO2”) business were to normalize. However, setting the TiO2 business aside, the Company was confident

that its remaining businesses could generate $1.3 billion of Adjusted EBITDA over the same time period. The TiO2 business was spun-off

in mid-2017, and unfortunately, the remaining core business not only fell short of expectations, but would have performed significantly

worse had it not been for a one-time $125 million benefit from a commodity price spike that management acknowledged was unlikely to reoccur.

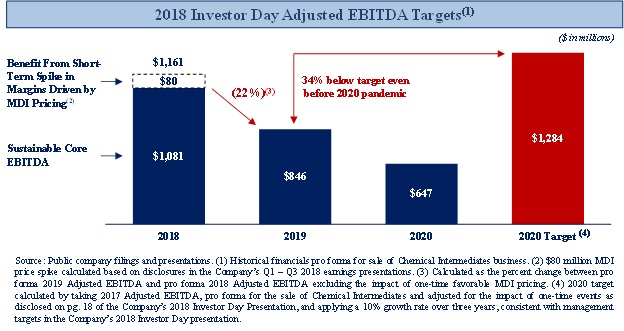

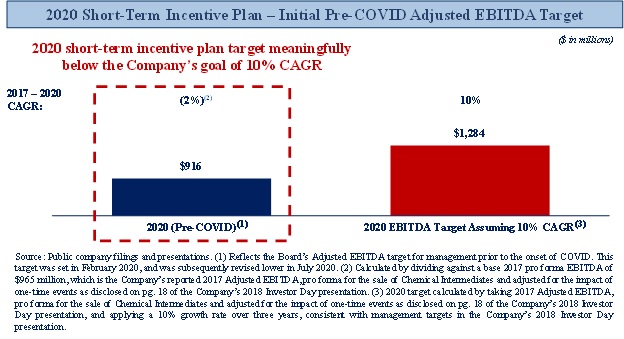

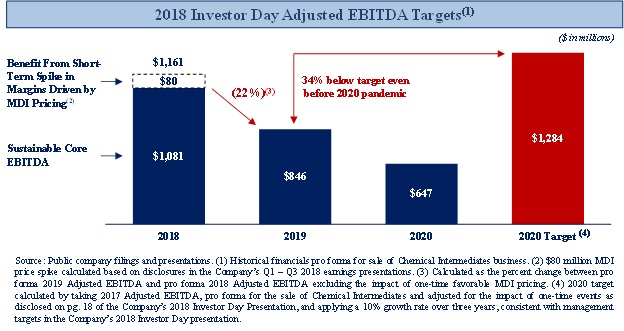

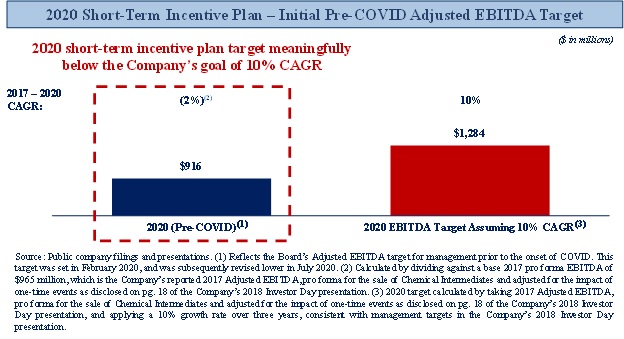

At Huntsman’s 2018 Investor

Day, the Company set a target for 10% Adjusted EBITDA CAGR over three years, and additionally outlined a plan to improve its share price

by $27 over the same time frame, implying Huntsman stock should be worth $60 per share by the end of 2020. Unfortunately, even before

the onset of the global pandemic, Adjusted EBITDA had already declined by over 20% between 2018 and 2019, and the Company’s stock

price had declined from the low-$30s into the mid-$20s, which was well below the $60 price target implied at the Company’s 2018

Investor Day.

