and dyes industries. We are a leading global producer in many of our key product lines, including MDI, amines, maleic anhydride, epoxy-based polymer formulations, textile chemicals and dyes.

We operate in four segments: Polyurethanes, Performance Products, Advanced Materials and Textile Effects. In August 2017, we separated our Titanium Dioxide and Performance Additives business (the “P&A Business”) through an initial public offering (“IPO”) of ordinary shares of Venator Materials PLC (“Venator”), formerly a wholly-owned subsidiary. Beginning in the third quarter of 2017, we reported the results of operations of Venator as discontinued operations. On December 3, 2018, we sold an additional 4% of Venator ordinary shares which allowed us to immediately deconsolidate Venator and account for our remaining ownership interest in Venator as an equity method investment using the fair value option. For more information, see “Note 4. Discontinued Operations and Business Disposition—Separation and Deconsolidation of Venator” to our consolidated financial statements. On January 3, 2020, we completed the sale of our Chemical Intermediates Businesses, and, beginning in the third quarter of 2019, we reported the results of our Chemical Intermediates Businesses as discontinued operations. For more information, see “Note 4. Discontinued Operations and Business Dispositions—Sale of Chemical Intermediates Businesses” to our consolidated financial statements. In a series of transactions beginning in 2006, we sold or shut down substantially all of our Australian styrenics operations and our North American polymers and base chemicals operations. We also report the results of operations of these businesses as discontinued operations.

As of December 31, 2019, we employed approximately 10,000 associates worldwide, including approximately 1,000 employees associated with the Chemical Intermediates Businesses that was sold on January 3, 2020. Our revenues for the years ended December 31, 2019, 2018 and 2017 were $6,797 million, $7,604 million and $6,845 million, respectively.

Our Products

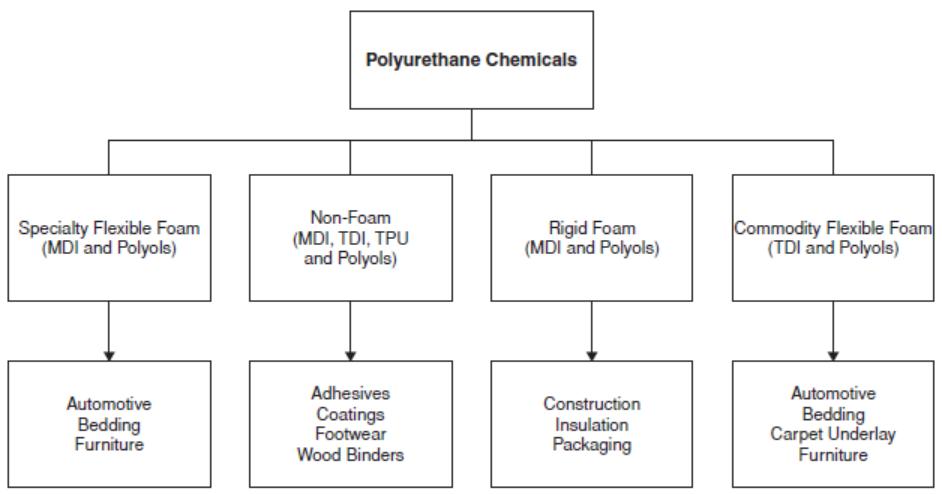

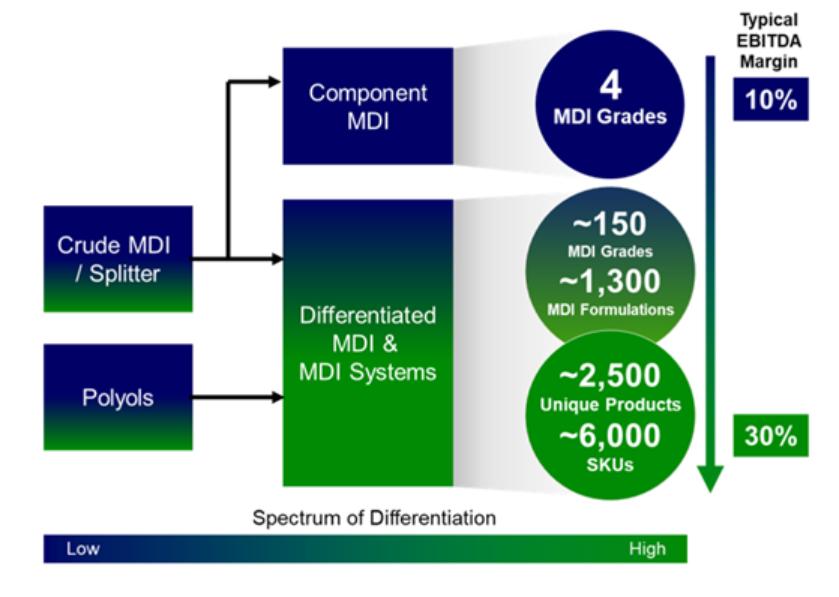

Our Polyurethanes, Performance Products, Advanced Materials and Textile Effects segments produce differentiated organic chemical products. Growth in our differentiated products has been driven by the substitution of our products for other materials and by the level of global economic activity. Accordingly, the profitability of our differentiated products has been somewhat less influenced by the cyclicality that typically impacts the petrochemical industry.

(1) | Percentage allocations in this chart do not give effect to Corporate and other unallocated items and eliminations. For a reconciliation of adjusted EBITDA to net income attributable to Huntsman Corporation and cash provided by operating activities, see “Part II. Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations—Results of Operations.” |

2