Collectively, we believe

the Company’s years of missed execution and broken promises have severely eroded stockholder confidence, resulting in significant

long-term stock price underperformance versus peers, and against the chemical and broader market indices. While we remain hopeful that

the Company will achieve and exceed its new 2021 Investor Day targets, we are highly concerned that continued poor execution and lack

of accountability will once again lead to stockholder disappointment. As a result, we not only strongly believe that further Board refreshment

is necessary, but also believe our proposed nominees, who are highly experienced and qualified board members, are the right individuals

needed to hold management accountable for achieving or exceeding the Company’s new financial targets.

We Believe the Board Has Not Fostered a Culture

of Accountability

While we are certainly disappointed

by the Company’s track record of poor execution, we believe such extended mediocrity has largely been enabled by the Board’s

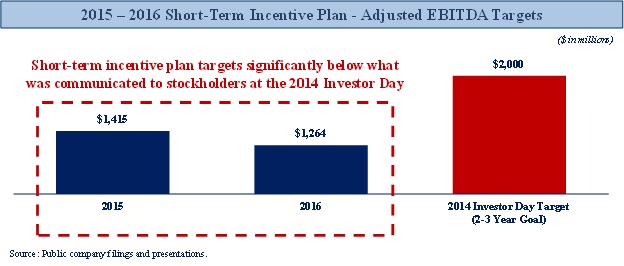

seeming indifference and unwillingness to demand accountability. A review of management’s historical short-term incentive compensation

plans reveals a consistent disparity between the Board’s targets for management, and management’s commitments to stockholders.

For background, Adjusted

EBITDA is a metric used to determine management’s short-term incentive compensation.2

As such, we would have expected the Board to set Adjusted EBITDA targets to reflect commitments made to stockholders at

the Company’s various investor days. Unfortunately, the Board does not appear to have been interested in fostering a culture of

accountability.

At Huntsman’s 2014 Investor Day, the Company committed to achieving $2.0 billion of Adjusted EBITDA within the next two to three

years. However, by 2016, the Board’s Adjusted EBITDA target for management’s short-term compensation plan not only remained

more than $500 million below the Company’s $2.0 billion target, but had also been lowered relative to the prior year.

At Huntsman’s 2016 Investor

Day, the Company committed to achieving $1.4 - $1.7 billion of Adjusted EBITDA by 2017 ($1.3 billion of Adjusted EBITDA in the core

Huntsman businesses and $100 - $400 million of Adjusted EBITDA in the TiO2 business). However, the Board again set targets far below what

was promised to stockholders. In fact, the Board’s Adjusted EBITDA targets, which included contribution from the Company’s

TiO2 business, were so modest that they were even lower than the ex-TiO2 Adjusted EBITDA target previously communicated to stockholders.

2

For clarity, the Company refers to Adjusted EBITDA as “Corporate Adjusted EBITDA” in its proxy filings when

discussing short-term incentive compensation.

At Huntsman’s 2018

Investor Day, the Company committed to an Adjusted EBITDA CAGR of greater than 10% through 2020. Despite this commitment, and even before

the impact of COVID was known, the Board had lowered its target for management to negative 2% CAGR versus the positive 10% CAGR that

the Company had previously targeted. Once again, the Board seemed to demonstrate no intention of holding management accountable for the

Company’s commitments to stockholders.

We are highly concerned by the Board’s tendency over many years

to be undemanding of management. We believe this apparent inability or unwillingness to demand accountability has not only enabled the

Company’s track record of poor execution, but also eroded the Company’s credibility with both stockholders and investment

analysts. Further, we are highly concerned with the Board’s willingness to set internal compensation goals meaningfully below the

Company’s publicly committed targets and believe there is a need for strong and capable independent Board members to improve Board

oversight and accountability.

We Believe the Board’s Recent Actions

Are Reactive and Serve to Disenfranchise Stockholders

We believe years of operational

underperformance have created significant, deep-seated skepticism among the stockholder base, not only skepticism that the Company will

finally begin to deliver on its commitments, but also skepticism that the Board will finally hold management accountable if it falters.

While the Company has added new directors in recent years, we believe stockholders should be incredibly concerned by the Board’s

recent actions and question whether new faces in the boardroom are simply perpetuating old stockholder-unfriendly tendencies.

By way of brief background,

we had hoped to collaborate with the Company on a plan for Board refreshment to bring talented, objective, independent and fervent stockholder

advocates into the boardroom. We had explained to the Company that the timing of such refreshment seemed appropriate as a number of long-tenured

and highly conflicted incumbent directors were nearing or had already surpassed the Company’s mandated retirement age. However,

rather than engage constructively with us despite our sincere efforts, the Board chose to react in a highly defensive manner, taking three

distinct actions that we believe were intended to disenfranchise stockholders:

| 1. | The Board chose to quickly replace its most tenured members and suggested to stockholders that these replacements

were part of a planned board refreshment process, a questionable claim when at least two outgoing members had previously been allowed

to serve for years after exceeding the Board’s suggested retirement age. |

| 2. | On Sunday, January 2, 2022, less than

a week after the 31-day director nomination window for stockholders had opened, the Board

maneuvered to abridge the nomination window from nearly a month to just ten (10) days. In

continued poor form, the Company issued the press release notifying stockholders of such

action on the Sunday after New Year’s Day, which we believe was deliberately timed

with the hope of catching stockholders unaware or to further reduce the nominating window’s

practical number of business days, or both.3 |

| 3. | The Board refused our repeated requests to allow stockholders the use of a universal proxy card despite

the SEC having already adopted rules requiring the use of a universal proxy card for all contested annual

meeting elections after August 31, 2022. The Board’s refusal to use a universal proxy card is especially perplexing because the

use of a universal proxy card is widely acknowledged as a governance best practice and offers stockholders the greatest ability to vote

for their preferred mix of director nominees. Further, we would note that the Board made its refusal to use a universal proxy card after

the addition of its new nominees, and as such, we presume the new nominees were not only included in the Board’s decision-making,

but were also supportive of straying from governance best practices. |

Collectively, the Board’s

recent stockholder-unfriendly actions have provided us further conviction that change is necessary. Stockholders deserve a Board that

can provide proper independence, governance, and accountability, and we firmly believe that the Board, as currently constituted appears

to lack the independent strength, skill, and experience to fervently represent the best interests of all stockholders.

We Believe Huntsman Needs a Reconstituted

Board to Restore Credibility with Stockholders

Our goal is to create value

for the benefit of all stockholders. We believe that Huntsman has the potential to become a best-in-class differentiated chemicals company.

However, poor operational execution, insufficient accountability, and poor Board oversight have contributed to financial results that

dramatically understate the intrinsic potential of the Company’s assets.

Over the past few months,

Huntsman has not only presented stockholders with financial targets that seem to promise a better future, but has also asked stockholders

to trust management and the Board to finally execute with excellence. We have no doubt that Huntsman’s assets are capable of much

more than historical results might suggest, but we also believe that Huntsman needs better oversight and appropriate guidance to significantly

improve its financial trajectory.

To this end, we are seeking

to elect four (4) distinguished and well-qualified individuals to serve as directors of Huntsman. Over the coming weeks and months, we

look forward to sharing our detailed views and plans for Huntsman, which will include, among others, plans to improve the Company’s

operating performance and governance practices. If elected, our Nominees are prepared to work constructively with their fellow Board

members to ensure accountability and improve operational execution in order to maximize value for all of Huntsman’s stockholders.

We look forward to engaging with you as we approach the Annual Meeting.

__________________________

3

The initial director nomination deadline for the Annual Meeting was January 28, 2022, which was abridged pursuant to the

Company’s Bylaws to January 12, 2022 following the Company’s announcement in a press release issued on January 2, 2022 that

the Annual Meeting would be held more than 30 days earlier than the anniversary of the Company’s 2021 Annual Meeting of Stockholders.

PROPOSAL NO. 1

ELECTION OF DIRECTORS

The Board is currently

composed of fourteen (14) directors, each with terms expiring at the Annual Meeting. The Company has announced that four (4) of is fourteen

(14) directors, Nolan D. Archibald, M. Anthony Burns, Sir Robert J. Margetts and Wayne A. Reaud, will be retiring from the Board immediately

before the Annual Meeting, meaning ten (10) directors will be up for election at the Annual Meeting. We are seeking your support

at the Annual Meeting to elect our four (4) Nominees, James L. Gallogly, Sandra Beach Lin, Susan C. Schnabel and Jeffrey C. Smith. Your

vote to elect our Nominees will have the legal effect of replacing four (4) incumbent directors of the Company with our Nominees. If

elected, our Nominees will represent a minority of the members of the Board and therefore it is not guaranteed that they will be able

to implement any actions that they may believe are necessary to enhance stockholder value, including the implementation of our comprehensive

plans for the Company, which we plan to release in the coming weeks. There is no assurance that any incumbent director will serve as

a director if our Nominees are elected to the Board. You should refer to the Company’s proxy statement for the names, background,

qualifications and other information concerning the Company’s nominees.

THE NOMINEES

The following information

sets forth the name, age, business address, present principal occupation, and employment and material occupations, positions, offices,

or employments for the past five years of each of the Nominees. The nominations were made in a timely manner and in compliance with the

applicable provisions of the Company’s governing instruments. The specific experience, qualifications, attributes and skills that

led us to conclude that the Nominees should serve as directors of the Company are set forth above in the section entitled “Reasons

for the Solicitation” and below. This information has been furnished to us by the Nominees. All of the Nominees are citizens of

the United States.

James L. Gallogly,

age 69, is the former Chief Executive Officer of LyondellBasell Industries N.V. (NYSE: LYB), a global plastic, chemical and refining

company, from May 2009 until his retirement in January 2015, where he also served as Chairman of the Management Board from May 2010 to

January 2015. Prior to that, Mr. Gallogly held several executive roles at ConocoPhillips (NYSE: COP), an energy company, including Executive

Vice President of Worldwide Exploration and Production from October 2008 to May 2009, and Executive Vice President of Refining, Marketing

and Transportation, from April 2006 to October 2008. From 2000 to 2006, he was President and Chief Executive Officer of Chevron Phillips

Chemical Company, LLC, a global plastics and chemical company. Mr. Gallogly began his career with Phillips Petroleum Company in 1980,

serving in a variety of legal, financial and operational positions including Vice President of Plastics, Vice President of Olefins and

Polyolefins and Senior Vice President of Chemicals and Plastics. Mr. Gallogly served on the board of directors of Continental Resources,

Inc. (NYSE: CLR), a petroleum and natural gas exploration and production company, from May 2017 to May 2018, and E. I. du Pont de Nemours

and Company (n/k/a DuPont de Nemours, Inc.)(NYSE: DD), a chemicals, agriculture and specialty products company, from February 2015 to

August 2017. Mr. Gallogly serves as the Vice Chairman of the University Cancer Foundation Board of Visitors at the University of Texas

M.D. Anderson Cancer Center. He previously served on the boards of the American Chemistry Council, the American Plastics Council, the

National Petrochemical and Refiners Association, Junior Achievement of Southeast Texas and the American Petroleum Institute. Mr. Gallogly

most recently served as the President of the University of Oklahoma, from July 2018 to May 2019, and is currently involved in philanthropy,

ranching and private investing. Mr. Gallogly holds a B.A. from the University of Colorado at Colorado Springs and a J.D. from the University

of Oklahoma. Mr. Gallogly is a graduate of the Advanced Executive Program at the Kellogg Graduate School of Management at Northwestern

University.

Starboard believes Mr. Gallogly’s

significant executive experience in the chemical industry and his knowledge of capital markets, environmental management, global business,

corporate governance, portfolio assessment and business transformation, will make him a valued addition to the Board.

Sandra Beach Lin, age

63, currently serves as a member of the board of directors of each of Trinseo PLC (NYSE: TSE) (f/k/a Trinseo S.A.), a global materials

solutions provider and manufacturer of plastics and latex binders with a focus on delivering innovative, sustainable, and value-creating

products, since November 2019; Avient Corporation (NYSE: AVNT) (f/k/a PolyOne Corporation), a leading provider of specialized and sustainable

material solutions, since May 2013; Interface Biologics Inc. (“Interface”), a privately held, commercial stage developer of

innovative material science technologies for Medtech and Pharmaceutical applications, since October 2012; Ripple Therapeutics Inc., a

therapeutics and drug delivery company and Interface spin-off, since January 2020; and American Electric Power Company, Inc. (NASDAQ:

AEP), one of the largest electric energy companies in the United States, since July 2012. Previously, Ms. Lin served as President and

Chief Executive Officer of Calisolar, Inc. (n/k/a Silicor Materials Inc.), a global leader in the production of solar silicon, from August

2010 to December 2011; Executive Vice President, then Corporate Executive Vice President of Celanese Corporation (NYSE: CE), a global

hybrid chemical company, from 2007 to 2010; Group Vice President of Avery Dennison Corporation (NYSE: AVY), a global materials science

company specializing in the design and manufacture of a wide variety of labeling and functional materials, from 2005 to 2007; President

of Alcoa Closure Systems International, a division of Alcoa Incorporated, a global aluminum leader, from 2002 to 2005; and in various

executive positions at Honeywell International Inc. (NASDAQ: HON), a diversified manufacturing and technology company, from 1994 to 2001.

Ms. Lin previously served on the board of directors of WESCO International, Inc. (NYSE: WCC), a leading provider of business-to-business

distribution, logistics services and supply chain solutions, from 2002 to May 2019. Ms. Lin received her MBA in Marketing and Policy and

Control from the Stephen M. Ross School of Business at the University of Michigan and her BBA in General Management from the University

of Toledo.

Starboard believes Ms. Lin’s

extensive senior executive experience managing large global businesses in multiple industries and her experience as a public company director

will make her a valuable addition to the Board.

Susan C. Schnabel,

age 60, is the Co-Founder and Co-Managing Partner of aPriori Capital Partners L.P. (“aPriori Capital”), an independent leveraged

buyout fund advisor created in connection with the spin-off of DLJ Merchant Banking Partners from Credit Suisse in 2014. Prior to forming

aPriori Capital, Ms. Schnabel worked at Credit Suisse as a Managing Director in the Asset Management Division and Co-Head of DLJ Merchant

Banking, from 1998 to 2014. Prior to that, Ms. Schnabel served as Chief Financial Officer of PetSmart, Inc. (formerly NASDAQ:PETM), a

retail chain engaged in the sale of pet animal products and services. Currently, Ms. Schnabel serves as a member of the Board of Directors

of Altice USA, Inc., an American cable television provider, since June 2021, and as the Chair of the Audit Committee of Kayne Anderson

BDC, Inc., a closed-end, non-diversified management investment company that qualifies as a business development company, since October

2020. She previously served as a member of the Board of Directors of each of Versum Materials, Inc. (formerly NYSE: VSM), a leading electronic

materials company, from September 2016 until it was acquired by Merck KGaA, Darmstadt, Germany in October 2019, STR Holdings, Inc. (NYSE:

STRI), a provider of encapsulants to the solar industry, from 2007 to 2014, Neiman Marcus, a luxury department store chain, from October

2010 to October 2013, Pinnacle Gas Resources, Inc. (formerly NASDAQ: PINN) (n/k/a Summit Gas Resources, Inc.), an independent energy company,

from 2005 to 2011, Rockwood Holdings, Inc. (formerly NYSE: ROC), a performance additives and titanium dioxide business, from 2004 to 2009,

and Shoppers Drug Mart Corporation (TSX: SC), a Canadian retail pharmacy chain, from 2001 to 2004. She has also served on a number of

other boards, including Visant Corp, Jostens Inc, Arcade Bioplan, Merrill Corp. (n/k/a Datasite), Deffenbaugh Industries, DeCrane Aircraft

Holdings, Inc., Enduring Resources, LLC, Laramie Energy LLC, Target Media Partners and Total Safety USA. Ms. Schnabel also serves as a

Trustee of Cornell University (Finance Committee and Investment Committee), as a member of each of the California Institute of Technology

- Investment Committee, the US Olympic & Paralympic Foundation Board of Directors - Finance Committee, and formerly served on the

Board of Directors of the Los Angeles Music Center Foundation - Treasurer and Investment Committee. In addition, Ms. Schnabel recently

completed her term on The Harvard Business School Alumni Advisory Board where she served on the Executive Committee. Ms. Schnabel received

her B.S. in Chemical Engineering from Cornell University and her MBA from Harvard Business School.

Starboard believes Ms. Schnabel’s

substantial business experience, coupled with her extensive experience serving as a director of public and private companies will make

her a valuable addition to the Board.

Jeffrey C. Smith, age

49, is a Managing Member, Chief Executive Officer and Chief Investment Officer of Starboard Value LP, a New York-based investment adviser

with a focused and fundamental approach to investing primarily in publicly traded U.S. companies. Prior to founding Starboard Value LP

in April 2011, Mr. Smith was a Partner Managing Director of Ramius LLC (“Ramius”), a subsidiary of the Cowen Group, Inc. (“Cowen”),

and the Chief Investment Officer of the Ramius Value and Opportunity Master Fund Ltd. Mr. Smith was also a member of Cowen’s Operating

Committee and Cowen’s Investment Committee. Prior to joining Ramius in January 1998, he served as Vice President of Strategic Development

of The Fresh Juice Company, Inc. (formerly NASDAQ: FRSH). He currently serves as the Chair of the Board of Directors of Papa John’s

International, Inc. (NASDAQ: PZZA), the world’s third-largest pizza delivery company, since joining the Board of Directors in February

2019 and as a member of the Board of Directors of Cyxtera Technologies, Inc. (NYSE: CYXT) (“Cyxtera”), a provider of data

center colocation, enterprise bare metal, and interconnectivity services from a footprint of sixty-two data centers around the world,

since July 2021. Mr. Smith was formerly the Chair of the Board of Directors of Starboard Value Acquisition Corp. (formerly NASDAQ: SVAC),

a blank check company formed for the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization

or similar business combination with one or more businesses, from November 2019 until it merged with Cyxtera in July 2021; Advance Auto

Parts, Inc. (NYSE: AAP), one of the largest retailers of automotive replacement parts and accessories in the United States, from May 2016

to May 2020; Darden Restaurants, Inc. (NYSE: DRI), a multi-brand restaurant operator, from October 2014 to April 2016; and Phoenix Technologies

Ltd. (formerly NASDAQ: PTEC), a provider of core systems software products, services, and embedded technologies, from November 2009 until

the sale of the company to Marlin Equity Partners in November 2010. In addition, Mr. Smith previously served on the Board of Directors

of a number of public companies, including: Perrigo Company plc (NYSE; TASE: PRGO), a leading global healthcare company, from February

2017 to August 2019; Yahoo! Inc. (formerly NASDAQ: YHOO), a web services provider, from April 2016 until its operating business was sold

to Verizon Communications Inc. in June 2017; Quantum Corporation (NASDAQ: QMCO) (formerly NYSE: QTM), a global expert in data protection

and big data management, from May 2013 to May 2015; Office Depot, Inc. (formerly NYSE: ODP) (n/k/a The ODP Corporation)(NASDAQ: ODP),

an office supply company, from August 2013 to September 2014; Regis Corporation (NASDAQ: RGS), a global leader in beauty salons, hair

restoration centers and cosmetology education, from October 2011 until October 2013; Surmodics, Inc. (NASDAQ: SRDX), a leading provider

of drug delivery and surface modification technologies to the healthcare industry, from January 2011 to August 2012; Zoran Corporation

(formerly NASDAQ: ZRAN), a provider of digital solutions in the digital entertainment and digital imaging market, from March 2011 until

its merger with CSR plc in August 2011; Actel Corporation (formerly NASDAQ: ACTL), a provider of power management solutions, from March

2009 until its sale to Microsemi Corporation in October 2010; Kensey Nash Corporation (formerly NASDAQ: KNSY), a medical technology company,

from December 2007 to February 2009; S1 Corporation (formerly NASDAQ: SONE), a provider of customer interaction software for financial

and payment services, from May 2006 to September 2008; and The Fresh Juice Company, Inc., from 1996 until its sale to the Saratoga Beverage

Group, Inc. in 1998. Mr. Smith began his career in the Mergers and Acquisitions department at Société Générale.

Mr. Smith graduated from The Wharton School of Business at The University of Pennsylvania, where he received a B.S. in Economics.

Starboard believes Mr. Smith’s

extensive knowledge of the capital markets, corporate finance, and public company governance practices, together with his significant

public company board experience, would make him a valuable asset to the Board.

The principal business address

of Mr. Gallogly is 4401 North Capital of Texas Highway, Austin, Texas 78746. The principal business address of Ms. Lin is 3754 Melville

Circle, Flower Mound, Texas 75022. The principal business address of Ms. Schnabel is 3303 FarView Drive, Austin, Texas 78730. The principal

business address of Mr. Smith is c/o Starboard Value LP, 777 Third Avenue, 18th Floor, New York, New York 10017.

As of the date hereof, Mr.

Smith does not directly own beneficially or of record any securities of the Company. Mr. Smith, as a member of Principal GP and as a

member of each of the Management Committee of Starboard Value GP and the Management Committee of Principal GP, may be deemed to beneficially

own the 18,817,818 shares of Common Stock beneficially owned in the aggregate by Starboard as further explained elsewhere in this Proxy

Statement. For information regarding transactions in securities of the Company during the past two years by Starboard, please see Schedule

I attached hereto.

As of the date hereof,

Mr. Gallogly directly beneficially owns 655 shares of Common Stock. For information regarding transactions in securities of the Company

during the past two years by Mr. Gallogly, please see Schedule I.

As of the date hereof,

Ms. Lin beneficially owns 1,332 shares of Common Stock held jointly with her spouse. For information regarding transactions in securities

of the Company during the past two years by Ms. Lin, please see Schedule I.

As of the date hereof,

Ms. Schnabel beneficially owns 1,000 shares of Common Stock held jointly with her spouse. For information regarding transactions in securities

of the Company during the past two years by Ms. Schnabel, please see Schedule I.

Starboard V&O Fund, Starboard

S LLC, Starboard C LP, Starboard P LP, Starboard P GP, Starboard R LP, Starboard L Master, Starboard L GP, Starboard R GP, Starboard Echo

II LLC, Starboard Leaders Fund, Starboard A LP, Starboard A GP, Starboard X Master, Starboard G LP, Starboard G GP, Starboard Value LP,

Starboard Value GP, Principal Co, Principal GP, Mr. Feld and the Nominees (collectively, the “Group”) entered into a Joint

Filing and Solicitation Agreement in which, among other things, (i) the Group agreed to solicit proxies or written consents for the election

of the Nominees, or any other person(s) nominated by Starboard V&O Fund, to the Board at the Annual Meeting, (ii) the Group agreed

to take all other action the Group deems necessary or advisable to achieve the foregoing, and (iii) Starboard V&O Fund, Starboard

S LLC, Starboard C LP, Starboard P LP, Starboard L Master, Starboard Echo II LLC, Starboard X Master, Starboard G LP and Starboard Value

LP through the Starboard Value LP Account agreed to bear all expenses incurred in connection with the Group’s activities, including

approved expenses incurred by any of the parties in connection with the solicitation, subject to certain limitations.

Each of the Nominees, as a

member of a “group” for the purposes of Section 13(d)(3) of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), may be deemed to beneficially own the shares of Common Stock owned in the aggregate by the other members of the Group. Each

of the Nominees specifically disclaims beneficial ownership of the shares of Common Stock owned by the other members of the Group. For

information regarding transactions in securities of the Company during the past two years by the participants in this solicitation, see

Schedule I.

Starboard V&O Fund has

signed separate letter agreements with each of the Nominees (other than Mr. Smith) pursuant to which it and its affiliates have agreed

to indemnify such Nominees against certain claims arising from the solicitation of proxies from the Company’s stockholders in connection

with the Annual Meeting and any related transactions. For the avoidance of doubt, such indemnification does not apply to any claims made

against such Nominees in their capacities as directors of the Company, if so elected.

Starboard V&O Fund has

signed compensation letter agreements (the “Compensation Letter Agreements”) with each of the Nominees (other than Ms. Lin

and Mr. Smith), pursuant to which it has agreed to pay each of such Nominees: (i) $25,000 in cash as a result of the submission by Starboard

V&O Fund of its nomination of each of such Nominees to the Company and (ii) $25,000 in cash upon the filing by Starboard V&O Fund

of a definitive proxy statement with the SEC relating to the solicitation of proxies in favor of such Nominees’ election as directors

of the Company. Pursuant to the Compensation Letter Agreements, each of such Nominees has agreed to use the after-tax proceeds from such

compensation to acquire securities of the Company (the “Nominee Shares”) at such time that each of such Nominees shall determine,

but in any event no later than fourteen (14) days after receipt of such compensation, subject to Starboard V&O Fund’s right

to waive the requirement to purchase the Nominee Shares. Pursuant to the Compensation Letter Agreements, each of such Nominees has agreed

not to sell, transfer or otherwise dispose of any Nominee Shares until the earliest to occur of (i) the Company’s appointment or

nomination of such Nominee as a director of the Company, (ii) the date of any agreement with the Company in furtherance of such Nominee’s

nomination or appointment as a director of the Company, (iii) Starboard V&O Fund’s withdrawal of its nomination of such Nominee

for election as a director of the Company, and (iv) the date of the Annual Meeting; provided, however, in the event that the Company enters

into a business combination with a third party, each of such Nominees, may sell, transfer or exchange the Nominee Shares in accordance

with the terms of such business combination.

Starboard believes that each

Nominee presently is, and if elected as a director of the Company, each of the Nominees would be, an “independent director”

within the meaning of (i) applicable New York Stock Exchange (“NYSE”) listing standards applicable to board composition and

(ii) Section 301 of the Sarbanes-Oxley Act of 2002. Notwithstanding the foregoing, Starboard acknowledges that no director of a NYSE listed

company qualifies as “independent” under the NYSE listing standards unless the board of directors affirmatively determines

that such director is independent under such standards. Accordingly, Starboard acknowledges that if any Nominee is elected, the determination

of the Nominee’s independence under the NYSE listing standards ultimately rests with the judgment and discretion of the Board. No

Nominee is a member of the Company’s compensation, nominating or audit committee that is not independent under any such committee’s

applicable independence standards.

Other than as stated herein,

and except for compensation received by Mr. Smith as an employee of Starboard Value LP, there are no arrangements or understandings between

Starboard and any of the Nominees or any other person or persons pursuant to which the nomination of the Nominees described herein is

to be made, other than the consent by each of the Nominees to be named in this Proxy Statement and to serve as a director of the Company

if elected as such at the Annual Meeting. None of the Nominees is a party adverse to the Company or any of its subsidiaries

or has a material interest adverse to the Company or any of its subsidiaries in any material pending legal proceedings.

We do not expect that any

of the Nominees will be unable to stand for election, but, in the event any Nominee is unable to serve or for good cause will not serve,

the shares of Common Stock represented by the enclosed BLUE proxy card will be voted for substitute nominee(s), to the extent this

is not prohibited under the Company’s Bylaws and applicable law. In addition, we reserve the right to nominate substitute person(s)

if the Company makes or announces any changes to the Bylaws or takes or announces any other action that has, or if consummated would have,

the effect of disqualifying any Nominee, to the extent this is not prohibited under the Bylaws and applicable law. In any such case, shares

of Common Stock represented by the enclosed BLUE proxy card will be voted for such substitute nominee(s). We reserve the right

to nominate additional person(s), to the extent this is not prohibited under the Bylaws and applicable law, if the Company increases the

size of the Board above its existing size or increases the number of directors whose terms expire at the Annual Meeting. Additional nominations

made pursuant to the preceding sentence are without prejudice to the position of Starboard that any attempt to increase the size of the

current Board or to classify the Board constitutes an unlawful manipulation of the Company’s corporate machinery.

WE URGE YOU TO VOTE FOR THE ELECTION OF THE

NOMINEES ON THE ENCLOSED BLUE PROXY CARD.

PROPOSAL NO. 2

NON-BINDING ADVISORY VOTE TO APPROVE THE

COMPENSATION OF HUNTSMAN’S NAMED EXECUTIVE

OFFICERS

As disclosed in the Company’s